-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Trending Topics

Publication

Engineered Stone – A Real Emergence of Silicosis

Publication

Use of Artificial Intelligence in Fire Protection and Property Insurance – Opportunities and Challenges

Publication

Generative Artificial Intelligence and Its Implications for Weather and Climate Risk Management in Insurance

Publication

Public Administrations’ Liability – Jurisprudential Evolution, Insurance Implications, and a Comparative Analysis Across Countries

Publication

Risk Management Review 2025

Publication

Who’s Really Behind That Lawsuit? – Claims Handling Challenges From Third-Party Litigation Funding -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Training & Education

Publication

AI Agent Potential – How Orchestration and Contextual Foundations Can Reshape (Re)Insurance Workflows

Publication

Diabetes and Critical Illness Insurance – Bridging the Protection Gap

Publication

Group Medical EOI Underwriting – Snapshot of U.S. Benchmark Survey

Publication

Why HIV Progress Matters

Publication

Dying Gracefully – Legal, Ethical, and Insurance Perspectives on Medical Assistance in Dying Moving The Dial On Mental Health

Moving The Dial On Mental Health -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Lockdown, Traffic Down…Claims Down? Why Assessing the Impact of the Pandemic on UK Motor Claims Requires Careful Handling

December 06, 2021

Richard Tunnard

Region: United Kingdom

English

The COVID‑19 pandemic and its associated impact on motor travel have materially reduced motor claim frequencies across the world. While there is no question that traffic levels and claim frequencies reduced in 2020 and much of 2021, there is no consensus on how traffic varied or how precisely this affected claim frequencies. This presents a challenge to insurers and their reinsurers when assessing the performance of portfolios and the impact of risk mix changes and rating actions.

This blog post focusses on the impact of lockdowns on motor claims in the UK. The data sources are UK‑specific, although equivalents may be available in other territories. Changes in claim mix and claims inflation are not considered here but are also important areas of uncertainty.

The Impact of COVID‑19 on UK Traffic

A variety of statistical sources are available to assess traffic levels throughout the pandemic. Since March 2020, the UK Department for Transport (DfT) has published daily statistics on average transport usage, split by mode of transport. Apple has published national mobility information worldwide, including for the UK, while insurers with telematics portfolios will have direct access to mobility data.

Each of these sources has its limitations. The DfT figures are based on a statistical sampling of traffic at approximately 275 locations, chosen as representative of national traffic. However, changes in driving patterns during the pandemic could potentially have disrupted the relationships used to calibrate the statistical extrapolation.

Apple’s figures are based on direction requests in Apple Maps, which (a) biases the sample towards a small fraction of the UK population,1 and (b) is biased toward people travelling on routes with which they are less familiar. The introduction of Low Traffic Neighbourhoods and the rise of “stay-cations” will also have had a disproportionate impact on the Apple figures.

Finally, regarding the third statistical source, telematics portfolios are generally concentrated in lower age and income groups whose mobility may have been affected differently than the population as whole.

Why the Data Requires Careful Handling

Of these three sources, the DfT figures are likely to be the least biased and are the ones we have seen being used most widely in the market, although all of the sources can provide some insight.

The DfT figures do, however, come with an additional caveat that does not appear to be universally recognised, despite being highlighted in their methodology document:2 All motor vehicle numbers are indexed relative to the same day in the first week of February. For example, when the DfT reports a traffic level of 94% on Wednesday, 22 September 2021, this is not 94% of the traffic we would normally expect on that given day, it is 94% of the level seen on Wednesday, 5 February 2020. This difference is important because traffic levels vary across the year.

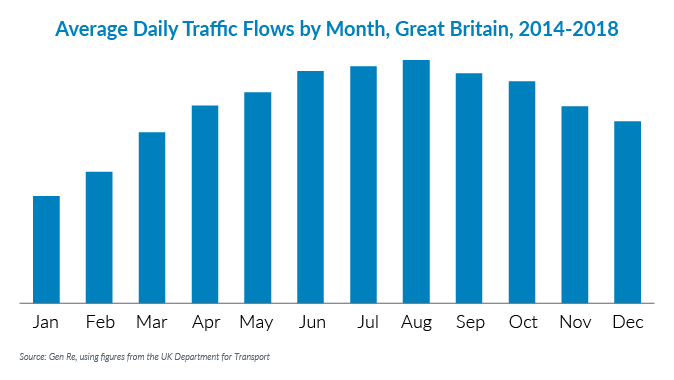

Fortunately, the UK also publishes detailed road traffic statistics, including by month.3 This enables adjustment of the DfT mobility data to account for seasonal variations in traffic and a better estimate of the true traffic level to be made.

By way of an example, consider Wednesday, 22 September 2021. The DfT reports 94%, but average traffic levels in September are 14% higher than in February. So, without the impact of COVID, we would expect the DfT figure to be 114%. The 94% therefore represents a traffic level 17% less than expected, almost triple the 6% from the raw DfT figures.

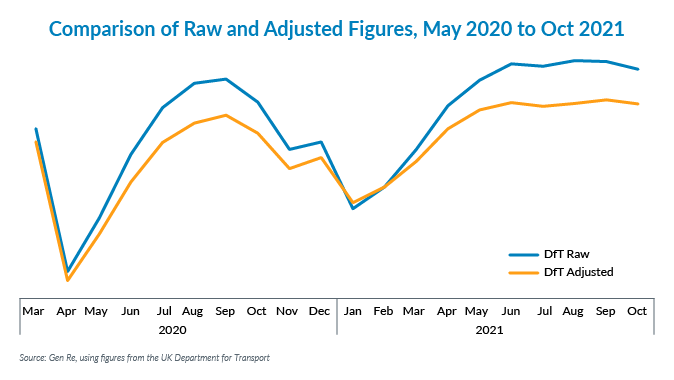

On average, February has the second lowest level of traffic in the year (for cars and taxis). This leads to the DfT figures presenting an overestimate of the traffic level. The chart below compares levels on both a raw and adjusted basis:

This dramatically shifts the view of traffic levels, especially from May 2021 onwards. If one were to rely only on the raw DfT figures, the conclusion would be that we are nearly back to normal levels. However, after adjusting for seasonality, traffic levels are almost 10% lower and 15% below “normal”.

For insurers assessing the performance of risk mix changes since 2019, the belief that traffic levels are nearly back to normal would mask material increases in frequency. This risks delaying remedial action and potentially compounding issues by driving incorrect rating actions.

Conclusion

While all available measures of UK traffic flow have their limitations, the data from the DfT is likely to be more reliable than that of Apple, or that of telematics data for non‑telematics business. However, their definition needs to be carefully considered, and adjustments such as those described above may be necessary. Further consideration could also be given to:

- The detailed vehicle split

- Exposure to other road users

- The impact of changing traffic mix between weekdays and weekends

While we have only looked at frequency measures here, there are multiple moving parts in the motor claims environment today. Other effects, such as the changing claim mix (fewer smaller claims but more larger claims in lockdown), rapid spare parts inflation, the Financial Conduct Authority’s general insurance pricing practices review, and whiplash reforms are all vying for attention and will be important considerations in reinsurance renewal discussions.

The question of whether or not there will be a new normal is irrelevant here: a 5% sustained reduction in traffic may well be seen. However, based on adjusted DfT data we are not yet at this level, and assuming we are risks overstatement of any risk mix improvements since 2019.

Endnotes

- iPhone accounts for c. 50% of the UK mobile phone market share, according to Statista.

- https://www.gov.uk/government/statistics/transport-use-during-the-coronavirus-covid-19-pandemic/covid-19-transport-data-methodology-note

- https://www.gov.uk/government/organisations/department-for-transport/series/road-traffic-statistics and table TRA0305