-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

Use of Artificial Intelligence in Fire Protection and Property Insurance – Opportunities and Challenges

Publication

Public Administrations’ Liability – Jurisprudential Evolution, Insurance Implications, and a Comparative Analysis Across Countries

Publication

Generative Artificial Intelligence and Its Implications for Weather and Climate Risk Management in Insurance

Publication

Engineered Stone – A Real Emergence of Silicosis

Publication

Risk Management Review 2025 -

Life & Health

Life & Health Overview

Life & Health

Gen Re’s valuable insights and risk transfer solutions help clients improve their business results. With tailor-made reinsurance programs, clients can achieve their life & health risk management objectives.

UnderwritingTraining & Education

Publication

Diabetes and Critical Illness Insurance – Bridging the Protection Gap

Publication

Underwriting the Dead? How Smartphones Will Change Outcomes After Sudden Cardiac Arrest

Publication

Always On: Understanding New Age Addictions and Their Implications for Disability Insurance

Publication

Dying Gracefully – Legal, Ethical, and Insurance Perspectives on Medical Assistance in Dying

Publication

AI Agent Potential – How Orchestration and Contextual Foundations Can Reshape (Re)Insurance Workflows Business School

Business School -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Critical Illness Insurance – Highlights of 2018 U.S. Market Survey

October 09, 2019

Heidi Alpren

Region: North America

English

Gen Re is pleased to share this summary of key highlights from our 2018/2019 U.S. Critical Illness Insurance Market Survey. The full report provides insight into the state of the market as of December 2018 and represents companies that are actively marketing a Critical Illness (CI) product, as well as those who are exploring it as a new product offering. The comprehensive report is made available only to participating companies.

Fifty-three companies responded to this survey and 43 are currently marketing a CI product. Of the 10 companies not actively marketing CI, three are considering or developing a product.

Thirty-four companies completed a separate section on Accident Insurance.

Throughout the following summary report, some comparisons have been made to prior years’ results. Caution should be used in interpreting these comparisons, as the companies participating vary from year to year. In addition, as awareness of and interest in this product increases in the U.S., new companies are constantly entering the market. While each report is intended to be a snapshot for that year, we understand the importance of identifying trends and to that end have provided some commentary.

For CI products, unless otherwise mentioned, results represent standalone and rider policies combined.

Marketers of Critical Illness Insurance

Products Marketed and Future Plans

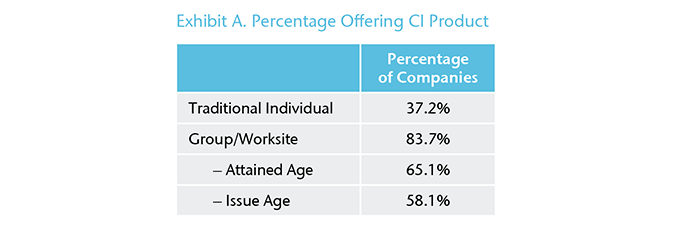

Of the 43 participating companies currently marketing CI, 20 offer one product, 20 offer two products and the remaining companies offer three products. The majority (84%) offer a group/worksite (G/W) product, with 17 companies offering both G/W products. (Exhibit A)

Over half (51%) of the companies currently marketing a CI product expect to increase their focus on CI over the next few years. None reported their focus would decrease.

Product Performance

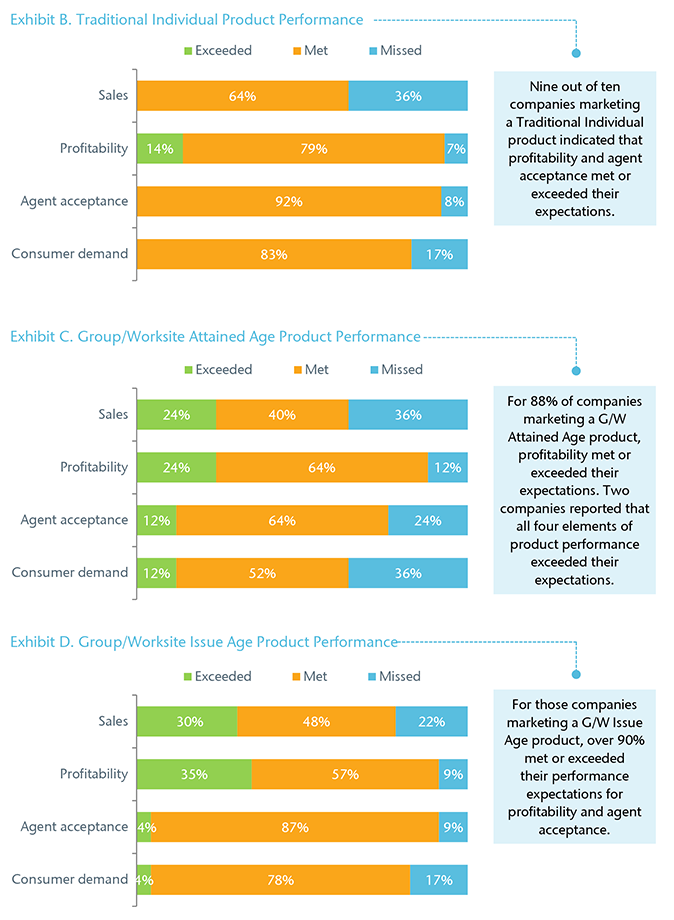

Across all products, the majority of companies met or exceeded their expectations with regard to key areas of product performance in 2018. (Exhibits B, C, and D)

New Business Sales

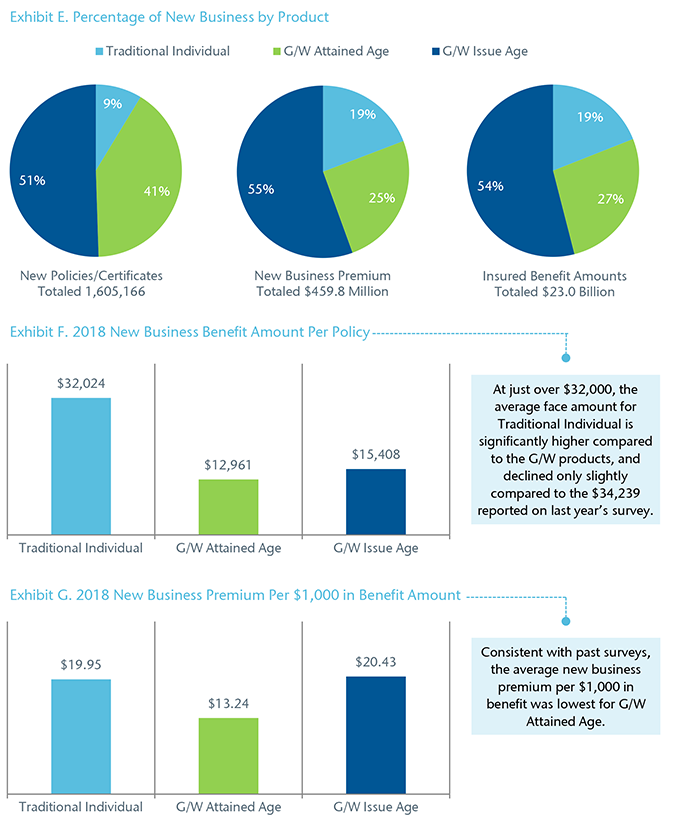

For 2018, participants reported selling 1.6 million new policies/certificates and just over $459.8 million in new sales premium. With sales of $254.9 million, the largest segment was attributed to G/W Issue Age business, representing 55% of total premium sold. (Exhibit E)

Same Company Growth in Sales

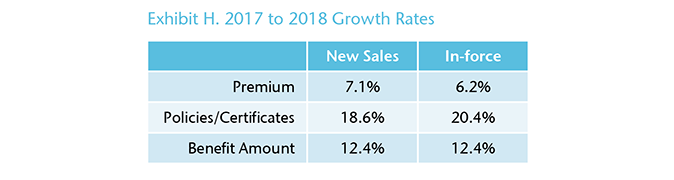

When comparing only those companies that provided product data for both survey years and taking into account any adjustments made to the 2017 data, the CI industry continued to exhibit positive growth in 2018. (Exhibit H)

It is difficult to determine which product had the greatest impact on the combined growth, as the number of companies participating vary from year to year. That being said, growth results continue to be positive over time.

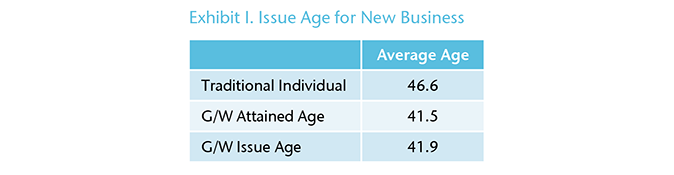

Average Age at Time of Sale

The issue age for new business averaged 43.3 years for all three products combined. Traditional Individual averaged the highest issue age at 46.6 years, compared to just under 42 years for both G/W Attained Age and Issue Age. (Exhibit I)

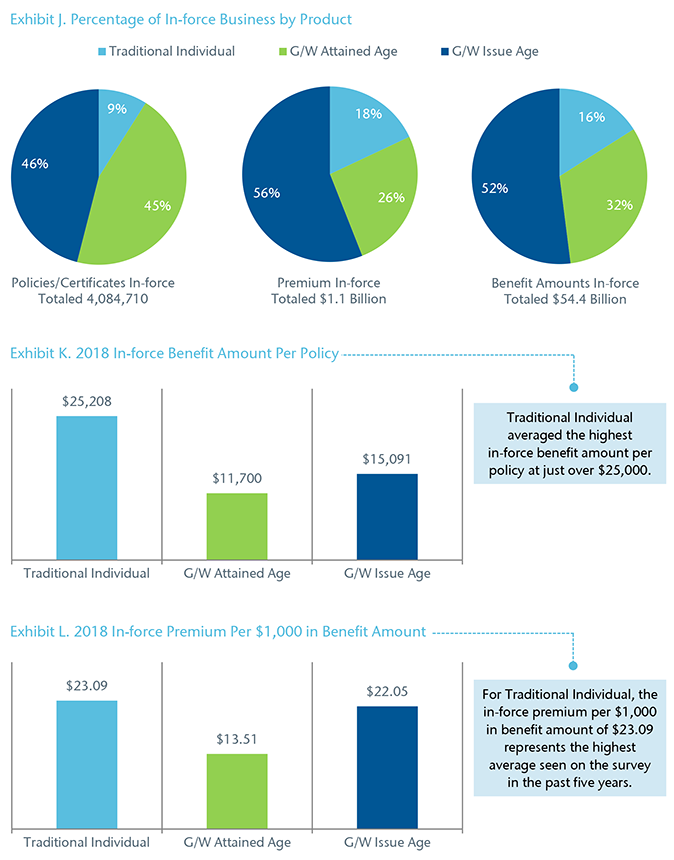

In-force Business

For 2018, participating carriers reported a combined total of 4.1 million policies/certificates with just over $1.1 billion of in-force premium. (Exhibit J) G/W Issue Age business accounted for 56% of total in-force, with $629.5 million in premium.

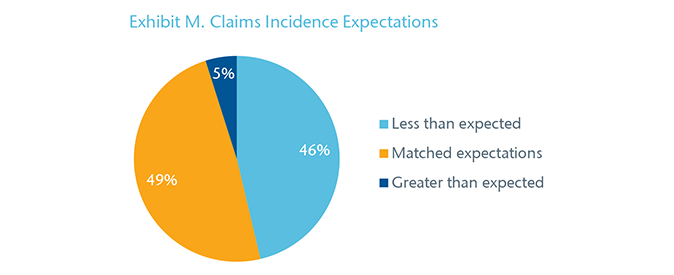

Claims Experience to Date

At the time that data was collected in June and July of 2019, just over 95% of the participants reported their claims incidence was less than or matched their expectations for the year. (Exhibit M) For two companies, incidence was greater than expected.

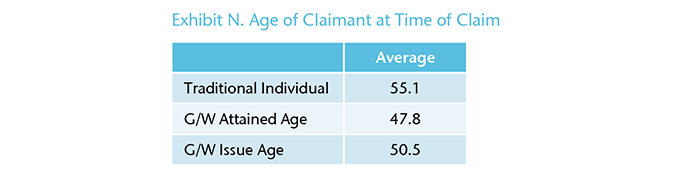

Claimant Age

At time of claim, the average age of a Traditional Individual claimant was 55.1 years, compared to 47.8 years for G/W Attained Age and 50.5 years for Issue Age. (Exhibit N) The lowest claimant age reported was 28 years for Traditional Individual and the highest was 73 years for the same product.

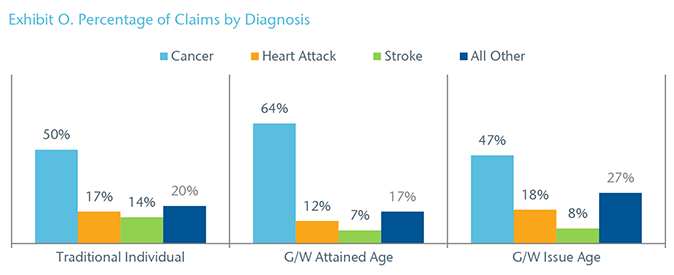

Types of Claims

The three major triggers combined represent over 80% of the claims submitted for Traditional Individual and Attained Age, and over 70% for Issue Age. (Exhibit O)

Download the PDF version for a list of participating companies.