-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

Structured Settlements – What They Are and Why They Matter

Publication

PFAS Awareness and Concern Continues to Grow. Will the Litigation it Generates Do Likewise?

Publication

“Weather” or Not to Use a Forensic Meteorologist in the Claims Process – It’s Not as Expensive as You Think

Publication

Phthalates – Why Now and Should We Be Worried?

Publication

The Hidden Costs of Convenience – The Impact of Food Delivery Apps on Auto Accidents

Publication

That’s a Robotaxi in Your Rear-View Mirror – What Does This Mean for Insurers? -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Publication

Key Takeaways From Our U.S. Claims Fraud Survey

Publication

Favorite Findings – Behavioral Economics and Insurance

Publication

Individual Life Accelerated Underwriting – Highlights of 2024 U.S. Survey

Publication

Can a Low-Price Strategy be Successful in Today’s Competitive Medicare Supplement Market? U.S. Industry Events

U.S. Industry Events

Publication

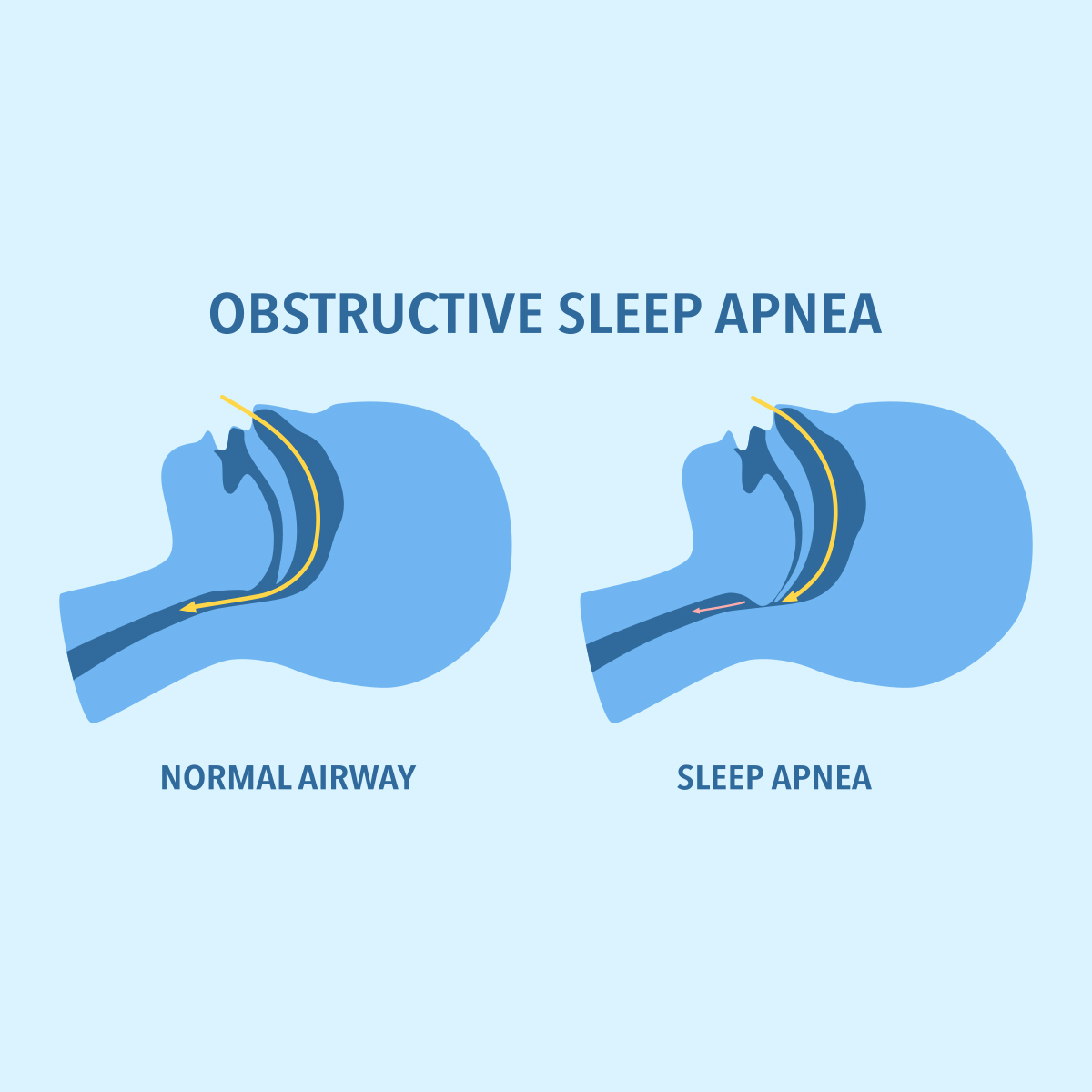

The Latest in Obstructive Sleep Apnea -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Insuring Liquor Liability – Knowing the Rules of the Road

January 16, 2019

Laura Allison, Jeff Markowski

Region: North America

English

Are you keeping up with the changes in liquor liability laws?

It seems that as one state tightens those laws, another state opens the door to more claims. Do these developments matter in the grand scheme of things? Yes, they sometimes do. A few laws can impact the hazard grades often used to develop appropriate rates and underwriting guidelines.

For those in the field, you may know that Eastern Iowa has often been a preferred jurisdiction of plaintiffs seeking to avoid the low liquor liability caps in Illinois that apply to economic as well as non-economic damages. We have seen several large losses in the Hawkeye state that would have been reduced if brought forward in Illinois, where the drunk driver was served. However, this past summer, Iowa enacted major revisions to its strict liquor liability laws. Now the incentive is diminished, and the playing field is almost level. These changes will be very beneficial to restaurants and bars as well as their insurers.

Iowa’s Senate Bill 2169 (effective July 2018) contains a new $250,000 cap on non-economic damages except in cases of death or major impairment. This revision has also strengthened proximate cause by changing “knew or should have known” that the patron was intoxicated, to the patron is “visibly intoxicated.” Iowa law is now very clear. The intoxicated party, whether minor or adult, has no cause of action for his or her own injuries. These updates follow prior changes that allow aggregate limits in liquor policies, something that some state regulators had previously rejected.

Like ISO, we have adjusted our hazard grades following the enaction of this new and improved regulation. Failing to do so can put you in a noncompetitive situation with carriers who have kept current on liquor liability.

In addition to changes to state laws like the positive developments out of Iowa, there can also be an unexpected interpretation by the courts which can change rules that have been in place for many years.

For example, in Oregon the state supreme court will soon determine the constitutionality of its dram shop and social host laws’ prohibition on first party recovery. Oregon has laws denying a cause of action for the drunk driver’s own injuries.1 Its courts have upheld this statutory language, but the high court accepted a new constitutional challenge from social hosts. If the high court overturns this part of the law, commercial and personal liability carriers will be faced with significantly more exposure.

Another surprise comes from Ohio, where an appellate court found a duty to defend a liquor claim under a General Liability policy.2 The plaintiff pursued common law negligence against an establishment for (among other things) failing to stop an inebriated patron from leaving the premises and for escorting that patron out of the premises where he was then able to drive away. The liquor exclusion in the policy did not contain the negligence wording added by ISO in 2013, applying the exclusion to:

(a) The supervision, hiring, employment, training or monitoring of others by that insured; or

(b) Providing or failing to provide transportation with respect to any person that may be under the influence of alcohol . . ..”3

The court held that the negligent conduct was independent of the service of alcohol, and thus covered by the pre-2013 wording.

Another potential issue critical to liquor liability is enforceability of Assault and Battery (A&B) exclusions. In most cases, the exclusion holds up, but there are times when the facts or law can open you up to exposure. With more high-value claim activity, knowing the latest A&B exclusions and where they are applicable can make the difference between a profitable book and an unprofitable one.

There are also many, new emerging issues impacting liquor liability profitability. Among them Uber/Lyft usage and even the combined effects of marijuana and alcohol. In addition, autonomous driving will no doubt be a future factor. It is too early to know how these broader trends will influence exposure and rates.

For now, insurers can at least stay current with changing liquor liability law and coverage. The more you stay in step with liability and coverage, the more your guidelines and pricing will be accurate. It pays to know the rules of the road. If we can help, feel free to contact us or your Gen Re representatives.

Endnotes

- Schutz v. La Costita III, 2018 Ore. LEXIS 31250.

- Mesa Underwriters Specialty Ins. co. v. Secret’s Gentleman’s Club, 2018 U.S. App. LEXIS 28995.

- CG 00 01 04 13 more fully adds: “This exclusion applies even if the claims against any insured allege negligence or other wrongdoing in: (a) The supervision, hiring, employment, training or monitoring of others by that insured; or (b) Providing or failing to provide transportation with respect to any person that may be under the influence of alcohol; . . .”