-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

Six Things We Can Do to Curb Legal System Abuse

Publication

Is Human Trafficking the Next Big Liability Exposure for Insurers?

Publication

When Likes Turn to Lawsuits – Social Media Addiction and the Insurance Fallout

Publication

Generative Artificial Intelligence and Its Implications for Weather and Climate Risk Management in Insurance

Publication

Creating Strong Reinsurance Submissions That Drive Better Outcomes

Publication

Do Commercial General Liability Policies Cover Mental Anguish From Sexual Abuse? -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Publication

Group Medical EOI Underwriting – Snapshot of U.S. Benchmark Survey

Publication

Next Gen Underwriting Insights – 2025 Survey Results & Confusion Matrix Considerations [Webinar]

Publication

GLP-1 Receptor Agonists – From Evolution to Revolution U.S. Industry Events

U.S. Industry Events

Publication

Always On: Understanding New Age Addictions and Their Implications for Disability Insurance

Publication

Dying Gracefully – Legal, Ethical, and Insurance Perspectives on Medical Assistance in Dying -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Public Administrations’ Liability – Jurisprudential Evolution, Insurance Implications, and a Comparative Analysis Across Countries

September 10, 2025

Federica Ermacora

Region: Europe

English

Italiano

Civil liability for damage caused by things under one’s control, as established in Article 2051 of the Italian Civil Code, is a highly relevant topic in the Italian market. It is actively debated in jurisprudence and represents one of the most frequent disputes in civil matters.

Article 2051 states that “everyone is responsible for the damage caused by things in one’s control, unless they can prove it was due to unforeseeable events”.

This article focuses on the liability of public administrations, including, for instance, cases where pedestrians or motorcyclists fall due to potholes on municipal roads. More specifically, this piece examines the evolution of jurisprudence regarding the applicability of Article 2051 of the Italian Civil Code to public administrations, the role of the injured party’s conduct, and the impact on the Italian insurance market. It also offers a comparative analysis across different countries.

Development of Case Law on Public Administrations’ Liability

The prevailing case law attributes liability to public administrations (hereafter P.A.), under Article 2051 of the Italian Civil Code. However, this has not always been the case. Over the years, the Supreme Courts have adopted different approaches to this matter.

Until the 1990s, jurisprudence generally excluded the applicability of Article 2051 of the Italian Civil Code to the public administration, due to the extent of public property and its widespread, direct use by the public. Therefore, it was considered impossible for P.A. to effectively discharge their duty of supervision.

This changed with Constitutional Court ruling no. 156/1999, which established that Article 2051 of the Italian Civil Code could be applied to P.A., but only in cases where they exercised effective control over the public asset. This marked a departure from the previously rigid judicial approach.1

Starting in the early 2000s, the Supreme Court progressively expanded the applicability of Article 2051 of the Italian Civil Code to P.A., regardless of the extent or nature of the public domain involved. This jurisprudential evolution led to a unified judicial approach and introduced a form of strict liability for P.A.2

Consequently, public administrations that own and manage roads open to public traffic are generally held strictly liable under Article 2051 of the Italian Civil Code for damages resulting from hazardous conditions related to the structure of the road or its appurtenances. The only exception applies when the authority can demonstrate that the damage was caused by a fortuitous event: an external, exceptional, and unforeseeable circumstance capable of breaking the causal link between the property and the harm suffered.3

The Impact of the Injured Party’s Negligent Behavior

Having outlined the evolution of the applicability of Article 2051 of the Italian Civil Code to P.A., it is also important to highlight that case law has progressively developed regarding the role of the injured party’s negligent behavior. The relevance of the injured party’s conduct began to emerge with Constitutional Court ruling no. 156/1999 issued in 1999. This decision marked a significant departure from the previous approach, which treated liability under Article 2051 of the Italian Civil Code as a form of strict liability, without considering the claimant’s negligent behavior.4

Subsequently, the conduct of claimants gained increasing importance, as they are subject to a duty of care when using public property and are expected to take reasonable precautions to protect themselves.

From the second decade of the 2000s onward, case law further refined the assessment of the subjective element, placing growing emphasis on the imprudent or negligent behavior of the injured party.5

Recent jurisprudence continues along in the same direction. The prevailing position of the Supreme Court provides for the full or partial exclusion of liability for P.A. when the injured party could have foreseen and avoided the danger through the exercise of ordinary diligence. Such conduct is deemed to constitute an independent causal factor, capable of interrupting or mitigating the liability of the P.A.

This principle was reaffirmed by the Supreme Court in Order no. 20943 issued on 30 June 2022, which referred to what had already been established in judgments no. 2480 and no. 2481 of 1 February 2018.6 According to these rulings, the claimant’s negligent behavior may exclude or mitigate the liability of the P.A., provided that such conduct was a decisive factor in the occurrence of the damage.

The Supreme Court ruling no. 16034 of 7 June 2023, is a recent and significant example of how jurisprudence is increasingly emphasizing the role of the claimant’s conduct in determining liability. In this specific case, the Court dismissed an appeal filed by a claimant who had sued the Municipality of Rome following a fall caused by a depression in the road surface. The Court found that no liability could be attributed to the P.A., as the incident was solely the result of the claimant’s negligent behavior.7 Consequently, plaintiffs are required to exercise a duty of caution and prudence when using public property.

How This Affects Insurance

The jurisprudential developments outlined above have had a significant impact on insurance. The previously rigid judicial approach, which treated liability under Art. 2051 of the Civil Code as a form of strict liability, led to frequent judgments against P.A., resulting in an increase in compensation claims and a corresponding rise in insurance costs for municipalities. In response to this trend, insurance companies have introduced measures within General Third-Party Liability policies to mitigate and reduce the negative economic consequences. These measures include the introduction of higher deductibles or Self-Insurance Retentions (S.I.R.),8 which have significantly reduced the cost of managing high-frequency claims (so‑called mass claims), by shifting their handling to the insured P.A.

These mechanisms are incorporated into General Third-Party Liability policies of P.A. in various forms: policies can include deductibles ranging from EUR 500 to EUR 5,000, going as high as EUR 30,000. Insurance companies have also modified the policy structure by incorporating S.I.R. ranging from EUR 5,000 to EUR 100,000.9

Municipality of Milan (Case Study)

In this context, it is useful to specifically mention the General Third-Party Liability policy of the Municipality of Milan, covering the period from 31 December 2021, to 31 December 2024, which includes a S.I.R. of EUR 30,000 per claim, which increases up to EUR 100,000 for fatal claims.10 This approach confirms the activity of mitigating the negative impact of high-frequency claims.

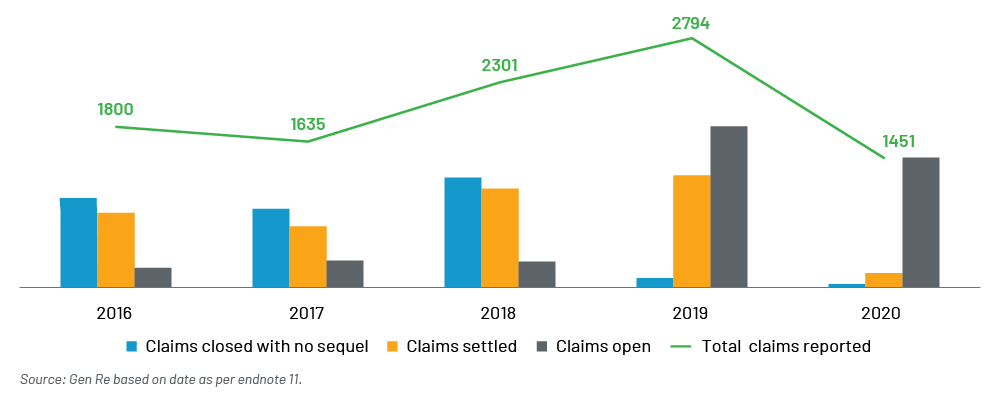

The Municipality of Milan published data on claims frequency on its official website.11 As illustrated in the chart below, during the observation period from 2016 to 2020, approximately 10,000 claims were reported, with an average of 1,990 claims per year. Notably, the year 2019 recorded a peak of nearly 2,800, while a significant decrease was observed in 2020, due to the traffic restrictions imposed during the COVID‑19 pandemic.

The chart below provides a detailed view of the claims’ frequency recorded by the Municipality of Milan over the past five years, highlighting the annual variations.

Claims Frequency Data – GTPL Policy of Municipality of Milan

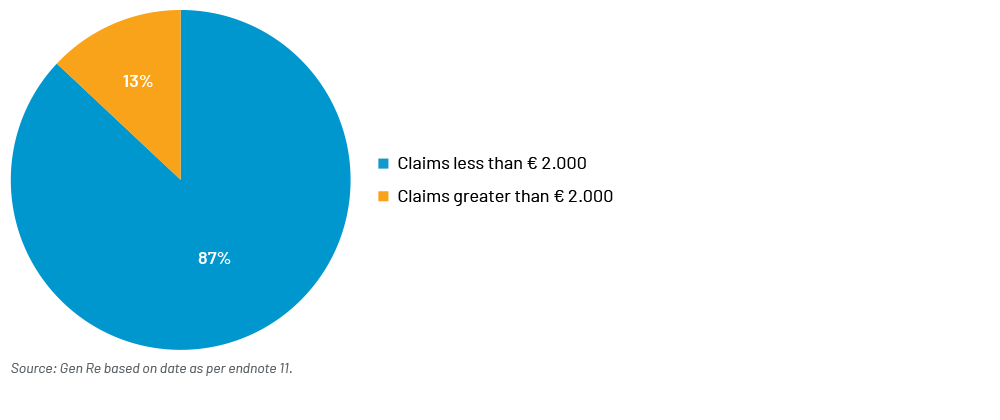

An analysis of the claims currently under review reveals a particularly noteworthy trend: approximately 87% of the 10,000 total claims are classified as mass losses, referring to events with amounts below EUR 2,000. The average amount paid for settled claims is approximately EUR 1,900. Conversely, large claims exceeding EUR 100,000 are rare, accounting for only about 0.13% of the total. Among these, only two claims were settled: one for EUR 250,000 (bodily injury) and the other for EUR 500,000 (fatality).

Focus on Claims Frequency vs. Serverity

Public Administrations’ Liability – Comparative Analysis Across Different Countries

After examining the liability of P.A. within the Italian system, it is interesting to expand the analysis through a comparative perspective, highlighting the differences and similarities among Germany, France, Spain, England and Wales, and Australia.

Germany

Public authorities have a duty to take the necessary and reasonable precautions to prevent harm to others. This duty does not imply the elimination of all possible risks but does require public authorities to ensure a necessary level of safety. If a public authority fails to fulfill the duty of care, it may be held liable for damages pursuant to Article 34 of the German Basic Law (Grundgesetz, GG),12 in conjunction with the German Civil Code (Bürgerliches Gesetzbuch, BGB).

However, if an accident occurs despite implementation of appropriate safety measures, it may be classified as a “general risk of life”. Such events are considered part of the risk of everyday life and are not necessarily attributable to negligence on the part of the public authority. Therefore, they do not give rise to liability (§ 839 (3) BGB).13

France

Under the French legal system, P.A. have a duty of care to ensure a necessary level of safety in the management of public facilities. In cases of loss or damage arising from the use of such facilities, it is the responsibility of the victim to establish a causal link between the facility and the harm suffered. However, the P.A. may avoid liability by demonstrating either that the facility was properly maintained, that the damage resulted from the victim’s own fault, or that it was caused by a force majeure event.

Spain

The Spanish system represents an exception compared to the other systems analyzed, as there is a strict liability for P.A.: the conduct of the injured party is not relevant.

The liability of public authorities is governed by Article 106.2 of the Spanish Constitution, which states that individuals are entitled to compensation for any damage to their property or infringement of their rights caused by the operation of public services, except in cases of force majeure.14

This constitutional principle is further developed in Law 40/2015 on the Legal Regime of the Public Sector, particularly, in Article 32.1, which affirms the obligation of public authorities to compensate individuals for harm caused by their actions or omissions in the exercise of public functions. Moreover, Article 34.1 of the same law introduces a limitation: damages are not compensable if they result from events or circumstances that could not have been foreseen or avoided according to the state of scientific or technical knowledge at the time the damage occurred.15

England and Wales

Public authorities may be held liable only in limited circumstances. To obtain compensation, a claimant must demonstrate that the authority has breached one of the following three principles:

- Breach of statutory duty – Under the Highways Act 1980, local authorities have statutory duty to maintain highways to ensure safe passage. If the highway is out of maintenance and the claimant suffers injury as a result, the authority may be held liable. However, the authority must prove that it took “such care as in all the circumstances was reasonably required”16 to ensure the highway was not dangerous.

- Misfeasance in public office – This occurs when a public official knowingly abuses their powers or acts with reckless disregard for the legality of their actions, causing foreseeable harm.

- Negligence – P.A. may be liable in negligence if it breaches the standard of care expected in the circumstances, and this breach causes the claimant to suffer loss.

In general, courts are cautious in imposing a duty of care on P.A. to prevent a flood of speculative or frivolous claims. As with the other legal systems analyzed, the conduct of the injured party is a relevant factor in assessing liability and may reduce or eliminate compensation if contributory negligence is established.

Australia

In Australia, many states and territories provide statutory protection for P.A. with respect to personal injury claims. These protections were introduced through legislative reform in response to the rising cost of liability insurance. As a result, most Australian jurisdictions adopted a form of statutory “policy defense”, limiting the circumstances under which P.A. can be held liable.

The liability of a P.A. is based on the principle of “Wednesbury unreasonableness”, for which a P.A. may only be held liable for a policy decision if that decision was so unreasonable that no reasonable authority could have made it.17 Plaintiffs advancing claims in negligence against public authorities must prove the existence and breach of a duty by the authority.

In line with the other legal systems considered here, the conduct of the claimant is relevant. If the plaintiff has contributed to the occurrence of their injury, the courts may apply the principle of contributory negligence, resulting in a proportionate reduction of any damages awarded.

Conclusion

The previously rigid judicial interpretation of Article 2051 of Italian Civil Code, establishing a form of strict liability, over time has contributed to a significant increase in compensation claims and corresponding judgments against public authorities. This trend prompted insurance companies to adjust liability policies to mitigate risk and ensure the long-term stability of the system.

In recent years, however, the Supreme Court increasingly emphasized the relevance of the injured party’s behavior. The court recognized that such conduct may play a decisive role in the occurrence of damage and, in certain cases, may justify a reduction or even exclusion of compensation. Within this legal context, a form of “counter-reaction” has begun to emerge within insurance companies. Preliminary market analyses indicate a trend toward reducing or even eliminating deductibles in general third-party liability policies, particularly among smaller municipalities.

It will be of particular interest to monitor how these dynamics continue to evolve and what further adjustments may arise within the insurance market in response to ongoing legal and judicial developments.

With contributions from Kelly Lieu, Anna Dalton, Janine Oelfert, Martin Peiffer, Barbara Kostic, Federico Maroto.

Download PDF version for Endnotes