-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

Florida Property Tort Reforms – Evolving Conditions

Publication

Is Human Trafficking the Next Big Liability Exposure for Insurers?

Publication

When Likes Turn to Lawsuits – Social Media Addiction and the Insurance Fallout

Publication

Generative Artificial Intelligence and Its Implications for Weather and Climate Risk Management in Insurance

Publication

Engineered Stone – A Real Emergence of Silicosis

Publication

Who’s Really Behind That Lawsuit? – Claims Handling Challenges From Third-Party Litigation Funding -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Publication

Understanding Physician Contracts When Underwriting Disability Insurance

Publication

Voice Analytics – Insurance Industry Applications [Webinar]

Publication

GLP-1 Receptor Agonists – From Evolution to Revolution U.S. Industry Events

U.S. Industry Events

Publication

Always On: Understanding New Age Addictions and Their Implications for Disability Insurance

Publication

Dying Gracefully – Legal, Ethical, and Insurance Perspectives on Medical Assistance in Dying -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

A Call to Action on Supply Chain Risk

August 08, 2019

Takashi Ishii

English

Chinese

Supply chains play the role of blood vessels in today’s global economy: When they stop running freely, different parts of the economy start to shut down, like organs in the body. Events from the past several years have demonstrated how vulnerable links in the supply chain can be.

Extreme weather, such as hurricanes in the Gulf of Mexico, have repeatedly cut off energy supply and/or increased fuel prices. Similarly, after the 2011 floods in Thailand and the East Japan earthquake, the semiconductor supply chain was devastated, impacting electronics and automakers, not just at home but around the world.

Recently, cyber-attacks like the infamous NotPetya and WannaCry ransomware events, have also highlighted the potential for man-made events to seriously disrupt suppliers’ and end-users’ processes.

Meanwhile, the continuing trend for globalization (fueled by the growth in trading blocs like the EU and other regional economic alliances such as Free Trade Agreements and Economic Partnership Agreements), plus the worldwide proliferation of sophisticated IT, has led to a marked increase in the complexity of supply chains. Indeed, the concept of temporal distance has all but disappeared in today’s interconnected world.

The strategies of businesses operating internationally can also be greatly affected by developments in foreign policy - Brexit and recent changes to U.S. economic policies being two obvious examples. Given the central strategic importance of supply chains for business operations, it’s unsurprising that supply chain resilience and business interruption have moved sharply up the corporate risk register in recent years.

Handling supply chain risk

Supply chain management, responsible for increasing the added value of products and services, is an important part of many corporations’ enterprise risk management (ERM) programme. In addition, capital and re/insurance as substitutes for capital are at the centre of any ERM policy.

It’s worth pointing out that the growing importance of ERM in recent years has been accompanied by a rise in the cost and complexity of risk. In addition, there is a growing demand for the minimisation of capital cost and incremental improvements in capital efficiency. This is happening against a backdrop of low growth and depressed interest rates.

It’s against this backdrop that corporate risk managers must evaluate expanded business risk or newly arisen business risk, and then procure more capital and appropriately select and combine risk hedging. Whether to hedge risk by using additional capital, or by purchasing insurance (including derivatives and other insurance-type financial products), depends on differences in the function of capital and insurance.

Capital is a long-term and rigid means of handling multiple types of risk, while insurance is a flexible way to handle specific risks. Importantly, procedures for insured risk are simple and insurance terms can be reviewed over a prescribed or short-term period.

Insurance for breaks in supply chains

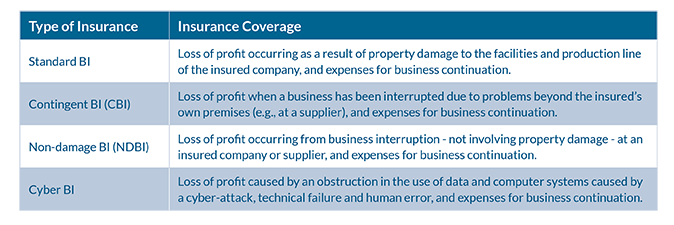

Business Interruption (BI) insurance protects against the economic damage resulting from breaks in supply chains. There are four main categories of insurance, depending on the risk characteristics:

Although it is necessary to quantify risk to structure insurance, there are great differences in risk situations for individual BI insurance. Getting a handle on risk and calculating the amount of risk for standard BI insurance is comparatively easy when contrasted with CBI insurance, where business interruption is caused by a breakdown in suppliers and information can be infinitely more difficult to obtain.

Understanding and providing NDBI risk insurance is becoming a vexed issue for insurers and their corporate clients. The difficulty in risk quantification has intensified recently as a result of cyber terrorism attacks, for example. In addition, while reinsurance compensates for insufficient insurance capacity and can absorb volatility, it is not a strategy for resolving the problem of insufficient risk information.

It’s inevitable, due to the large sums involved in Cyber BI insurance, that private insurance and reinsurance capital is limited. It’s my personal belief that the introduction of financial market capacity or an insurance system based on government credit extension (or a combination thereof) must be explored.

However, there is a method for resolving supply chain risk due to causes other than the interruption of business resulting from cyber breakdown. If an early recovery from supply chain interruption can be achieved through property insurance and standard BI insurance, it follows that the period during which the supply chain is broken is shortened and the effect on customers is reduced. The need for CBI insurance and NDBI insurance is then reduced and insurers are more likely to be willing to provide coverage.

Likewise, reinsurance companies would be more willing to expand reinsurance for property insurance and standard BI insurance.

Social responsibility?

Insurers and reinsurers certainly have a role, if not a social responsibility, to keep the world’s economic lifeblood flowing. Stable economic development relies on corporations’ continued business operations. That, in turn, relies on a functioning supply chain.

The availability of additional, efficient capital is a prerequisite in an age of low growth and low interest rates. In such an environment, increased attention must be paid to expanding the penetration and scope of insurance. This is particularly true for standard BI insurance related to factories and machinery and other property, where measuring risk is relatively straightforward.

But, there is still more that re/insurers can do to minimise the risks around supply chain disruption. The industry is moving fast to act on climate change resilience with new risk transfer products, innovation is also the key to better insulating the global economy from serious business interruptions.