-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

Use of Artificial Intelligence in Fire Protection and Property Insurance – Opportunities and Challenges

Publication

Public Administrations’ Liability – Jurisprudential Evolution, Insurance Implications, and a Comparative Analysis Across Countries

Publication

Generative Artificial Intelligence and Its Implications for Weather and Climate Risk Management in Insurance

Publication

Engineered Stone – A Real Emergence of Silicosis

Publication

Risk Management Review 2025 -

Life & Health

Life & Health Overview

Life & Health

Gen Re’s valuable insights and risk transfer solutions help clients improve their business results. With tailor-made reinsurance programs, clients can achieve their life & health risk management objectives.

UnderwritingTraining & Education

Publication

Diabetes and Critical Illness Insurance – Bridging the Protection Gap

Publication

Underwriting the Dead? How Smartphones Will Change Outcomes After Sudden Cardiac Arrest

Publication

Always On: Understanding New Age Addictions and Their Implications for Disability Insurance

Publication

Dying Gracefully – Legal, Ethical, and Insurance Perspectives on Medical Assistance in Dying

Publication

AI Agent Potential – How Orchestration and Contextual Foundations Can Reshape (Re)Insurance Workflows Business School

Business School -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Group Term Life – Results of 2019 U.S. Market Survey

June 17, 2020

Heidi Alpren

Region: North America

English

Gen Re is pleased to present the summary report of the 2019 U.S. Group Term Life Market Survey. Our annual survey covers the Group Term Life (GTL) and AD&D industries, tracking sales and in-force results. The full Market Survey is available only to participating companies, providing a valuable opportunity for participants to benchmark their results against those of their peers, as well as the industry as a whole. Eighteen of the 29 companies participating in the 2019 survey have provided Group Term Life data over the past 10 survey years.

Unless otherwise mentioned, total Group Term Life and total AD&D include combined employer-paid and employee-paid results. Reported growth rates are based on companies providing comparable data for 2018 and 2019.

Download the PDF version for a list of participating companies.

Group Term Life and AD&D In-force Results

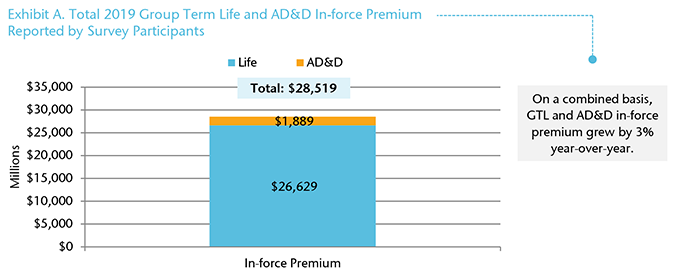

Twenty-nine companies provided Group Term Life (GTL) results for 2019; all but one company also reported AD&D data. Total combined GTL and AD&D in-force premium reached over $28.5 billion. The majority of business continues to be attributed to GTL, representing 93% of the total. (Exhibit A)

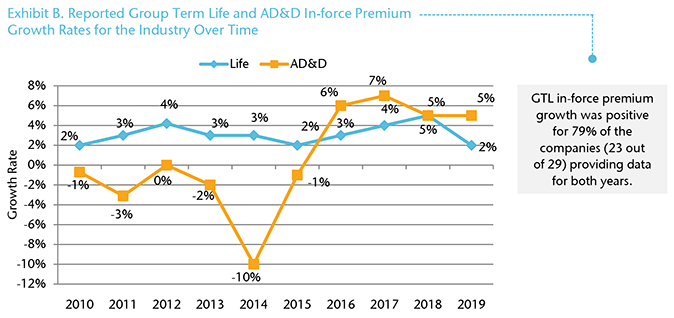

GTL in-force premium grew at a modest pace of 2% in 2019. GTL in-force premium growth has remained in the 2% to 5% range over the past 10 years, often driven by results of a small number of companies.

Outpacing GTL results in 2019, AD&D in-force premium increased by 5%. Notably, this represents the fourth year in a row of positive growth for AD&D in-force premium. (Exhibit B)

Group Term Life and AD&D Sales Results

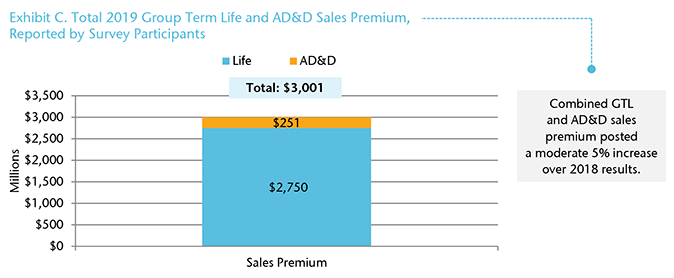

Combined GTL and AD&D sales premium reached just over $3.0 billion in 2019, with GTL representing 92% of the total. (Exhibit C)

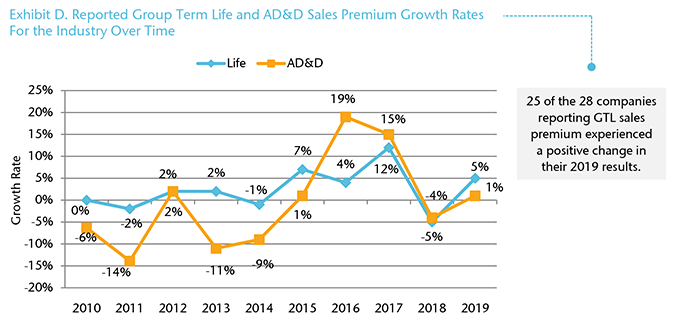

On an industry level, new GTL sales premium results continued to exhibit volatility. After last year’s reported decline, GTL new sales premium was once again on the upswing in 2019, posting a 5% increase. (Exhibit D)

As mentioned each year, a small number of companies can have a strong impact on results. Removing just two companies with large year-to-year changes from the industry calculations would result in the growth changing from 5% to a flat 0%.

AD&D sales premium also rebounded with a 1% increase year-over-year.

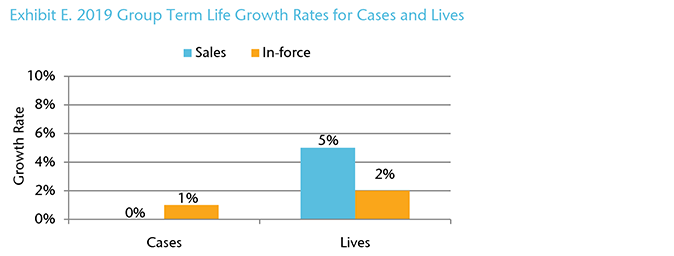

Group Term Life Growth – Cases and Lives

In 2019, new sales case counts were flat for the first time since 2011, while in-force results were up by a marginal 1%, similar to last year. (Exhibit E)

After new sales lives declined significantly on the survey last year, there was evidence of some larger case activity, with a 5% increase in lives in 2019. In-force lives grew by 2% year-over-year.

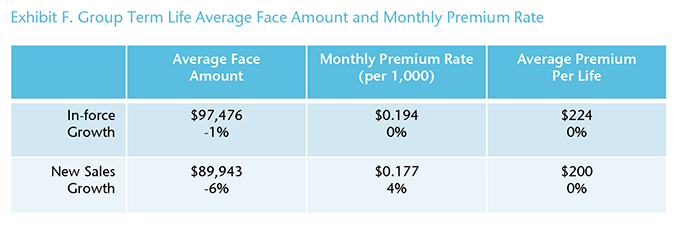

Group Term Life Pricing and Volume Levels

Average face amounts declined year-over-year for both sales and in-force. (Exhibit F)

Monthly premium rates were flat for in-force and up at a modest pace for new sales. Of those companies reporting an increase in their new sales monthly premium rates, five companies showed growth in the double-digits.

Average premium per life remained level across new sales and in-force business.

In Our View

After experiencing a decline in new sales premium in 2018, the Group Term Life (GTL) industry rebounded with a moderate 5% increase in the 2019 Market Survey. Twenty-five out of 28 companies reported a positive change in new sales GTL premium. Anecdotally, there were some signs of larger case activity, and average new sales lives per case rose by 5% year-over-year.

For GTL, there were some key items of special note for this year’s survey. At an average of $89,943, new sales face amounts per life posted a year-over-year decline for the first time since 2014. And, having risen gradually over the years, new sales premium per life reached $200 for the first time in the history of the survey, while the gap between sales and in-force premium per life lessened.

GTL in-force premium was up at a more modest pace of 2% and continues to exhibit stability with growth remaining in the 2% to 5% range over the past 10 years.

AD&D new sales premium was up by 1%, an improvement over last year’s reported decline. AD&D in-force premium grew at a higher pace than GTL, posting a 5% increase in 2019. As seen on past surveys, overall AD&D results continue to be more volatile than GTL.

In Gen Re’s related 2019 Market Pulse survey companies alluded to various challenges they were expecting to face in 2020, including a high level of competition for both products and pricing, impacts on market strategy, financial pressures, and technology. These all-too-familiar concerns have created headwinds for the industry to varying degrees over the years. However, these issues pale in comparison to the real and potential challenges the industry faces with regard to COVID-19. The current scenario will have far-reaching impacts and as such, the awareness of the need for financial protection through Group Life insurance has never been more visible. Gen Re will continue to follow developments closely as the marketplace responds to an unprecedented new reality.