-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Trending Topics

Publication

That’s a Robotaxi in Your Rear-View Mirror – What Does This Mean for Insurers?

Publication

Cat Bonds – A Threat to Traditional Reinsurance?

Publication

Decision-Making in the Age of Generative Artificial Intelligence

Publication

Buildings Made of Wood – A Challenge For Insurers?

Publication

The CrowdStrike Incident – A Wake-Up Call for Insurers?

Publication

PFAS Awareness and Concern Continues to Grow. Will the Litigation it Generates Do Likewise? -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Training & Education

Publication

How Is AI Being Used to Enhance Traditional Life Underwriting?

Publication

Understanding Physician Contracts When Underwriting Disability Insurance

Publication

Decision-Making in the Age of Generative Artificial Intelligence

Publication

Favorite Findings – Behavioral Economics and Insurance

Publication

Finding the Balance – Assessing Weight Changes in Underwriting Moving The Dial On Mental Health

Moving The Dial On Mental Health -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Riots and Civil Commotion – Disquieting Times Ahead

July 23, 2020

Tim Fletcher

Region: North America

English

There existed an eerie and historical sense of déjà vu as riots broke out in Minneapolis, Atlanta, New York, Los Angeles and other cities around the country in late May and early June. Images of burning buildings, looting and vandalism brought to mind the late 1960s, when such disturbances arose after shocking events, such as the assassination of Rev. Martin Luther King.

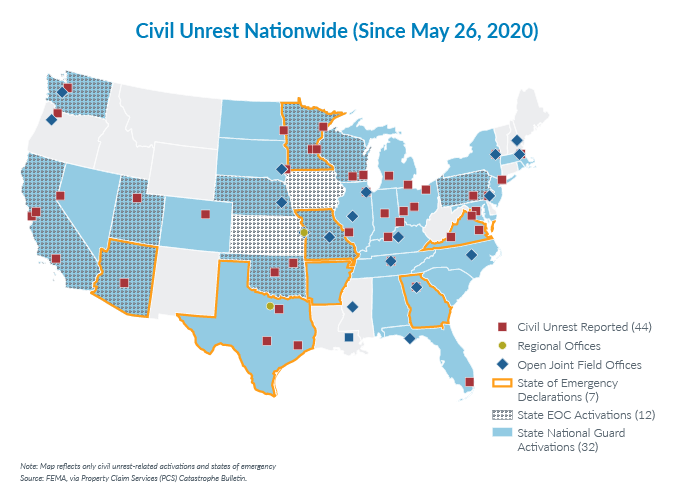

Whatever the root causes, these disturbances will certainly jolt an insurance industry coming to grips with COVID-19 and a looming hurricane season. ISO’s Property Claim Services (PCS) designated the Minneapolis riots as the first civil disturbance catastrophe since the 2015 Baltimore riots following the death of Freddie Gray while in police custody. Because rioting erupted in other states, PCS expanded the designation to include more than one state for the first time in its history.1

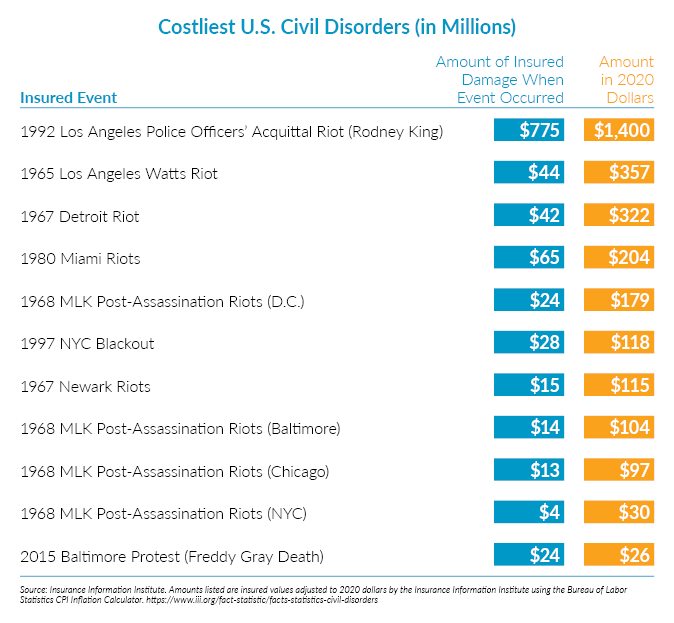

The Minneapolis event damaged some 400 businesses and is expected to cause an estimated $500 million in damage. Countrywide, the riots occurred over a two-week period and came after numerous peaceful protests over the George Floyd tragedy. Early industry estimates suggest that total insured riot-related damages will range between $1 billion and $3 billion. If true, this forecast will portend of the largest insured civil disorder loss in American history, surpassing these previous well-known events.

The following map shows the event’s unprecedented national geographic spread:

Coverage Issues

Losses arising from these events are disturbing. For example, the owner of a damaged Minneapolis dental clinic watched as his on-premises security cameras captured looters breaking in and destroying expensive dental equipment before setting the structure ablaze. Other business owners told similarly harrowing tales, many of them as they were beginning to reopen after governmentally imposed lockdowns.

Insurance claim staff adjusting these losses are working through coverage and valuation issues that include the following:

- One or Multiple Occurrences - A policyholder might have experienced multiple losses at a single location (vandalism and looting on consecutive days), or losses at multiple locations in the same or different cities. Crucial to this analysis will be policy language, the facts, and circumstances of the loss as well as applicable law. Because some reinsurance contracts contain hours clauses, the PCS designation of the catastrophe as running from May 26 to June 8 may have significance for primary carriers that seek recoveries.

- Business Income Loss Calculations - Calculating business income losses must by necessity contemplate COVID-19’s impact on business operations, particularly in those situations in which businesses are just emerging from COVID-19 lockdowns. Additionally, a co-insurance analysis (if applicable) will need to be conducted to determine if the policyholder was insured to the full value of the loss.

- Limitations of Civil Authority Coverage - Civil authority coverage typically mandates that property damage occur within a specified radius of the insured premises; a time limitation may also apply. Additionally, most provisions require that property access be denied by the actions of a civil authority.

- Fraudulent Claims - Some in the industry are concerned that these recent events and the current economic crunch may conspire to generate fraudulent claims and exaggerated damage submissions. While typical fraud indicators may be involved, such as looting without evidence of physical damage or documentation of inventory, other factors could be present to explain a reporting delay or complicate the submission of a detailed proof of loss.

In each of the above instances, review of applicable policy language will be vital. Although many carriers may use standard ISO-issued forms, some employ manuscript policies that can dramatically alter coverages and impact losses submitted.

Industry Response

Some observers suggest that recent events are a new phenomenon, while others state that they are nothing more than a continuation of a trend first seen internationally in the 2010 Toronto G20 protests and more recently in Chile and Hong Kong. Regardless, the potential for riot and civil commotion events is on the rise.

As the second half of 2020 starts, many questions remain, including:

- Will the current political climate create social unrest that spills over into civil disturbance?

- Could a second wave of COVID-19 lockdowns push simmering frustration to the boiling point?

- Will a lumbering economy with a protracted and uneven recovery serve as an accelerant for civil commotion?

- Will the November elections play any role?

At its core, insurance provides financial stability in uncertain times. Recent events will provide the industry an opportunity to confirm that assessment.

Endnote

- Property Claim Services (PCS) Catastrophe Bulletin, 20+ states are included.