-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

Biometric Information Privacy – Statutes, Claims and Litigation [Update]

Publication

Inflation – What’s Next for the Insurance Industry and the Policyholders it Serves?

Publication

Human Activity Generates Carbon and Warms the Atmosphere. Is Human Ingenuity Part of the Solution?

Publication

Illinois Changes Stance on Construction Defect Claims – The Trend Continues

Publication

Generative Artificial Intelligence in Insurance – Four Aspects of the Current Debate

Publication

Battered Umbrella – A Market in Urgent Need of Fixing -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Publication

Underwriting High Net Worth Foreign Nationals – Considerations for U.S. Life Insurance Companies

Publication

Group Term Life Rate & Risk Management – Results of 2023 U.S. Survey

Publication

Trend Spotting on the Accelerated Underwriting Journey

Publication

All in a Day’s Work – The Impact of Non-Medical Factors in Disability Claims U.S. Industry Events

U.S. Industry Events

Publication

Marginal Gains in the Medicare Supplement Market -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

U.S. Supplemental Benefits Remain Strong Throughout the Pandemic

November 30, 2021

Kayla Rooney

Region: North America

English

Despite the many challenges confronting the supplemental health industry during the pandemic, first-year premium growth remained positive, albeit modest, for Critical Illness insurance.

This indicator is one of many revealed in Gen Re’s recently released U.S. Critical Illness Insurance Market Survey. Our annual survey covers Traditional Individual Critical Illness, Group/Worksite Critical Illness, and Accident products.

Survey Overview

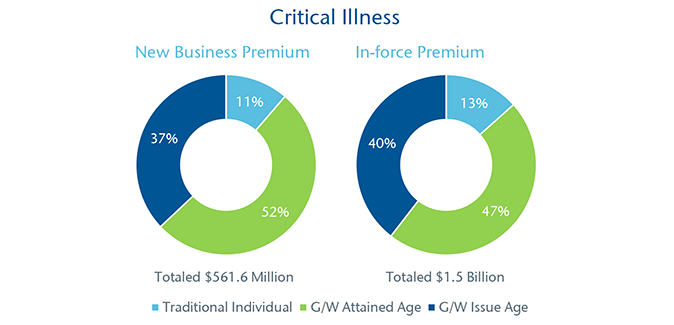

Thirty-nine carriers participated in this year’s survey, reporting $1.5 billion in Critical Illness in‑force premium and $562 million in new sales for 2020. Unsurprisingly, the vast majority of Critical Illness sales premium (89%) was attributed to group/worksite products.

It is worth noting that the list of participating companies can vary year-to-year. As such, it is helpful to recognize and address these fluctuations. Based on information reported in previous years, Gen Re estimates the 2020 market in‑force premium is closer to $2.2 billion and the sales premium to be in the range of $839 million.

Thirty‑one carriers provided results for their Accident insurance product, and they reported $1.5 billion in‑force premium and $484 million in new sales for last year.

3 Indicators the Market Remains Strong:

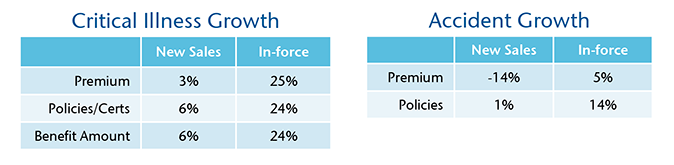

1 – Sales premium increased 3% in 2020 for all Critical Illness products combined.

While this number is certainly much smaller than the 2019 sales premium growth of 14%, given the pandemic, some decrease was to be expected. These growth percentages are based on year-over-year growth for carriers reporting data for both 2019 and 2020 only. Particularly in the worksite market, COVID‑19 brought on many sales pipeline challenges, such as: declines in the number of employees, implementation delays due to furloughs and layoffs, competing priorities for employers and the desire to maintain consistency with benefits through a time of uncertainty.

Although Accident sales decreased in 2020 compared to 2019 for the 31 carriers that reported this year, in‑force premiums increased by 5%.

2 – Experience remains favorable.

At the time that data was collected in June and July of 2021, all carriers with Critical Illness products reported their claims incidence was less than their expectations, or matched them, since the inception of their program. This statement holds true for 2020 claims experience as well.

Accident claims experience has remained favorable as well, with 93% of carriers reporting that their 2020 claims matched or were below expectations.

3 – Innovation is abundant.

In order to keep up with the environment and competition, carriers continue to improve and evolve their supplemental benefits products. This can take many forms, including but not limited to:

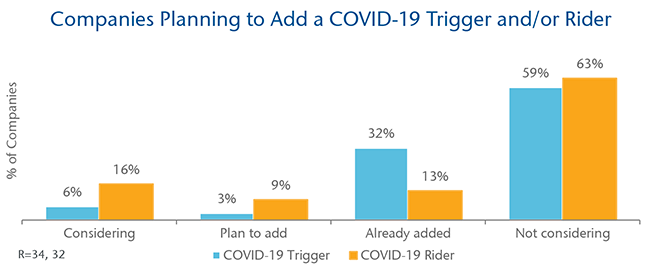

- New Benefit Trigger – COVID‑19 or Infectious Disease

41% of carriers reported that they have either already added, plan to add, or are considering adding a COVID‑19 trigger to their base CI coverage. 37% answered the same way for CI Riders. We are also seeing some carriers modify their wellness benefits, whether it be for COVID‑19 testing or vaccines.

- Technology Improvements

With more business being done remotely than ever before, online capabilities such as enrollment systems need to be cutting edge. With the lack of face-to-face meetings, digital marketing materials and videos can help. Additionally, as state variations increase, administration capabilities need to be advanced enough to handle many nuances within the same product. - Cross-Selling or Bundling

The majority of carriers reported that they market their CI product alongside other supplemental benefits. While the two products most commonly partnered with CI are Accident and Hospital Indemnity, at 89% and 76% respectively, carriers responded with products that range anywhere from life to disability or medical products. Given these statistics, it is not surprising that the second most commonly reported reason for worksite takeover is “the ability to bundle coverage/existing relationship.”

The trends highlighted above remind us that in changing times, flexibility remains more important than ever. Whether it be product design flexibility to satisfy employer/broker demands, or compliance/pricing flexibility to work through the varying but increasing number of state objections, carriers need to be ready.

Gen Re delivers customized reinsurance programs and risk management solutions for Supplemental Benefits carriers – with our research complementing that by offering valuable information and insights. If you’d like to learn more about the survey results, feel free to reach out to me directly.