-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Trending Topics

Publication

Engineered Stone – A Real Emergence of Silicosis

Publication

Use of Artificial Intelligence in Fire Protection and Property Insurance – Opportunities and Challenges

Publication

Generative Artificial Intelligence and Its Implications for Weather and Climate Risk Management in Insurance

Publication

Public Administrations’ Liability – Jurisprudential Evolution, Insurance Implications, and a Comparative Analysis Across Countries

Publication

Risk Management Review 2025

Publication

Who’s Really Behind That Lawsuit? – Claims Handling Challenges From Third-Party Litigation Funding -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Training & Education

Publication

AI Agent Potential – How Orchestration and Contextual Foundations Can Reshape (Re)Insurance Workflows

Publication

Diabetes and Critical Illness Insurance – Bridging the Protection Gap

Publication

Group Medical EOI Underwriting – Snapshot of U.S. Benchmark Survey

Publication

Why HIV Progress Matters

Publication

Dying Gracefully – Legal, Ethical, and Insurance Perspectives on Medical Assistance in Dying Moving The Dial On Mental Health

Moving The Dial On Mental Health -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Direct Marketing of Personal Insurance

June 27, 2016

Dr. Karsten Kroll, Senior Account Direct Marketing Turkey, Malta

English

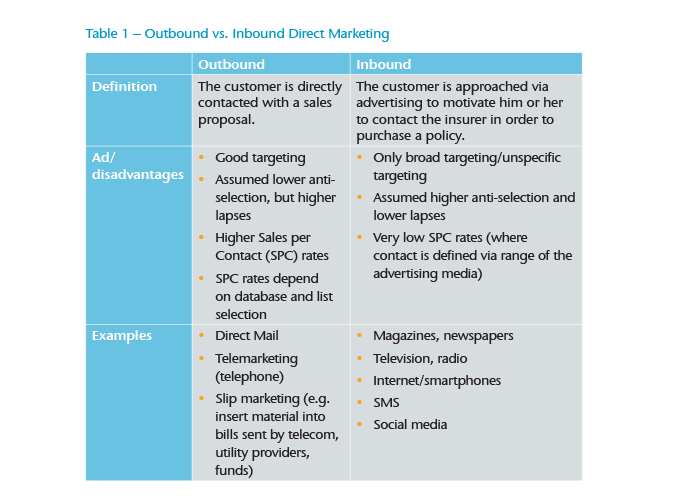

Direct Marketing (DM) of personal insurance can be defined as selling protection products directly to consumers through a variety of sales media. Yet this is only one possible interpretation, since DM of insurance business is continually evolving to fit changes to distribution channels and technical developments in IT. In general terms we can distinguish between Outbound and Inbound DM (see Table 1).

Because Inbound DM mainly depends on the quality of advertising, sales skills and distribution are less important. The insurer’s advertising is often not product-specific but tries to present the insurer in a positive way to the potential customer.

This article is focused on Outbound DM because it requires particular skills – in sales, processing and data analysis – that are not required (or not needed to as great an extent) in other forms of DM personal insurance.

Outbound DM

The oldest forms of outbound DM include mailed postcards and letters, but telemarketing gained tremendously in importance over recent decades. Other methods have played only a minor role in Outbound DM to date. Nowadays, however, telemarketing is under greater constraint than in the past because of increased consumer rights and protection. For example, in most major insurance markets, it is no longer permitted to call a prospective customer with the purpose of selling them a product without having previously obtained their consent to receive such a call.

Any DM program must deliver the right product at the right time to the right person in the right way. Hence, DM is complex, and to be effective it requires expertise in key areas, five of which are outlined below.

1. Identifying the target market

A target market is usually chosen for optimum results, measured by sales volume, sales per contact (SPC) and persistency. Two factors influencing the target choice are the product on offer and the available database, or list of potential customers. If the insurer opts not to market to a list of existing customers, perhaps because the list is too small, lacks sufficient data or has been used before, then a new database must be obtained, which can be a most challenging task.

Databases with lists of names are available from different sources and in different forms: from credit card companies, banks or financial institutions, or as affinity lists, such as from telecommunication and utility providers, or as commercial lists, such as subscribers to magazines or supermarket loyalty cards. Databases specifically created by a specialist DM company represent a special category. The type of list typically will influence the SPC and persistency: the affinity towards purchasing cover (and thus the SPC) and the persistency usually decreases from insurers’ databases down to affinity lists. Since the database owner (list holder) generally has a say about what product(s) will be offered to which customers, those owners will further influence the choice of target markets.

The final choice of product may also hinge on other factors, such as:

- Available customer data, and its quality (e.g. products designed for senior citizens cannot be adequately directed when the individuals’ ages are unknown)

- Sales target volumes (the more customers to be called, the less specific a product can be)

- The products that have already been targeted to the database members

- The desired selection approach (i.e. with or without underwriting)

- Products deemed to be selling well via DM in the market

- Lines of business and capabilities of the insurer

The final adjustment to the target market is made by selecting customers from the database who are most likely to purchase and least likely to lapse. Today the selection often uses predictive modeling or big data analysis to obtain the best market segmentation and thereby achieve optimal sales results.

2. Choosing the right sales media

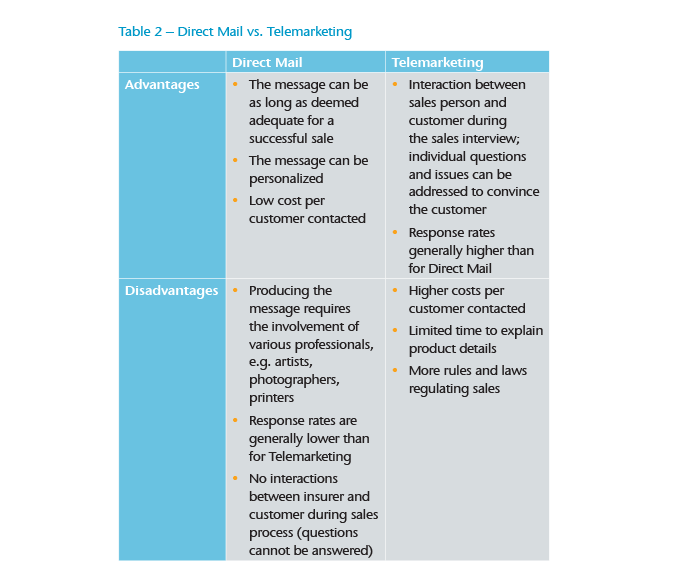

First, the data required for the sales media has to be available; for example, customers’ postal addresses are more readily available in databases than their telephone numbers. The final choice will be further influenced by the effectiveness of methods applied to the target market in the past. A brief comparison of the various advantages and disadvantages of Direct Mail and Telemarketing is shown in Table 2.

3. Designing the product and underwriting approach

DM products should be tailor-made to appeal to the selected target group to support sales (e.g. double benefits for motor traffic accidents in marketing to a motor list). In the 1980s few products sold via DM provided cover other than against accidental harm. As the market became saturated, the range of products was widened to meet demand. Today most types of life insurance products can be sold via DM. However, they should not be over-complex since they must be easily explained in a letter or phone call. This implies that products with very large numbers of benefits (e.g. in Accident or Critical Illness products) may not be best suited for DM distribution. The number of policy options available is less relevant in a Telemarketing context as the sales agent can steer the sales interview in this regard.

An important consideration for any non-accident product is whether to offer it with only simplified (minimal) underwriting or with no underwriting. Offering products with no underwriting invites increased levels of anti-selection. Levels should be lower in outbound than inbound DM or in sales through brokers and agents. While it is tempting to conclude that anti-selection from any reduction in underwriting can be offset by an increase in premiums, not all underwriting compromise can be balanced this way. DM products can, to an extent, because of their limited benefits, but will sell successfully only if premiums are not too high, which further limits potential increases to reflect simplification in underwriting.

4. Simplifying the policy issue process

In order to avoid putting off potential customers, the policy issue process should also be kept simple. For example, in Direct Mail programs, customers return completed and underwritten application forms plus any other required documents, enabling the insurer to issue a policy quickly if appropriate processes have been implemented at the insurer.

Telemarketing programs present more of a challenge, and the final process is often influenced by local law or regulation. For example, in some markets insurers may – with customer consent – record and store the sales interview as proof of purchase of a policy. This means no further signature is required before cover is issued, which represents the most straightforward process imaginable in Telemarketing.

In other markets, however, anti-money laundering legislation requires the identity of a policyholder to be confirmed. This means the insurer must see a copy of an ID card or equivalent document prior to formalizing an insurance contract. This additional step has, in some cases, been observed to stop about 30% of customers from finalizing their purchase.

5. Customer retention

Traditionally, policyholders have received little contact from the insurer following the policy sale, but more recently this has approach has changed. Many insurers, often on the advice of regulators, now keep regular contact with policyholders – for example, to check that their coverage continues to meets their needs. Insurers can address customer retention in the following ways:

- Cross-selling to the portfolio

- Integrating value services that help the insured (e.g. legal assistance on the phone or second medical opinion)

- Contacting by phone policyholders who want to lapse in order to convince them to continue the policy

- Offering to reduce sums insured and lower premiums to counter lapses due to unaffordability

Parties involved in a DM program

The number of parties involved in a DM projects depends, to some extent, on the assignment of the various tasks listed above. The minimum number of parties is obviously two – the insurance company selling and the customer buying. Here the insurer undertakes all of the tasks itself, while also financing the acquisition costs and owning the customer database.

Additional parties, including a listholder, specialist DM company and/or a reinsurance company, may participate in a DM project.

A listholder is a third-party owner of a database. Unless an insurer intends to market to an existing customer portfolio, it will need to source a database from a listholder. Listholders usually earn commission from licensing the database for use by the insurer. The terms of use and privacy of the data as well as the commissions are agreed in a contract between the listholder and the insurer – in some cases, between the listholder and a specialist DM company.

Many insurance programs involve a specialist DM company, which will sometimes supply the database but will also have greater experience in selling via DM, selecting from lists those customers most prone to buy. A specialist DM company knows how to best address the customer to optimize the SPC rate.

The insurer may also simply prefer not to participate in the marketing risk, perhaps due to sales program costs. The production costs of acquiring the business depend to a large degree on the customer database segmentation and the sales media. If the SPC is below what had been anticipated in the business plan for the sales program, the profits made during the runoff of the portfolio will be insufficient to claw back the acquisition costs. An insurer can avoid this risk by allowing the DM company to execute the program and pay only a pre-agreed amount for each policy sold, the acquisition commission.

DM specialists have experience in making a good estimate for the SPC of a program. Even if the specialist overestimated the SPC for one program, losses could be compensated by better than expected results from another. The main income and profit of a DM company executing a program is from the acquisition commission; often the company is also being paid an ongoing commission for in-force policies.

Involving a reinsurer confers an insurer several benefits – for example, with product development, pricing and underwriting expertise. The biometric risk, acquisition costs and lapse risk can be shared. If lapses are higher than planned, the profits during the runoff of the portfolio created by the sales program are lower than expected and it may not be possible to earn back the initial acquisition costs. Reinsurance is usually offered on a quota share original terms basis.

Many insurers prefer using both a DM company and a reinsurer, as this reduces (or even eliminates) their acquisition costs (no capital to be allocated to the sales program in business planning), marketing risk and lapse risk, while dramatically increasing the profit per premium retained at the expense of significantly decreased retained premiums.

Looking ahead

Is Outbound DM still fit for a future likely dominated by electronic and social media and the Internet? There seems little reason to believe otherwise, at least for the foreseeable future.

Direct Mail may be supplanted by e-mail to a greater extent in future but there are few differences between the two modes in regard to sales proposal design or communication with customers. Even electronic signatures are becoming more common in use. E-mail marketing should work well, e.g in combination with Twitter, Facebook and Google Plus. Social media has a role in promoting a company and may foster the creation of lists of potential new customers.

Telemarketing currently remains the sole type of Outbound DM that involves personal interaction. This interaction can be a big advantage. Thus, it is not unreasonable to forecast that Telemarketing, or sales approaches derived from it (perhaps combining sound and vision instead of sound only), will remain one of the pillars of Outbound DM.