-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Trending Topics

Publication

Engineered Stone – A Real Emergence of Silicosis

Publication

Use of Artificial Intelligence in Fire Protection and Property Insurance – Opportunities and Challenges

Publication

Generative Artificial Intelligence and Its Implications for Weather and Climate Risk Management in Insurance

Publication

Public Administrations’ Liability – Jurisprudential Evolution, Insurance Implications, and a Comparative Analysis Across Countries

Publication

Risk Management Review 2025

Publication

Who’s Really Behind That Lawsuit? – Claims Handling Challenges From Third-Party Litigation Funding -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Training & Education

Publication

AI Agent Potential – How Orchestration and Contextual Foundations Can Reshape (Re)Insurance Workflows

Publication

Diabetes and Critical Illness Insurance – Bridging the Protection Gap

Publication

Group Medical EOI Underwriting – Snapshot of U.S. Benchmark Survey

Publication

Why HIV Progress Matters

Publication

Dying Gracefully – Legal, Ethical, and Insurance Perspectives on Medical Assistance in Dying Moving The Dial On Mental Health

Moving The Dial On Mental Health -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Workers’ Comp Industry – “Strong & Resilient”

May 31, 2022

Bill Lentz

Region: North America

English

According to the latest Workers’ Compensation industry analysis provided at NCCI’s AIS, the industry ended 2021 with strong and stable results while continuing to outperform other Property/Casualty lines of business in the U.S. As continued profitability, strong employment and payroll increases yield a healthy Workers’ Comp system, future challenges include potential inflationary pressure on medical costs and concerns stemming from labor shortages. Read on for a summary and highlights of what I learned at the symposium.

Industry Results

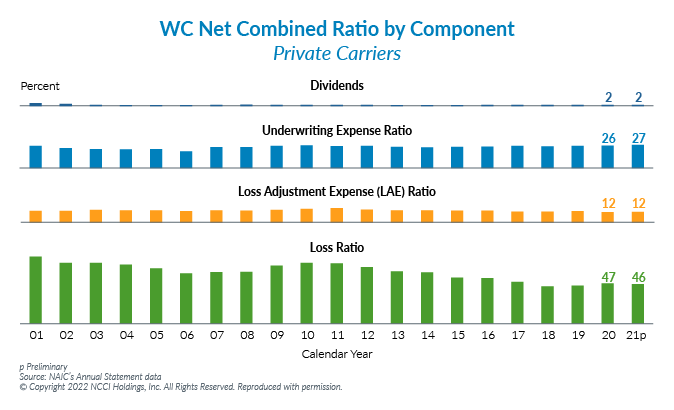

The calendar year 2021 combined ratio remained flat at 87% for private carriers. This is now the eighth consecutive year that Workers’ Comp has posted an underwriting profit and the fifth consecutive year of results under 90%. Workers’ Comp results compare favorably against the total P/C combined ratio of 99%. While there was a 7% increase in lost-time claim frequency in 2021, this is likely due to the reopening of businesses and workers returning to work. When combining the frequency changes over the past two years, injury frequency experienced a -1% decline since 2019. It is NCCI’s belief that the long-term decline in lost-time claim frequency will continue.

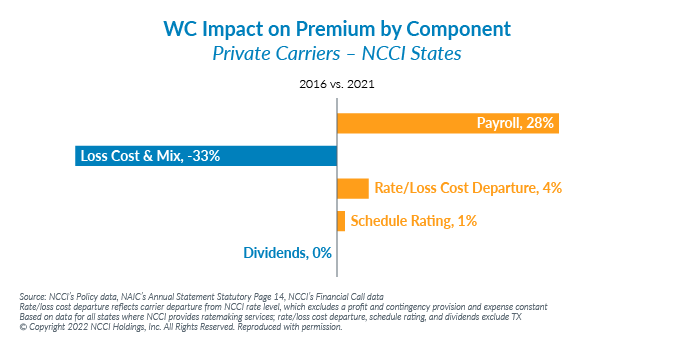

Net written premiums for primary carriers in 2021 was $38 billion, seeing no change from 2020. However, Bureau premium levels continue to decrease and are expected to do so by an average of -7.5% from 2021 to 2022 based on approved NCCI filings. Payroll growth has returned and continues to be the premium component that provides the largest offset against the decrease in loss costs. There was a 10.6% increase in payroll in 2021, of which 7.1% is attributable to wage rate.

Jobs / Workforce

Strong job growth has resulted in the reduction of unemployment to 3.6%, which is considered “full employment.” The largest areas of job growth have been in warehousing and transportation. The hardest hit sector for job loss due to the pandemic – leisure and hospitality – is seeing growth but not to the extent of other sectors.

While at full employment, NCCI reports there are two million fewer workers, resulting in a labor shortage. This shortage has empowered workers to look for new opportunities, and they are doing so, often moving across different occupations and industry sectors. While this is not believed to be a long-term effect, it may cause short-term frequency anomalies due to a higher number of short-tenured workers in the workforce as they are more likely to sustain an injury when compared to full-tenured workers. However, this varies widely across industries.

While remote work existed before the pandemic, the number of remote workers tripled by the end of 2021, even when accounting for the reopening of businesses during the year. A large portion of remote work is concentrated in the professional and business services sector. Based on the information available to NCCI to date, remote workers appear to have a lower frequency of job-related injuries than on‑site workers.

COVID‑19 Update

According to NCCI data, there have been approximately 60,000 reported Workers’ Comp claims with associated losses related to COVID‑19 over 2020 and 2021. These claims total approximately $500 million in losses. In comparison to 2020, Workers’ Comp COVID‑19 claims reported in 2021 were significantly lower in frequency.

More than two-thirds of Workers’ Comp COVID‑19 claims have incurred losses of less than $1,500. Claims with over $100,000 in incurred loss account for less than 2% of all COVID‑19 claims. Similar to 2020, frontline workers continue to make up the majority of all Workers’ Comp COVID‑19 claims in 2021; however, the share of claims for nursing and convalescent homes decreased significantly. Conversely, COVID‑19 claims for retail, education and trucking workers increased due to the reopening that began across the country in 2021.

NCCI continues to gather information as part of its assessment of Long COVID and its impact on the Workers’ Comp system.

Inflationary Pressure

The average indemnity cost per claim in 2021 remained about the same as in 2020 ($25,600), per NCCI estimates. Indemnity claim severity has tracked closely with changes in the average weekly wage for the past 10 years. However, NCCI reports strong wage growth is starting to widen the gap between wages and indemnity claim severity.

Medical lost-time claim severity also remains flat ($26,200) with a 0% change from 2020 to 2021 according to NCCI. The slowdown in medical lost-time severity growth over the past two years is the result of pandemic-related impacts. While the “all items” CPI as of March 2022 grew to 8.5%, medical inflation was 2.9%. Medical costs include various component distributions, including physician services, facilities, drugs, etc. Both price and utilization of individual services also play important parts. As a result of this mix, it is projected that medical inflation will likely increase by 2023, but not by much and certainly not in line with CPI figures.

NCCI State of the Line Report

NCCI’s Chief Actuary Donna Glenn provided a detailed review of results, trends and cost drivers in the Workers’ Comp industry. Here are some selected highlights from the presentation:1

- WC Premium – Countrywide private carrier direct written premium increased by 1.9% between 2020 and year‑end 2021. Net written premium for private carriers in 2021 was $38 billion, which is consistent with 2020. Private carrier and state fund combined net written premium was $43 billion, a 1% increase from 2020.

- WC Net Combined Ratio – The 2021 calendar year combined ratio for private carriers is 87%. This is the fifth consecutive year of results under 90%. The 2021 accident year (AY) combined ratio is 102%. NCCI believes the accident year ratio will trend downward, likely by 10 points, as other AY years have developed in this manner.

- Investment Results – WC investment gain on insurance transactions increased to 12% in 2021. While trending slightly higher, it remains consistent with the long-term average of 11.8%.

- Pre‑Tax Operating Gain – 2021 saw a pre‑tax operating gain of 25%. This consists of a 12% investment gain ration and a 13% underwriting gain. Five consecutive years with results over 20% makes this the most profitable period in the past 30 years.

- Reserve Adequacy – NCCI estimates the year‑end 2021 WC reserve position for private carriers has grown to a $16 billion redundancy, as compared to the $14 billion redundancy for 2020. This is a stark contrast to an approximate $12 billion deficiency that existed in 2012.

- Claim Frequency – WC lost-time frequency for AY 2021 is estimated to be 7% higher than AY 2020. This was anticipated given the large drop in 2020 due to pandemic-related shutdowns and the subsequent reopening that occurred during 2021. When combining the frequency changes over the past two years, frequency experienced a -1% decline since 2019. As previously noted, it is NCCI’s estimation that the long-term decline in lost-time claim frequency will continue.

- Indemnity Severity – The 2021 average indemnity claim severity is estimated at $25,600, which remains the same as it was for 2020.

- Medical Severity – It is estimated that the average medical lost-time claim severity for 2021 was $26,200. This amount remains flat from 2020. While not tied directly to CPI, it is projected that medical inflation will see a slight increase from its March 2022 level of 2.9%.

As noted by Bill Donnell, President & CEO of NCCI, in his introductory remarks, the Workers’ Comp system is strong and resilient. It has adapted and responded well over these last two years while staying true to its responsibility of serving injured workers and their families. At Gen Re we are proud to work together with our clients toward their continued success of delivering on that promise!

Endnote

- Full report is available at NCCI.com. 2021 data is preliminary.