-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

Production of Lithium-Ion Batteries

Publication

Time to Limit the Risk of Cyber War in Property (Re)insurance

Publication

Generative Artificial Intelligence in Insurance – Three Lessons for Transformation from Past Arrivals of General-Purpose Technologies

Publication

Human Activity Generates Carbon and Warms the Atmosphere. Is Human Ingenuity Part of the Solution?

Publication

Inflation – What’s Next for the Insurance Industry and the Policyholders it Serves? -

Life & Health

Life & Health Overview

Life & Health

Gen Re’s valuable insights and risk transfer solutions help clients improve their business results. With tailor-made reinsurance programs, clients can achieve their life & health risk management objectives.

UnderwritingTraining & Education

Publication

The Key Elements of Critical Illness Definitions for Mental Health Disorders

Publication

What Are We to Make of Cannabis Use in The Insured Population? Business School

Business School

Publication

Knife or Needle: Will the New Weight Loss Medication Replace Bariatric Surgery?

Publication

Weight Loss Medication of the Future – Will We Soon Live in a Society Without Obesity? Moving The Dial On Mental Health

Moving The Dial On Mental Health -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Social Inflation Is Complicated and Costly - Underwriting Overview [Part 1 of 5-Part Series]

May 05, 2021

Ridge Muhly,

Craig Beardsley,

Jon Bergner, NAMIC Vice President of Public Policy and Federal Affairs (guest contributor)

Region: North America

English

This is part one (Underwriting Overview) of a five‑part series – in partnership with NAMIC – examining social inflation and its impact on insurers. Future parts will cover Actuarial, Legal, Claims and Emerging Issues.

If you’re a regular consumer of television, you’ve no doubt seen at least one, or perhaps multiple, commercials from accident lawyers promising big dollar settlements against rich insurance companies. The number of such commercials has only increased over the past several years, as a phenomenon called “social inflation” has taken root in our legal system.

Since the term social inflation first emerged in the 1970s, it has grown and expanded into a catch‑all of sorts to describe a host of deleterious cost-drivers that involve litigation and that chip away at insurers’ books of business, increase their operating costs, and eventually metastasize in the form of higher premiums for policyholders. Unusually large or so‑called nuclear verdicts catch our attention, but the underlying causes are broader and deeper. Many of these cost-drivers have existed in some capacity for decades, yet the past several years have demonstrated that the insurance industry really needs to understand the social inflation landscape so we can begin to address it.

Some insurers may be wondering why they should be concerned about social inflation when so many more pressing matters are threatening the profitability of their businesses. Social inflation hasn’t had an impact on businesses and insurers the way COVID‑19 did in 2020. Instead, the progression of social inflation has been slow and almost imperceptible, making it harder to identify and address. While some insurers have not observed an upward severity trend in their books of business, chances are that social inflation is quietly making inroads right now.

Actuarial, claims, and legal professionals are often the first to spot a shift in loss severity through the emergence of nuclear verdicts, rising compensatory demands, or an upward movement in losses. How early and deep the impact depends, in part, on the insurer’s classes of business and territories, so some carriers may not yet have seen the signs. To learn more about how social inflation is affecting the Property/Casualty insurance industry, Gen Re has partnered with NAMIC to find out what those on the front lines of social inflation - actuaries, claims, legal, and emerging issues - are witnessing, in order to share with readers a multipart analysis of social inflation, starting with this overview.

Ticking Upward in Commercial Auto

When a jury awards $50 million in a non‑fatal single-victim auto accident, insurers take note and label it an anomaly, but don’t necessarily see it as cause for alarm. Yet, when awards and settlements for such accidents routinely top $10 million, often coupled with an insurer bad faith component, it’s time for insurers to take notice.

Gen Re and NAMIC, along with other insurance companies, first observed an uptick in loss values in the Commercial Auto line starting in 2015. Prior to that, the industry had been reserving Commercial Auto in a loss ratio range that was consistent with historical performance. By 2015, it became clear that the line was performing worse than expected and the actual results climbed to more than 10 points above industry reserving picks for the preceding five years. It took nearly five years of development before the actual and projected loss ratio divergence became apparent, and that is a relatively short-tail line.1 The industry continued to underestimate loss experience on the line despite significant rate adjustments that chased but never caught up with trend. In short, Commercial lines insurers missed the loss inflection point - something hard to spot and costly to miss.

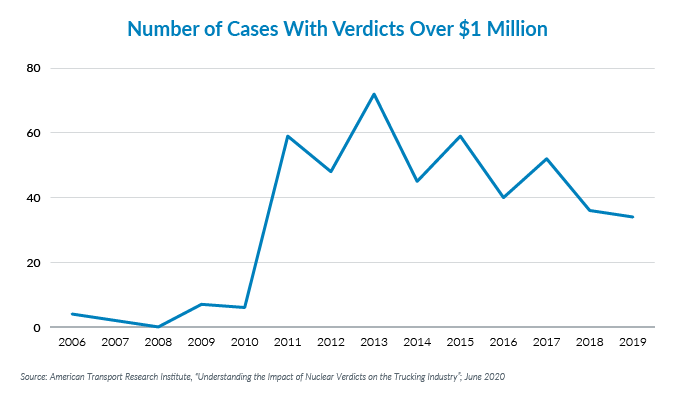

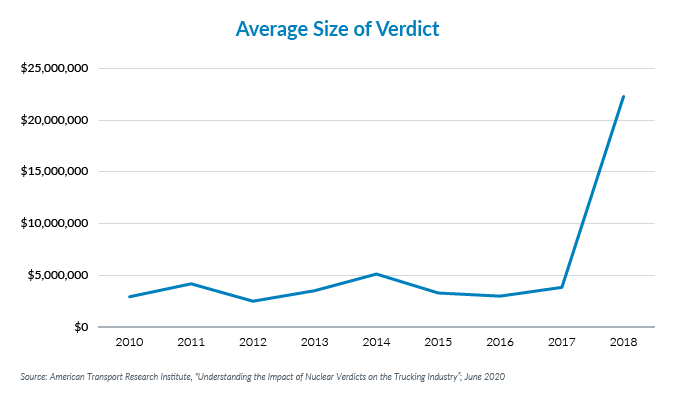

More recently, the American Transport Research Council shared its research on the verdicts that underlie the insurance industry’s numbers.2 It highlighted an increase in verdicts over $1 million starting in 2010 and an average verdict size sharply rising in 2017.3

Insurers are no doubt wondering if social inflation has migrated to other lines of business, most notably General Liability, Umbrella (non‑auto) and Personal Auto. There is early evidence of some unusual loss activity in Premises Liability, but nowhere as pronounced as in Commercial Auto. To evaluate the threat to other lines of insurance, this project seeks to analyze the drivers of social inflation seen in Commercial Auto and other areas and gauge how they may impact premises, products, and General Liability business.

Severity Drivers

Although a few economic and demographic trends are unique to Auto, most trends cross over to other Liability lines. Bodily Injury is certainly the defining element in large Auto losses, but serious injuries also occur in Premises and Products Liability. Some of Gen Re’s clients, particularly in the claims departments, have observed early notices of losses, attorney tactics, and unexpected trial outcomes first‑hand.

Specifically, below is a list of likely causes of social inflation, identified by Gen Re and its clients, which have resulted in an undermining of profitability in the Commercial Auto and Liability lines in recent years:

- More Miles Driven/Personnel Shortages - With the economic recovery following the Great Recession (2007‑2009), more trucks have been on the road, yet there are fewer experienced drivers to pilot them (subject to a COVID pause in activity).

- Distracted Driving - Smartphones and other distractions contribute to higher accident severity.

- Litigation Funding - The stronger cases are well-funded and under pressure to produce higher settlements and verdicts.

- Widening Wealth Gap - Jury backlash against “rich corporations” reflects a wealth disparity gap that has expanded by disproportionately higher COVID-related job losses in low-wage occupations.

- More/Earlier Attorney Involvement - This is indicated by an increasing number of first notice of losses where an attorney is already involved.

- Increasing Plaintiff Bar Sophistication - This trend has crystallized through trial bar networking, training, technology, and techniques to improve success rates on a nationwide scale.

- Defense Bar Complacency - Insufficient preparation and financial incentives weaken the ability to counter aggressive trial bar efforts.

Previous research on the relationship between wealth disparity and loss ratios has found that, all else being equal, jury awards are higher in geographic areas with greater levels of income inequality.4 However, studies connecting causes and social inflation, or quantifying its impact on insurers, are few and limited in scope. That absence means insurers must draw lessons from their own loss experience and from their reinsurers, who have a broader, national view of the market. Even with insurers and reinsurers sharing perspectives, pricing for social inflation is incredibly challenging. The industry’s experience with Commercial Auto tells that story.

Addressing Social Inflation

Over the last few years, Commercial Lines results have experienced an upward inflection point driven by social inflation. It is nearly impossible to detect this kind of inflection point in real time, but carriers should be vigilant, identifying trends and reacting quickly when the industry around them starts to shift. Staying alert to underwriting and claim developments - and listening to colleagues both internally and externally - can provide valuable insights. Social inflation is a complex issue for even the largest carriers with rich data and vast resources.

Throughout this series on social inflation, specialists from various disciplines - actuarial, claims, legal, and emerging issues - will share the latest data and perspectives. While COVID claims may be dominating the focus of management now, social inflation remains a critical issue that deserves a much higher degree of attention going forward.

Next up: Legal and Regulatory changes related to social inflation. Gen Re General Counsel Andrew Gifford and NAMIC Government Affairs Counsel Andrew Pauley discuss changes the insurance industry can make to reverse the threat of ballooning social inflation.

Endnotes

- Gen Re blog on Personal and Commercial Auto Trends, https://www.genre.com/knowledge/publications/2018/november/spotlight-on-commercial-and-personal-auto-en.html

- “Understanding the Impact of Nuclear Verdicts on the Trucking Industry” (June 2020), https://truckingresearch.org/wp-content/uploads/2020/06/ATRI-Understanding-the-Impact-of-Nuclear-Verdicts-on-the-Trucking-Industry-06-2020-2.pdf; see articles at www.ccjdigital.com

- “Understanding the Impact of Nuclear Verdicts on the Trucking Industry” (June 2020), https://truckingresearch.org/wp-content/uploads/2020/06/ATRI-Understanding-the-Impact-of-Nuclear-Verdicts-on-the-Trucking-Industry-06-2020-2.pdf

- Research by Frank Schmid, Gen Re CTO, reported by Chris Mackeprang, Gen Re actuary, https://www.genre.com/knowledge/publications/social-inflation-measures-of-wealth-and-income-inequality-warrant-attention-from-underwriters-en.html

Jonathan Bergner is Vice President of Public Policy and Federal Affairs for the National Association of Mutual Insurance Companies in Washington D.C. Jon is involved in the full range of NAMIC’s government relations activities from legislative strategy, to policy development, the political action committee, grassroots mobilization, and strategic communications. His issue portfolio includes insurance regulation, the implementation of the Dodd-Frank Wall Street Reform and Consumer Protection Act, terrorism risk insurance, cannabis, auto safety, and underwriting restrictions, among others.

Jonathan Bergner is Vice President of Public Policy and Federal Affairs for the National Association of Mutual Insurance Companies in Washington D.C. Jon is involved in the full range of NAMIC’s government relations activities from legislative strategy, to policy development, the political action committee, grassroots mobilization, and strategic communications. His issue portfolio includes insurance regulation, the implementation of the Dodd-Frank Wall Street Reform and Consumer Protection Act, terrorism risk insurance, cannabis, auto safety, and underwriting restrictions, among others.