-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

Structured Settlements – What They Are and Why They Matter

Publication

PFAS Awareness and Concern Continues to Grow. Will the Litigation it Generates Do Likewise?

Publication

“Weather” or Not to Use a Forensic Meteorologist in the Claims Process – It’s Not as Expensive as You Think

Publication

Phthalates – Why Now and Should We Be Worried?

Publication

The Hidden Costs of Convenience – The Impact of Food Delivery Apps on Auto Accidents

Publication

That’s a Robotaxi in Your Rear-View Mirror – What Does This Mean for Insurers? -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Publication

Key Takeaways From Our U.S. Claims Fraud Survey

Publication

Favorite Findings – Behavioral Economics and Insurance

Publication

Individual Life Accelerated Underwriting – Highlights of 2024 U.S. Survey

Publication

Can a Low-Price Strategy be Successful in Today’s Competitive Medicare Supplement Market? U.S. Industry Events

U.S. Industry Events

Publication

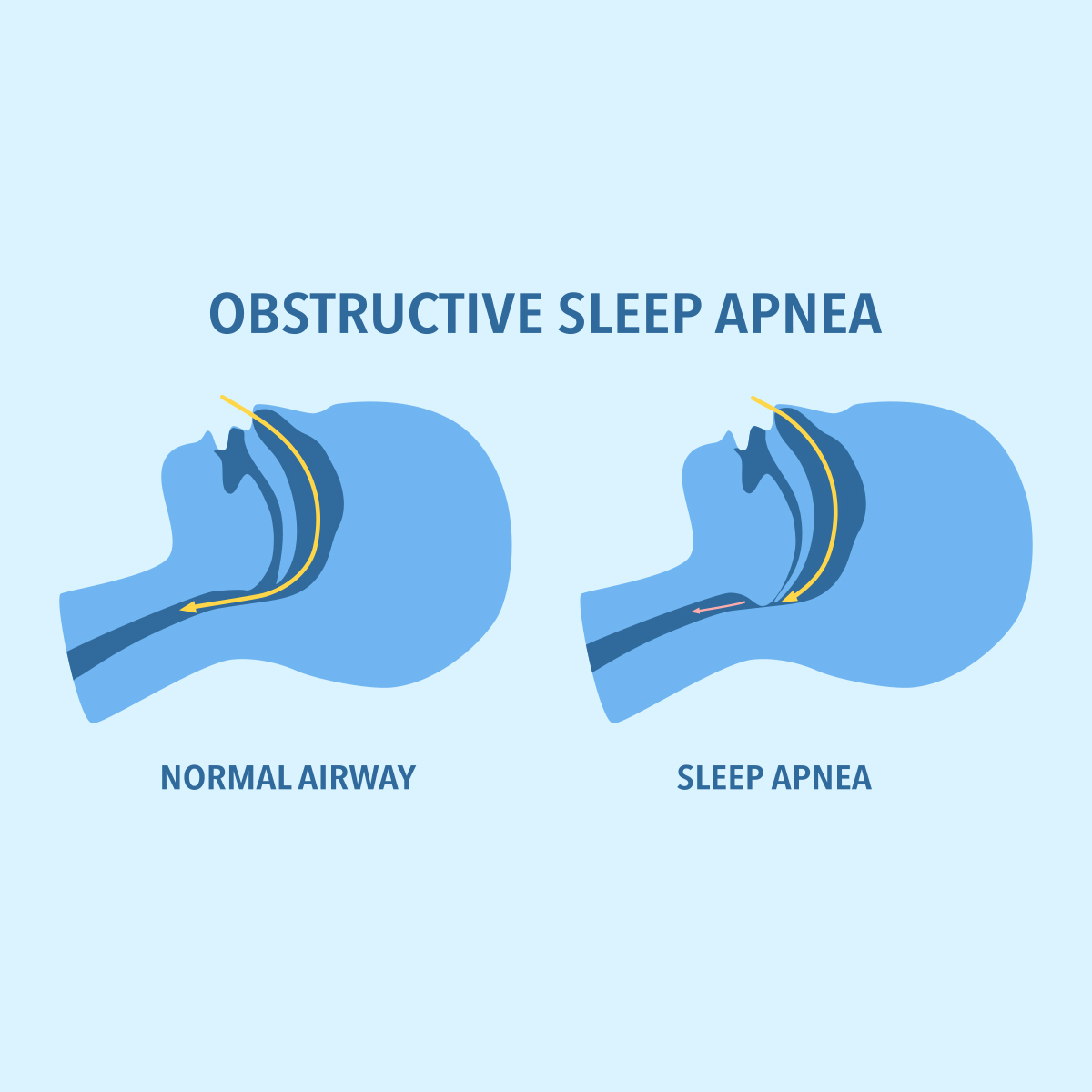

The Latest in Obstructive Sleep Apnea -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Remember to Forget – Insuring Cancer Survivors in the EU

December 16, 2022

Dr. Åsa Weber

Region: Europe

English

Français

Life insurers across Europe are facing new legislative challenges around insuring cancer survivors and their “right to be forgotten” (RTBF). The moves come after the European Commission published its “Europe’s Beating Cancer Plan” in February 2021. This campaign includes steps for the prevention, early detection and treatment of cancer and aims to ensure that “cancer patients live long, fulfilling lives, free from discrimination and unfair obstacles”1. The latter refers to the provision of financial services, including insurance, enabling long-term cancer survivors to apply for insurance without having to disclose their history of cancer.

A few European countries have already implemented the RTBF. It has been effective in France since 2016, followed by Belgium, Luxembourg and The Netherlands in the years 2020–2021; Portugal and Romania brought in legislation in 2022 and Italy has also presented legislation to the senate.

Within the scope of the RTBF, insurers must not consider medical information on cancers that occurred earlier than a defined period, usually five or 10 years after the completion of the therapeutic protocol without recurrence, when calculating insurance premiums.

To target the law to a particular population and essential financial services, the initial RTBF legislation had a narrow scope applying to certain types of life insurance only, with additional restrictions addressing maximum insurance amounts and age ranges. For certain cancers that have a particularly good prognosis and a low risk of recurrence, special shortened cut-off times apply, defined in so-called “medical grids”. Other chronic diseases such as hepatitis or HIV which are often included in the grids must also be disregarded, or may be rated only with a fixed maximum additional premium.

“Europe’s Beating Cancer Plan” aims to achieve the RTBF in all EU countries by 2024 and we therefore expect more European countries to follow suit and to start implementing the RTBF. How the law will be applied is, however, not precisely defined and European states are taking different approaches. While the first introductions of the law were relatively clear-cut and limited, recent advances have been more far-reaching.

For example, Portugal is the first country to extend the right to forget to chronic illnesses that have been “effectively and continuously treated for two years”. The Belgian insurance association has obliged its members to a code of conduct that applies the RTBF to “Guaranteed Income Insurance” and in France, medical underwriting for loan insurance with sums assured up to EUR 200,000 has been abolished altogether.

With the foreseeable implementation of the RTBF in further countries, we think it is important to create a basis for dialogue between representatives from politics, patient groups, and insurance that will make it possible to find consensual regulation.

In a detailed whitepaper, Gen Re is providing an overview of cancer risk in general, focusing on long-term mortality risk and on how the RTBF could affect a life insurer’s portfolio. We look at the RTBF across the EU, discuss the implications for underwriters and address questions such as possible risk mitigation measures, ways of disclosure and the challenges of including chronic diseases to the RTBF.

You can read the full paper, “Remember to Forget: Insuring Cancer Survivors and the Right To Be Forgotten”, here.

Endnote

- Link to Europe’s Beating Cancer Plan: Implementation roadmap: https://health.ec.europa.eu/system/files/2022-02/eu_cancer-plan_en_0.pdf. Last accessed 07.12.2022.