-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

Florida Property Tort Reforms – Evolving Conditions

Publication

Is Human Trafficking the Next Big Liability Exposure for Insurers?

Publication

When Likes Turn to Lawsuits – Social Media Addiction and the Insurance Fallout

Publication

Generative Artificial Intelligence and Its Implications for Weather and Climate Risk Management in Insurance

Publication

Engineered Stone – A Real Emergence of Silicosis

Publication

Who’s Really Behind That Lawsuit? – Claims Handling Challenges From Third-Party Litigation Funding -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Publication

Understanding Physician Contracts When Underwriting Disability Insurance

Publication

Voice Analytics – Insurance Industry Applications [Webinar]

Publication

GLP-1 Receptor Agonists – From Evolution to Revolution U.S. Industry Events

U.S. Industry Events

Publication

Always On: Understanding New Age Addictions and Their Implications for Disability Insurance

Publication

Dying Gracefully – Legal, Ethical, and Insurance Perspectives on Medical Assistance in Dying -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Voluntary Health Insurance in Hong Kong – Three Decades in the Making

April 07, 2020

Orchis Li

Region: Asia

English

The Hong Kong Voluntary Health Insurance Scheme (VHIS) was finally launched on 1 April 2019. It followed three decades of public consultation and took a concerted effort from the government and the insurance industry.

The government first launched its consultation paper back in 1985 with the aim of improving the healthcare system for the people of Hong Kong. The paper on which VHIS was based on was published in December 2014. Since that time the insurance industry has worked closely with the Food and Health Bureau (FHB) to agree product features, benefit scales, terms and conditions, and scheme rules.

The “Choose with Confidence” slogan of VHIS aims to stimulate increased uptake of private healthcare services for those who can afford it. It is hoped this will help to alleviate the heavy burden on the public sector, especially given the fast-aging population and high medical inflation seen in Hong Kong. With an all-in daily price for hospitalization of HKD 120 (USD 15), it is no surprise that 80%–90% of in-patient services are currently skewed towards government-funded hospitals.

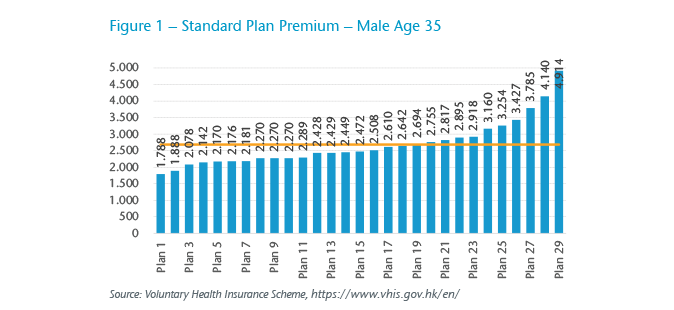

The medical reimbursement plans certified compliant with VHIS requirements are classified into two types, namely Standard Plans and Flexi Plans. The Standard Plan gives basic coverage under general ward class. Insurance carriers involved in the VHIS must offer the Standard Plan. The plan has fixed benefits and terms & conditions. This makes the premiums very comparable across the market. The price difference between providers is primarily driven by the expense ratio, commission rate to distributors (if any), the assumed underwriting experience and profit margin requirements. As of February 2020, there were 29 Standard Plans on offer, most launched on 1 April 2019 when VHIS came into effect. As all companies were preparing for this independently, it is interesting to see how different premiums are.

Figure 1 shows the average premium for males aged 35 is HKD 2,683 (USD 345). However, the range of premiums that you can obtain from the various plans is wide, from the cheapest (HKD 1,788 or USD 230) to the most expensive (HKD 4,914 or USD 630), i.e. 175% more expensive. It will be interesting to see whether prices converge over time or if the experience of different companies results in a diverse range of prices. Throughout the period when companies are developing their VHIS plans, we have stressed the importance of underwriting with this very transparent plan. In theory, the tighter the selection criteria the better the result of any medical portfolio. As all the pricing information is available on the VHIS website, an informed customer could easily purchase the cheapest plan. Of course, there are other considerations for customers, such as the ease of the application process, the service provided by the company, the financial strength and the brand of the company or how sustainable the premiums are, to name a few.

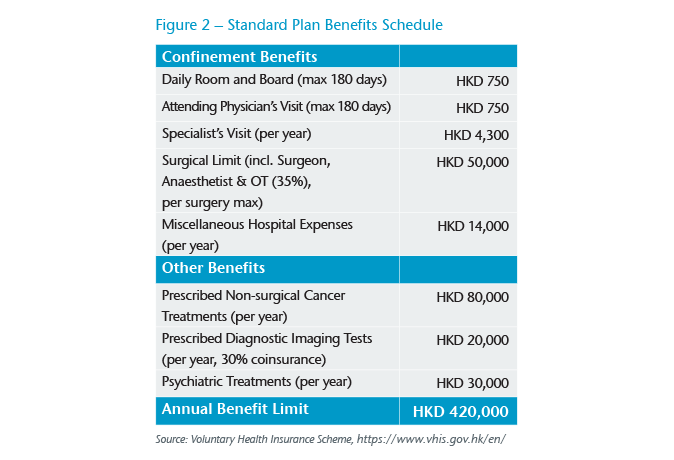

Another area of interest is whether the Standard Plan provides adequate cover for hospitalization. The government has stressed the importance of this point when developing a Standard Plan. Inadequate coverage from plans in the market discourage people from choosing the private sector. Figure 2 shows the benefit schedule of the Standard Plan.

One observation is that the benefit limit is not quite high enough when compared to some key items where there is publicly available information. For example, the room and board limit is HKD 750 (USD 100) while the general ward charges by some of the more highly utilized hospitals are ranging from HKD 560 to HKD 1,800 (USD 70–USD 230).

Another area of comparison is the Surgical Limit. Gastroscopy is a very common procedure within Gen Re’s medical portfolios and from what we observe, especially if it is in a confinement setting, the maximum payment for a minor procedure of HKD 5,000 (USD 640) paid by the Standard Plan is below the amount required to cover all the likely incurred costs. Also, indicated in the Hospital Authority’s list of services, gastroscopy’s range of fees is from HKD 6,070 to HKD 12,750 (USD 770–USD 1,600).

It is certainly a hard act to balance having adequate benefit limits while being affordable to most.

It seems likely most people will purchase Flexi Plans instead. This conclusion is supported by the fact that non-VHIS plans that are selling well generally offer richer benefits than the VHIS Standard Plan. The FHB announced that over 300,000 policies were bought in the first six months from launch with 96% being Flexi Plans.

Flexi Plans offer Standard Plan equivalent protection plus flexible top-up protection with a variety of different benefit items, higher coverage and so forth. Hong Kong consumers look for comprehensive coverage, with guaranteed renewability to age 100 and peace of mind that benefit items cannot be reduced or cancelled. This leans toward a more cautious product design. How risks and costs are managed is of key importance here.

All in all, at Gen Re, we believe that other than a good product design, close monitoring of medical portfolios is very important. Data analytics should be performed on a regular basis such that you will be able to gain insights about the portfolio and manage risks before they get out of hand. In Asia where medical inflation is high, you also need to consider increasing premiums regularly to catch up with the inflation trend even when the portfolio looks healthy. There is indeed a lot of work involved in managing medical business, and in general companies with strong enterprise risk management frameworks that involve all stakeholders tend to perform better. By establishing a regulated framework and raising awareness through VHIS, I believe more people will purchase medical reimbursement plans. The issue for us is how to make such an important insurance product sustainable and affordable to all.