-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Trending Topics

Publication

Production of Lithium-Ion Batteries

Publication

Time to Limit the Risk of Cyber War in Property (Re)insurance

Publication

Generative Artificial Intelligence in Insurance – Three Lessons for Transformation from Past Arrivals of General-Purpose Technologies

Publication

Human Activity Generates Carbon and Warms the Atmosphere. Is Human Ingenuity Part of the Solution?

Publication

Inflation – What’s Next for the Insurance Industry and the Policyholders it Serves?

Publication

Pedestrian Fatalities Are on the Rise. How Do We Fix That? -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Training & Education

Publication

Key Takeaways From Our U.S. Claims Fraud Survey

Publication

The Effects of Heatwaves – A Look at Heat-related Mortality in Europe and South Korea

Publication

The Key Elements of Critical Illness Definitions for Mental Health Disorders

Publication

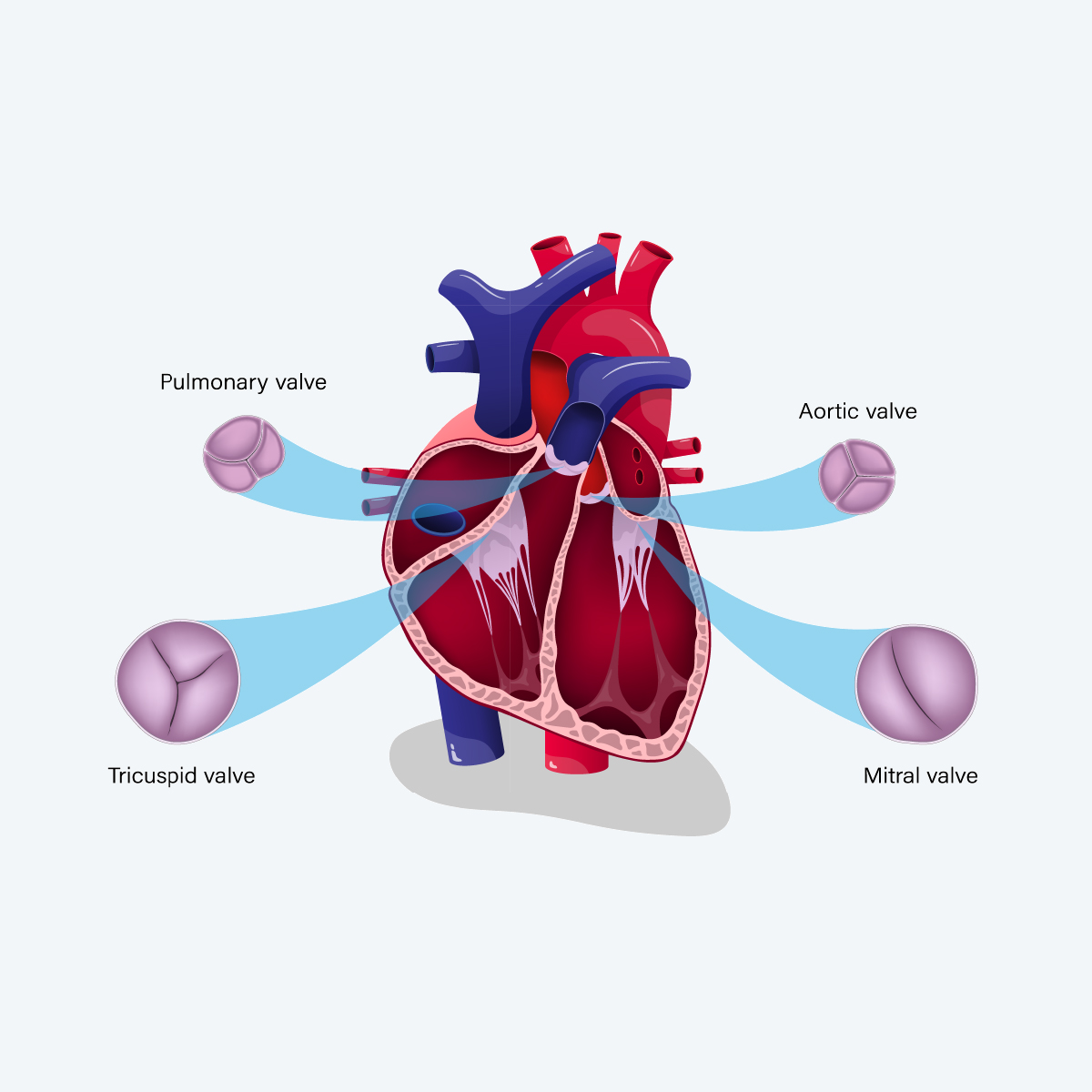

An Overview of Mitral Regurgitation Heart Valve Disorder – and Underwriting Considerations

Publication

Body Mass Index as a Predictor of Cardiovascular Health Moving The Dial On Mental Health

Moving The Dial On Mental Health -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

New Jersey Court Agrees Proposed Bankruptcy Plan Unfair to Insurers

October 16, 2023

Max Branson

Region: North America

English

Update: March 18, 2024

The United States Bankruptcy Court for the District of New Jersey finally approved the Diocese of Camden’s bankruptcy plan, but only after requiring a further round of revisions last month. In total, it took three attempts for the plan proponents to obtain approval for the plan, which will establish an $87.5 million trust to compensate victims of sexual abuse. The trust will be funded by the debtor (the Diocese), along with a group of non-debtor entities (individual parishes, schools, etc.), each of whom will receive releases in exchange for their contributions. Claimants will be entitled to pursue insurers for additional recoveries.

The prior versions of the plan were rejected because they failed to treat insurers fairly. While the final plan is far from perfect from an insurer’s perspective, it was good to see the court recognize that insurers’ interests must be considered in mass tort bankruptcies.

On a related note, the United States Supreme Court may address the issue of insurer neutrality in connection with the standing issues involved in Truck Insurance Exchange v. Kaiser Gypsum Co., which will be argued this month. In addition, the court’s ruling in Harrington v. Purdue Pharma, L.P., argued in December, may affect whether non-debtors (like the parishes and schools in the Diocese of Camden) are entitled to receive releases through the bankruptcy court. These upcoming decisions will likely have a significant impact on this area of law.

Update: January 9, 2024

Diocese of Camden Bankruptcy Plan Still Unfair to Insurers

The United States Bankruptcy Court for the District of New Jersey has, now for the second time, rejected the Diocese of Camden’s proposed bankruptcy plan because it did not include sufficient protections for the Diocese’s insurers. Judge Poslusny’s latest decision addressed a modified plan submitted by the plan proponents in response to deficiencies previously identified by the judge. Again, Judge Poslusny stated that he will not confirm the plan without further modifications.

Among other things, the judge held that the plan proponents must clarify the limited insurer defenses that will be eliminated under the plan to ensure that other valid defenses held by the insurers (such as non-meritorious or fraudulent claims, or claims outside the policy period) are not unintentionally negated. He also ruled that the plan proponents must better describe the process for liquidating survivor claims for the purposes of pursuing coverage from the insurers, and that the plan must require the trust administrator to disallow facially invalid claims.

The plan proponents submitted yet another modified plan at the end of December that attempts to address the court’s concerns. It will be interesting to see what happens next. Our blog in October 2023 addressed Judge Poslusny’s first decision.

New Jersey Court Agrees Proposed Bankruptcy Plan Unfair to Insurers

October 16, 2023

For those who do not keep close tabs on what is happening in the intertwined worlds of sexual abuse claims against the Roman Catholic Church and United States bankruptcy law, in August 2023, U.S. Bankruptcy Judge Jerrold Poslusny Jr. rejected a proposed bankruptcy plan submitted by the Diocese of Camden, New Jersey, the debtor in the bankruptcy proceeding, because it did not include sufficient protections for the Diocese’s insurers.

Background

The Diocese filed for Chapter 11 bankruptcy protection in 2020. Like many other Catholic Dioceses in the last decade, the Diocese of Camden was facing an influx of claims due to the State of New Jersey’s Child Victims Act (the “NJ CVA”), which reopened the statute of limitations for child sexual abuse claims. Like similar laws in other states, the NJ CVA allowed previously time-barred claims (many going back to incidents of abuse in the 1960s and 1970s) to be brought within a two-year period, thus resurrecting liabilities previously thought to be in the past. A flood of claims soon followed. Dozens of these claims were filed against the Diocese of Camden, and a total of 362 proofs of claim were filed in the bankruptcy prior to the bar date.

The Diocese, now the debtor, initially negotiated with its insurers and reached a settlement under which the insurers would pay a total of $30 million into a trust for the benefit of survivors. In exchange, the insurers would receive a full release and protection under a channeling injunction to be entered by the court upon settlement approval. But the Diocese continued to negotiate with the Official Committee of Tort Claimant Creditors (the “Committee”), who disfavored the insurer settlement.

Ultimately the Diocese decided to abandon its agreement with the insurers and seek entry of a new proposed plan. Under the new plan, control of the claims would be ceded to the trust, which would be administered largely by representatives appointed by the Committee. The insurers, still on the hook for potentially uncapped liability for covered claims, were left out in the cold.

The insurers objected to the new plan, arguing, among other things, that it was negotiated in bad faith and that the Diocese should be held to the prior agreement. That request was denied. More importantly (and perhaps more realistically), the insurers also argued that the new proposed plan would both inflate the value of the claims themselves and rob the insurers of important rights the insurers held under the policies, including the right to effectively defend the claims. Similar arguments have frequently been made by insurers in previous mass tort bankruptcies, which have been a preferred method for some mass tort defendants to attempt to resolve their claims, often trying to leverage insurers into accelerated and inflated payments.1

The Bankruptcy Ruling

In his ruling, Judge Poslusny found that the efforts to resolve the Diocese’s liabilities went too far, and he therefore rejected the plan proposed by the debtor and the Committee. Among other things, Judge Poslusny pointed out the following aspects of the proposed plan that were unfair to the insurers:

- It allowed victims to submit their claims to a retired judge (the “Neutral”) for a “verdict value assessment” – i.e., the amount of damages that a reasonable jury might award – with the right to collect against the impacted insurance policies. Judge Poslusny observed that the Neutral was, in fact, to be selected by representatives appointed by the Committee, when for a truly fair assessment the Neutral must be more independent. Further, the “verdict value assessment” was likely to inflate the value of the claims because it did not account for the risk and costs associated with pursuing the same claims in the tort system.

- Although potentially implicated insurers were to be given notice and a “reasonable” opportunity to defend claims, there were procedural limitations that would not apply in the tort system (e.g., a 90‑day deadline for discovery which could only be extended in exceptional circumstances). The Judge stated that the Neutral must have the ability to control the procedures on a case-by-case basis as they see fit. In addition, there was inconsistent language in the plan about what defenses remained available to the insurers, prompting the Judge to state that, “[f]or the Court to approve the plan, the Plan Proponents must provide more clarity over which, if any, of the Insurers’ defenses are preserved or eliminated under the Plan.”

- The proposed plan allowed survivors who filed timely proofs of claim to collect an expedited payout of $2,500, with no further questions asked and no defenses or objections presented. According to Judge Poslusny, who read every survivor claim, many of the claims did not involve the debtor (instead alleging abuse by others) or did not allege abuse of a minor. The Judge held that the “Expedited Review” option cannot be an avenue for such facially invalid (or potentially fraudulent) claims.

- Finally, Judge Poslusny found fault with the plan provisions that allow a claimant’s attorney to collect a 40% contingency fee, including on expedited claims that only required claimants to fill out and submit a simple nine-page form.

Since Judge Poslusny’s ruling in favor of the insurers, the debtor has filed a modified plan that attempts to resolve the Judge’s concerns. For example, the “Expedited Review” option would now require the claims to be reviewed to ensure they each meet minimum criteria, and to be submitted by the claimant under oath. The court recently held the debtor need not provide a new disclosure statement or resubmit the new plan for another vote by creditors, despite the insurers’ arguments that the new plan did not address the court’s concerns and would substantively alter claimants’ rights. A confirmation hearing is now scheduled in November.

Stay tuned for updates – and please reach out to me or your Gen Re Claims executive with any questions in the meantime.

Endnote

- It will be interesting to see whether bankruptcies remain a viable option for resolving these liabilities, given recent objections to the granting of releases to non-debtor parties in such cases, see, e.g., In re Purdue Pharma L.P., 69 F.4th 45 (2d Cir. 2023), cert granted, __ S.Ct. __ (Aug. 10, 2023), the so‑called “Texas Two-Step,” see e.g., Wall Street Journal, “Senators Press J&J Official on Whether Bankruptcy System is Being Manipulated,” https://www.wsj.com/articles/senators-press-j-j-official-on-whether-bankruptcy-system-is-being-manipulated-e13b9cf7, and other general criticisms of the approach.