-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

Six Things We Can Do to Curb Legal System Abuse

Publication

Is Human Trafficking the Next Big Liability Exposure for Insurers?

Publication

When Likes Turn to Lawsuits – Social Media Addiction and the Insurance Fallout

Publication

Generative Artificial Intelligence and Its Implications for Weather and Climate Risk Management in Insurance

Publication

Creating Strong Reinsurance Submissions That Drive Better Outcomes

Publication

Do Commercial General Liability Policies Cover Mental Anguish From Sexual Abuse? -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Publication

Group Medical EOI Underwriting – Snapshot of U.S. Benchmark Survey

Publication

Next Gen Underwriting Insights – 2025 Survey Results & Confusion Matrix Considerations [Webinar]

Publication

GLP-1 Receptor Agonists – From Evolution to Revolution U.S. Industry Events

U.S. Industry Events

Publication

Always On: Understanding New Age Addictions and Their Implications for Disability Insurance

Publication

Dying Gracefully – Legal, Ethical, and Insurance Perspectives on Medical Assistance in Dying -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

UBI - The New MVR?

October 08, 2020

Brian Monahan,

Karen Tuomi

Region: North America

English

If I drive my vehicle half as much as last year and expect to continue doing so, does it make sense for me to pay just 15% less for my auto insurance? Does this mean my insurance company was taking advantage of me last year? Are they now? Considerations such as these demonstrate why interest in usage-based insurance (UBI) has been growing in 2020.

UBI relies on when, where, and how a vehicle is used, rather than MVR (motor vehicle records) and traditional driver characteristics like credit scores, marriage status and gender to determine premiums. This alternative type of vehicle insurance is not new. Progressive began experimenting with UBI more than 20 years ago1 by giving drivers dongle devices to keep in the vehicle to record driving behavior. Today, dongles are being replaced by applications on smartphones and a growing number of newer vehicles are already equipped with connectivity capability.

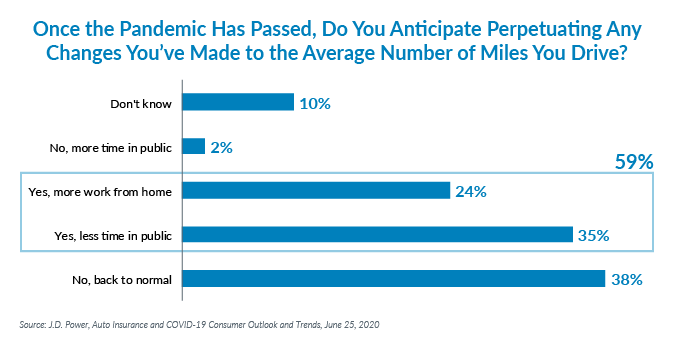

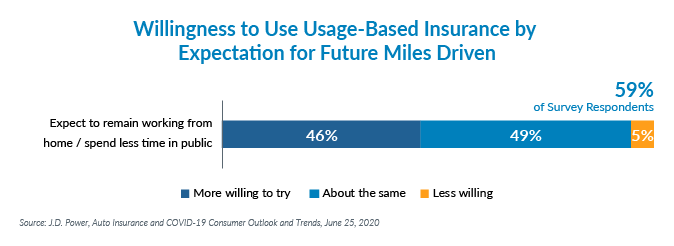

According to a June 2020 survey by J.D. Power, 59% of consumers expect to continue spending less time away from home, and 46% of those consumers are highly interested in UBI solutions.

Further, the auto insurance industry has close to a 20% satisfaction deficit versus pre-COVID.2 Satisfaction is a key driver of customer retention. And for the first time in its 21-year history, the J.D. Power U.S. Auto Insurance Study found that websites mattered more than a human agent for client satisfaction when interacting with auto insurers.3 Is this interest in UBI, and dissatisfaction with current insurance carriers and their procedures, enough to initiate a shift away from traditional auto insurance?

First, let’s consider the availability of such programs. Nine of the top 10 largest private passenger auto insurers have UBI programs in place.4 Alternatively, we recently conducted an informal survey among personal lines executives at 10 carriers with direct premiums written between $35M and $750M. Seven of the 10 carriers included in the survey do not currently have a UBI product.

Within our discussions we heard similar themes:

- Skepticism - Concern that participation rate will not produce positive returns on investment

- Demand doesn’t exist - Agents are not asking for it

- Low priority - No rush

- Unavailable resources

- Waiting for more pervasive OEM connectivity - Bigger pool of data

It’s understandable that companies of all sizes are hesitant to dive in. As mentioned earlier, Progressive first developed a usage-based product in the mid-1990s. It took about 15 years of testing before they released the first version of their current Snapshot product.5 Most companies don’t have that kind of time and money. Savings realized from developing better drivers and lowering acquisition expenses must outweigh the cost of researching and implementing the technology. Other challenges include a dearth of enthusiasm for the product within all ranks of the organization as well as their consumer and agency bases. State requirements for new rating plans vary, with some requiring statistical data and others raising privacy concerns. And UBI may not be a better alternative for drivers who work third shift hours or knowingly drive aggressively.

But as the technology continues to improve and younger, tech-savvy generations comprise more of the population, companies may find it worthwhile to rethink implementing a UBI program. Consider the following:

- The continuous monitoring enabled by UBI eliminates under- and overestimated mileage gathered traditionally through manual periodic applications. Better data = improved risk selection and pricing precision = better outcomes for insurance companies.

- Increasingly, consumers want more frequent, meaningful and personalized communications.6 UBI offers a platform for insurers to become more engaged with their policyholders allowing them to offer immediate feedback and even rewards for measurable improvements.

- UBI could potentially reduce claims, acquisition and policy administration costs, and allow for more effective policy pricing.7

- UBI programs have a positive effect on driving behavior. A survey from the Insurance Research Council (IRC) found that 80% of drivers who participated in a UBI program reported changing how they drive for the better. For 58% of them, these improved driving behaviors became permanent!8

- People are becoming increasingly tech-reliant. 33% of the U.S. population is between the ages of 15 and 39 which classifies them as Generations Z and Y (Millennials).9 Almost 100% of Millennials use the internet and 19% do not have broadband internet service at their homes: they are smartphone-only internet users.10 Generation Z has little or no memory of the world as it existed before smartphones.11 Changing social attitudes and demographics are making UBI technology and data sharing more acceptable to consumers.

Several UBI platforms exist, such as The Floow, TrueMotion, Cambridge Mobile Telematics, and Arity. Costs associated with UBI technology will begin to decline as more insurtech companies develop such products. This will allow more carriers to adopt UBI products if desired. And it’s becoming increasingly common for car manufacturers to partner directly with insurers. On September 3, Ford Motor Company and Metromile announced a partnership “to provide Ford connected vehicle owners with personalized car insurance to be more affordable and fairer.”12

Technological advancements are increasingly impacting insurance companies and policyholders: Water leaks can be detected and stopped remotely; potential intruders can be seen and deterred; and vehicles can apply the brakes faster than the driver. Usage-Based Insurance is yet another quickly developing technology that may benefit insurers and policyholders. However, the benefits of a UBI product may not extend to all drivers. Furthermore, the implementation of a UBI platform may not pay off for every carrier. Regardless of an insurer’s position in the UBI development spectrum, it is prudent for carriers to be aware and educated about this growing form of auto insurance.

Endnotes

- Insurance Information Institute, ”Background on: Pay-as-you-drive auto insurance (telematics),” March 12, 2020, https://www.iii.org/article/background-on-pay-as-you-drive-auto-insurance-telematics

- J.D. Power, ”Auto Insurance and COVID-19: Consumer outlook and trends,” June 25, 2020, https://discover.jdpa.com/hubfs/Files/COVID-19/20200625_PULSE%20Insurance%20After%20COVID19_Distribution.pdf

- J.D. Power, 2020 U.S. Auto Insurance Study, June 11, 2020, https://www.jdpower.com/business/press-releases/2020-us-auto-insurance-study

- Insurance Information Institute, “Background on: Pay-as-you-drive auto insurance (telematics),” March 12, 2020, https://www.iii.org/article/background-on-pay-as-you-drive-auto-insurance-telematics

- “How Progressive began & evolved,” https://www.progressive.com/about/history

- EY Global, “Five tech trends that will define the future of insurance,” January 8, 2019, https://www.ey.com/en_gl/insurance/five-tech-trends-that-will-define-the-future-of-insurance

- Ibid.

- American Property Casualty Insurance Association, “IRC Study Finds Telematics Changes Drivers Behaviours, But Not Permanently,” August 21, 2020

- U.S. Census Bureau, Current Population Survey, Annual Social and Economic Supplement, 2019

- Pew Research Center, “Millennials stand out for their technology use, but older generations also embrace digital life,” September 9, 2019, https://www.pewresearch.org/fact-tank/2019/09/09/us-generations-technology-use

- Pew Research Center, “On the Cusp of Adulthood and Facing an Uncertain Future: What We Know About Gen Z So Far,” May 12, 2020, https://www.pewsocialtrends.org/essay/on-the-cusp-of-adulthood-and-facing-an-uncertain-future-what-we-know-about-gen-z-so-far

- https://www.businesswire.com/news/home/20200903005298/en/Metromile-Ford-Team-Bring-Highly-Personalized-Car