-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

Florida Property Tort Reforms – Evolving Conditions

Publication

Is Human Trafficking the Next Big Liability Exposure for Insurers?

Publication

When Likes Turn to Lawsuits – Social Media Addiction and the Insurance Fallout

Publication

Generative Artificial Intelligence and Its Implications for Weather and Climate Risk Management in Insurance

Publication

Engineered Stone – A Real Emergence of Silicosis

Publication

Who’s Really Behind That Lawsuit? – Claims Handling Challenges From Third-Party Litigation Funding -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Publication

Understanding Physician Contracts When Underwriting Disability Insurance

Publication

Voice Analytics – Insurance Industry Applications [Webinar]

Publication

GLP-1 Receptor Agonists – From Evolution to Revolution U.S. Industry Events

U.S. Industry Events

Publication

Always On: Understanding New Age Addictions and Their Implications for Disability Insurance

Publication

Dying Gracefully – Legal, Ethical, and Insurance Perspectives on Medical Assistance in Dying -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Group Medical Evidence of Insurability – Highlights of 2019 U.S. Underwriting Survey

November 19, 2019

Lisa Bolduc

Region: North America

English

Gen Re is pleased to share this summary of key highlights from our 2019 U.S. Group Medical Evidence of Insurability (EOI) Underwriting Survey. The full report focuses on the amount of staff and the methods used by companies to process EOI applications. The comprehensive report is made available only to participating companies.

Twenty companies participated and all reported that they track EOI data for their Group Term Life, Short Term Disability and Long Term Disability products.

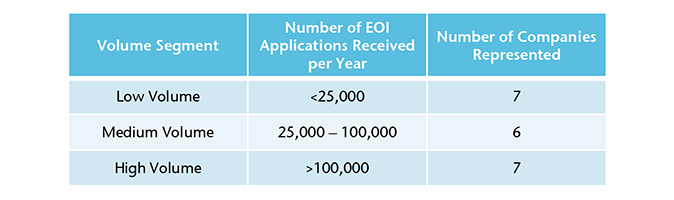

For additional analysis, participating companies were grouped into three segments based on the number of EOI applications received in 2018. Those segments are as follows:

Metrics & Staffing

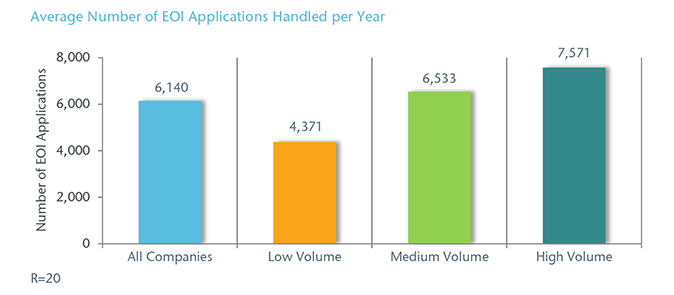

On average, how many EOI applications does a full-time underwriter handle per year?

On average, a full-time underwriter handles 6,140 EOI applications per year. By segment, low volume companies handle about 4,400 EOI applications compared to high volume companies that handle nearly 7,600 EOI applications per year.

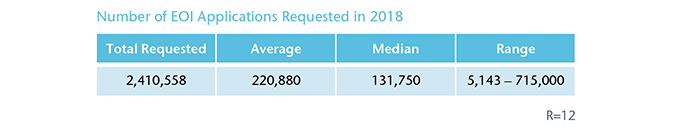

On average, how many EOI applications did your company request in 2018?

For companies able to provide this metric, a total of 2.4 million EOI applications were requested in 2018. The number of requested applications ranged from 5,143 (low volume) to over 700,000 (high volume). Of those requested, 67% were returned. By segment, companies in the low volume segment averaged a return rate of 75%, while the return rate for the medium and high volume segments averaged 65% and 64%, respectively.

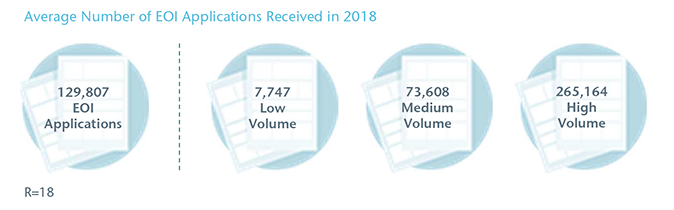

On average, how many EOI applications did your company receive in 2018?

More than 2.3 million EOI applications were received in 2018. This averages to nearly 130,000 applications for all companies reporting this data.

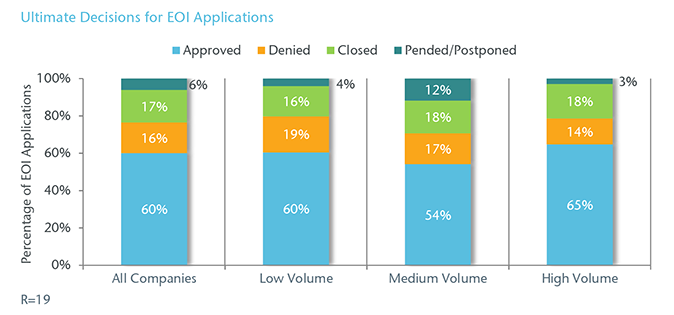

Of your 2018 EOI applications received, what percentage were ultimately approved, denied, closed (for reasons other than decline), or pended/postponed.

On average, 60% of the EOI applications received in 2018 were approved and 16% were denied. By segment, high volume companies approved 65% and denied 14%, compared to 54% approved and 17% denied for medium volume companies.

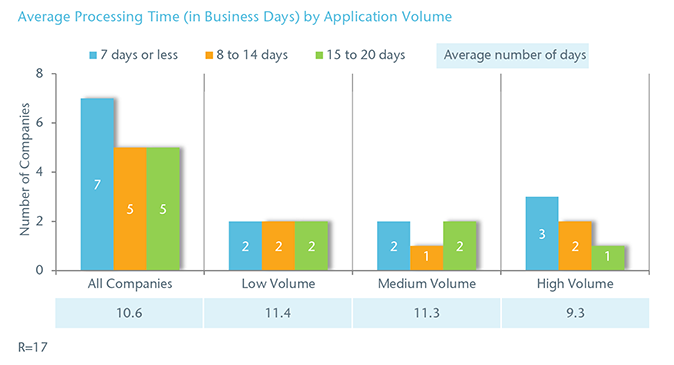

What was the average processing time for your EOI applications, from date of original receipt to date of final decision (include approved, denied and closed)?

Seventeen of the 20 companies (85%) track the processing time for their EOI applications. From the date of the original receipt to the date of the final decision, EOI applications are processed in about 11 business days. Companies in the low and medium volume segments averaged longer processing times at 11 days than companies in the high volume segment that averaged nine business days.

Underwriting Resources & Challenges

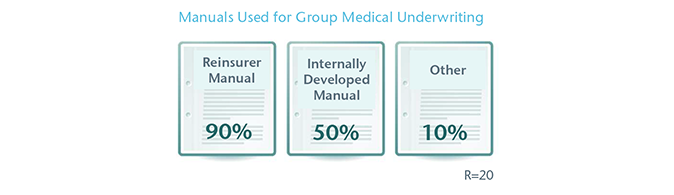

What type of medical underwriting manual(s) does your company use for group medical underwriting?

Eighteen of the 20 companies (90%) use their reinsurer’s manual for group medical underwriting and half use an internally developed manual. Eight of those companies use both manuals.

“Other” mentions include using a company’s own manual with consultation from its reinsurer, and using a reinsurer’s manual in conjunction with a company’s internal policies.

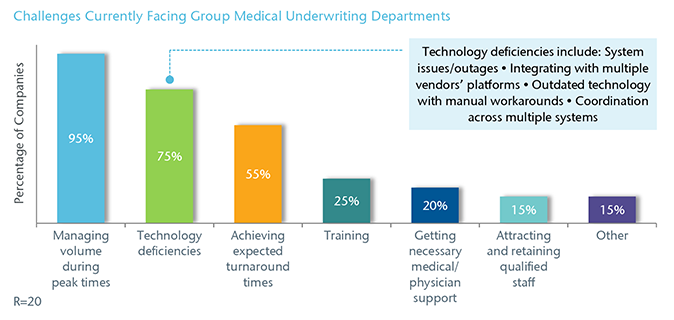

What are the top three challenges facing your group medical underwriting department today?

Managing volume during peak times continues to be the greatest challenge facing group medical underwriting departments today. Technology deficiencies and achieving expected turnaround times also continue to be problematic.

Application Details & Processes

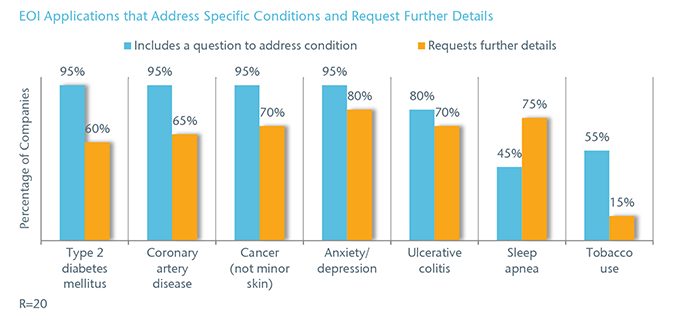

Does your EOI application include a question and/or request further details to address the following conditions?

Of the conditions referenced in the questionnaire, almost all companies include a question to address type 2 diabetes, coronary artery disease, cancer and anxiety/depression on their EOI applications. The condition least likely to appear on an EOI application is sleep apnea. However, although only nine companies include a question about sleep apnea specifically, 15 request further details; some companies include a “catch-all” question for applicants to provide additional detail about conditions not specifically asked about.

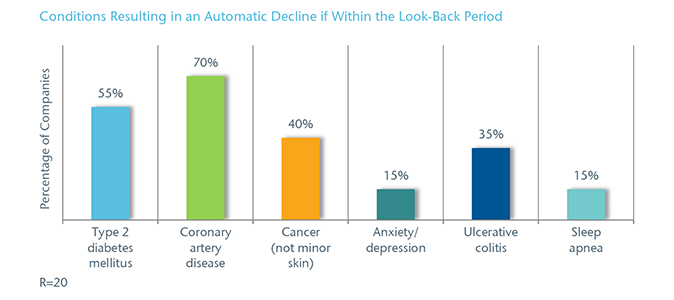

If your EOI application includes a look-back period, do the following conditions result in an automatic decline if within the look-back period?

More than half of the companies would automatically decline an applicant with a history of type 2 diabetes mellitus or coronary artery disease, if within the look-back period. Few companies would decline an applicant with a history of anxiety/depression or sleep apnea.

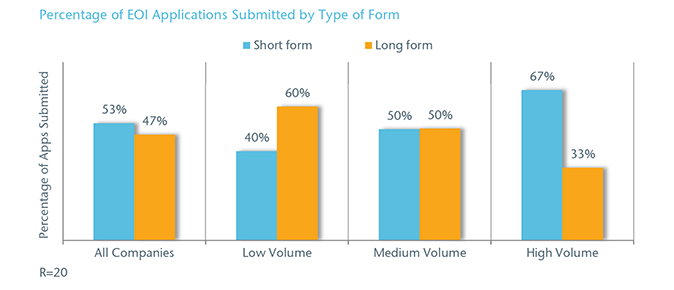

What percentage of your 2018 EOI applications were submitted using a short form and/or long form application?

Overall, slightly more than half (53%) of the EOI applications were submitted using a short form in 2018. Companies in the low volume segment had 40% of their EOI applications submitted via a short form, compared to the high volume segment that had 67% submitted using a short form.

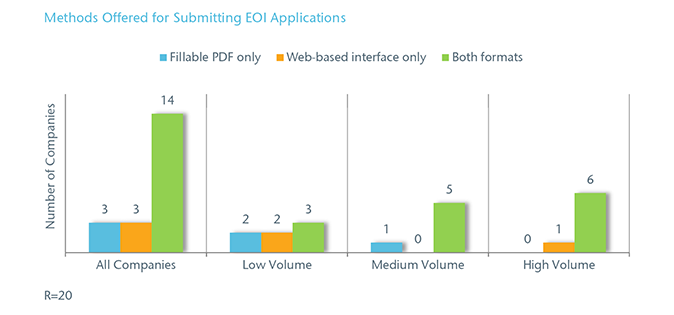

Can your EOI application be submitted to your company via a fillable PDF and/or web-based interface? In 2018, approximately what percentage of your total EOI applications were submitted via a web-based interface?

The majority of companies (70%) provide both a fillable PDF and web-based interface for applicants or agents to submit EOI applications. On average, 53% of EOI applications were submitted via web-based interface in 2018.

Automated Underwriting System

Does your EOI system have the ability to automatically approve coverage without the review of a medical underwriter? Approximately how many of your total EOI apps were processed through this system?

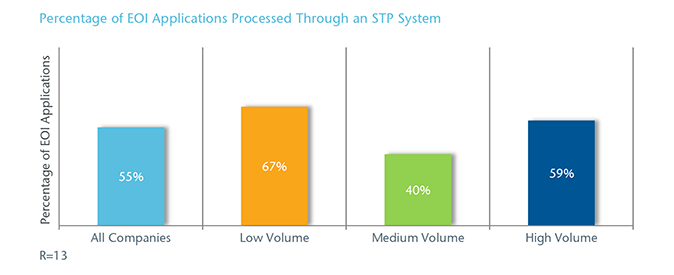

Eighty percent of the companies have an EOI system that can automatically approve coverage without a medical underwriter’s review; also known as straight through processing (STP). Of the four companies that don’t have STP, only one plans to develop the capability within 24 months.

For companies that provided both the number of EOI applications received in 2018 and the number processed through their automated system, on average, 55% were processed through their STP system.

What percentage of your total EOI apps had the following outcomes?

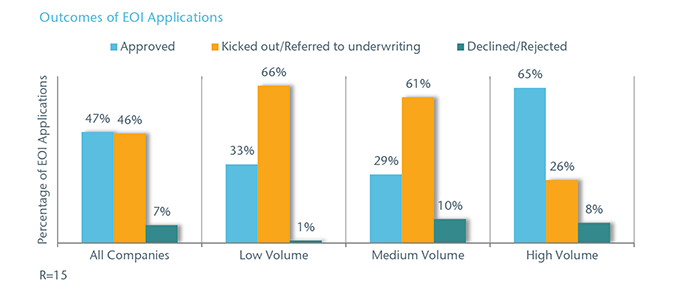

Overall, just under half of the EOI applications processed through an automated underwriting system were either approved or referred to underwriting at 47% and 46%, respectively. For companies in the low volume segment, 66% of applications needed a review from an underwriter compared to 26% for high volume companies. Additionally, high volume companies approved about twice the EOI applications than the low and medium volume segments at 33% and 29%, respectively.

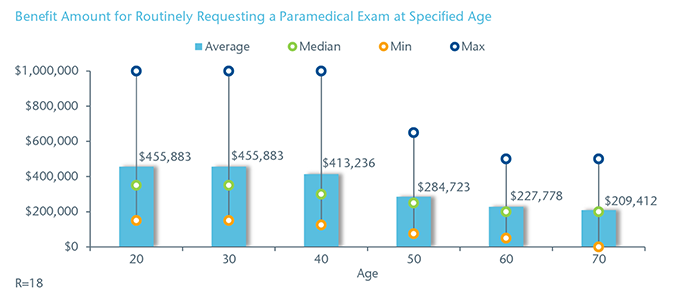

For Group Life, what is your minimum benefit amount for routinely requesting a Paramedical Exam at the specified age?

The minimum benefit amount averaged over $400,000 for routinely requesting a paramedical exam for applicants ages 20 to 40. For two companies, the minimum benefit amount for those ages is $1 million.

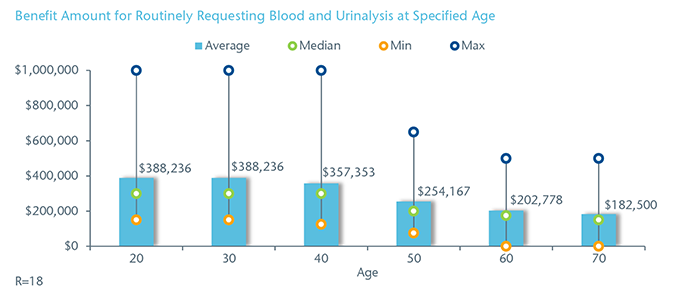

For Group Life, what is your minimum benefit amount for routinely requesting Blood and Urinalysis at the specified age?

The minimum benefit amount averaged under $400,000 for applicants ages 20 to 40 and about $200,000 for ages 60 to 70, for routinely requesting blood and urinalysis. For ages 50 to 60, one company reported a higher benefit amount for a blood test than for a urine test.

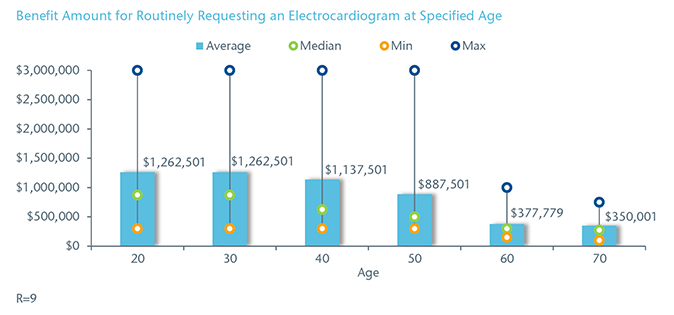

For Group Life, what is your minimum benefit amount for routinely requesting an Electrocardiogram (EKG) at the specified age?

Although fewer companies have a minimum benefit amount requirement for an electrocardiogram, it averaged over $1 million for applicants ages 20 to 40 and nearly $900,000 for age 50. For applicants age 50, two companies reported a minimum benefit amount just over $1 million and one company reported a benefit amount of $3 million for an EKG.

Download the PDF for a list of participating companies and survey definitions.