-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

Structured Settlements – What They Are and Why They Matter

Publication

PFAS Awareness and Concern Continues to Grow. Will the Litigation it Generates Do Likewise?

Publication

“Weather” or Not to Use a Forensic Meteorologist in the Claims Process – It’s Not as Expensive as You Think

Publication

Cyber Risks – Deepfake Exposures

Publication

Georgia and Louisiana Pass Sweeping Tort Reform Legislation. What Does It Aim to Do and What Are the Implications for Insurers?

Publication

That’s a Robotaxi in Your Rear-View Mirror – What Does This Mean for Insurers? -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Publication

Highlights from the Group Term Life and AD&D Market Survey – Growth and Stability

Publication

Favorite Findings – Behavioral Economics and Insurance

Publication

Understanding Physician Contracts When Underwriting Disability Insurance

Publication

Voice Analytics – Insurance Industry Applications [Webinar] U.S. Industry Events

U.S. Industry Events

Publication

The Mass Phenomenon of Esports – A Look Behind the Screen -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Enhancing Total and Permanent Disability Sustainability in Australia – The Role of Financial Controls

May 22, 2025

Bindu George

Region: Australia

English

The sustainability of Total and Permanent Disability (TPD) insurance has emerged as an important issue in Australia’s financial landscape. Amid mounting financial pressures, the relevance and viability of TPD benefits is currently under scrutiny. As work environments change, medical advancements continue, and economic conditions shift, we should carefully analyse whether the current TPD benefit amounts are truly serving their intended purpose at the time of claim.

Key regulatory and industry bodies such as the Australian Prudential Regulation Authority (APRA),1 the Australian Securities and Investment Commission (ASIC),2 the Actuaries Institute,3 and the Australasian Life Underwriting and Claims Association (ALUCA)4 have stressed the importance of robust financial controls in maintaining the viability of TPD insurance.

This article explores the central role that financial controls play in ensuring that TPD benefits remain relevant and sustainable, drawing on insights and recommendations from these leading institutions.

The Sustainability Challenge of TPD in Australia

Since the 1960s, TPD insurance has been a cornerstone of Australia’s financial safety net, providing crucial support to individuals unable to work due to severe disabilities. Traditionally, TPD benefits are designed to provide a lump sum which can be used at the recipient’s discretion. The retail TPD insurance amounts are calculated based on estimated future income loss and are intended to cover expenses such as debt, living costs, home modifications, and rehabilitation.

A primary concern in TPD insurance today is the provision of benefits that exceed the necessary replacement of estimated future income loss. In 2022, the industry recorded its first loss for individual lump sum payments in many years.5

APRA has been actively reviewing TPD insurance to address sustainability issues within the industry.6 Similarly, ASIC has highlighted ongoing gaps, despite the progress in strengthening the TPD safety net.7 The Actuaries Institute’s Disability Insurance Taskforce has also urged life insurers to consider the interaction between lump sum and income protection benefits.8

In July 2024, ALUCA published a consultation paper addressing the ongoing sustainability of TPD insurance. This paper identifies five key challenges:

- the attraction and finality of a large lump sum;

- over-insurance especially when combined with other solutions;

- the subjectivity and difficulty in determining the permanency of a condition;

- management of occupation;

- and the constraints on TPD product evolution.9

Excessive benefits play a major role in the sustainability issues facing TPD insurance. This requires a comprehensive re‑evaluation of the current benefit structures to secure the long-term viability of TPD insurance within the financial system.

Decoding Today’s TPD Benefit Calculations

TPD policies typically align with the policyholder’s working life, usually up to the age of 65, resulting in a policy term ranging from 20 to 40 years, depending on when the policy is taken out. The underwriting formula for calculating the appropriate amount of TPD cover primarily relies on an age-dependent multiple of the insured’s gross annual income.

The rationale behind determining the suitable income multiple is straightforward: it considers the future earning potential based on the number of active working years remaining and assumes that the individual’s income will remain stable. Most insurers further consider any mortgage and future educational expenses for dependent children. The TPD cover is further adjusted for inflation and added as an optional rider to the policy. Generally, the TPD benefit is calculated using gross annual income, without accounting for personal income tax.

While this method is generally well-founded, it has some potential gaps. The following example underscores the shortcomings of current financial underwriting methods.

Let’s examine a case study of a 35‑year-old applicant with an annual income of AUD 80,000 seeking TPD insurance. Table 1 outlines the underwriting calculation for TPD.

Table 1 – Example of an Underwriting Calculation for TPD

Annual gross income: AUD 80,000 (including superannuation)

Age: 35

Income multiple: 25 (as a reflection of industry average for this age group)

This applicant is seeking TPD cover of AUD 2.2 million, accompanied by a statement of advice outlining “other needs”, including a AUD 500,000 mortgage and AUD 100,000 for future educational expenses for three dependent children.

Calculation

Maximum TPD cover based on income multiple: AUD 2 million

TPD cover was offered for AUD 2.2 million in this instance considering the income multiple and other needs as per the statement of advice

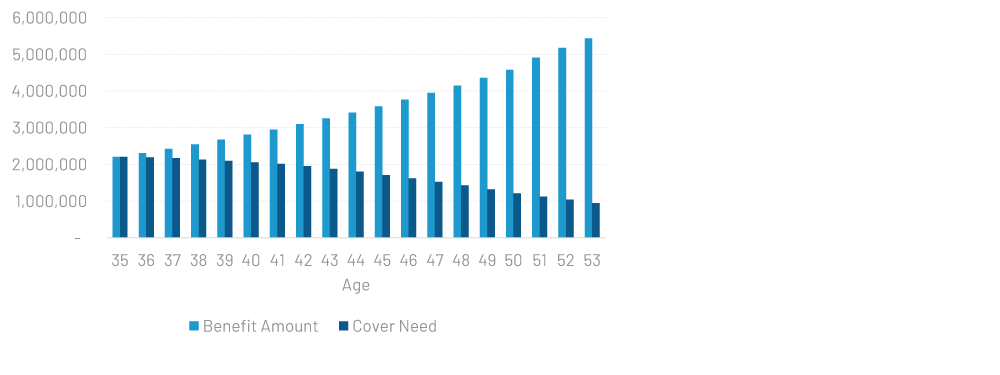

Figure 1 illustrates the trajectory of TPD cover of AUD 2.2 million from the above example in relation to indexation and wage inflation. It is important to note that the need for insurance follows a different pathway as the years remaining until age 65 decrease, along with the reduction in mortgage obligations.

There is a significant disconnect between the benefit that will be made available at older ages for this applicant and the actual expected need at these ages.

Figure 1 – TPD – Cover Amount vs Need

Key Challenges in TPD Benefit Structures

The above case study highlights the significant need to reassess current benefit structures. The fundamental principle of insurance is to indemnify, or restore, the insured to their pre-loss financial position, not to provide a financial windfall. Designing TPD payouts to replace lost future income rather than to enrich claimants is vital for the financial sustainability of the insurance system.

Key considerations include the use of current income multiples, potential overlaps with other disability benefits, the impact of annual indexation, and the effects of personal income taxation. Addressing these factors is crucial to ensure benefits accurately replace future income loss. These measures will, in turn, support the long-term sustainability of TPD products.

Need for cover

Traditional methodologies assume that the need for insurance remains stable over the policy term, typically spanning 20 to 40 years. However, the need for cover is higher in the early years due to expected career progression, home purchases, and family needs, and decreases in later years. Our current approach, which is based on the number of active working years remaining, does not account for this “life cycle need”, leading to an overestimation of the need for cover later in the policy term.

Wage progression

Insurers use income multiples based on the assumption of stable income progression, which heavily relies on overall economic stability. However, these assumptions can be adversely impacted by external factors such as recessions. Over the past decade, the average annual wage inflation in Australia has generally ranged between 2% and 3%.10,11 There have been fluctuations, especially in the mid-2010s, when wage growth was around 1%.12 More recently, wage growth has picked up, with annual increases around 4% in the last few years.13 Therefore, the assumption that income will remain stable has led to shortcomings in the use of current income multiples.

Overlap with other disability benefits

Many individuals hold both TPD and long-term income protection through retail policies and superannuation. Receiving benefits from both can result in substantial payouts.14 The availability of overlapping benefits may encourage claims, increasing the financial burden on insurers and potentially leading to higher premiums for policyholders.

Impact of annual indexation

While annual indexation helps keep the cover amount aligned with inflation, it also causes the cover amount to increase over time, potentially resulting in a windfall at the time of a claim. This escalation can lead to significant premium increases, making the policy progressively less affordable and potentially unsustainable in the long run.

Effects of taxation

It is quite common for the impact of taxation to be overlooked in calculations, which can significantly affect the overall financial outcome. TPD benefits are generally not considered taxable income, making TPD claim payouts tax-free. However, the calculation at the underwriting stage uses pre-tax income rather than post-tax income. This approach can lead to an overestimation of the actual income replacement needed, as the policyholder’s net income (after tax) is what they realistically need to replace their lost future income.

Future-proofing TPD Insurance – Essential Financial Considerations

The sustainability of TPD products relies on striking a delicate balance between affordability for consumers and the financial viability of insurance providers. By revising benefit structures and implementing robust financial underwriting practices, we can significantly enhance the long-term sustainability of TPD insurance. Innovation in TPD insurance products is crucial for maintaining this sustainability.

Reevaluate income multiples

- Adjust income multiples to reflect realistic income progression and economic conditions.

- Incorporate a more realistic model to respond to the changing need for cover over the policy term, for example by introducing negative indexation at later stages.

Address overlapping benefits

- Implement stricter guidelines to manage the overlap between TPD and other disability benefits.

- Consider setting a cap on the TPD coverage to prevent excessive claims that could lead to financial gain instead of compensating for the actual loss.

Refine annual indexation

- Balance indexation to keep pace with inflation without causing excessive increases in cover amounts.

- Regularly review and adjust indexation rates to ensure they remain appropriate and sustainable.

Incorporate tax considerations

- Ensure consistent treatment of tax impacts at both the benefit calculation and the claim stages.

- Use post-tax (net) income for benefit calculations to accurately reflect the policyholder’s financial needs and ensure benefit amounts align with the income required to replace estimated future income loss.

Now is the Time to Act

Insurers have a unique opportunity to promote sustainability and resilience through their expertise in risk management. By committing to long-term sustainability, insurers can ensure that everyone is protected against life’s uncertainties. This dedication will guarantee that TPD insurance continues to provide essential financial protection to Australians in need. Together, we can build a brighter and more secure financial future for all.

- APRA’s Quarterly life insurance performance statistics: highlights December 2022 (released 2 March 2023)

- ASIC media release: ASIC finds gaps remain despite progress to repair the TPD ‘safety net’ (published 2 August 2021)

- Actuaries Institute release: Disability Insurance in Australia: Findings and Recommended Actions(released in September 2024)

- ALUCA’s TPD Insights from The Frontline: Where to next (released 24 July 2024)

- APRA’s Quarterly life insurance performance statistics: highlights December 2022 (released 2 March 2023)

- APRA’s Quarterly life insurance performance statistics Note 1 & 5

- ASIC media release: ASIC finds gaps remain despite progress to repair the TPD ‘safety net’ (published 2 August 2021)

- Actuaries Institute release: Disability Insurance in Australia: Findings and Recommended Actions (released in September 2024)

- ALUCA’s TPD Insights from The Frontline: Where to next (released 24 July 2024)

- Australian Bureau of Statistics: Wage Price Index, Australia (released 13 September 2024)

- Reserve Bank of Australia: New Timely Indicators of Wages Growth. Bulletin – September 2023 Australian Economy (released 21 September 2023)

- ABC article: Fact check: Have wages grown steadily and outstripped inflation over the past decade? Credit RMIT ABC Fact Check (published on 1 November 2018)

- Australian Bureau of Statistics: Wage Price Index, Australia (released 13 September 2024)

- ALUCA’s TPD Insights from The Frontline: Where to next (released 24 July 2024); Actuaries Institute release: Disability Insurance in Australia: Findings and Recommended Actions(released in September 2024)