-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Trending Topics

Publication

That’s a Robotaxi in Your Rear-View Mirror – What Does This Mean for Insurers?

Publication

Cat Bonds – A Threat to Traditional Reinsurance?

Publication

Decision-Making in the Age of Generative Artificial Intelligence

Publication

Buildings Made of Wood – A Challenge For Insurers?

Publication

The CrowdStrike Incident – A Wake-Up Call for Insurers?

Publication

PFAS Awareness and Concern Continues to Grow. Will the Litigation it Generates Do Likewise? -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Training & Education

Publication

How Is AI Being Used to Enhance Traditional Life Underwriting?

Publication

Understanding Physician Contracts When Underwriting Disability Insurance

Publication

Decision-Making in the Age of Generative Artificial Intelligence

Publication

Favorite Findings – Behavioral Economics and Insurance

Publication

Finding the Balance – Assessing Weight Changes in Underwriting Moving The Dial On Mental Health

Moving The Dial On Mental Health -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Essential Abilities Insurance – An Attractive and Innovative Product for all Markets

July 24, 2025

Sabrina Link

English

Introduction

Although occupational disability insurance (DI) offers excellent protection against loss of income due to sickness or injury, it comes at a price. For blue-collar workers, higher claims costs result in relatively higher premiums that need to be funded out of typically lower disposable income levels. Furthermore, the claims management process is complex. Essential Abilities (EA) insurance is an answer to those needs and has become increasingly popular in Germany over the past years.

In markets where traditional DI products are established, EA products can be an attractive and affordable alternative for those who may find occupational DI premiums too high or who are ineligible due to pre-existing medical conditions or specific occupational risks. EA products may also be of interest to markets without DI experience and/or where the complexity of traditional DI products has led to significant insurance gaps. For those markets, the main advantage lies in easier claims management, with mental ill-health playing a smaller role.

Background

Traditional DI Products

Traditional DI products use a benefit trigger based on how the claimant’s disease or injury impacts them in their occupation. The occupation refers to the insured’s own occupation, any occupation suited to them based on their education, training, and experience, or any occupation whatsoever – the latter usually used with a lump sum benefit payment. The risk of disability heavily depends on the occupation of the insured, making premiums particularly high for blue-collar workers. Certain occupations are ineligible for DI cover, such as artists or professional athletes, and medical underwriting is particularly thorough.

EA Cover

Since 2013, Gen Re has played a pivotal role in the development of EA insurance products in Germany, involved in more than 60% of these product developments. EA cover moves away from definitions based on loss of income due to sickness or injury and instead defines disability as the inability to perform a set of predefined essential abilities that are important for being able to work in general. This innovation has allowed a more affordable and accessible insurance option, particularly for those who would not pass the medical or occupational underwriting for occupation-based DI. Experience from Germany has shown that more manual workers are covered under an EA product than under an occupational DI product which is dominated by white-collar workers.

The ability-based benefit trigger also eases the claims management process, which makes the product easier to implement for markets which have limited experience with disability income protection.

Product Concept

The EA cover triggers benefits upon the loss of a certain number of essential abilities. This is akin to the Activities of Daily Living (ADL) concept used for Long Term Care (LTC) but adapted for a younger target group. The product is designed to be simple, with objective benefit triggers. It can work as a standalone product or as a rider to existing covers. The benefit can be a lump sum payment, annuity payments until retirement age, or a fixed benefit period of, say, five years, ending no later than retirement age. Mental health conditions are not directly included, which simplifies the product and reduces costs.

Typical Structure

Base Version

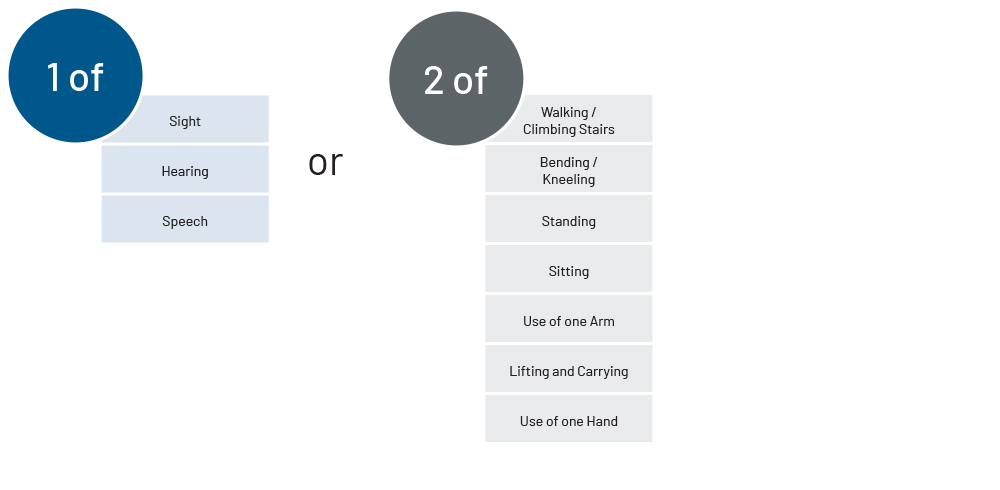

For a base version of an EA product, the essential abilities covered could include sight, hearing, speech, walking / climbing stairs, bending / kneeling, and use of one arm. An LTC component can also form part of the cover. The benefit trigger could require:

- The loss of sight, hearing or speech (first component); OR

- The loss of two of the following three essential abilities: walking / climbing stairs, bending / kneeling, use of one arm (second component); OR

- The failure of three out of six ADLs (LTC component).

Extended Version

The extended version adds further essential abilities to the second component, making it more generous. These abilities are standing, sitting, lifting and carrying, and use of one hand as shown below.

The product design has developed further in the German market (see below), but for the initial introduction of a new concept we suggest limiting the complexity.

General Characteristics of the Benefit Trigger

The impairment should be caused by illness, injury or declining health and lead to measurable physical changes. The loss of an essential ability must be permanent and irreversible, and confirmed by a medical specialist. Deferment periods are recommended to exclude temporary illnesses, and to ensure benefits start after a minimum survival period of the life insured.

Underwriting

For a product design as described in this article, underwriting for EA cover leads to fewer ratings and/or exclusions compared to traditional DI and, often, to Critical Illness (CI). Fewer pre-existing conditions result in a loading or a declinature, meaning that the potential target group is larger, and it is possible to take out a policy even at an advanced age. Special focus is on pre-existing conditions of the locomotor system and impairments of the senses that may provoke anti-selective purchase of insurance cover. However, severe illnesses such as cancer, cardiovascular diseases, and diabetes must not be disregarded.

Questions on mental health should be included, even without an explicit mental trigger, as individuals with mental health issues have a higher risk of physical diseases. In fact, mental ill-health has a significant impact on a person’s physical health, sometimes less obvious (e.g. increased risk of heart attack or stroke, unfavourable lifestyle choices, etc.), sometimes more obvious (e.g. anorexia, substance abuse, etc.). Additionally, the elevated risk of suicide attempts associated with poor mental health may affect EA outcomes in cases where the attempt is not fatal.

Two occupational classes (white/blue collar) are recommended for simple versions or specified target groups. Only a few occupations are completely excluded from insurance coverage, such as explosives clearance specialists.

Disability can result from complications related to sports injuries and hobby accidents, ranging from short-term conditions such as sprains to long-term conditions such as those following a head injury. Information is therefore needed to assess participation levels in sports and hobbies.

Claims Management

Claims assessment for EA products is independent of the insured’s job activities at policy issue or just prior to disability. Additionally, mental disorders, which are difficult to assess, are less relevant since claims mainly arise from physical illnesses. Consequently, the claims process is typically faster for clients.

The examination usually starts by checking any non-disclosure. This is essential as this has been identified as an important issue by our claims assessors.

Unlike traditional DI, the impact of the medical diagnosis on the ability to work doesn’t need to be considered, but solely its impact on the loss of one or more of the covered essential abilities. The claims assessor should consider the symptoms or impairments that result from the diagnosis. The focus is on the claimant’s physical capabilities and limitations, rather than the diagnosis itself.

Standardised measurement sheets and, if available, discharge reports from rehabilitation centres are appropriate tools in claims assessment. Detailed claims assessment questionnaires can help medical practitioners examining the claimant understand the intent of the covered benefit. These questionnaires enhance the transparency of the claims assessment process and provide valuable insights that enable claims assessors to make an adequate claims decision.

Experience from Germany

EA products have become popular in Germany in recent years as a response to the limitations and expenses associated with traditional DI products. They are also a result of ever finer occupational classification in DI that increased the occupation-based premium spread. Now, most traditional disability carriers are offering them, and some are even selling more EA than DI policies. In addition to the number of providers on the market, the variety and complexity of products have also increased significantly (with expanded claim triggers and increasingly broad definitions requiring stricter underwriting).

The number of EAs offered in the market and other benefit triggers for annuity payments has roughly doubled over the past five years to more than 50. Sales are experiencing a high relative increase on still comparatively small absolute numbers.

Unlike with occupational DI, the trigger for benefits under EA insurance does not directly relate to the profession exercised, so the influence of the occupation on the premium is significantly lower: While roofers often pay many times the premium paid by a white-collar staff for occupational DI, the premium for EA insurance is often “only” 1.3 to 1.5 times higher – and for workers with less hazardous jobs, the premiums are in some cases no different from those paid by academics for EA insurance.

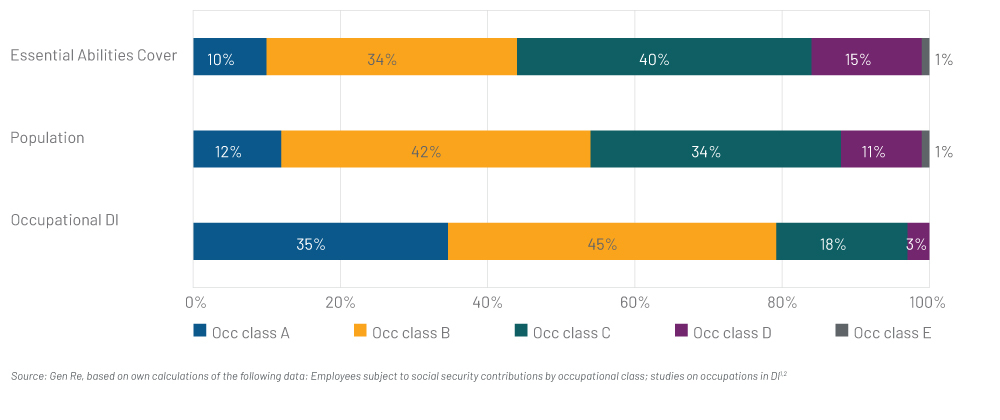

The resulting shift in the target group can be observed in new business: among all occupational DI policies, the lower-risk occupational classes A and B are significantly more common than their share of the population would suggest. Conversely, the share of higher-risk occupational classes C and D, as well as occupational class E – which includes occupations that are not covered by occupational DI as standard – is even higher than the population average. The EA cover thus successfully reaches the target group of physically active people and helps to ensure that broader sections of the population receive disability cover (Figure 1).

Figure 1 – Distribution of occupational classes in the German population and in new DI and EA business

Competing with Other Insurance Products

In markets new to EA cover, it can be a missing piece of the insurance landscape.

CI insurance is based on diagnosis, but not every disease or ailment meets the requirement. One of the most notable advantages of EA insurance products is their coverage of injuries and the musculoskeletal system. These categories are often excluded from CI policies, which primarily focus on late-stage (“dread”) diseases. Considering that injuries and musculoskeletal disorders constitute more than half of all valid EA claims in Germany, EA insurance products may provide broader and more relevant coverage for quite a few individuals. In the medical underwriting process, some pre-existing conditions lead to ratings and/or exclusions for CI policies, but not for EA products, which allows them to cover more people.

Hospital cash insurance can offer much-needed benefits but requires hospitalisation and pays out for only a limited time. In some countries Total & Permanent Disability (TPD) insurance has strict criteria for benefit eligibility where it is required that the claimant cannot perform any occupation irrespective of the insured’s experience and education, which may result in some individuals not receiving benefits despite experiencing loss of income due to illness or injury.

Advantages

EA insurance products offer several advantages:

- Occupation-independent benefit triggers and thus less complex claims handling process

- Affordability

- Wider accessibility

- For larger parts of the population with pre-existing conditions or risk factors

- For a wide(r) range of occupations

- Fewer unfavourable underwriting decisions

This product concept is attractive to customers and enables insurers to reach new market segments. In addition to blue-collar workers, casual workers may also be considered as a new target group. The gig economy, characterised by freelance and contract-based work, is rapidly expanding. This transformation in the labour market is driven by technological advancements, urbanisation and an increasing demand for flexible work arrangements. However, gig workers face significant challenges as they generally do not receive employee benefits such as health insurance, paid leave, or income protection if unable to work.

Conclusion

EA insurance products represent a significant evolution in the DI market. They offer affordable and accessible coverage, overcoming the limitations and high costs of traditional loss of income DI products. With simple designs and easy-to-understand benefit triggers, EA cover is poised to become a successful product and popular option for individuals seeking disability protection – a great opportunity for the insurance industry. Get in touch with us – we will be happy to support you in the (further) development of your EA product.

Endnotes

- Statistik der Bundesagentur für Arbeit, Auftragsnummer 350818, own calculations (24.01.2024).

- Deutsche Aktuarvereinigung e.V.: DAV 2021 I: Biometrische Rechnungsgrundlagen für Berufsunfähigkeitsversicherungen (26.01.2022)