-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

Production of Lithium-Ion Batteries

Publication

Time to Limit the Risk of Cyber War in Property (Re)insurance

Publication

Generative Artificial Intelligence in Insurance – Three Lessons for Transformation from Past Arrivals of General-Purpose Technologies

Publication

Human Activity Generates Carbon and Warms the Atmosphere. Is Human Ingenuity Part of the Solution?

Publication

Inflation – What’s Next for the Insurance Industry and the Policyholders it Serves? -

Life & Health

Life & Health Overview

Life & Health

Gen Re’s valuable insights and risk transfer solutions help clients improve their business results. With tailor-made reinsurance programs, clients can achieve their life & health risk management objectives.

UnderwritingTraining & Education

Publication

The Key Elements of Critical Illness Definitions for Mental Health Disorders

Publication

What Are We to Make of Cannabis Use in The Insured Population? Business School

Business School

Publication

Knife or Needle: Will the New Weight Loss Medication Replace Bariatric Surgery?

Publication

Weight Loss Medication of the Future – Will We Soon Live in a Society Without Obesity? Moving The Dial On Mental Health

Moving The Dial On Mental Health -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Will On-Demand Deliveries Hit Umbrella Insurance Policies?

March 09, 2020

Jill Tumney,

Christine Unger

Region: North America

English

The popularity of on-demand delivery services continues to rise, and companies like DoorDash, Postmates, Uber Eats, Amazon Flex, and Grubhub have become household names. Nearly 2/3 of retailers were expected to offer same-day delivery services by the end of 2019, and UBS has predicted that by 2030 most meals will be ordered online and delivered directly to consumers.1

These companies depend on a workforce of independent contractors (IC) delivering food and goods on their behalf. These independent contractors may be family members of insured homeowners looking to earn extra money, or even a business using its vehicles to deliver food or packages for another business to earn extra income. In the event of an accident, insureds may be unclear about their coverage. And insurers may not have contemplated the exposure in their underwriting, pricing or policies. This knowledge gap has implications for everyone in the insurance chain. In this post, we try to fill some of that gap for Umbrella insurers.

Coverage From On-Demand Companies - It Varies

Many of the delivery services are currently providing some type of insurance to their independent contractors but the details vary and the public information available is not always clear. Delivery services generally require that the IC driver have auto insurance as part of the application process, but the similarities of the insurance being provided by delivery services appear to end there. Reviewing the website of each delivery service company may be helpful but more research is probably needed.

Here is what we could glean from a few company websites. At one end of the spectrum, Grubhub provides no insurance to its IC drivers for accidents occurring during food delivery whereas Amazon Flex and DoorDash each provide certain coverages. Amazon Flex provides ICs with a commercial auto insurance policy including liability, UM/UIM, and comprehensive / contingent collision but only when the IC is actively delivering Amazon products, and not in New York. DoorDash provides commercial auto insurance up to $1,000,000 but only on liability to third parties and only while the IC is on active duty. If and how these insurance policies will apply to a specific accident will depend on details not always apparent on websites.2

Will the IC or the delivery company policy cover the loss? What outcome was intended?

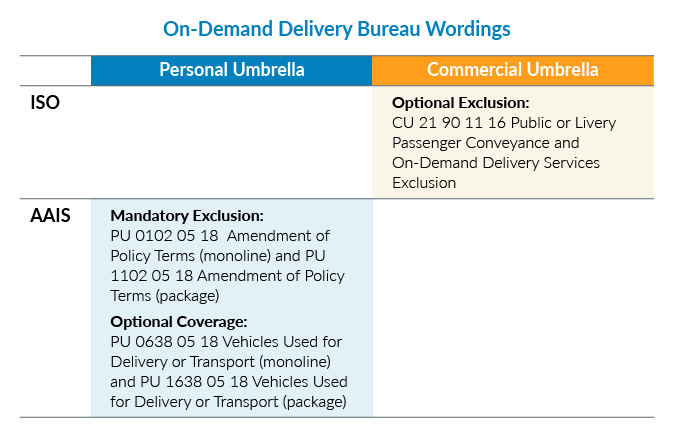

Umbrella Options for Insurers - ISO and AAIS

The insurance industry has responded with coverage options that also vary. Except for a few exceptions, the industry treats the delivery of food and goods as a business and covers it as such. From there the paths diverge.

The ISO Personal Umbrella product does not address on-demand delivery services. Transportation Network Company (TNC) exclusions are available, but they do not mention delivery services. The business exclusion can come into play, but it doesn’t apply if the insured generates under a stated amount of annual revenue ($2,000 in DL 98 01 02 15 edition). Even if this threshold is breached, an exception preserves coverage for insureds that are minors (either under 18 or under 21, if a full-time student) and whose work is part-time or occasional, as well as customarily undertaken on that basis by minors. In contrast, the ISO Commercial Umbrella product offers an exclusion that addresses both public livery and on-demand delivery services.

AAIS provides a mandatory Personal Umbrella endorsement clarifying there is no coverage for the use of a motorized vehicle while the insured is delivering or transporting food or other goods. Then AAIS offers Personal Umbrella endorsements to grant coverage for these services. The AAIS Commercial Umbrella products do not provide options for delivery or livery services.

Of course, insurers can create their own forms to fill in the blanks and align coverage with underwriting intent.

Underwriting Considerations for Umbrella Carriers

Both personal and commercial lines writers are exposed to on-demand delivery. As a personal lines writer, you might wonder if the homeowner’s college student is delivering food on weekends to earn extra cash. If you focus on commercial lines, you could face a scenario where a business is looking to augment income by using its commercial vehicles off-hours to deliver goods for another business. Here are a few important considerations:

- Available Forms - Are you using the appropriate coverage forms to reflect underwriting intent? If Bureau options do not fit your needs, are you developing a proprietary solution?

- Underlying Exclusions, Limits and Dropdown - If the underlying auto policy has an exclusion or sublimit for on-demand coverage, is there a dropdown exposure?

- Details of Delivery Company Insurance - Do you know the details of the company’s commercial insurance coverage? Is it limited to actual delivery time? Which cover applies first?

- Side Gigs - Are your small commercial accounts picking up extra unrelated income by using vehicles to deliver food and goods? Risk classification and pricing are likely very different.

- Agent Education - Can you help your agents recognize the potential exposure to their personal and commercial customers? Does the application or renewal process reveal the exposure?

As on-demand delivery coverage increases in demand, the underwriting questions and coverage options will no doubt evolve. Personal and Commercial Umbrellas are only one piece of the delivery services’ insurance puzzle, but they may be the largest financial piece of any verdict or settlement. It is worth the time to explore and understand how all the pieces fit together.

Endnotes

- https://www.conveyco.com/delivery-statistics; https://www.ubs.com/global/en/investment-bank/in-focus/2018/dead-kitchen.html

- grubhub.com; flex.amazon.com; doordash.com