-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

Structured Settlements – What They Are and Why They Matter

Publication

PFAS Awareness and Concern Continues to Grow. Will the Litigation it Generates Do Likewise?

Publication

“Weather” or Not to Use a Forensic Meteorologist in the Claims Process – It’s Not as Expensive as You Think

Publication

Phthalates – Why Now and Should We Be Worried?

Publication

The Hidden Costs of Convenience – The Impact of Food Delivery Apps on Auto Accidents

Publication

That’s a Robotaxi in Your Rear-View Mirror – What Does This Mean for Insurers? -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Publication

Key Takeaways From Our U.S. Claims Fraud Survey

Publication

Favorite Findings – Behavioral Economics and Insurance

Publication

Individual Life Accelerated Underwriting – Highlights of 2024 U.S. Survey

Publication

Can a Low-Price Strategy be Successful in Today’s Competitive Medicare Supplement Market? U.S. Industry Events

U.S. Industry Events

Publication

The Latest in Obstructive Sleep Apnea -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Workers’ Comp – “An Era of Exceptional Performance”

May 28, 2025

Bill Lentz

Region: North America

English

2025 NCCI’s Annual Insights Symposium – Gen Re Summary & Highlights

Solid financials, continued claim frequency reduction, and further underwriting gains have made 2024 another positive year for the Workers’ Compensation industry. According to the latest analysis provided by NCCI at its Annual Insights Symposium (AIS), Workers’ Compensation continues to outperform most other Property/Casualty lines of business in the U.S. While there are concerns regarding economic uncertainty, the Workers’ Comp industry is well positioned to handle such challenges. Read on for a summary and several key takeaways from the symposium.

Industry Results

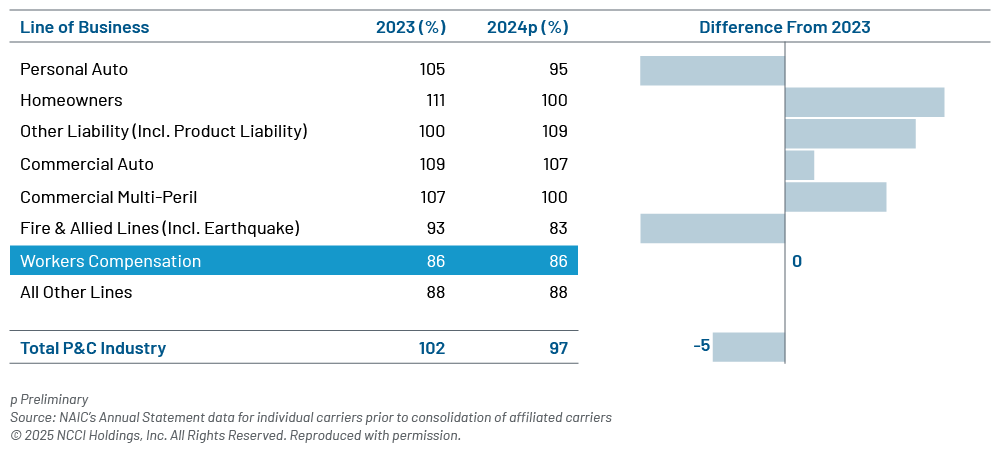

The Calendar Year 2024 combined ratio for private carriers is 86%. This is the eighth consecutive year of results under 90% and the eleventh consecutive year of underwriting gains. Workers’ Comp results continue to compare favorably against the total P&C net combined ratio of 97%. Lost-time claim frequency estimates for 2024 is 5% lower than 2023 which is more than the long-term average annual change of ‑3.6%. Severity increased by 6% for both medical and indemnity.

Net written premium for private carriers in 2024 was $41.6 billion, which is a decrease of 3% from 2023. Rates continue to decline, and written Bureau premium levels are expected to decrease by an average of 6.1% from 2024 to 2025 based on loss cost/rate changes in approved NCCI filings. Payroll increased by 5% in 2024, consisting of 1% from employment and 4% from wages. While wage growth was strong across many sectors, the largest employment gains were in the Health Care sector, along with above average increases in the Leisure & Hospitality and Construction sectors.

P&C Industry Net Combined Ratio (Private Carriers)

Economy

According to Stephen Cooper, Executive Director & Senior Economist for NCCI, the U.S. economy was in a position of exceptional strength leading into 2025, having grown 13% larger than it was coming out of the pandemic and outperforming its developed market peers, including Canada and the EU. However, since the tariff increases in April, the narrative has been one of economic uncertainty, including increased fears of a recession. Economic forecasts for 2025 are declining and the economists survey based probability of a recession increased in April to a 46% average compared to a 23% average in January. This contrasts with the current level of consumer spending, which has been stable. Cooper believes that if this indication remains positive, a recession may be avoided.

Based on data presented by Cooper regarding past recessions, short and mild ones do not have much impact on Workers’ Comp. Longer and deeper ones do not appear to impact severity; however, frequency may spike during the recovery as employers bring on new employees.

Labor Market

While employment growth has become more volatile, the labor market appears strong. Although there was a mid-summer dip in job gains in 2024, there was a strong recovery at year-end with over 200,000 new jobs each month. The start of 2025 has been solid in this area as well. While Cooper states there have been no warning signs in the labor market, he adds that it is a lagging indicator and only once the economy is in a recession will signs of stress appear and a notable decline in employment.

Payroll growth also remains solid, although the most gains have been concentrated in Construction, Healthcare and Leisure and Hospitality. In 2025 year-to-date growth data, Transportation and Warehousing is also showing large gains. As Cooper states, payroll growth does not usually decline unless there is a longer and deeper recession, however, there are concerns as to whether the trend in wage growth is sustainable considering the current economic uncertainty.

At a more macro level, it has been estimated by the Congressional Budget Office that deaths may begin to exceed births in the U.S. as early as 2033. As such, absent any immigration, the U.S. population would start to decline at that time. Cooper indicated that while foreign-born workers represent a smaller share (approx. 20%) of the U.S. workforce, they make up over half of the labor market growth that we have experienced since 2009. Economic growth needs labor market growth. Hazardous occupations, such as construction/extraction, farming, maintenance, healthcare support and food preparation are most reliant on foreign-born workers. As such, Cooper states that any reduction in labor supply or tightening of the labor market in these high hazard industries could have a negative impact on claim frequency.

Inflation

The status of the tariffs keeps changing as there appear to be new developments and announcements on a weekly basis. While the ultimate impact on inflation is uncertain, Cooper believes prices on goods will increase due to tariffs, whether we see increased inflation or not.

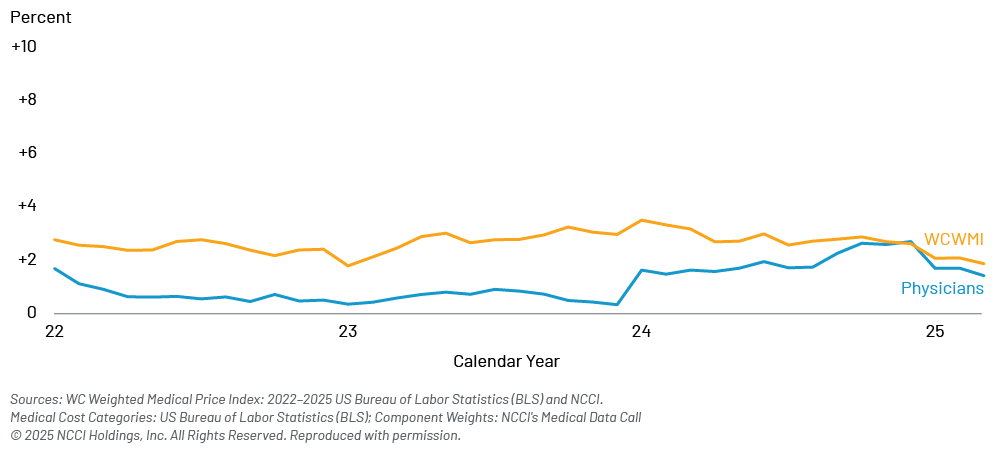

NCCI measures the rate of Workers’ Comp medical price increases via the Workers’ Compensation Weighted Medical Price Index (WCWMI) which adjusts to specifically Workers’ Comp related medical costs. This index reflects medical inflation to be currently back to pre-pandemic levels which is around 2% after spiking to 3% last year.

The two components of the medical cost distribution that would likely to be directly impacted by tariffs are drugs and medical supplies. Cooper believes that a realistic estimated cost increase for these components would raise the WCWMI from its current 2% rate to approximately 3% to 3.5%, which is what it was in early 2024. However, the Trump Administration, via recent Executive Order, is potentially linking drug prices to the foreign rate which is typically lower. As such, any increase in medical costs via tariffs could potentially be offset by lower drug prices. Overall, NCCI believes that any medical price impacts are likely to be manageable.

Workers’ Comp Weighted Medical Price Index (WCWMI)

NCCI State of the Line Report

NCCI’s Chief Actuary, Donna Glenn, provided a detailed review of results, trends, and cost drivers in the Workers’ Comp industry. Here are selected highlights from her presentation.1

- WC Premium – The 2024 net written premium for private carriers decreased 3% from 2023 to $41.6 billion. When including state fund data, the total net written premium was $46.3 billion. Premium decrease was driven by decreases in rates that exceeded the pace of payroll growth in 2024.

- WC Net Combined Ratio – The 2024 private carrier calendar year (CY) combined ratio is 86%. The 2024 accident year (AY) combined ratio is 99% but NCCI believes it will develop favorably over time and improve by seven points (to 92%) when all claims are settled and closed.

- Investment Results – The preliminary WC investment gain on insurance transactions ratio increased slightly to 10% in 2024. It is noted that this is still below the WC long-term average of 11.4%.

- Pre-Tax Operating Gain – 2024 saw a 24‑point pre-tax operating gain (10% investment gain ratio and 14% underwriting gain). This is the eighth straight year with results over 20% and 10 straight years of operating gains greater than the long-term average of 14%.

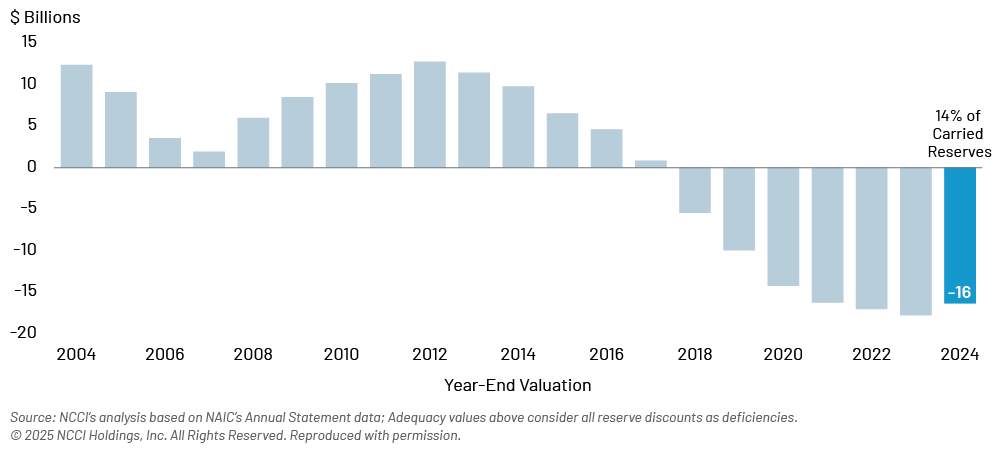

- Reserve Adequacy – NCCI estimates the year-end 2024 WC reserve position for private carriers to be a $16 billion redundancy. This is a slight reduction from the $18 billion redundancy in 2023 but still a stark contrast to the $12 billion deficiency that existed in 2012. WC has been in a redundant reserve position since year-end 2018.

- Claim Frequency – NCCI estimates WC lost-time claim frequency for AY 2024 is 5% lower than the previous year. This is the third consecutive decrease in frequency greater than the long-term (2004‑2023) average annual change of ‑3.6% that followed the pandemic-related increase in AY 2021.

- Indemnity Severity – The average indemnity cost per claim for AY 2024 is estimated to be 6% higher ($30K) than for AY 2023. The larger than average change is mostly driven by increased wages which have risen significantly in recent years; however, wage growth has outpaced the growth in average indemnity claim severity. The rate of wage growth has put upward pressure on indemnity claim costs.

- Medical Severity – NCCI estimates the average medical lost-time claim severity for AY 2024 to also be about 6% higher ($29.6K) than AY 2023. The volume of medical losses in AY 2024 is approximately 2% higher than AY 2023, but the lost-time claim volume is estimated to have decreased by approximately 4% in AY 2024.

Workers’ Comp Net Loss and LAE Reserve Adequacy (Private Carriers)

As noted by Tracy Ryan, President & CEO of NCCI, in her introductory remarks, Workers’ Comp is rooted in employee protection and care. Great strides have been made to make workplaces safer. Along with a greater emphasis on safety, technology has been used to automate repetitive tasks, leverage robots for dangerous and high-risk jobs, and using wearables to prevent accidents before they occur. To this extent, Ryan also notes that the industry has done a great job in leveraging data and analytics to make the Workers’ Comp system more efficient and sustainable. While acknowledging the impact that Artificial Intelligence could have on the Workers’ Comp industry, Ryan states that the potential benefits of greater efficiency, accuracy, and insights must be guided by transparency, ethical responsibility, and regulatory compliance. She believes future investment in data and analytics is critical for futher advances in safety and modeling future scenarios for use in anticipatory decision‑making.

Worker’s Comp has been stable for the last decade, benefiting from a decline in frequency, rising wages, and moderate severity. While it has been relatively unaffected by issues other Property/Casualty lines have been facing, concerns still exist regarding economic uncertainty, both near-term and long-term risks to the labor market, and the potential for future global events.

Gen Re is proud to be a part of a healthy and strong Workers’ Comp system that continues to deliver on its promise. We look forward to working together on any future challenges towards continued success!

Endnote

- Full report is available at NCCI.com. 2024 data is preliminary.