-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

Structured Settlements – What They Are and Why They Matter

Publication

PFAS Awareness and Concern Continues to Grow. Will the Litigation it Generates Do Likewise?

Publication

“Weather” or Not to Use a Forensic Meteorologist in the Claims Process – It’s Not as Expensive as You Think

Publication

Phthalates – Why Now and Should We Be Worried?

Publication

The Hidden Costs of Convenience – The Impact of Food Delivery Apps on Auto Accidents

Publication

That’s a Robotaxi in Your Rear-View Mirror – What Does This Mean for Insurers? -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Publication

Key Takeaways From Our U.S. Claims Fraud Survey

Publication

Favorite Findings – Behavioral Economics and Insurance

Publication

Individual Life Accelerated Underwriting – Highlights of 2024 U.S. Survey

Publication

Can a Low-Price Strategy be Successful in Today’s Competitive Medicare Supplement Market? U.S. Industry Events

U.S. Industry Events

Publication

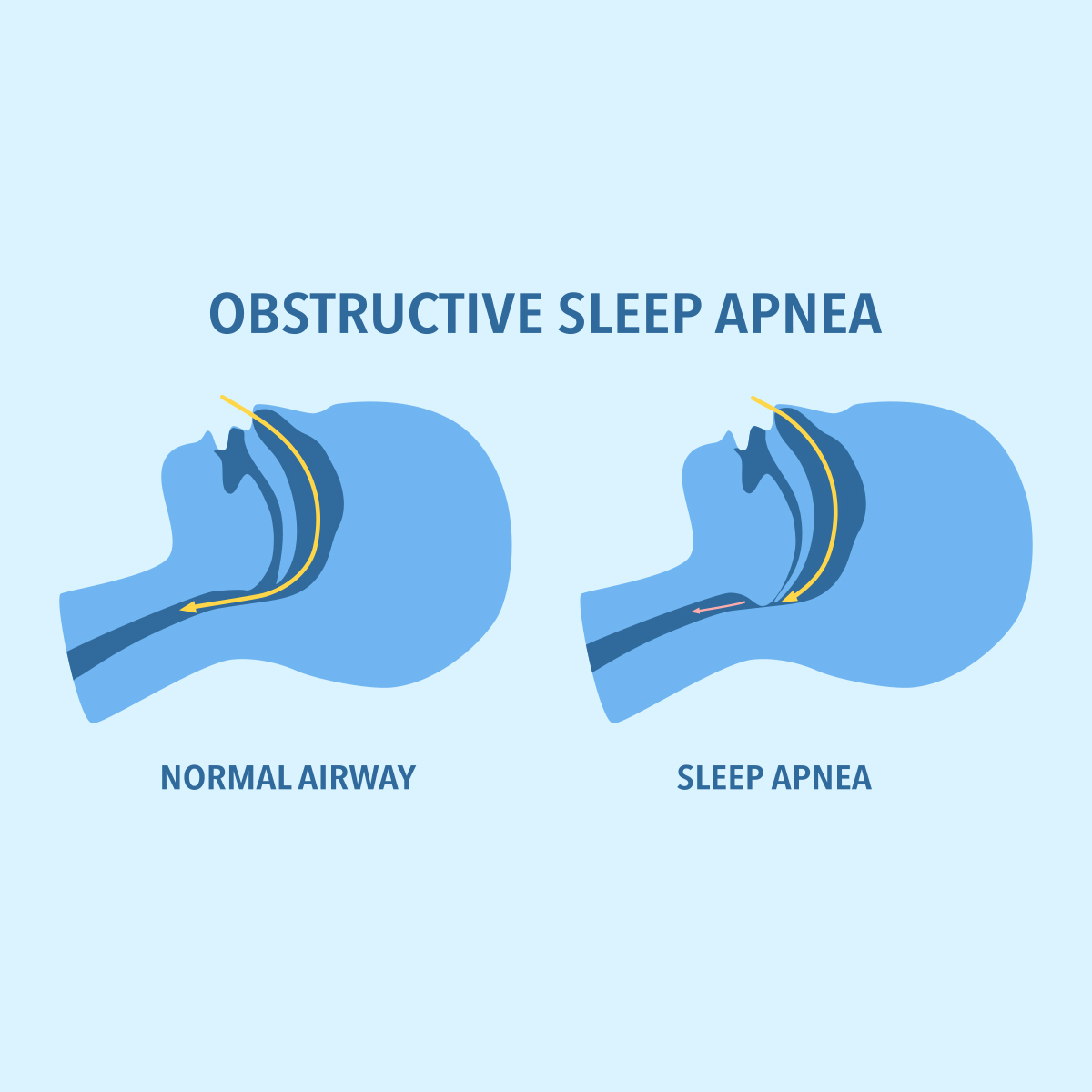

The Latest in Obstructive Sleep Apnea -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Your Data, Systems and Culture – Get Future-Fit

June 12, 2017

Andres Webersinke,

Karin Brendel

English

Insurers can only survive if they succeed in transitioning from a product- to a customer-centric value proposition. This shift necessitates a focus on knowing more about customers and better understanding their behaviours and decision-making processes.

Increasing client intimacy can be developed through interactions between customers and the insurer as well as with other entities, i.e. from own or otherwise easily available data and increasingly from not yet used data sources. Data analytics makes use of this data and feeds into all aspects of the insurance value chain. This requires investments into data analytics capabilities as well as a change in culture on the side of insurers.

Every customer already experiences data analytics in action – often cleverly interwoven with our online behaviours. This frictionless customer experience contrasts with the product proposition developed and offered to life insurance customers today, where lengthy application processes, including paper files and multiple disruptions in media and communication, all not seamlessly connected, prevail.

Most insurers built their propositions for processing over a long period, and hence all face the same challenges in implementing smart processing based on artificial intelligence, machine-learning or other advanced technologies.

People and Culture

Life insurance actuaries are experts in analysing claims experience and other data from the past in order to assess and manage future risks. With the abundance of new data available, innovative approaches must be considered in order to link the data to an insurer’s long-term experience.

Tools are being developed for analysing data and transferring statistical theories into high-performance algorithms. New machine-learning techniques evolve at such a fast pace that even the most willing and capable actuaries can’t keep up with it. So-called InsurTech firms have the technical expertise but may lack the business knowledge, which is equally important. Technical expertise can be built up within an insurer but it also requires an integrator, one who brings the new expertise and its results and implications as well as the future-phobe and future-phile together.

Data

Insurers, whose business model has always been to sell intangible products, rely on data but have not always paid close attention to efficiently collecting all the information their customers are willing and able to share. As a result, we often face data that has gaps and mistakes, cannot be easily connected, is mostly inconsistent, and ignores many touchpoints with customers, such as calls or communication between adviser and customer. In addition, a lot of the information is only available on paper, even in handwriting, which may be illegible for a human and as yet for machines.

... people involved in this project found the collaboration to be an excellent and highly motivating experience ...

Systems

From an abstract perspective, it could be so easy: Join all data sources and applications available for any insured life and analyse the resulting data cube in all dimensions that a curious mind can imagine. In practice, however, different systems have not been designed with a view to seamless integration and hardly allow the combination of data from different sources with unique identifiers. Furthermore, small companies have too little data in all segments to generate meaningful insights. On the other hand, data from large companies or pooled data from multiple companies become so huge that available IT infrastructures and statistical tools are stretched to their (current) limits.

It sounds like an insurmountable challenge but one that needs to be tackled: doing nothing at all and leaving the data unused, or not improving data collection, is not an option.

While insurers would not want to rely on expensive external solutions in the long run, collaboration with consultants, reinsurers or specialists in analytics could be a first step towards making better use of data and building up their own expertise in data analytics.

Some insights gained from the projects illustrating the power of data

Application data

Background: The insurer sells Mortality and Disability Income cover online, as well as via inbound and outbound telephone calls. The products are fully underwritten and underwriting decisions vary from standard premium rates, with modified terms and a premium loading, and/or an exclusion to the offering of an alternative product.

Analysis

Factors influencing the issue rate after completion of the questionnaire

Some of the findings

- Applicants for Mortality cover who disclose a history of mental health disorder are significantly more likely to purchase a policy than others. This is also true for (the 2% of) applicants with a relatively recent history of drug use.

- The issue rate for a Disability Income policy is highest amongst applicants in the building industry followed by real estate and the media.

- The number of disclosures by underwriting decision is broadly similar across the distribution channels with a slightly higher number of disclosures made over the phone.

These results may confirm certain beliefs and highlight others (but beware of confirmation bias):

- Applicants with disclosures are more engaged in the process of purchasing life insurance.

- Certain underwriting decisions by this insurer may be relatively generous and/or the underwriting process may be relatively simple in comparison to the market.

- Taboos and social stigma may impact the disclosure rate in a face-to-face environment with an adviser.

- Advisers do not reach all groups in a market (e.g. people in lower socio-economic groups), and as such, non-advice products are an important additional offering to address the insurance gap.

Claims data from Southeast Asia

Background: The insurer sells two hospitalisation products, a hospital and surgical cash product and a medical reimbursement plan. Both products are available with different annual limits and are fully underwritten. Some agents and even some hospitals have been identified as being involved in a significantly higher number of suspicious claims beforehand.

Analysis

Factors indicating fraudulent claims in order to prioritise claims investigation resources

Some of the findings

- Very early claims and simultaneous claims under both products had a significantly higher probability of being fraudulent.

- Age and gender proved to be highly predictive of a suspicious claim.

- Claims due to minor conditions are more than three times more likely to be suspicious claims.

These results have been used to develop a systematic ranking approach in order to channel claims investigation resources. The insurer adopted the model and was not only able to stabilise but also to improve the loss ratios.

DEAP – Decision Analytics Project

Gen Re maintains a strong focus on technical expertise, which is why we have started to build up our own network of experts dealing with new analytic techniques, to overhaul our systems accordingly and to extend our capabilities by working on real-life questions from clients’ and own data. At all times we are focussed on the importance of getting actionable insights from the data, which is why Gen Re uses the term decision analytics, combining analytics with decisions and not purely with data.

We brought together 11 actuaries and statisticians from nine different locations – ranging from Stamford, Connecticut in the U.S. to Sydney, Australia for a joint kick-off workshop in Cologne, Germany. We asked our international business units for data-rich and meaningful projects, and selected four that lent themselves best to the application of a broad array of statistical tools and allowed for comparison with traditional analyses.

The four projects

For a large Southeast Asia health portfolio, we built a systematic approach for identifying potentially fraudulent cases in order to optimise claims investigation resources and thus increase efficiency to the benefit of both the insurer and the mostly honest customers.

The data from Gen Re’s own 6th Dread Disease Survey served as a basis for one of the projects. The results left some questions unanswered for which new multivariate techniques are required. For instance, we are interested in differentiating between (anti-) selection effects and calendar year effects as well as regional influences and their correlation with insurance companies operating on a regional or national basis.

... designing systems needs to bear in mind full possibilities for analysis and easy data transfer ...

Lastly, we separately analysed application data from a UK insurer and an Australian insurer. Policies were sold via brokers in the one case and directly in the other. Where possible, we combined the insurance data with external data and looked for deviations in the applicant’s data compared to the population characteristics. This allowed us to predict the underwriting outcome or identify brokers with unexpected disclosure rates amongst their customers. For the direct business, we analysed behaviours by various factors.

It’s a journey, not a sprint

Given the separate challenges of People/Culture, Data and Systems, the first lesson we had to learn was related to Data. While all the projects were selected for their data quality, and some of the data was already analysed by traditional means, the data was not prepared for the application of new methodologies. The loss of detail due to data aggregation, contradictory combinations or erroneous data entries became apparent, making it difficult if not impossible to improve the data quality in retrospect. Designing systems not merely with a view to capturing data, but bearing in mind future possibilities of evaluating numerous attributes and allowing for easy data transfers, is an immediate conclusion.

... the more precise the question relating to the data, the more effective the investigation ...

The people involved in this project found the collaboration on these new and challenging tasks to be an excellent and highly motivating experience for everybody. The team developed an outstanding degree of dedication and continued to work on their respective projects with regular exchange even across 15-hour time differences. Building this collaborative network offers ample opportunity to discuss questions on the data, as well as on the methodologies, and to transfer best practices amongst the decision analytics experts.

The more precise the question relating to the data is formulated, the more effective the investigation. This translates into an approach that looks not for just any new insight, as this might leave the user lost in the sheer data volume and its possibilities; rather decision analytics needs to have a clear focus on (answerable) questions paired with an open and curious mind, prepared to explore new paths throughout the process. While the goal or question may be adapted to changing requirements and results, it should be kept within sight.

Most readers will have experienced confirmation bias, i.e. the fact that results confirming our assumptions and lying in line with our expectations are quickly accepted, easy to explain as we (assume to) see a comprehensible causation between attributes and outcome. But what about counter-intuitive results, showing merely a correlation? Will they be trusted? Is the insurer’s culture ready for dealing with what could be described as implausible or surprising effects? Can we unveil the causation by analysing more data? Machine-learning algorithms will produce results that are based on patterns and correlations in the data – will we be prepared to develop detailed pricing or underwriting models based on these? On the other hand, it can create significant differentiation from competitors.

It is certainly a sound approach to focus on data that is easily available within a company or accessible with comparable ease from external sources. In the world of big data, however, this is clearly only a small fraction of what is going to be possible eventually. Access to customer data on lifestyle, activities and medical status in a real-time environment is a different challenge altogether.

This certainly needs defining meaningful metrics, estimating impact on morbidity, mortality and retention on the insurer’s side while transforming this into a measurable benefit for the customer, supporting them in leading their lives as healthy and active as the ones for which they strive.

Summary

Quite obviously, the future of decision analytics holds exciting opportunities. While armies of actuaries, statisticians and data scientists will increasingly grow their experience in analysing more data with better tools, the challenge will be to seamlessly interweave the gained insights with common sense and the company’s overall strategy for differentiation and customer-centricity.

Chief Underwriting Officer and Head of Research & Development – Life & Health

See All Articles