-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

Florida Property Tort Reforms – Evolving Conditions

Publication

Is Human Trafficking the Next Big Liability Exposure for Insurers?

Publication

When Likes Turn to Lawsuits – Social Media Addiction and the Insurance Fallout

Publication

Generative Artificial Intelligence and Its Implications for Weather and Climate Risk Management in Insurance

Publication

Engineered Stone – A Real Emergence of Silicosis

Publication

Who’s Really Behind That Lawsuit? – Claims Handling Challenges From Third-Party Litigation Funding -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Publication

Understanding Physician Contracts When Underwriting Disability Insurance

Publication

Voice Analytics – Insurance Industry Applications [Webinar]

Publication

GLP-1 Receptor Agonists – From Evolution to Revolution U.S. Industry Events

U.S. Industry Events

Publication

Always On: Understanding New Age Addictions and Their Implications for Disability Insurance

Publication

Dying Gracefully – Legal, Ethical, and Insurance Perspectives on Medical Assistance in Dying -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Group Term Life – Results of 2018 U.S. Market Survey

June 25, 2019

Region: North America

English

Our annual survey covers the Group Term Life (GTL) and AD&D industries, tracking sales and in-force results. The full Market Survey is available only to participating companies, providing a valuable opportunity for participants to benchmark their results against those of their peers, as well as the industry as a whole. Eighteen of the 25 companies participating in the 2018 survey have provided Group Term Life data over the past 10 survey years.

Unless otherwise mentioned, total Group Term Life and total AD&D include combined employer-paid and employee-paid results. Reported growth rates are based on companies providing comparable data for 2017 and 2018.

Download the PDF version for a list of participating companies.

Group Term Life and AD&D In-force Results

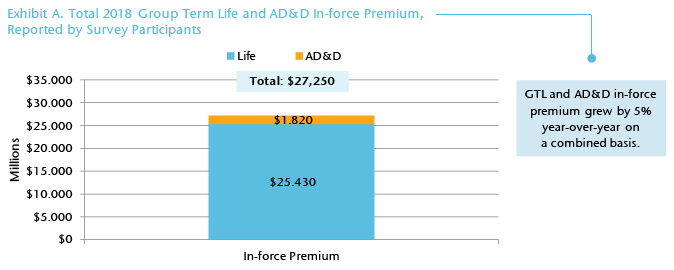

Twenty-five companies provided Group Term Life (GTL) results for 2018, with all but one also reporting AD&D data. On a combined basis, total GTL and AD&D in-force premium reached over $27.2 billion, with GTL representing 93% of the total. (Exhibit A)

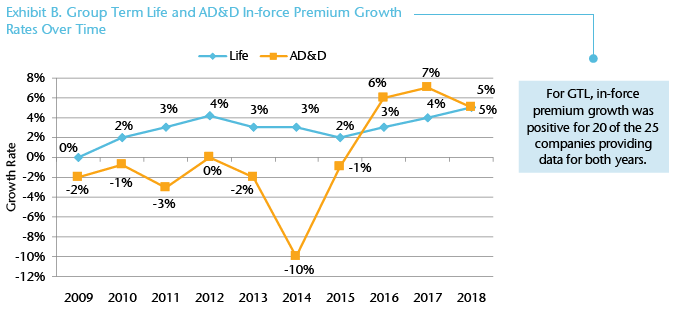

In-force premium in 2018 grew by 5% compared to 2017 for both GTL and AD&D.

For GTL, this represented the highest level of in-force premium growth for the industry in 10 years.

AD&D results trended downward slightly in 2018 after last year’s 7% increase. However, the level of growth remains higher compared to earlier survey years. (Exhibit B)

Group Term Life and AD&D Sales Results

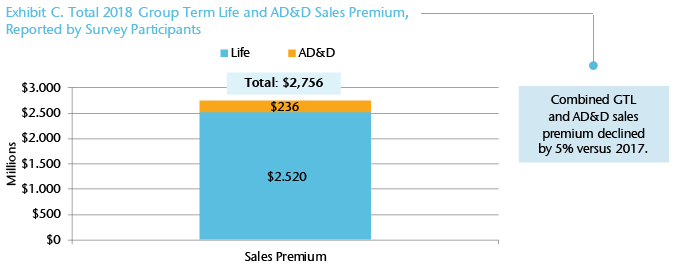

Participating companies reported close to $2.8 billion in combined total GTL and AD&D sales premium in 2018. (Exhibit C)

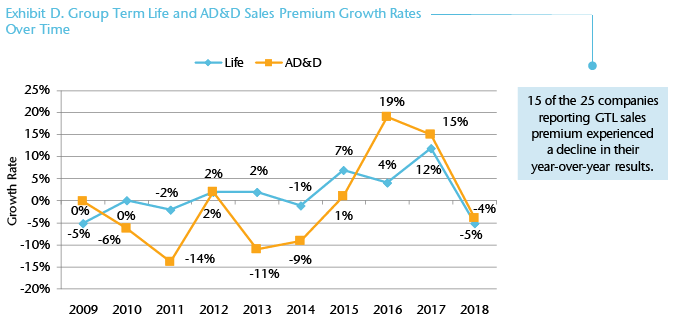

For the industry, new GTL sales premium results have shown some volatility over the past few years. After posting a 12% increase in 2017, results declined by 5% in 2018. (Exhibit D) For 11 of the 15 companies reporting declines, premium fell by 10% or more.

After two years of strong double-digit growth, AD&D sales premium was also down, with a 4% decline year-over-year in 2018.

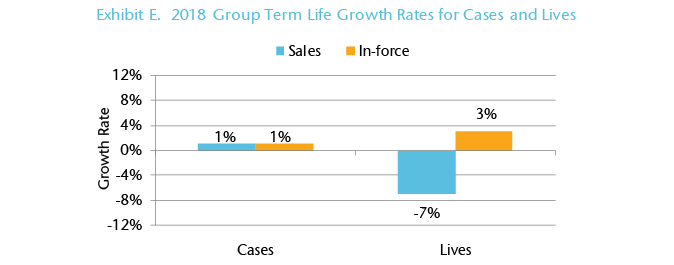

Group Term Life Growth – Cases and Lives

Reported GTL case counts increased by 1% for both new sales and in-force in 2018. (Exhibit E)

While larger case activity may have played a role in the double-digit increase in new sales lives reported on the survey last year, some normalization may have occurred in 2018 as participating companies reported a 7% decline.

In-force lives grew at a modest pace of 3% year-over-year.

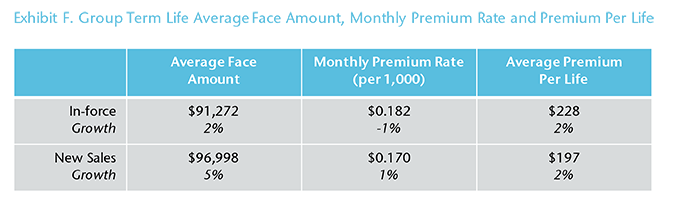

Group Term Life Pricing and Volume Levels

Average face amounts were up by 5% for new sales and 2% for in-force. (Exhibit F)

Results were mixed for monthly premium rates, showing a slight increase for new sales and a decline for in-force. This represented the only calculated in-force metric on the survey that exhibited a year-over-year decrease. Average sales premium per life was up by a modest 2% in 2018 for both new sales and in-force.

In Our View

Over the past 10 years, while Group Term Life (GTL) in-force premium has exhibited a steady trend of positive single-digit growth, new sales premium has shown more volatility. After last year’s reported 12% increase, new sales premium declined by 5% in 2018. Not since our 2009 Market Survey has the industry produced this same result. However, as some large case activity appeared to play a role in last year’s significant increase, this year’s result may be due to some normalization occurring in the marketplace. To that end, the 7% decline in both new sales lives and corresponding lives per case for 2018 is notable.

Looking across all metrics for GTL new sales, the growth in average face amounts showed the largest gain, increasing by 5% to reach $96,998. This is also the highest average sales face amount seen on the survey in over a decade.

GTL and AD&D results appeared to be in tandem in 2018, with AD&D in-force premium increasing by 5% and new sales premium declining by 4%. The decrease in AD&D new sales premium follows a two-year period of increases in the 15% to 19% range. Over half of the companies reported year-over-year declines in AD&D new sales premium for 2018.

Looking forward to 2019, companies will continue to face various challenges. According to Gen Re’s 2018 Market Pulse survey results, areas of concern mentioned by companies include a competitive landscape, managing persistency, and changes in strategy and technology.

New trends are also setting the stage for potential changes in the marketplace in the coming years, challenging more “traditional” approaches to life insurance product design and servicing. From online crowdfunding and registries that fund end-of-life situations to activity trackers measuring effects on mortality, the industry will need to monitor many current and even unforeseen influences.

Given these complexities, Gen Re will continue to work with our clients, as well as the industry, to keep track of the “pulse” of this business and future impacts to come.