-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

Use of Artificial Intelligence in Fire Protection and Property Insurance – Opportunities and Challenges

Publication

Public Administrations’ Liability – Jurisprudential Evolution, Insurance Implications, and a Comparative Analysis Across Countries

Publication

Generative Artificial Intelligence and Its Implications for Weather and Climate Risk Management in Insurance

Publication

Engineered Stone – A Real Emergence of Silicosis

Publication

Risk Management Review 2025 -

Life & Health

Life & Health Overview

Life & Health

Gen Re’s valuable insights and risk transfer solutions help clients improve their business results. With tailor-made reinsurance programs, clients can achieve their life & health risk management objectives.

UnderwritingTraining & Education

Publication

Diabetes and Critical Illness Insurance – Bridging the Protection Gap

Publication

Underwriting the Dead? How Smartphones Will Change Outcomes After Sudden Cardiac Arrest

Publication

Always On: Understanding New Age Addictions and Their Implications for Disability Insurance

Publication

Dying Gracefully – Legal, Ethical, and Insurance Perspectives on Medical Assistance in Dying

Publication

AI Agent Potential – How Orchestration and Contextual Foundations Can Reshape (Re)Insurance Workflows Business School

Business School -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Critical Illness – Fit for the Elderly?

August 31, 2014

Tim Eppert

English

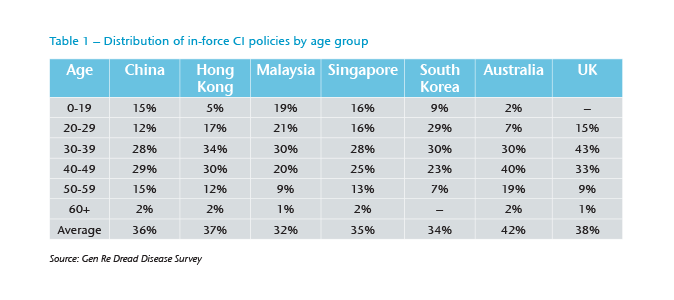

In almost all important insurance markets, individual life expectancy has increased enormously during the past decades and is likely to increase further in the future – while birth rates fall in many countries. Although many societies are in the process of ageing, it is not yet possible to visualise the impact of this on Critical Illness (CI) insurance. One reason is the lack of penetration the product has into this market – a fact borne out by the findings of Gen Re’s most recent market survey. The proportion of in-force CI policies held by people over age 60 is still marginal (see Table 1). The data demonstrates that, up to now, younger consumers are seen as the main target group in many markets. It also serves to illustrate the rather limited experience that the industry has with this product in older ages.

Younger people are an obvious target group for benefits of CI protection, especially in the context of family protection and mortgage security. They are also simple to administer from an underwriting perspective as most are in good health, so agents may be less afraid of negative underwriting results, and premiums are low compared to higher ages.

In addition to political pressures, there is an economic incentive for insurers to address the demand for CI insurance from people aged 55 and over. While traditional target groups will shrink in coming years, the proportion of wealthy and healthy consumers close to retirement age is set to grow in many markets. Insurable interest continues even in retirement and not only if direct medical expenses need to be covered. The potential still exists to incur costs for short-term care following a medical event or when making housing adaptations to accommodate new disability, for example. Income Protection (IP) insurance has only a minor role, if any, to play for retired people, and their need to insure residual debts should also diminish. Hence, the insurable amount required by individuals should be smaller in high ages than in young ages for many markets.

In this scenario it becomes increasingly relevant that CI policies sold today work effectively in the future when a significant proportion of in-force policyholders have aged into their 70s and 80s. It is also appropriate to ask at this point how a CI product that is directly addressed to the older generation should look.

Shifts in claims and diseases

Cancer is currently responsible for almost 90% of all female CI claims in many markets. Even though the number of claimants aged 60 or more is limited, it is already possible to trace a marked increase in the proportion of cardiovascular disease claims compared to the age group 40-59 (see Figure 1). From population statistics it is possible to infer this effect will be even more pronounced for women in their 70s and 80s. It is arguable whether pure cancer cover, popular in several markets and offering a high level of protection for women in younger ages, remains appropriate for products that cover higher ages as well.

Even within a disease significant change will evolve with increasing policyholder age. For example, the impact of prostate cancer on claims for all cancers is negligible in young men, but is globally the most frequent cancer for men aged 65 and over.1 Many prostate tumours found in older men are slow growing and, in many cases, will not be treated or pose any immediate health threat, but can easily be detected via screening.

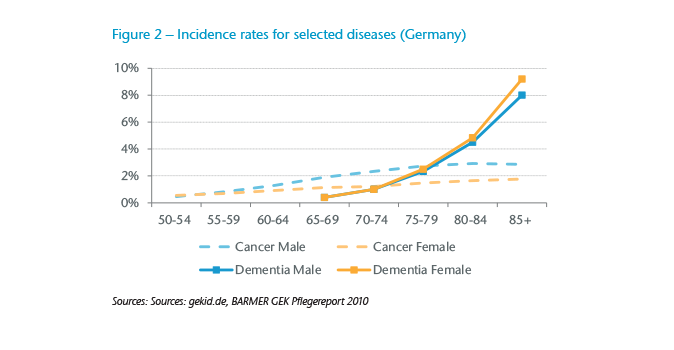

A major issue in higher ages will be dementia. As dementia in young portfolios is almost non-existent, insurers risk not focusing enough on this disease and not deriving rates or definitions with sufficient care. A comparison of population rates for cancer and dementia reveals how strongly the weight of certain diseases on claims experience may change with increasing age (see Figure 2).2

On CI claims some companies control the increasing impact of dementia, Parkinson’s disease and other age-specific conditions by limiting the age spectrum of coverage to a maximum age (e.g., 65) with all other diseases included in the scope of cover with no age limit. While this approach is an effective way to control premium increase in later years, it is not without risk. It could be seen as a form of age discrimination and may not be possible in countries where it is not permissible to restrict insurance cover by age. In this case it would be better to include cover for dementia and the rest for the complete policy term (and price for it explicitly) or not offer it at all as the additional protection in young ages is very small.

Consideration must be given to shifting medical guidelines if major organ transplantation or other surgical procedures are included in the scope of CI cover sold to older lives. Improvements in clinical practices, coupled with improved life expectancy, may increase the maximum age limits of people undergoing certain treatments and interventions, and this in turn could impact on future incidence rates in this area.

Medical events that are common in older age – fractures of the pelvis or femoral neck, for example – appear as an attractive addition to CI products aimed directly at this target group. In many markets hospital data provide robust information on their frequency. Depending on the total insured amount, a partial payment can be appropriate for such events. Assistance services could be added as well. To balance this, conditions predominantly seen as disorders of the young – polio, muscular dystrophy, encephalitis or meningitis, for example – could be removed from the cover.

Incurring claims from elderly lives implies that a high proportion of claimants will have multi-morbidity. A study of 85-year-olds found that 68% had at least two chronic diseases.3 From a certain age onward, multi-morbidity is the norm, not the exception. This can complicate CI claims management as it will not always be clear what disease caused which physical limitation. A possible response is to price for a lump sum disability benefit or a long-term care cover based on an Activities of Daily Living (ADL) definition. When the combined consequences of the multiple diseases are severe enough to fail ADLs, a claim is payable whether or not it is possible to link the physical decline to a specific disease. For the specific diseases, however, it becomes more important to stress that the severity levels, which are part of the disease definition, must be caused by this specific disease.

Underwriting

For a young target group, the maximum end age will only have a small influence on underwriting requirements. However, if dementia is covered without an age limit, dementia- specific questions can improve the underwriting result.

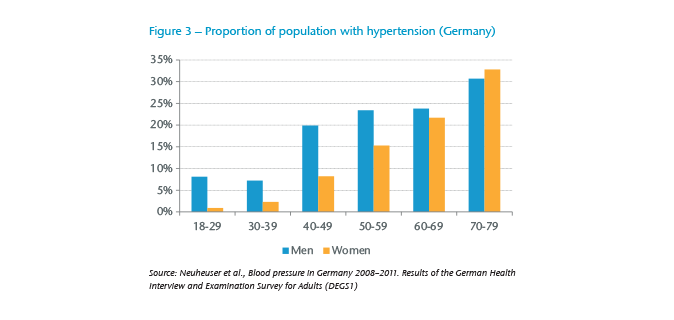

But a standard underwriting approach is reaching its limits if such a product is to be systematically sold to the generation 55+. Classic risk factors, such as hypertension, are much more prevalent in higher ages than in younger ages (see Figure 3). This means they work less successfully as indicators of substandard risks in an underwriting context for elderly lives. Using these classic risk factors in the same way as for a 20-year-old would lead to unacceptably and unnecessarily high declinature rates. Compared to these risk factors, existing disease and treatment become more important to identify sub-standard risks.

The increase in existing disease and disease risk factors hinders the effectiveness of underwriting in the absence of intensive individual assessment, which in turn leads to an increased risk of asymmetric information and anti-selection. A limitation on the upper age limit for the entry age (e.g., age 70 or 75) is recommended, especially when an insurance company is just starting to sell to higher age groups and still needs to gather experience.

Product design

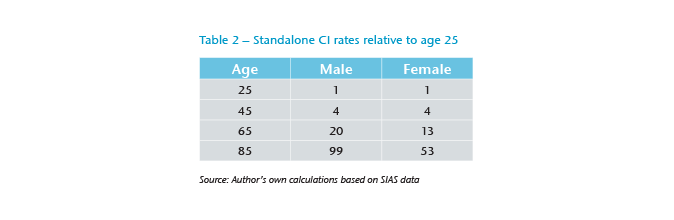

It is not only the shift in the claim causes, but also the strongly increasing frequency of claims that can be an issue in high ages (see Table 2). Data on population-based CI incidence rates for 36 diseases, including dementia,revealed that the CI incidence for women aged 85 is about 50 times as high as for women aged 25; for men the difference is even higher with a factor close to 100.4

For the highest ages, claims will not only become more frequent, but it is harder to derive rates for these ages. Even in markets where CI is a commonly available product, insurers will rely on population data to some extent while there is only a small number of insured in the highest age category. Population statistics must be adjusted as the underlying definition is different and the selection effect for the insured portfolio needs to be calibrated. In addition, the very long durations between entry age and maximum covered age make it difficult to estimate how medical progress and changes to disease screening and social behaviours will impact the observed incidence rates over time. Taking this uncertainty into account will lead to a further increase in costs for old age CI.

On the other hand, policyholders’ disposable income will typically not increase much after retirement and, in most cases, are likely to be significantly less than before. Unaffordable premiums in higher ages are unlikely to meet customers’ needs – and neither are they a suitable solution to reduce insurers’ exposure in higher ages as the likely lapses would be highly anti-selective.

Keeping it affordable

What are ways to limit the uncertainty for the insurer and keep the product affordable for the client? One consideration is that robust definitions with objective severity criteria become even more important when higher ages are covered. Compared to a pay-out on any diagnosis, the risk of deteriorating claims experience is strongly reduced due to medical progress or changing screening behaviour. In addition, if only severe events are covered, fewer claims are to be expected for each age. Where CI is not mainly sold to cover direct medical expenses, this approach is also adequate for elderly insured. For example, a minor stroke might reduce the ability to work but will often still enable an independent life during retirement; thus, the need to cover early events is diminished.

In addition, it makes sense to decrease the capital at risk with a market segment increasing in age, especially if the product contains guaranteed premiums. One possibility would be the reduction of the sum insured over time – just as it is implicitly implemented, for instance, in credit life insurance – and is in line with the decreasing insurable interest. This can reduce the risk for the insurer and limit the insurance costs for the policyholder. Another option is to use the CI cover as an accelerator to a life insurance policy. At the very least it should be ensured that inflation protection and other increase options cannot lead to unreasonably high sums assured in the long run.

For a product with the end-age set during retirement or even whole life cover, a level premium makes more sense than risk premiums. As life expectancy is likely to increase, insurers may find that insured lives live longer than expected. A long premium payment period can help to ensure that at least a part of this prolonged cover is paid for. If minor diseases with partial payments are covered as well, these should not lead to a waiver of premiums.

There will still be insurers that do not want to offer cover beyond retirement. To cope with current and potential future anti-age discrimination laws, they may think about selling policies with a fixed duration instead of a fixed end-age.

Demographic transition offers chances, and insurers who directly address elderly consumers can gain new and wealthy target groups. They will, however, need to rethink their underwriting process and product design. Long-tem care insurance already demonstrates that is to possible to accept a high proportion of older applicants. All insurers that offer cover up to high ages – whether they concentrate on current target groups or not – will be affected by ageing portfolios. Some effects, such as the uncertainty that comes along with long-term covers, may even have a harder hit on portfolios that sell to young entry ages. Robust definitions and limited sums at risk in high ages can help to manage the changing age structure. Insurers who adjust their products accordingly will be rewarded: due to increased awareness of the risks of criticall illnesses in aging societies, excellent marketing perspectives exist.