-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

Use of Artificial Intelligence in Fire Protection and Property Insurance – Opportunities and Challenges

Publication

Public Administrations’ Liability – Jurisprudential Evolution, Insurance Implications, and a Comparative Analysis Across Countries

Publication

Generative Artificial Intelligence and Its Implications for Weather and Climate Risk Management in Insurance

Publication

Engineered Stone – A Real Emergence of Silicosis

Publication

Risk Management Review 2025 -

Life & Health

Life & Health Overview

Life & Health

Gen Re’s valuable insights and risk transfer solutions help clients improve their business results. With tailor-made reinsurance programs, clients can achieve their life & health risk management objectives.

UnderwritingTraining & Education

Publication

Diabetes and Critical Illness Insurance – Bridging the Protection Gap

Publication

Underwriting the Dead? How Smartphones Will Change Outcomes After Sudden Cardiac Arrest

Publication

Always On: Understanding New Age Addictions and Their Implications for Disability Insurance

Publication

Dying Gracefully – Legal, Ethical, and Insurance Perspectives on Medical Assistance in Dying

Publication

AI Agent Potential – How Orchestration and Contextual Foundations Can Reshape (Re)Insurance Workflows Business School

Business School -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Insurance Idea Pulse 2020: Where Is Life and Health Insurance Making Innovations?

March 11, 2020

Ewa Widenka, Ninety Consulting (guest contributor)

English

“There are only five ideas in insurance” is a throw away comment we overheard at a Ninety Consulting workshop, but it got us thinking: Is this a fair assessment of the state of insurance innovation today? We reviewed more than 500 innovations made from 2017 to 2019 by 250 major players in the global insurance sector to find out. This blog summarises the findings we published as Insurance Idea Pulse 2020.

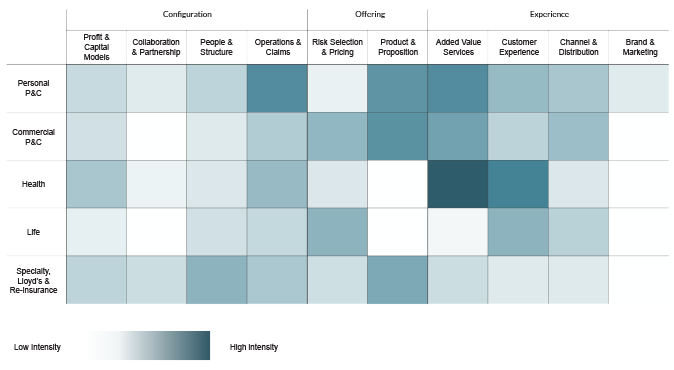

The full report provides insights into what we discovered not only about Life and Health insurance innovations, but also Personal and Commercial P&C and specialty lines. This heat map (Figure 1) shows the intensity of innovation by type and by business line. The darker the colour, the more intensely insurers innovate in that category.

Figure 1 - Innovation Intensity Heat Map

Source: Ninety Consulting

Health insurance leads the charge with the highest intensity of innovation across all lines. Of 10 categories of innovation, the most activity is concentrated in Added Value Services and Customer Experience. The aggregate innovation portfolio across health insurance appears, in fact, to be skewed toward these two areas and neglects many of the other types of innovation.

Innovations in health insurance mainly offer policyholders access to preventative care and wellness features, including access to lower cost health support through digital means, e.g. telemedicine.1 This is largely a response to rising healthcare provider and claims costs and aims to nurture a healthier book of policyholders. Customers will perceive these as new services from their health insurer.

These innovations fall outside of the core insurance product. The ongoing uncertainty about healthcare provision in the U.S. is likely playing into this with insurers looking to offerings less prone to regulatory or political disruption. Our data suggests that, outside of underwriting new conditions, health insurers are typically doing very little to innovate the product itself. This represents an opportunity for disruption; the health insurance product of the future needs to be born.

Life insurance lags behind, which is frustrating as this insurance category has very human qualities. In our experience, life insurers share this frustration. Perhaps the paucity of innovation is not entirely surprising. Personal lines adopted digital technologies early on, facilitated by a customer proximity, regular touchpoints and a rapid renewal cycle. These features allowed for trial and failure without long-term implications for the business. Contrast this with Life insurance where a failed idea might adversely impact the underwriting result for the next 30-40 years.

Most Life insurers are looking at innovation either for customer engagement or as a long-term savings and protection “aggregation portal”. There are examples of innovation connected with customer experience and risk selection and pricing. As with Health insurance, it looks like Life Insurance 2.0 is begging to be invented. In the meantime, companies could do more to emulate the work on value-added services that other lines are pursuing. Risk prevention is an idea that may combine various innovations and is an increasingly ubiquitous theme in health and wellness propositions, just as it is in smart home solutions.

What about the cold spots in our heat map that are particularly relevant to the Life and Health business? These important areas deserve our attention and include:

- Cost Innovation of the claims supply chain cost innovation especially in the context of healthcare providers

- Emerging greenfield/novel insurance carriers and managing general agents that have low headcount and expense ratios

- Development of smarter, more automated risk selection and underwriting protocols

- Personalization of health and wellness services and tailoring of clinical pathways to help individuals be healthier, including the potential of genetics

- New subscription-based policies that help to break policy renewal cycles, where these exist, and align better with new customer expectations

- Non-premium value-added risk management services that allow insurers to create more touchpoints with policyholders

The new decade reveals a wide variety of innovation across the global insurance market. We believe the sector should be proud of its efforts to date but recognize how much work is left to do. Consider some of our missed opportunities and the Innovation Intensity Heat Map as a guide to your innovation portfolio planning and a chance to spot new opportunities and expand your thinking about innovation.

This blog is abridged from a report published by Ninety Consulting, “Insurance Idea Pulse 2020 - Taking the Pulse of Ideas and Innovation Across Major Global Insurers”. Ninety Consulting is a group of insurance-specialist innovation practitioners with a mission to help insurers innovate and thrive in a fast-changing world.

Endnotes

About the author

Ewa Widenka is Innovation & Product Manager at Ninety Consulting. She is involved with research in insurance innovation and new product and services development.