-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Trending Topics

Publication

That’s a Robotaxi in Your Rear-View Mirror – What Does This Mean for Insurers?

Publication

Cat Bonds – A Threat to Traditional Reinsurance?

Publication

Decision-Making in the Age of Generative Artificial Intelligence

Publication

Buildings Made of Wood – A Challenge For Insurers?

Publication

The CrowdStrike Incident – A Wake-Up Call for Insurers?

Publication

PFAS Awareness and Concern Continues to Grow. Will the Litigation it Generates Do Likewise? -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Training & Education

Publication

When Actuaries Meet Claims Managers – Data-Driven Disability Claims Review

Publication

Chronic Pain and the Role of Insurers – A Multifactorial Perspective on Causes, Therapies and Prognosis

Publication

Fasting – A Tradition Across Civilizations

Publication

Alzheimer’s Disease Overview – Detection and New Treatments

Publication

Simplicity, Interpretability, and Effective Variable Selection with LASSO Regression Moving The Dial On Mental Health

Moving The Dial On Mental Health -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Childhood Sexual Abuse Claims and Law Reforms – 3 Things Underwriters Can Do

July 29, 2019

Carey Quigley

Region: North America

English

State legislatures across the U.S. are enacting reforms for claims of past childhood sexual abuse that previously were barred by statutes of limitations, and so now old claims are being revived. AM Best has also warned insurers to expect a marked increase in claims frequency in states with reformed statute of limitations laws and that some carrier ratings could ultimately be affected.1 Several national writers have already announced reserve increases on their past risks. Here I’m exploring what the laws mean for underwriters and their current book of business.

In a commercial setting, the risks with “child custodial care” encompass schools, churches, youth activities (including organized sports), camps, day care and virtually any establishment providing some type of education to minors. Unless their policies were written on a claims-made basis, the liability of these organizations for the past conduct of employees and volunteers does not typically affect their exposure under current insurance policies. Yet, the new laws put a spotlight on these groups and many underwriters are taking the opportunity to review guidelines and policy forms with a fresh eye.

1 - Build a Hazard Scale

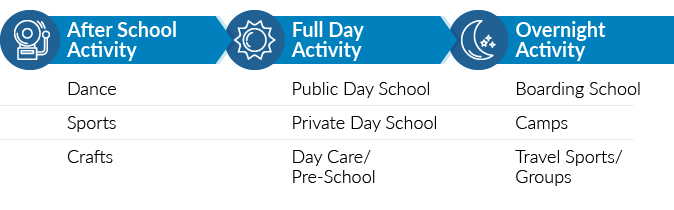

All youth organizations and institutions present some degree of risk, but the degree can vary significantly. As we know from news reports, basic exposure can exist for any or all of these entities.

The more prolonged the activity, the greater the potential hazard, with private boarding schools representing perhaps the far end of the spectrum. On the other hand, parents are more involved in and present at their kids’ activities today, so some of the local groups and gatherings present risk at the lower end of the spectrum.

This scale also reflects the developmental nature of many risks. A child may begin soccer lessons after elementary school and later progress to the travel team and overnight competitions.

2 - Review Insurance Forms

Although several specialty writers serve the youth sports, school, and church markets, most general commercial writers may have the local dance school and perhaps a small church in their portfolio. To serve these policyholders, insurers have developed Sexual Abuse and Molestation (SAM) endorsements offering critical but not unlimited protection.

SAM coverage is typically granted by first excluding the exposure from the GL coverage and then giving it back as separate coverage. It’s subject to new terms and limits which may be sublimited in comparison to the General Liability (GL) policy. A $1 million GL policy might provide SAM limits of $100,000 per claim/$300,000 aggregate, and we have seen policies providing sublimited coverage at limits of $25,000/$50,000. These lower limits may apply in addition to the larger GL limit or they may erode it, depending on the insurer’s appetite for exposure.

While a claims-made coverage trigger might be the preferred approach, these commonly used endorsements for child custodial risks typically contain modified occurrence language, but that can still mean many things. The intent is to contain the exposure for abuse of multiple victims, multiple incidents, and across multiple policy periods, to prevent stacking of limits and policies. Underwriters accomplish this by telescoping coverage to one policy or claim limit, based on one or more of the factors listed below.

Insurers might include language in their SAM endorsement to:

- Push all coverage into the policy when the abuse first began

- Treat all abuse by a single perpetrator as a single claim, no matter how many victims or instances of abuse

- Treat all abuse of a single victim as a single claim, no matter the number of perpetrators and instances

- Treat all related or interrelated abuse as a single claim, without further qualification

- Provide coverage on a claims-made basis

3 - Decide Exclusions and Check Wording

Another underwriting issue is whether the exclusion will extend to all types of physical abuse, or only sexual abuse. Frequently these terms are defined to prevent overlap with the GL policy and stacked limits from the endorsement and base policy. The definition should include negligent employment, investigation, supervision, reporting, and retention. Another way to avoid overlap is to make sure the GL policy excludes all the abuse and molestation coverage provided by the SAM endorsement.

If a lawsuit alleges sexual abuse with false imprisonment or battery, for example, the insurer probably intends that all such allegations trigger only the SAM endorsement.

Whatever approach the insurer takes, clear policy language is essential to achieving the desired result. That requires monitoring court decisions to learn how similar forms are interpreted by courts, and even checking forms filed by other insurers to see how they address the stacking issues.

Looking into the future to make good risk decisions today is the underwriter’s challenge. What risks are being written now (or not long ago) that will present unexpected claims 20 or even 50 years from today? Will you be financially prepared for - and collect reinsurance on - those long-tail losses? How will current forms respond to new types of claims and coverage challenges? If we can help you meet that challenge, and help answer these questions, contact your Gen Re representative.

Endnote

- AM Best’s Commentary, “Expanding Child Victim Compensation Laws Could Adversely Affect Insurers,” (July 23, 2019).