-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

Structured Settlements – What They Are and Why They Matter

Publication

PFAS Awareness and Concern Continues to Grow. Will the Litigation it Generates Do Likewise?

Publication

“Weather” or Not to Use a Forensic Meteorologist in the Claims Process – It’s Not as Expensive as You Think

Publication

Phthalates – Why Now and Should We Be Worried?

Publication

The Hidden Costs of Convenience – The Impact of Food Delivery Apps on Auto Accidents

Publication

That’s a Robotaxi in Your Rear-View Mirror – What Does This Mean for Insurers? -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Publication

Key Takeaways From Our U.S. Claims Fraud Survey

Publication

Favorite Findings – Behavioral Economics and Insurance

Publication

Individual Life Accelerated Underwriting – Highlights of 2024 U.S. Survey

Publication

Can a Low-Price Strategy be Successful in Today’s Competitive Medicare Supplement Market? U.S. Industry Events

U.S. Industry Events

Publication

The Latest in Obstructive Sleep Apnea -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Hospitals in Germany – An Underestimated Property Insurance Risk?

October 09, 2018

Leo Ronken

Region: Germany

English

Deutsch

There are frequent reports in the media about fires and water damage in hospitals.

On 30 September 2016 a patient on the sixth floor of a German hospital poured disinfectant over herself and set herself on fire. A short time later, the ward was on fire. The patient and another person from the room next door died in the disaster, and seven more people were seriously injured.1 The estimated property damage was in the region of EUR122 million.

On 5 April 2018 a Turkish hospital tower, which had approximately 10 floors, and an adjacent building caught fire. Fortunately, the fire only took hold of the facade, sparing the interior of the building. Nevertheless, it caused considerable damage.2

In addition to fire, water damage often causes spectacular damage worth millions of euros.3 Building defects, burst water pipes, roof leaks, and facades that let in moisture, are just some of the frequent causes of major water damage, resulting in projected renovation expenses that are sometimes in excess of new construction costs.

Insurers have been observing an ominous trend for some time, raising the question whether they might be underestimating the risk presented by hospitals.

This article examines the current situation facing insurance companies and discusses possible concepts for protective measures as well as underwriting recommendations.

Background

In Germany the term hospital refers to any operation as described in the Hospital Financing Act (KHG) where people due to receive care are looked after and given accommodation. Representing a share of around 25%, hospitals are an integral part of the German healthcare system, which includes all facilities designed to maintain, promote and restore public health or to prevent illness and disease. In 2016 Germany had approximately 1,951 hospitals, providing a capacity of around 499,000 beds, employing some 1.2 million people (full- and part-time), and treating about 19.5 million patients each year.4 Inpatient hospital costs totalled around EUR87.8 billion in 2016, and there is no certainty of long-term economic viability: approximately 21% of hospitals are in a precarious financial situation.5 In 2017, for example, 41% of hospitals were unable to generate a surplus, according to a management consultancy study.6

Hospitals are classified in different ways – often in terms of their funding, the number of beds, medical care objectives, intensity of care and treatment, or additional services.7 Some typical distinctions are as follows:

- Nursing homes

- Psychiatric hospitals with little technology

- General hospitals with valuable specialist technology

- Hospitals with specialised, high-quality technology

- Clinic complexes with many highly specialised individual clinics

- Primary care hospitals

- Secondary care hospitals

- Tertiary care hospitals

- Maximum-care hospitals

Hospitals are run by public, private or non-profit organisations. With a trend towards privatisation in recent years, the number of public and non-profit organisations is in decline.8

Claims developments

Some years ago, a study covering the period between 1980 and 2001 determined that a hospital fire occurs at least every 14 days in Germany.9 Unfortunately, more recent reliable data about hospital claims is not available. Although the Federal Association for Technical Fire Protection (bvfa) in Germany creates a list of registered hospital fires, this is essentially based on media reports.10 This industry association recorded seven fires in 2016, 24 fires in 2017 and 26 fires in 2018 (as of 10 July).

In other countries, too, very little reliable data about fire damage claims for hospitals can be found. According to a study by the National Fire Protection Association (NFPA) in the U.S., most fire damage is minor. Only around 4% of fire damage extends beyond the room in which the fire broke out.11

However, according to an insurance company analysis from 2013, water damage in German hospitals and care facilities represents 63% of total claims expenditure, accounting for 43% of all damage.12

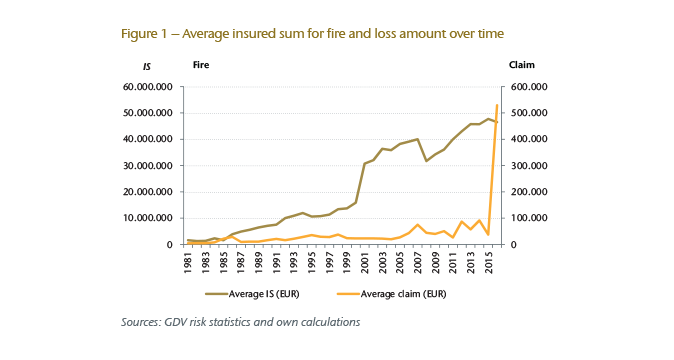

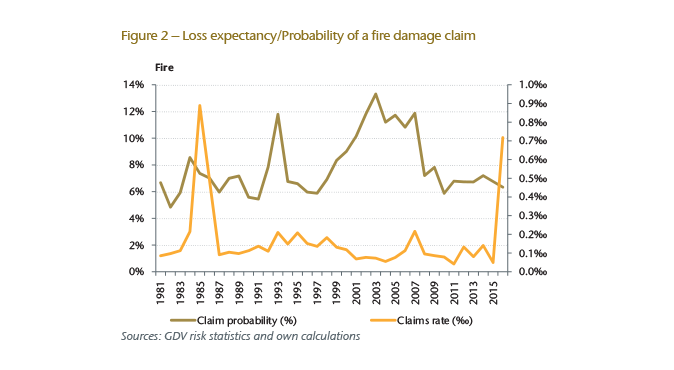

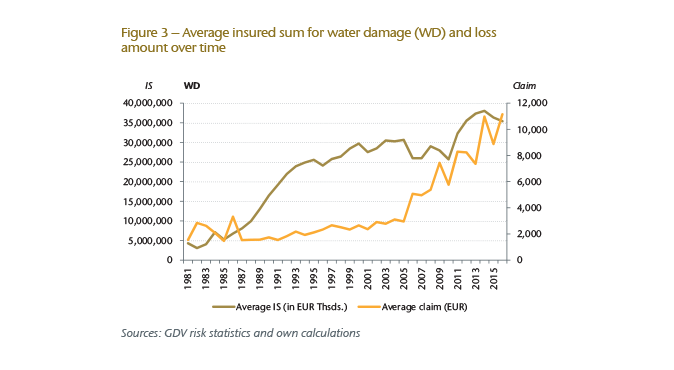

In addition, risk statistics released by the German Insurers’ Association (GDV) provide another source of information, compiled from member companies in an anonymous form that presents data and results about the claims history for various risks, specifically fire, water damage, storms and hail, and burglary.13 From this, it is possible to gain some insights for hospitals, as outlined in Figures 1-9.

In 2016 approximately 4,100 fire insurance contracts were registered in Germany. In the period under review, 1981 to 2016, the average insured sum (IS) increased continuously. The claims reflect a slight increase in the average amount of compensation, with a noticeable peak in 2016 resulting from major damage to a German hospital (see Figure 1).

Turning to the probability of fire damage claims in Germany (the number of claims observed divided by the number of insurance policies), it can be seen in Figure 2 that the value varies between 5% and 13% with an average of 8%.

By examining the expected claims burden for the same period in Germany (also known as the claims rate, a ratio based on registered claims and insured sums), we see that there is an average expected financial loss in the region of around 0.14‰ of the total value insured. This value is relatively low and, given the probability of a claim, it is an indication that the fire damage to be expected in individual cases is relatively small – with the exception of peaks in years when major damage occurred. Between 2003 and 2017, only 45 cases of major fire damage were registered in total. For each of these, the loss amount was in excess of EUR500,000 and the total claims expenditure amounted to around EUR233 million.

With regard to water damage insurance, the number of policies has declined in Germany since 1987, with the total number of claims decreasing even more sharply. In 2016 only 1,754 water damage insurance policies were registered in Germany. On the other hand, by comparing the development of the average insured sum and average loss amount over time, we see a significant increase for the period under review (see Figure 3).

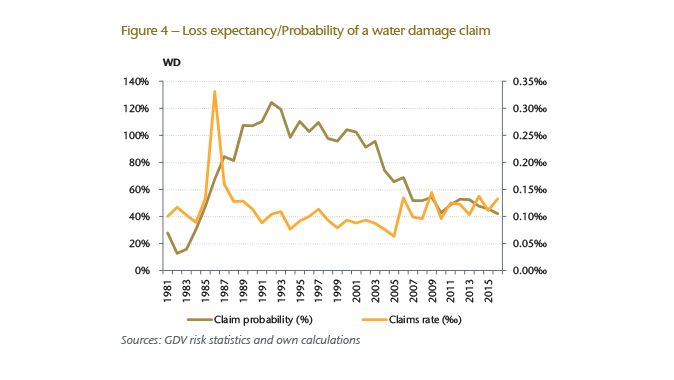

Looking at the probability of claims and loss expectancy in Germany, shown in Figure 4, we see a significant drop in claim probability – to 40% since the early 1990s. However, we also see in Figure 4 a rising trend for loss expectancy to around 0.13‰ (0.10‰ on average for the period under review).

In direct comparison with fire, the probability of claims for water damage is therefore significantly higher in Germany, at 79% on average for the period under review. At the same time, loss expectancy is close to the level recorded for fire damage, at 0.1‰. In the period from 2003 to 2017, 35 incidents of water damage were reported with a total claims expenditure of around EUR58 million. The amount of damage was in excess of EUR500,000 in each case.

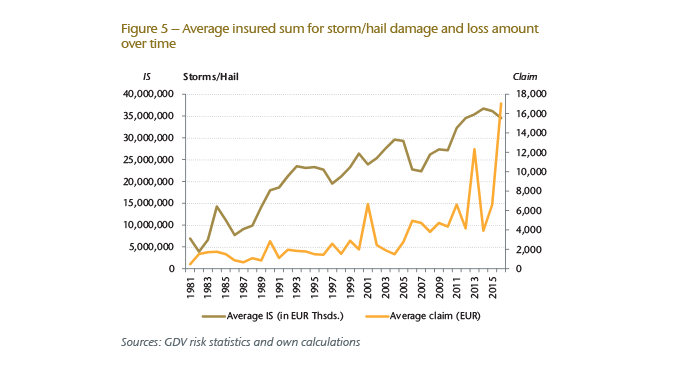

With regard to insurance against storm and hail damage in Germany, both the number of policies (2016: 1,695) and of reported claims have declined over the years – although here, too, there has been a significant increase in the average insured sum and loss amount (see Figure 5).

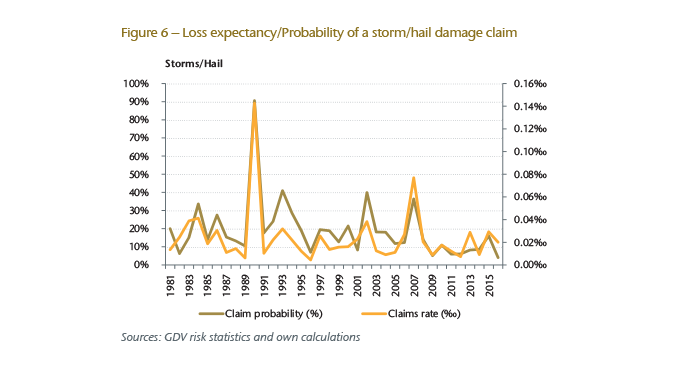

Overall, the probability of claims is in line with the familiar pattern of harmful storm years in Germany, whereby loss expectancy has increased in recent years and is much more volatile. The average probability of claims damage over the entire period under review is about 19%, while loss expectancy is about 0.02‰ (see Figure 6).

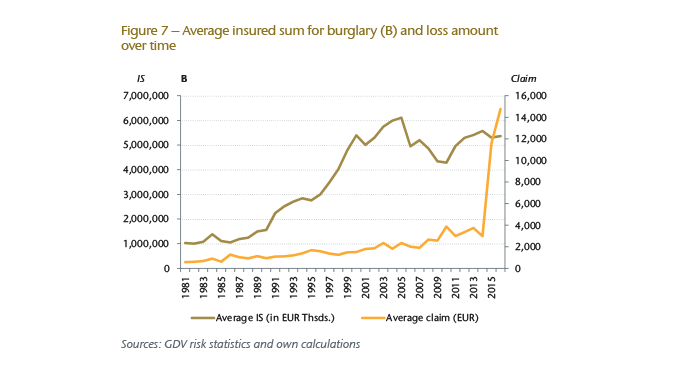

The number of policies against theft and burglary in Germany has remained almost the same over the years with some variation (2016: 2,012 policies). However, the average insured sum and loss amount have increased almost continuously (see Figure 7).

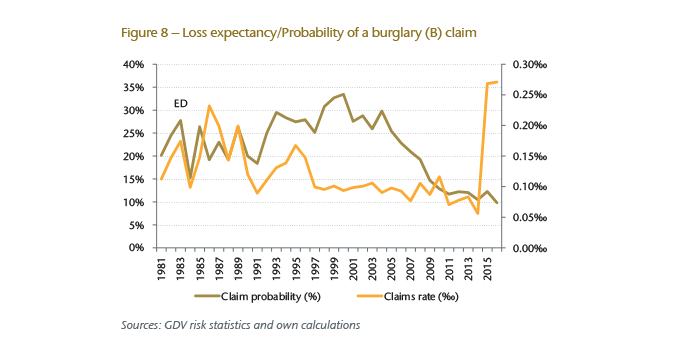

In 2015 and 2016 there was a steep rise in the average insured sum for policies offering protection against burglary in Germany, and this is certainly linked to the organised theft of high-quality medical equipment during this period.14

Figure 8 shows that the probability of claims for burglary in Germany has decreased steadily, reaching around 10% in 2016 (around 22% on average during the period under review). However, loss expectancy has increased dramatically in the last two years following a fairly stable period, reaching approximately 0.27‰ in 2016 (0.116‰ on average during the period under review).

In summary, this analysis indicates that the frequency of basic losses, in particular, is actually relatively high in Germany. The large number of claims ultimately leads to a significant claims burden with respect to hospital policies, even though the average loss amounts are relatively moderate with the exception of major losses, which do occur from time to time. A particularly striking observation is the frequency of claims relating to water damage.

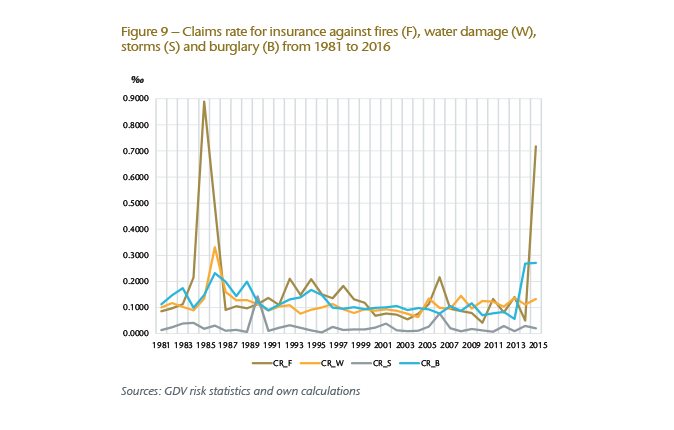

Looking at a summary of each claim rate over the period from 1981 to 2016, we see a relative constancy over the years with significant spikes for fire damage in 1985 and 2016 due to major damage as well as a peak for burglaries in 2015-2016 (see Figure 9).

In other words, claims rates for hospitals in Germany have not changed significantly in recent times compared to other types of organisations. This is certainly linked to the fact that no major shifts have taken place regarding the prioritisation and implementation of preventive risk management measures in hospitals – unlike in production companies, for instance, where it is clear that a significant effort has been made to improve risk management over the years. The most likely reason for this are the assumptions that hospitals will rarely experience loss on the one hand, and that budgets in many hospitals have been tight over the years – assumptions about loss and budgets that did not bear out with marked improvement to date.

Turning to other countries, an average of around 1,130 cases of fire damage occurred in hospitals each year in the U.S. between 2011 and 2015,15 and the loss amount exceeded the value of one room in about 4% of cases. In the UK, 3,648 cases of fire damage were reported in 2015,16 while 819 cases of fire damage were reported in South Africa between 2003 and 2015 with an average claims expenditure of around EUR13,000.17 Figures for other countries could not be obtained, despite a considerable effort to gather data. From discussions with colleagues in the industry, however, there is evidence of a high frequency of claims in countries, such as the Netherlands, with regard to insurance against fire and water damage, and this has prompted individual providers to withdraw from the segment, with others following suit.

Risk management

As things stand, there is no requirement in Germany to install automatic fire extinguishing systems in hospitals under planning laws or from an insurance perspective. Although the installation of an automatic fire alarm system is mandatory in Germany as part of a fire safety concept that has building regulation approval, the area being monitored is not usually comprehensive. Automatic fire extinguishing systems are scattered, with only partial coverage. As a result, the possible scope of protection is limited. A survey of other countries reveals the following findings concerning risk management:

- In the U.S., around 67% of hospitals are fitted with a sprinkler system, and damage was limited to the outbreak area in 87% of cases.18

- In Scandinavia the key areas of larger hospitals (wards, technical rooms, examination rooms and operating theatres) are usually protected with sprinkler systems, according to our findings.

- In the UK, France, the Netherlands and Poland, the standard of protection in hospitals is low: as in Germany, there is no obligation to install automatic fire extinguishing systems.

Insurance challenges

Taken as a whole, a hospital is an extremely complicated and high-tech entity. A hospital generally consists of a series of interconnected buildings that are linked together in various ways by corridors and tunnels. From a fire safety point of view, such a design is treated as one large, coherent building complex.

Hospitals are very efficient when processes run smoothly. However, if there is a disruption (e.g. fire or water damage), the vulnerable nature of a hospital can be seen very quickly. Especially if a problem affects one of the many areas prone to bottlenecks (e.g. a ward, intensive care unit, operating theatre or central infrastructure), the result may soon be disruption on a massive scale or even the total suspension of operations.

Increasingly, hospitals are focusing on issues of efficiency and profitability. As a result, statutory revenues are no longer sufficient in some cases to cover growing operating expenses, including the rising costs for essential investments. This has already led to an investment backlog in the past, especially for older hospitals. In order to fend off competition and to be attractive to patients, the available funds for investment have flowed into technical and medical modernisation programmes rather than risk management measures.19 From an insurance perspective, the increasing use of sophisticated technology increases the financial burden as well as the vulnerability of systems and rooms together with the claims expenditure in the event of fire or water damage caused by indirect or direct exposure to flames, increased humidity, mould and so on. All of this means that many hospitals in Germany have some catching up to do in order to minimise risks that have grown in recent years.

Current risk situation

A major fire in a hospital represents one of the most serious possible disruptions. On the one hand, a hospital fire can lead to material damage on an enormous scale due to the high value of technical equipment. On the other hand, a fire places many people in serious danger, and they need to be brought to safety as quickly as possible. This is made more difficult by the fact that many patients have limited mobility and are dependent on the help of third parties (staff and firefighters). Additionally, certain risks are particular to the hospital context:

- High concentrations of value due to expensive medical systems, devices and other equipment

- Preferred underground location of areas for diagnosis and examination as well as laboratories, surgical areas and the hospital pharmacy due to the weight of equipment (maximum floor load per square metre). In addition, central technical systems and utilities that are essential for the smooth running of a hospital are usually concentrated below the ground floor.

- An extensive and often confusing building layout with many floors above and below ground

- Highly complex ventilation and air-conditioning ductwork as well as connection and supply shafts, which potentially allow damage to spread

- Prioritisation of personal safety before firefighting

- Special requirements for restoration and refurbishment after damage events (e.g. due to hygiene regulations or updated statutory guidance and rules)

- Serious consequences for the continuation of hospital operations if central hospital departments are affected (damage caused by the interruption of operations)

However, it is not only fires that can lead to a major loss: there is also a significant possibility that damage caused to or by water pipes and systems may have the same result, especially as such damage is often only recognised after a considerable delay, during which time important technical equipment and structural areas may already be compromised. Generally speaking, renovation or restoration of the affected rooms is only possible under difficult conditions – specifically with continued hospital operation, taking into consideration the necessary hygiene requirements. There are constantly cases in which it appears ultimately more affordable to replace the area affected by damage with a new construction. Additionally, the replacement of central systems and facilities can lead to significant delays in hospital operations due to extended delivery periods.

As the above analysis of claims data shows, there are relatively few incidents of major damage in hospitals. A more problematic issue is the large number of minor claims, especially with respect to fire, water damage and burglary, all of which create a burden for the insurer concerned when taken cumulatively over a year. If unpredictable major losses are then added to this considerable basic burden, the insurance result will soon be negative – especially because significant price competition has led to falling premium income in this segment over recent years.

In my opinion, this situation makes it possible to draw two fundamental conclusions:

- On the one hand, hospital management teams must be made aware of the need for a tailored risk management strategy that takes current risk exposure into account.

- On the other hand, insurance providers should no longer consider hospital risks to be “simple” in nature, but adapt their underwriting and pricing in line with the respective risk exposure.

Typical protective measures

In Germany there are no standardised minimum fire safety requirements for hospitals, which means that different regulations are in place in each federal state. To improve the loss exposure situation in hospitals, which is not satisfactory at present, a range of appropriate technical measures could be taken to reduce existing risks and to limit the consequences of a loss event. Effective protective measures for individual threats are set out below.

Fire

- Fire-resistant construction of new buildings using non-combustible materials

- Fire-resistant cell construction of individual rooms, especially the central laboratory, central kitchens, laundries, storage, heating equipment rooms, waste collection areas, operating areas and areas at particular risk (e.g. storerooms for flammable liquids and gases, hospital pharmacy)

- Establishment of smoke sections and division of the hospital complex into fire zones

- Fire-resistant seals on all wall openings and supply shafts for electrical heating and media systems as well as cables, ventilation and other supply routes such as transport systems and chutes

- Comprehensive monitoring of all hospital areas using an automatic fire detection system that reports to a permanently staffed station where appropriate alarm and intervention measures can be initiated

- Installation of an automatic fire extinguishing system (e.g. a sprinkler system) in all key hospital areas, including wards, operating theatres, examination areas and central service areas

- Measures to raise staff awareness of fire safety and how to act in case of fire as well as planning adequate emergency escape and rescue routes

- Installation of a rising mains supply and hydrant systems as well as emergency firefighting supplies on-site and an adequate water supply for the fire brigade

- Smoke and heat exhaust systems

- Organisational fire safety measures, such as an appointed fire protection officer, best current practice, emergency fire plan, fire brigade access, fire safety training, fire extinguishers, creation of an internal firefighting team and development of an evacuation concept

- Construction and maintenance of electrical systems in line with valid regulations

- Routine inspection and checking of preventive fire safety measures and immediate rectification of any identified defects

Comprehensive recommendations for fire safety in hospitals can be found; for example, VdS20 published such a brochure and fire safety guidelines for hospitals have been published by a platform of German-speaking associations and societies for medical and operating technology in hospitals.21

Water

- New construction, reconstruction and renovation of buildings

- Sufficient capacity of water pipes and systems as well as wastewater facilities of suitable quality for use in the hospital sector, taking into account the latest technical regulations and, in particular, the specific challenges of acids, alkalis, wastewater, etc.

- No planning or laying of water pipes above critical systems and hospital areas

- Installation of leak detection systems and water detectors in critical areas with alarms at a permanently staffed station

- Installation of automatic shut-off valves in easily accessible areas as well as clear signing for shut-off areas

- Installation of water treatment facilities

- Regular inspection, maintenance and servicing of all water pipe systems and immediate expert action to correct any identified defects

- Installation of automatic shut-off valves in public areas (e.g. taps) to prevent vandalism

- Preparation of an emergency plan in the event of water damage and a contractual agreement with an emergency repair and drying service in order to minimise damage as soon as possible in the event of damage

- Provision of exact and up-to-date layout plans of all pipes and systems

- Measures to raise staff awareness of water damage, e.g. a reminder to close windows when it rains

- Regular inspection of roof areas for possible damage and water accumulation, especially after severe rain, storms or hail

- Regular inspection of air conditioning and ventilation systems for leaks

Break-ins and theft (burglary)

- Identification of hospital areas containing high-value medical equipment

- Limitation of access to especially valuable medical equipment

- Storage of high-value medical equipment in closed or locked rooms (with a locking system and alarm)

- Protection of rooms and areas with high-value content using automatic intruder detection systems with a corresponding alarm to a permanently staffed station (e.g. motion detectors, opening contacts for doors and windows)

- Safekeeping facility for valuables belonging to patients and staff

- Measures to raise staff awareness of theft (e.g. challenging strangers in non-public areas)

- Use of video surveillance at entrances and exits as well as in corridors and vehicle exits in compliance with data and staff protection regulations

Underwriting considerations

In principle, the underwriting and pricing for a hospital insurance policy should be based on a recent inspection report carried out by an insurance engineer. In addition to the risk of fire, there should also be information concerning the risk exposure with regard to insurance against water, storm and hail damage as well as burglary and natural hazards. Such an inspection should be repeated at regular intervals (e.g. annually). Any deficiencies identified during inspection, from lacking extinguishing systems or an inadequate water supply for firefighters to ineffective fire protection partition walls, should be properly corrected in a timely manner and reported by the policyholder.

Special attention should be given to the level of cover provided, and whether the insured sums are up to date, because new construction projects, conversion work, reorganisation and new acquisitions throughout the year can result in significant changes.

The risk of business interruption (BI) should no longer be considered as a supplement to Property insurance in the context of risk assessment and pricing.22 Instead, it should be taken carefully into account both when assuming risk and later underwriting risk.

In particular, the following considerations should be undertaken:

- The deregulation of planning laws, leading to a decreasing level of statutory protection and a certain neglect of fire safety issues in hospitals

- The presence or absence of preventive protection measures, such as fire-resistant cell construction, fire alarm systems, fire extinguishing systems and their expected effectiveness

- Possibly delayed action by the fire brigade, whose priority is to rescue and vulnerable people – with the result of potentially greater damage

- The common underground location of important technical rooms and infrastructure facilities as well as diagnosis and examination facilities, laboratories, research facilities and operating theatres, with a corresponding concentration of value and water damage risk

- In many cases, hospitals and building installations that were created in line with the rules and regulations in force at the time of construction (In the event of damage this likely means considerable additional expenses due to the expiry of grandfather rights and the implementation of more recent regulations, e.g. with regard to hygiene or the maximum occupancy of a patient room.)

- A realistic assessment of the exposure to risk of business interruption (Past experience with claims shows that interruptions to operations are increasingly determining the loss burden. Among other things, hospitals that specialise in elective surgery are at greater risk because patients can move to other establishments.)

- The importance of the underlying insurance policy and its provisions with a particular focus on:

- The definition of insured risks and exclusions, e.g. what kind of water damage is covered? (floods, heavy rain, storms, hail, water pipes, damage from other leaks)

- Agreed maximum compensation – Is this final or can it be exceeded through first loss positions?

- Agreed excesses – Are they suitable to effectively limit claims payments due to high-frequency claims?

- The nature, amount and effect of agreed first loss positions, e.g. higher liability, loss mitigation costs, additional costs, costs imposed by regulatory restrictions on rebuilding and operations, decontamination costs, restoration costs and provisions

- Identification of key areas that are necessary for the success of the hospital in question, e.g. intensive care units, operating theatres, wards and technical equipment – and the corresponding consequences in the event of failure

- A realistic assessment of possible backup and relocation opportunities in the event of damage as well as any resulting consequential costs

- A realistic assessment of PML and MFL (It is typical for rebuilding work on damaged buildings to take in the region or two or three years, if not more, according to past experience.)

- An analysis of past damage and the deduction of appropriate measures, e.g. additional technical preventive measures as well as insurance measures, such as customer selection, adjustment of agreed excesses and limitations of liability, limitation of coverage and adjustment of insurance premiums

Sufficient information should be available for underwriting and pricing that takes risk exposure properly into account. Here it is especially important to mention the following:

- Current and applicable insured sums (property, business interruption, first loss positions) on a new-value basis

- Desired coverage (wording)

- MFL estimate of the inspector with special consideration of the implications of consequential loss

- Type of building and number of floors

- Preventive protection, safety and risk management measures in place, especially any fire zones or complex partitions and fire extinguishing systems as well as measures to protect against burglary, theft and possible major water damage; emergency and evacuation plans

- Information about damage sustained over the last five (minimum) or 10 years

- Agreed excesses and sub-limits

Summary

An analysis of claims shows that hospitals are not “simple risks”, but that the frequency of claims in particular for various types of insurance can lead to a significant claims burden in any given year. If there is also a major loss event, the profitability of the insurance policy concerned or the entire hospital portfolio will generally be negative.

Preventive risk management measures to minimise damage and its consequences are rarely seen in the hospital sector due to a strained financial situation for many years. There is a lack of legal and building regulation requirements in Germany, which means that no fundamental changes can be expected in the future with regard to risk exposure and profitability. At the same time, the current rate competition for hospital insurance is set to continue, not least because the financial resources of hospitals will hardly improve.

In this respect, the underwriting practices of individual insurance providers are of particular importance: the profitability of individual risks should be pitched in accordance with the facts outlined above and after close consideration of the anticipated frequency of claims as well as the possibility of a major claim.