-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Trending Topics

Publication

Production of Lithium-Ion Batteries

Publication

Time to Limit the Risk of Cyber War in Property (Re)insurance

Publication

Generative Artificial Intelligence in Insurance – Three Lessons for Transformation from Past Arrivals of General-Purpose Technologies

Publication

Human Activity Generates Carbon and Warms the Atmosphere. Is Human Ingenuity Part of the Solution?

Publication

Inflation – What’s Next for the Insurance Industry and the Policyholders it Serves?

Publication

Pedestrian Fatalities Are on the Rise. How Do We Fix That? -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Training & Education

Publication

Key Takeaways From Our U.S. Claims Fraud Survey

Publication

The Effects of Heatwaves – A Look at Heat-related Mortality in Europe and South Korea

Publication

The Key Elements of Critical Illness Definitions for Mental Health Disorders

Publication

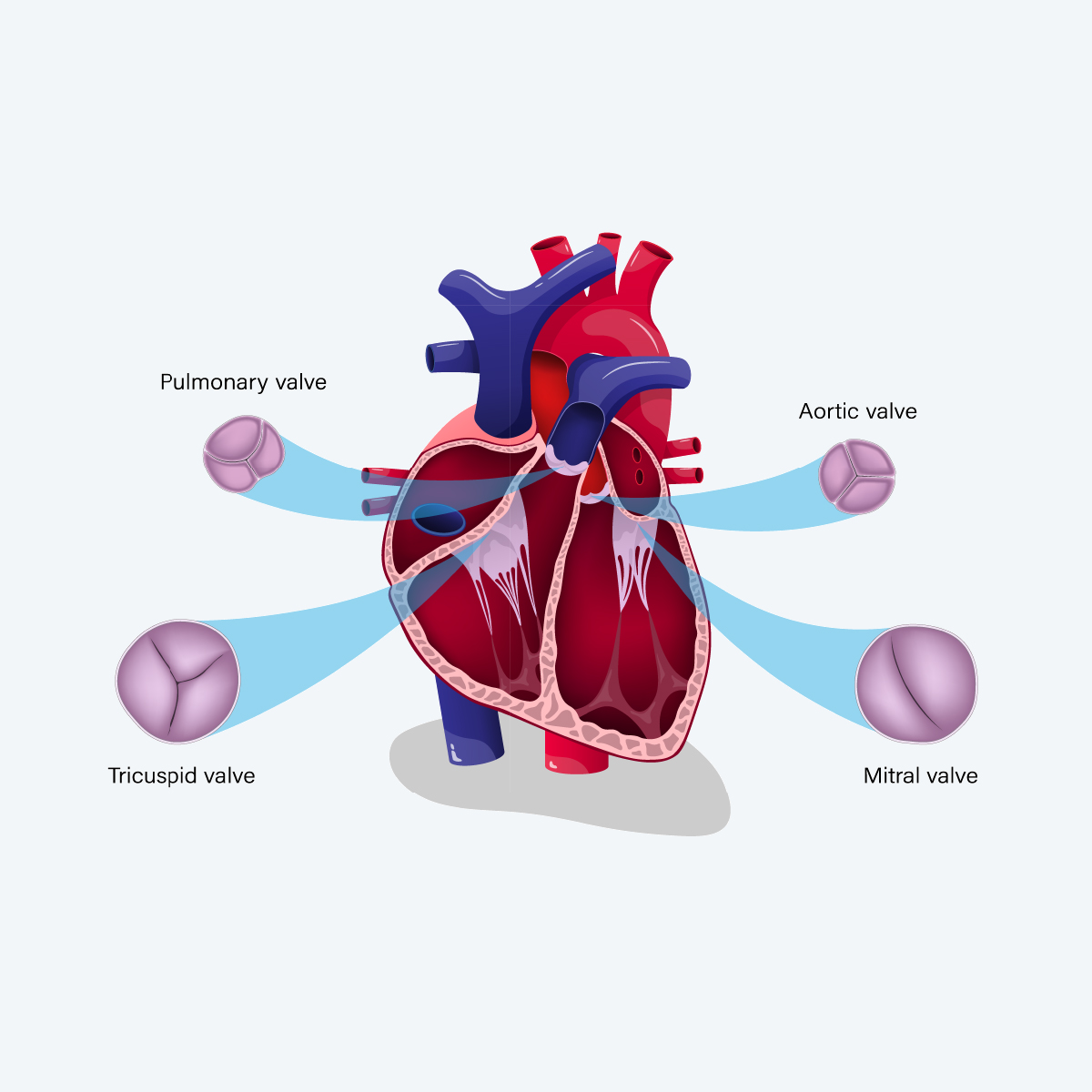

An Overview of Mitral Regurgitation Heart Valve Disorder – and Underwriting Considerations

Publication

Body Mass Index as a Predictor of Cardiovascular Health Moving The Dial On Mental Health

Moving The Dial On Mental Health -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

How Virtual Currency and Millennials, Among Other Factors, Are Influencing ISO’s 2022 Homeowners Forms

February 23, 2022

Karen Tuomi,

Christine Unger

Region: North America

English

Homeowners insurers take note: After more than a decade, ISO is updating its Homeowners forms with a proposed effective date of March 1, 2022. The newly updated forms will clarify intent; respond to legal, technological and societal changes; and seek to meet the needs of a younger generation.

Here are some of the major changes.

Cannabis

Under the current ISO Homeowners policy, liability coverage for bodily injury and property damage arising out of the use of controlled substances, which includes marijuana, is excluded, and there are no provisions for controlled substances in Section I – Property. Since many states have legalized the possession, growth and use of cannabis and cannabis-related products in recent years, ISO reacted by addressing the new exposure in the 2022 Homeowners Policy Program.

- The base form updates will include the following changes:

- A definition of cannabis is added to the form.

- Section I – Property Coverages, Property Not Covered – Addresses controlled substances, including cannabis.

- Section I – Additional Coverage for Trees, Shrubs and Other Plants – States cannabis is not covered.

- Section II – Liability Coverages, Controlled Substance Exclusion – Replaces existing references to marijuana with cannabis.

- Two new optional endorsements are being introduced in all applicable states, even in states where recreational use of cannabis is not legal. ISO has taken this approach because a) an insured may travel to, or be in possession of cannabis in, a state where its use or possession is legal, and b) it is conceivable that more states may overturn existing laws regarding cannabis possession or use.

- HO 06 01 – Limited Cannabis Property Coverage – Provides limited coverage for property loss to cannabis for certain specific perils.

- HO 24 01 – Cannabis Liability Coverage – Provides coverage for bodily injury and property damage arising out of the lawful use or possession of cannabis by any person.

Model or Hobby Aircraft and Watercraft

- Increasingly valuable model aircraft, and no reference of model watercraft, led ISO to make coverage changes regarding both of these exposures.

- Property – There is now a $2,000 limit on model or hobby aircraft (previously coverage was available up to the limit of liability for Coverage C – Personal Property).

- Liability – The definition of Watercraft within the Watercraft Liability definition now has an exception for model or hobby watercraft. As such, the Watercraft Liability Exclusion does not apply to model or hobby watercraft.

Home Sharing

The provisions of the mandatory Home-Sharing Host Activity Amendatory Endorsements are being incorporated into the base form (HO 06 52, HO 06 53, HO 06 54, HO 06 55, HO 06 56 and HO 06 58). These endorsements exclude coverage for home-sharing activities and property of a home-sharing occupant. Further, the Broadened Home-Sharing Host Activities Endorsements are being revised to delete content that will now be incorporated into the base Homeowners form (HO 06 62, HO 06 63, HO 06 64, HO 06 65, HO 06 66 and HO 06 68).

New Coverage Contents Coverage Form

After surveying persons between the ages of 18 and 39, otherwise known as millennials, ISO created a new policy form designed to meet a perceived gap in the needs of this age group, although other generations may be interested in this new form as well. The new Coverage Form, HO 00 14 Homeowners 14 – Contents Comprehensive Form, is a contents policy that addresses the changing needs of certain policyholders. For example, it includes broadened coverage for home-sharing host activities, coverage for hard drive data recovery and bed bug remediation coverage, and does not include liability coverages for watercraft or “residence employees.” The new form also removes or reduces property coverages for items such as watercraft other than models, and for trees, shrubs and plants. Endorsements are available to help insurers address the unique exposures of their insureds. Examples include a Broadened Residence Premises Definition Endorsement (HO 06 49) and an Additional Insured- Household Resident Endorsement (HO 04 58).

Motorized Bicycles and Motorized Scooters

The rise in use of bicycles and scooters with motors, especially in urban areas, necessitated acknowledgement of these new devices and the exposures they present. To that end, the definition of Motor Vehicle is being revised to include not only land or amphibious vehicles that are self-propelled, but also those that are capable of being self-propelled. This change allows such motorized bicycles and scooters to be treated in a similar manner as other motor vehicles designed for recreational use and not subject to motor vehicle registration.

ISO is also providing insurers with additional options in addressing these new types of vehicles. For example, for insurers who do not want to provide coverage for recreational use of non-owned motorized bicycles and motorized scooters, ISO offers optional endorsement Non-Owned Motorized Bicycle and Motorized Scooter Liability Exclusion (HO 24 03).

Other Notable Changes

Coverage and Noncoverage Clarifications

- The definition of Motor Vehicle Liability has been revised to state that liability arising out of the maintenance, occupancy, operation, use, and/or loading or unloading of a motor vehicle must be by an insured. Since liability coverage and medical payments do not apply to Motor Vehicle Liability in the Homeowners policy, this definition change has the effect of providing such coverages when the motor vehicle is maintained, occupied, operated, used, and/or loaded or unloaded by any person other than the insured.

- The definition of Business is being revised.

- It now includes the leasing of the mineral rights of an insured location, for hydraulic fracturing as an example, to clarify that no coverage exists from this exposure.

- Additionally, the dollar amount in total compensation has been increased from $2,000 to $5,000 to allow more activities to be conducted before they are considered a business and thus excluded from coverage.

- To reinforce that ISO Homeowners policies were not developed to provide coverage with respect to virtual, digital or electronic currency, virtual currency has been added to Property Not Covered under Property Coverages – Coverage C – Personal Property.

- To simplify the policy language and address emerging watercraft types, changes were made to the exceptions to the watercraft exclusion in Section II – Liability. The exceptions now include:

- Watercraft (non-sailing vessels) engines or motors of 25 horsepower or less, either owned or non‑owned

- Watercraft (non-sailing vessels) with engines or motors of more than 25 horsepower that are non‑owned

- Newly acquired outboard engines or motors with 25 horsepower or more if such engines or motors are reported to the insurer within the reporting requirements in the policy

- The language in Property Section I, Coverage C has been revised to make clear that coverage exists for motor vehicle equipment or parts while not in or upon the vehicle. This could apply to a detached convertible top that’s stored in a garage, for example.

- Changes are being made throughout the policy to indicate that a dwelling being remodeled, renovated or repaired is not considered vacant, and therefore, is not subject to exclusions/limitations in the policy regarding vacancy.

- An exception to the “motor vehicle” liability exclusion has been added specifying there is coverage for riding lawn mowers when, at the time of the occurrence, they are being used to mow a lawn.

- The Additional Living Expenses provision under Coverage D – Loss of Use has been revised to state that this coverage also applies to expenses incurred by covered residents of the named insured’s household, not just the insured him or herself.

Limits and Dollar Amounts

Throughout the policy, limits and dollar amounts are being increased to reflect increased business costs and inflation. Several Limits in Coverage C – Personal Property and Property Coverages – Additional Coverages and Section II Additional Coverages have been increased.

Endorsements

There are also several endorsements being added or amended to the suite of forms. Many of the new endorsements are designed to provide flexibility in connection with the coverage being offered. Some examples include:

- Since it is now common for banks and financial institutions to forgive losses as a result of unauthorized use of a credit card, ISO is removing from Property Coverages the additional coverage for Credit Card, Electronic Fund Transfer Card or Access Device, Forgery and Counterfeit Money. The coverage is now made available by an optional endorsement (HO 04 53) with a basic limit of $1,000 (limits up to $10,000 can be purchased).

- Limited Coverage for Theft of Personal Property Located in a Dwelling Under Construction (HO 06 07) is being revised to add the option to select a lower limit.

- New optional endorsement HO 24 02 – Other Insured Location(s) can be used to schedule an additional location which is not currently eligible to be scheduled as an insured location.

- New optional endorsement HO 06 21 – Specified Other Structure(s) Exclusion provides flexibility by allowing insurers to cover an entire risk BUT FOR one or more undesirable structures on the residence premises. The scheduled structure(s) can be excluded from property and liability coverage, or property coverage only. This will enable insurers to accept risks they previously were unable to accept.

Format

In addition to the changes in content described above, ISO revised the text format from two columns on each page to one. This applies to all endorsements and forms, not just those that have been updated.

Not all the changes to ISO’s 2022 Homeowners Program have been addressed within this publication. We encourage readers to review Circular LI‑HO‑2021‑039, including multistate forms filing HO‑2021‑OFR21 for a complete list of changes and the new and revised forms themselves. Please reach out to your Gen Re representative with any questions or for more information.