-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Trending Topics

Publication

Production of Lithium-Ion Batteries

Publication

Time to Limit the Risk of Cyber War in Property (Re)insurance

Publication

Generative Artificial Intelligence in Insurance – Three Lessons for Transformation from Past Arrivals of General-Purpose Technologies

Publication

Human Activity Generates Carbon and Warms the Atmosphere. Is Human Ingenuity Part of the Solution?

Publication

Inflation – What’s Next for the Insurance Industry and the Policyholders it Serves?

Publication

Pedestrian Fatalities Are on the Rise. How Do We Fix That? -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Training & Education

Publication

Key Takeaways From Our U.S. Claims Fraud Survey

Publication

The Effects of Heatwaves – A Look at Heat-related Mortality in Europe and South Korea

Publication

The Key Elements of Critical Illness Definitions for Mental Health Disorders

Publication

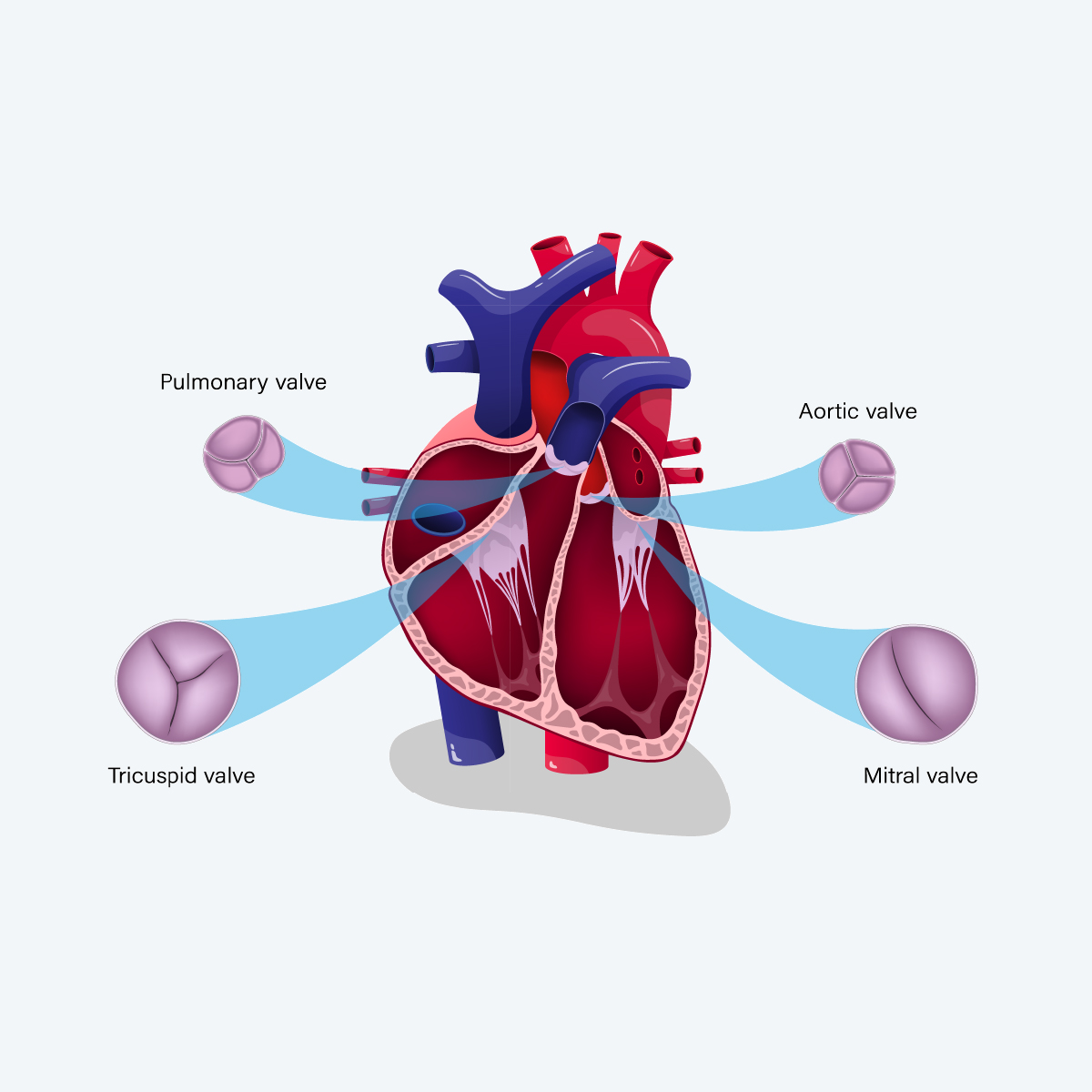

An Overview of Mitral Regurgitation Heart Valve Disorder – and Underwriting Considerations

Publication

Body Mass Index as a Predictor of Cardiovascular Health Moving The Dial On Mental Health

Moving The Dial On Mental Health -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

It’s Time to Future-Proof Your Data, Systems and Culture

September 05, 2017

Andres Webersinke

English

The long-term prospects of most Life and Health insurers are going to be determined by their ability to transition from a product-based approach to a customer-centric value proposition. But, if they’re going to make that leap, insurers will have to know more about their customers, their behaviours and decision-making processes.

Closer client intimacy can be developed through different interactions that customers have with their insurer, as well as with other entities. It’s achieved by using own or otherwise easily available data and, increasingly, from not-yet-used data sources.

However, making use of all this data and feeding it into the insurance value chain requires carriers to invest heavily in their data analytics capabilities, as well as make some fundamental changes to their culture.

It won’t always be easy. The gap that needs to be bridged is quite substantial: The product proposition offered to life insurance customers today frequently involves lengthy application processes and multiple disruptions in media and communications, not all of which are seamlessly connected.

Such processes have evolved over a long period and implementing smart processing based on artificial intelligence, machine-learning or other advanced technologies is a big challenge.

People need to adapt, too, and get to grips with the tools being developed for analysing data and transferring statistical theories into high-performance algorithms. Life insurance actuaries especially will have to consider such innovative approaches to link the abundance of new data to their company’s long-term experience.

Practically speaking, insurers need to start paying closer attention to collecting all the information their customers are willing and able to share. Again, it seems like a mountain to climb because data has gaps and mistakes, cannot be easily connected and is mostly inconsistent; it ignores many touchpoints with customers, such as calls or communication between adviser and customer.

Of course, yesterday’s systems were not designed with a view to seamless integration and they’re not suited to combining data from different sources with unique identifiers. A lot of useful information is only available on paper, even in handwriting, which may be illegible for a human and as yet for machines.

Insurers of all sizes face problems in this respect. Small companies have too little data in all segments to generate meaningful insights. On the other hand, data from large companies (or pooled data from multiple companies) is so huge that available IT infrastructures and statistical tools are stretched to their limits.

It sounds like an insurmountable challenge, but it’s one that simply must be tackled: Doing nothing, leaving data unused, or not improving data collection, is no longer an option.

Investing in data analytics is moving up the agenda in boardrooms around the industry. Few insurers want to rely on expensive external solutions in the long run and while so-called InsurTech firms often have the technical expertise they lack insurance business knowledge.

Yet collaboration with specialists from InsurTech companies or reinsurers could be a first step for insurers looking to build up their own expertise in data analytics to make better use of data.

Gen Re is strongly focused on technical expertise, which is why we are extending our capabilities by working on real-life questions from clients and our own data, with the emphasis on obtaining actionable insights from the data. It’s why Gen Re prefers to use the term “decision analytics,” whereby analytics is not purely combined with data but has a strong focus on outcome, i. e., decisions.

We firmly believe that decision analytics promises exciting opportunities in the future. Armies of actuaries, statisticians and data scientists are already gaining experience in analysing more data with better tools. The big challenge for insurers will be to seamlessly interweave these insights with common sense and an overall strategy for differentiation and customer-centricity.

Please also read our article in Risk Insights.

Chief Underwriting Officer and Head of Research & Development – Life & Health

See All Articles