-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

Biometric Information Privacy – Statutes, Claims and Litigation [Update]

Publication

Inflation – What’s Next for the Insurance Industry and the Policyholders it Serves?

Publication

Human Activity Generates Carbon and Warms the Atmosphere. Is Human Ingenuity Part of the Solution?

Publication

Illinois Changes Stance on Construction Defect Claims – The Trend Continues

Publication

Generative Artificial Intelligence in Insurance – Four Aspects of the Current Debate

Publication

Battered Umbrella – A Market in Urgent Need of Fixing -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Publication

Underwriting High Net Worth Foreign Nationals – Considerations for U.S. Life Insurance Companies

Publication

Group Term Life Rate & Risk Management – Results of 2023 U.S. Survey

Publication

Trend Spotting on the Accelerated Underwriting Journey

Publication

All in a Day’s Work – The Impact of Non-Medical Factors in Disability Claims U.S. Industry Events

U.S. Industry Events

Publication

Marginal Gains in the Medicare Supplement Market -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

2022: A Great Opportunity for the Disability Insurance Market

May 03, 2022

Mike Krohn

Region: North America

English

The COVID‑19 pandemic has caused all of us around the globe to rethink the paradigm around how we approach life. Many people have been asking novel and more complicated questions: How much socializing do I do in enclosed spaces? Should I work from home or in the office? Should I be saving more to protect my family or spending more to support local businesses? Should I move to a less expensive town at the cost of losing my current community? Is now the time to buy more insurance coverages or are they getting too expensive?

Market Results

Insurance purchasing behaviors have certainly changed during the pandemic. The Individual Life insurance market saw new sales premium drop in 2020 as agents’ abilities to get out and sell were hindered.1 Individual Disability insurance sales also suffered in 2020, with new sales premium down about 7%.2 In addition, potential buyers were understandably occupied with keeping their work and family lives going. But as the pandemic and its death toll continued to persist and climb, more consumers decided to purchase life insurance, with new sales premiums in 2021 growing by nearly 20%,3 while Individual Disability premium was flat in 2021 compared to 2020 according to Gen Re’s 2021 Disability Insurance Market Survey.

Impact of the Pandemic

As the reality of death became more front of mind for some individuals during the pandemic, so too did the vulnerability of a worker’s income, as millions of jobs were lost in early 2020. Disability insurance – or Income Protection insurance – fills a critical need in protecting an individual’s or a family’s income in the event of a disabling event. While not able to protect against the event of a job elimination, Disability insurance could replace a policyholder’s income if going to work becomes difficult due to a medical condition.

Some of the most common conditions that can result in a disability claim are back and musculoskeletal disorders, cancer, and some injuries.4 The COVID‑19 pandemic made it more possible to imagine being out of work due to complications from the illness or severe mental health issues stemming from social isolation or stress.

Yet…

An individual’s most important asset is often the income received from their job, generating millions of dollars over a lifetime. But a disabling condition removes that asset, and any replacement from Social Security Disability Income (SSDI in the U.S.) may only cover a small fraction of a disabled person’s income.

Unfortunately, there are over 50 million working adults in the U.S. that don’t have private Disability insurance coverage.5 According to a study done by Unum,6 a leading disability insurer, the most common reasons for forgoing Disability insurance are:

- “I’m healthy and don’t need it.”

- “I can’t afford it.”

- “I don’t see the value.”

The True Value of Disability Insurance

The reality is different than these perceptions. About 25% (1 in 4) of today’s 20‑year-olds can expect to be disabled before retirement.7 Injuries and cancer don’t seem to care what your cholesterol or glucose numbers are. Regarding affordability, the price point of a Disability insurance policy can be as little as about $1 a day for a 30‑year-old8 – you’re hard-pressed to find a cup of coffee as inexpensive as that today in the U.S.!

Finally, the value of Disability insurance is hard to overstate: Policies typically provide replacement of 50‑70% of an insured’s income, which allows most U.S. wage earners a higher income replacement ratio than SSDI alone (annual salaries of over $40,000 get less than 50% of income replaced by SSDI as of 2022). Losing one’s income for an unknown period of time inhibits the ability to pay bills on time, save money for an emergency fund, save enough money for retirement, make home improvements, and save for college. Given that a recent LIMRA study indicated the first three of these financial strains were in their list of top financial concerns impacted by COVID‑19,9 it shows that Disability insurance plays a vital role in maintaining financial wellness in a household.

Not only is Disability insurance a key tool to maintaining financial stability and wellness, but the U.S. Disability insurance market can provide valuable insurance coverage out of a position of strength.

Financial Stability of the Disability Insurance Market

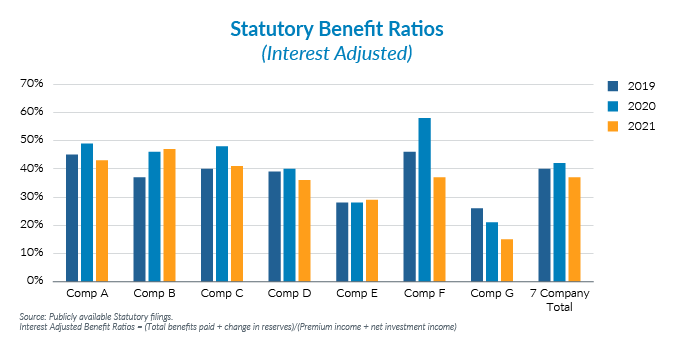

Statutory benefit ratios have been very stable throughout the COVID‑19 pandemic. This chart shows loss ratio results from seven of the top Individual Disability carriers, representing nearly $3 billion in annual premiums. The aggregation of these seven companies reveals that financial performance has been steady, with 2020 and 2021 benefit ratios averaging to the same level as 2019.

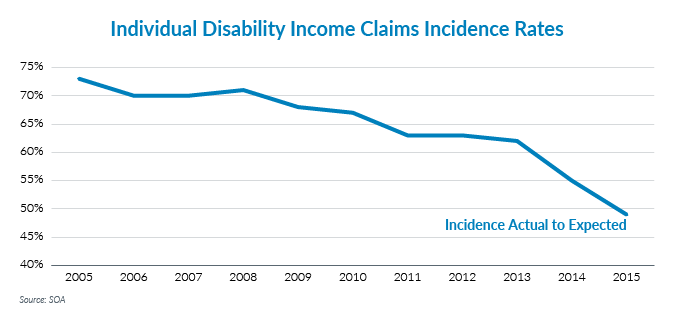

Second, one of the key drivers of these stable and low benefit ratios has been steady-to-declining rates of claims incidence. In a recent paper published by the SOA and co‑authored by Gen Re’s Jay Barriss, Individual Disability incidence rates were shown to have steadily improved over the 2005 to 2015 period, relative to the latest Individual Disability Valuation Table (IDIVT) incidence rate expectations.10 The favorable incidence rate trends have likely continued into at least into 2020 as Gen Re analysis on our reinsured blocks of disability business show continuing-to-stable incidence trends since 2015.

Summary

This is a great opportunity for the Disability insurance market to protect more workers' incomes. The topic of household financial uncertainty brought to the forefront through the personal lessons learned from the pandemic has the potential to make consumers more interested in obtaining income protection to weather the uncertainty of a disability in their future.

Favorable claims trends and stable financial performance allow Disability carriers to keep the cost of disability rates from rising, which is a great benefit for the consumer. And for guaranteed renewable policyholders, the risk of rate increases such as those seen on Long Term Care policies are unlikely to occur.

Finally, personal savings rates in the U.S. during the pandemic were the highest they’ve been in the past 20 years,11 which may facilitate more people willing to buy a policy in the near future. This point in history could be the best opportunity in our lifetimes for the Disability insurance industry to provide valuable and affordable insurance cover to an under-insured market. Gen Re’s experienced team of dedicated Disability underwriters, claims experts, and actuaries supports our clients in their business of offering protection to an individual’s most valuable asset – their income.

Endnotes

- LIMRA Press Release, 3/18/21: U.S. Life Insurance Policy Sales Increase 2% in 2020, https://www.limra.com/en/newsroom/news-releases/2021/limra-u.s.-life-insurance-policy-sales-increase-2-in-2020/

- Gen Re blog: The Impact of COVID on the U.S. Individual Disability Market, https://www.genre.com/knowledge/publications/the-impact-of-covid-on-the-us-individual-disability-market-en.html

- LIMRA, Third Quarter 2021 U.S. Life Insurance Sales, U.S. Retail Life Insurance Growth Rates by Product, https://www.limra.com/siteassets/newsroom/fact-tank/sales-data/2021/q3/third-quarter-2021-individual-life-sales-v-final.pdf

- Council for Disability Awareness, https://disabilitycanhappen.org/disability-statistic

- Ibid.

- Unum Disability Guide 2020, https://www.unum.com/-/media/B496CB05960F4FBD9A62E50A4A446104

- Id at note 4.

- Disability Insurance Premiums – Cost Of Disability Insurance, https://www.affordableinsuranceprotection.com/disability_premiums

- LIMRA 2021 insurance barometer study

- SOA 2005-2015 Experience Adjustments to the 2013 IDI Valuation Table Policy Incidence Rates, https://www.soa.org/resources/research-reports/2022/2005-15-idiet/

- Personal saving rate in the U.S. 1960-2021, https://www.statista.com/statistics/246234/personal-savings-rate-in-the-united-states/