-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

Generative Artificial Intelligence in Insurance – Four Aspects of the Current Debate

Publication

Risks of Underinsurance in Property and Possible Regulation

Publication

Personal Injury Compensation in Europe: An Updated Comparison Among Different Systems Within the European Market

Publication

Inflation – What’s Next for the Insurance Industry and the Policyholders it Serves?

Publication

Motor Insurance in the Post-Pandemic Era -

Life & Health

Life & Health Overview

Life & Health

Gen Re’s valuable insights and risk transfer solutions help clients improve their business results. With tailor-made reinsurance programs, clients can achieve their life & health risk management objectives.

UnderwritingTraining & Education

Publication

Where Soul Meets Body – The Link Between Somatic and Psychiatric Health

Publication

Striking the Balance – Underwriting Between Regulation and Digitisation Business School

Business School

Publication

Epigenetic Testing – The Way Ahead for Life & Health Underwriting?

Publication

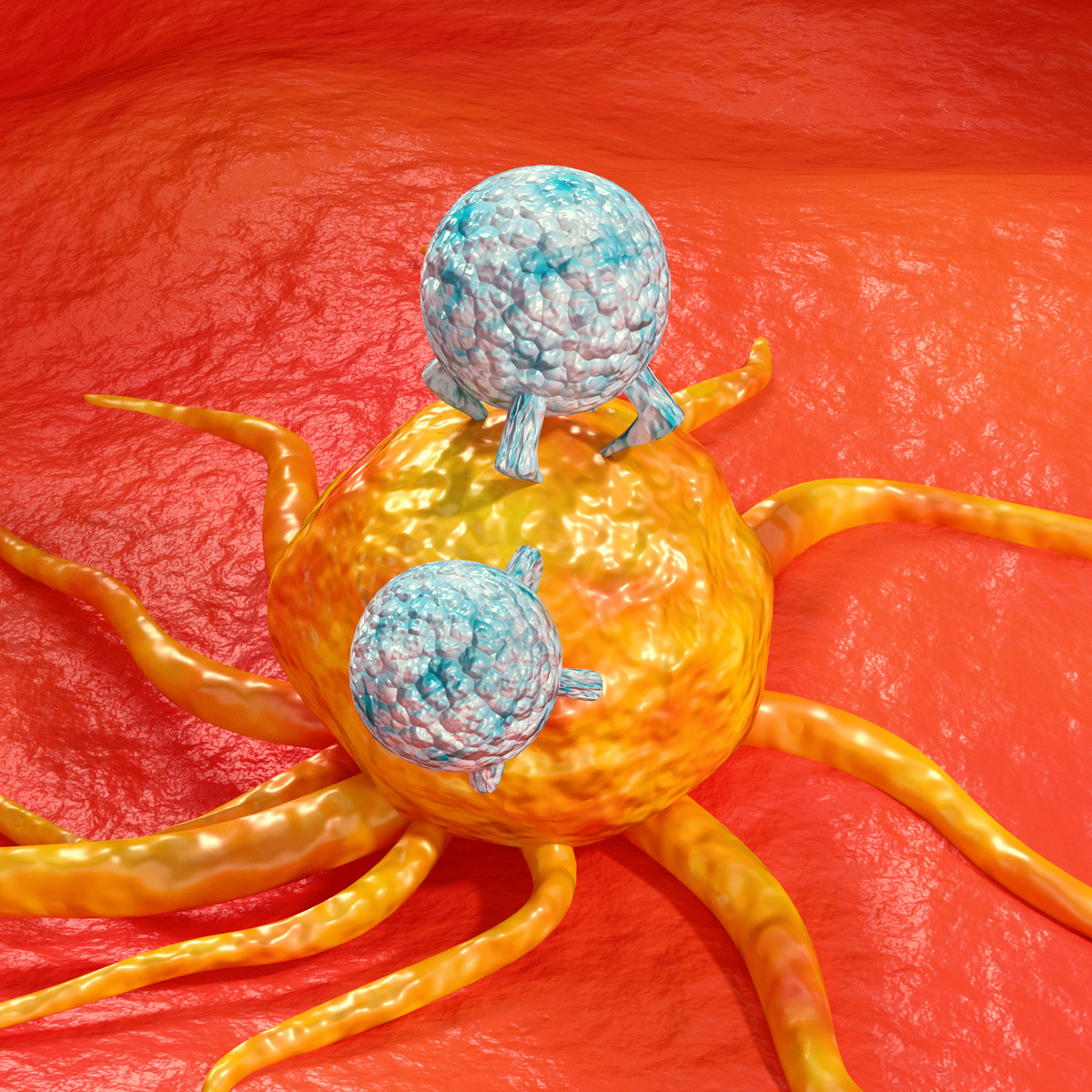

Cancer Treatment in Transition – Towards a Better Prognosis With Immunotherapies? Moving The Dial On Mental Health

Moving The Dial On Mental Health -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Products

At Gen Re, we believe that information and collaboration are the basis for great innovation.

We leverage the actuarial, medical, and underwriting expertise of our global units with the market-specific knowledge of our regional departments to support your product initiatives.

Our product development support comprises a wide range of services needed by primary insurers, including design of new products, calculation of the respective rates, and development of policy terms and conditions. Post-launch, our portfolio monitoring and experience studies offer additional valuable insights.

Our Products

Mortality

Longevity

Disability

Critical Illness/

Dread Disease

Health

Long Term Care

Our Services

Recent Research

Understanding Breast Cancer in Asia – Awareness and the Importance of Screening

Breast cancer ranks as the most prevalent cancer worldwide, and a staggering 2.3 million women were diagnosed with the illness globally in 2020. Although the prospects of survival in the battle against breast cancer are improving, the financial burden on patients remains significant. CI benefits can assist with managing the expenses.

Wendy Low,

Pei Nee Yong,

Samuel Lim

October 19, 2023

Individual Disability – Results of 2023 U.S. Market Survey

Sharing results of the latest Gen Re Individual Disability Market Survey. This year’s benchmarking survey covers Non-Cancelable, Guaranteed Renewable, Buy-Sell and Guaranteed Standard Issue product lines for 2022 and 2023. Seventeen carriers participated in the survey representing $5.4 billion of inforce premium.

Lisa Bolduc

May 09, 2024

Ushering in a New Era of Cystic Fibrosis Management

It has long been thought that cystic fibrosis is a pediatric disorder but has become a chronic disease to be managed into adulthood. A “new era” in cystic fibrosis care has been announced, however concerns are that these striking innovations will not be available or affordable across all markets.

Dr. Chris Ball

May 06, 2024

Growing Concern Over the Rise in Early-Onset Cancers – An Underwriting Perspective

You have cancer – three words no one ever wants to hear but especially those individuals under the age of 50. Sadly, the incidence of early-onset cancer, those diagnosed between the ages of 18-49, is increasing in the U.S. and globally. Here’s a look at the trend.

Lindsay McPeak,

Kim Sholtis

May 02, 2024

What is Claims Digitization and Why Do We Care?

Digitization is the crucial step in a business’s digital transformation process. Claims management is perfectly suited for implementing automated systems and digitizing transactional claims processes. This blog looks at key terms and the value and changes coming to the claims discipline.

Patricia Bailer

April 25, 2024