-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

Florida Property Tort Reforms – Evolving Conditions

Publication

Is Human Trafficking the Next Big Liability Exposure for Insurers?

Publication

When Likes Turn to Lawsuits – Social Media Addiction and the Insurance Fallout

Publication

Generative Artificial Intelligence and Its Implications for Weather and Climate Risk Management in Insurance

Publication

Engineered Stone – A Real Emergence of Silicosis

Publication

Who’s Really Behind That Lawsuit? – Claims Handling Challenges From Third-Party Litigation Funding -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Publication

Understanding Physician Contracts When Underwriting Disability Insurance

Publication

Voice Analytics – Insurance Industry Applications [Webinar]

Publication

GLP-1 Receptor Agonists – From Evolution to Revolution U.S. Industry Events

U.S. Industry Events

Publication

Always On: Understanding New Age Addictions and Their Implications for Disability Insurance

Publication

Dying Gracefully – Legal, Ethical, and Insurance Perspectives on Medical Assistance in Dying -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Will the COVID-19 Liability Shields Protect Your Business From Customer Lawsuits?

September 10, 2020

Tim Fletcher,

Mindy Pollack

Region: North America

English

U.S. businesses are re-opening their doors with relief and anxiety. Even if customers return to shops and restaurants, the risk of potential COVID-19 exposures and liability hangs over their operations. Businesses following the latest safety regulations and best practices may still be vulnerable to claims, and that is the reason for the latest legislative trend: COVID-19 liability shields.

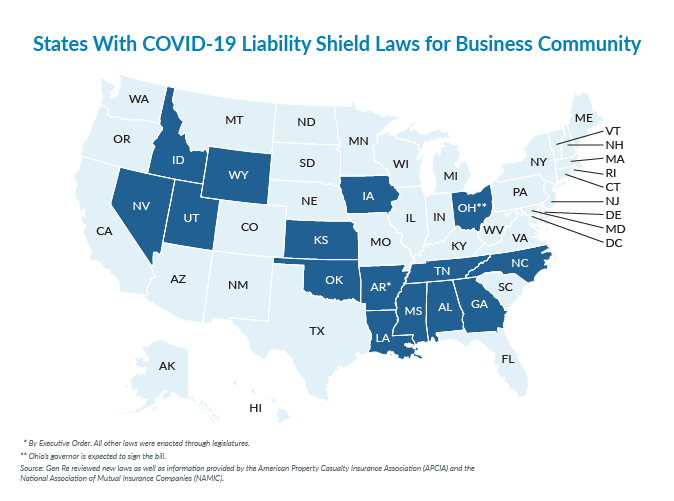

While Congress wrangles over a federal immunity bill, many states are quietly enacting their own liability shields for businesses within their borders. To date, over a dozen states have passed a liability shield law and more are considering proposals. These state liability shields are not identical and diverge widely from the federal proposals considered to date. By understanding a few key provisions and differences, insurers can start to assess if and how the liability shields will impact the risks in their book.

State Protections for Main Street

Insurers know that state laws are rarely identical, and that the devil is in the details. This holds true for the COVID-19 liability shields. We highlight a few critical areas and urge the reader to delve into the actual laws that apply to your risks. There are just too many details for one blog.

- Scope of Shield - Who is Protected? In the initial crisis days of coronavirus, state governors around the country issued emergency orders protecting health care providers, first responders and/or PPE manufacturers. With the focus shifted to reopening the economy, state legislatures are expanding protections to encompass “main street” businesses. Most of the new statutes do not limit the type or legal structure of the business, although at least one - North Carolina - targets “essential businesses” which, while broadly defined, is still not “all businesses.” Food preparation and property owners also receive special treatment in some laws.

- Compliance with Health and Safety Laws - How Close? Most but not all the laws require that businesses follow applicable health and safety laws; Georgia, Idaho and Utah are exceptions for lacking any such references. Of greater significance is how much compliance is needed for protection, and again the laws vary. Iowa, Kansas, Louisiana and Nevada, for example, demand “substantial compliance” but Mississippi, Oklahoma and Wyoming apply a “good faith” attempt to comply standard. These distinctions can make a huge difference when it comes to liability.

- Gross Negligence - When is Immunity Lost? Most of the laws drop the liability shield if the business is shown to have acted badly, and just how badly depends on the state. North Carolina excepts a business based on “gross negligence, reckless misconduct and intentional infliction of harm” and in general the states mirror this language. Iowa and Mississippi narrowed the exception to “actual malice or “intentional conduct” and removed negligence concepts. The states without this carve-out, such as Kansas and Oklahoma, seem to take the approach that a business complying with the health and safety laws should be protected regardless of other behavior.

- Presumptions and Notices - A Few More Differences. Although Georgia’s shield is not dependent on compliance with health guidance, it does require certain warnings and waivers for the business to benefit from a presumption that visitors assumed the risk. The law sets out very specific criteria for these notices. This protection is lost if gross negligence, willful and wonton misconduct, reckless or intentional infliction of harm is shown. Here is a picture that we recently saw posted in an office building:

- Effective Dates - When Does Immunity Begin and End? The protections apply to exposures starting anywhere from January 1, 2020 to early March, depending on the state. Most of the laws remain in effect through mid-2021, or until the emergency is no longer in effect in that state. One notable exception is Kansas where the shield expires January 26, 2021. Lawmakers may need to extend these timeframes, which means that more changes to the laws should be expected.

Tort Reforms and Federal Action

Several more states are debating liability shields and our map could be much more colorful by year end. As for the federal approach, the proposed bill will undergo the usual revision process (think of making sausage) and emerge looking very different, if it survives at all. From our first look, the proposed federal shield is significantly broader than the state versions. After requiring the plaintiff to show gross negligence and the failure to make reasonable efforts to satisfy health guidelines, the draft bill then prohibits non-economic damages unless the plaintiff can show willful misconduct. None of the state laws or bills have this heightened liability standard or damage limitation.

Despite the hyper focus on COVID-19, these laws may still face common legal challenges on constitutionality as well as their interpretation. Will they all hold up in court? The only prediction we make is that there is a lot more debate and judicial activity ahead for COVID-19 liability shields.

As always, please reach out to your Gen Re representative or one of us directly with any questions or to share your thoughts on this topic.