-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

Biometric Information Privacy – Statutes, Claims and Litigation [Update]

Publication

Inflation – What’s Next for the Insurance Industry and the Policyholders it Serves?

Publication

Human Activity Generates Carbon and Warms the Atmosphere. Is Human Ingenuity Part of the Solution?

Publication

Illinois Changes Stance on Construction Defect Claims – The Trend Continues

Publication

Generative Artificial Intelligence in Insurance – Four Aspects of the Current Debate

Publication

Battered Umbrella – A Market in Urgent Need of Fixing -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Publication

Underwriting High Net Worth Foreign Nationals – Considerations for U.S. Life Insurance Companies

Publication

Group Term Life Rate & Risk Management – Results of 2023 U.S. Survey

Publication

Trend Spotting on the Accelerated Underwriting Journey

Publication

All in a Day’s Work – The Impact of Non-Medical Factors in Disability Claims U.S. Industry Events

U.S. Industry Events

Publication

Marginal Gains in the Medicare Supplement Market -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Can Behavioural Science Increase the Appeal of Income Protection Business?

May 11, 2021

Carina Betz

Region: Germany

English

The insurance industry increasingly recognizes the role played by behavioural economic (BE) theory in its interactions with customers and other stakeholders. The thinking behind BE, which explores characteristic human behaviour, such as our partly irrational decisions in economic situations, can be applied in different parts of the insurance value chain. It’s especially interesting when it comes to developing or improving consumer products.

BE theory draws from psychology, neuroscience, sociology and economics to deepen our understanding of consumer behaviour. In our industry, the equivalent term “behavioural insurance” is coming into common parlance.

Behavioural economics starts with the premise that the functions of the human brain are complex and still largely unexplored. Our senses are continuously sending information to our brain, which classifies, analyzes and evaluates it and enables us to make decisions accordingly. Some research suggests that a person makes around 35,000 decisions each day. Having said this, most of these decisions are made – at least to a certain extent – subconsciously.

Shortcuts in our brain enable us to use existing information and experiences to facilitate and accelerate our decision-making process. Even before you start your day at work, you have already made hundreds of conscious or subconscious decisions. Your brain is your “consultant” when it comes to what you should wear or eat, which train to take, when you should cross the street, etc. Furthermore, it automatically analyses your surroundings and makes you aware of dangers, strange people or other things that might interest you (“Oh, what nice shoes…”).

While this type of “fast thinking” can be very helpful in our day‑to‑day lives, it might prevent us from being as rational as we think we are. Relating it to economic situations can explain why consumers do not always act rationally or as predicted by classical economic theories. People do not usually have detailed information nor do they carefully weigh up all options and outcomes or evaluate situations on a statistical and objective basis.

Daniel Kahneman, who won the Nobel Prize for Economics in 2002, is probably one of the best-known representatives in the BE discipline. In his research, he concludes that particularly in uncertain situations, people tend to rely largely on heuristics, also called mental shortcuts or rules‑of‑thumb.

Applying Kahneman’s conclusion that people are using shortcuts to understand and buy insurance, it follows that we should identify those shortcuts in order to anticipate the prospective buyer’s choice of insurance product. Not only would such an approach help ensure buyers bought the most appropriate cover, it would also potentially help insurers to make their product design more appealing for the customer.

We believe that BE theory could help improve the personal insurance proposition across many product lines, but one example stands out: Income Protection (IP).

Increase consumers’ acceptance of exclusions and loadings

Currently, many IP applications are accepted with exclusions or loadings. Although our assessments are evidence-based, the final decision might be unexpected for the customer, potentially causing that individual to not purchase the policies. This in turn leaves insurers unable to recoup their processing costs. To examine this poor outcome further, Gen Re formed a research collaboration with the Cologne University of Applied Sciences.

The aim was to generate new ideas to show how insurers can increase consumers’ acceptance of exclusions and loadings applied to IP policies. The study focused on the 20- to 30‑year‑old age group that has historically proved difficult to reach. Students from the University looked at the topic from different angles and applied theories of BE. Expert interviews were conducted with underwriting managers and insurance agents from German primary insurers, an insurtech company, and a test group of students from a partner university, specifically in order to reflect the target group.

Over the course of the project, availability bias, prospect theory and reactance theory emerged as the most interesting components of BE in the IP context.

Availability bias

Generally, the availability bias manifests as:

- Large variance between estimated and actual risk

- Perception of risk that is largely influenced by personal experience and available information, mainly the media

- Tendency to overestimate the likelihood of very unlikely events (“possibility effect”)

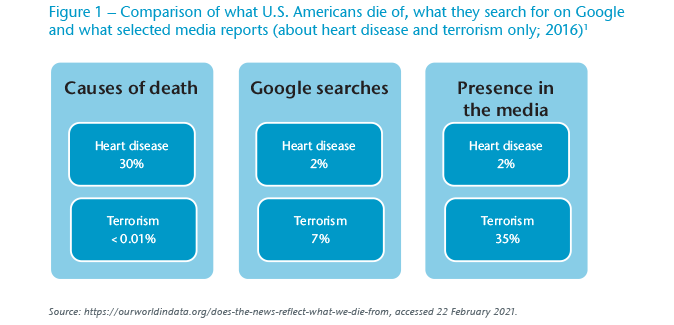

One example for this is the strong discrepancy between actual causes of death and public perception of those causes. This phenomenon has been analyzed in various studies that all showed that natural causes of death, such as heart attacks (the leading cause of death worldwide), seem to be significantly underestimated by the general population. In contrast, all forms of violent death are a cause of much greater concern.

An individual’s risk perception seems to be largely influenced by personal experience and available information. The more recent this information is, the higher is the focus on it. For example, after the 9/11 World Trade Center attacks in New York, which was obviously very prominent in the media, people became overly concerned about “plane crashes and terror attacks”. Masses of would‑be travellers cancelled their flights, and to this day people maintain this risk perception as a result of that unfortunate event.

Figure 1 compares the likelihood of events with interest in Internet searches and media coverage.

As an heuristic example, the availability bias also explains why sales of earthquake insurance increase sharply after an earthquake event. The risk is mostly the same as before, but the risk perception has changed.

Our study confirmed that insurers have difficulty interesting younger age groups in the benefits of IP policies. Perceptions among consumers are that the process of obtaining cover is complex, and this may be a contributory factor. Many potential customers are unfamiliar with IP product features or underestimate their risk of disability such that they see no value in insurance. Where the result of underwriting is a medical exclusion or a premium increase, the discouraging effect may be compounded.

Applying the concept of availability bias to marketing efforts could help increase awareness of the risk of disability and of the product itself. Additionally, it seems most important to create transparency around an insurer’s underwriting assessment thus helping an applicant to better understand the potential outcome. Independent statistics and typical claims scenarios could help to explain matters with the information made available in a simple and clear way without becoming a burden to the consumer.

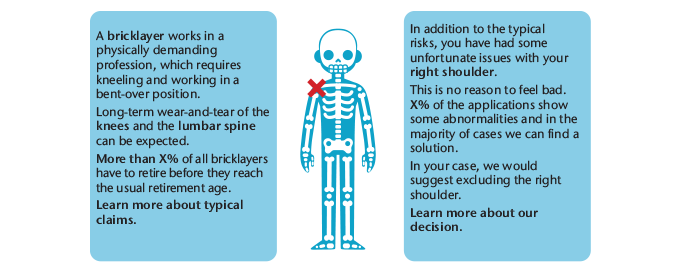

To achieve those goals, the University of Applied Science students came up with several novel ideas. One was to use a “digital corpse” in the sales presentation to illustrate typical impairments that might lead to an IP claim, supported by statistics.

It’s easy to imagine how models, tailor-made for the customer, could take into account occupations or pre‑existing conditions. The approach could also be used to make the applicant feel better. For example, “This is no reason to feel bad. X% of the applications show some abnormalities and in the majority of cases we can find a solution”. Agents and the focus group all confirmed that such an idea could be very helpful in the application process.

Prospect theory2

Heuristics of prospect theory that apply to insurance are:

- Behaviours in situations that involve risk and uncertainty

- The belief that a loss “will hurt more” than a gain “will feel good” (loss aversion)

- An increase in the perceived value of material goods when you own them (endowment effect)

An example of the loss aversion heuristic occurs in gambling, where it can easily be monitored. A behavioural experiment showed that if there is a 50% chance to win, most people will only accept the bet if their winning price is twice as high as the potential loss.3

The endowment effect, on the other hand, is obvious in the trading sphere. Have you ever wondered why some people offering their old stuff for sale at drastically inflated prices seem to be personally offended if you start negotiating? They are experiencing a strong form of the endowment effect.

Plenty of behavioural studies have analyzed how our perception of value changes when we are the owner of the object. Take a coffee mug, for example. When trading, the owner of the mug values it significantly higher than a potential buyer does. The owner is also less likely to exchange the mug for a product of equal value.4 This simple example perhaps explains why personal mugs in the office kitchen are so often a matter of discussion (“Who has taken my mug?!”). It also explains why an applicant might have strong, even negative feelings about an adverse underwriting outcome.

Once applicants apply for cover, they already view the insurance as theirs. Loadings and exclusions are therefore seen as a loss. They see the insurance company as delivering an unjust ultimatum: either they must pay a higher premium without any additional benefit or important aspects of their cover must be taken away. This feeling of injustice is especially true if applicants feel that they have fully recovered from their conditions. As health is the most valuable asset we “own”, it makes sense that we tend to overestimate its value.

In applying prospect theory to IP insurance marketing, the Cologne University students suggested several solutions that apply prospect theory to insurance marketing. One approach applies prospect theory heuristics by creating an additional benefit, especially for insurance applications that are offered with loadings/exclusions, e.g. offering supplementary health assistance services to improve physical or mental health. This could be in the form of diet advice, suggestions for exercises and workouts, but also mental wellbeing programs.

A positive side effect of this would be long-term positive contact between the customer and the insurance company. Gen Re’s collaborations with HealthTech providers – including PAI Health (heart health), TrackActive (musculosketal health), LiveSmart (healthy lifestyle) and Thrive (mental health) – could be applicable in this context.

Another idea is to offer discounts. Discounts are generally a powerful tool that influence customers emotionally, in particular helping form an impression of gain and satisfaction at having made a good deal.5

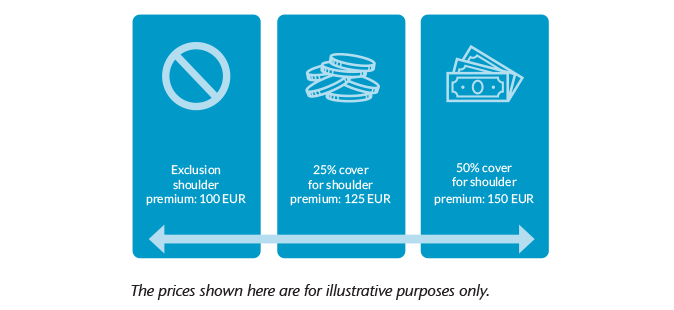

Are premium discounts possible when an exclusion is applied (limited cover)? Potentially, but it’s mainly a question of product design and pricing. Such an approach should be thought through carefully. However, calculating the cash value of an exclusion for a standard IP product in individual cases would be too complex, especially considering the correlations between completely different types of impairments (e.g. mental health and musculoskeletal problems).

An alternative pricing model was also discussed. This model would require a higher base premium and would allow mild impairments to be accepted as normal, and standard (preferred) lives could even be given a discount. The downside of this approach is that more expensive products could appear less attractive, for example on comparison shopping websites, which base a given ranking on price alone. The approach is already used in some markets, mostly in bank sales channels where the customer is not comparing different offers.

A possible variation of this approach is also used for niche products, such as specific Disability insurance for people who have diabetes. It is obvious that the standard price for this product is higher than for a regular Disability product, where individuals with diabetes may find cover is hard to secure. Policyholders could be offered premium discounts in return for demonstrating good compliance with treatment; for example, their blood sugar level is well controlled (continuous underwriting).

In order to minimize loss aversion and endowment effects, an option to review the underwriting decision was also examined. As applicants often think that a recurrence of their condition is unlikely, the offer of normal cover after a certain time is quite appealing to them. Offering to review an exclusion is not a new concept; but not all insurers seem to make use of this option, especially in a proactive way. Interviews with the focus group showed that such efforts from an insurer are viewed very positively and are seen as a concession, especially if well explained.

Taking this approach one step further, the idea arose of offering applicants the possibility to actively change their underwriting decision by improving their health. This could be done by fulfilling certain predefined criteria (e.g. successful physiotherapy and rehabilitation, participation in preventive sports classes, achieving an agreed number of hours per week of workouts using an health app). Such a “checklist” would of course require further research and refinement; however, the concept itself was extremely well received. The focus group used for the study liked the idea of policyholders working with the insurer with the goal of improving or maintaining their health. Similar concepts are already used in products with continuous underwriting or health insurers that offer bonus schemes.6

Reactance theory

- Freedom of choice is most important; any limitations are perceived poorly.

- Individuals want to have options.

- If no choice is given, the remaining option automatically appears less attractive.

When applicants have to accept an (in their minds, unjustified) exclusion in order to get insurance cover, they feel restricted. For example, imagine you are in a restaurant with two different specials. Before you can even choose, the waiter comes to your table and tells you that one of the specials is no longer available. At that moment your free choice is taken away. This limitation of choice automatically causes you to devalue the remaining option and you end up with the feeling that you would have strongly preferred the one no longer available.

For certain impairments, both an exclusion and a loading are applied in underwriting. Although most insurers have a clear underwriting philosophy towards one or the other option, this choice can be of great help for the underwriter in making adequate risk assessment and having more flexibility in the individual case if needed. As suggested by the reactance theory, the applicants might appreciate having a choice. However, giving the applicant the choice should be very carefully considered as it goes along with a high risk of anti-selection. Therefore, it is only possible for individual cases, if the following criteria are met:

- Appropriate framing and pricing

- Full and proper underwriting

- No particular increased risk for anti‑selection

- Both options would be equally risk adequate

Taking this concept further, it might be possible to identify situations and combinations of impairments where we would normally recommend an exclusion, but instead we could potentially give the applicant an offer of partial cover of the excluded impairment via an additional premium payment. Here’s an example:

An applicant has experienced a sport-induced injury to his shoulder. Now, three years after successful surgery, the client mentions that he is still occasionally experiencing issues with his shoulder, particularly after heavy physical activity. But he has no limitations and no time off work. He has consulted a doctor who confirmed that he does not require any further treatment or follow up.

The applicant is young and healthy, regularly does sport and has only a sedentary occupation. Accordingly, disability due to the minimal shoulder impairment is not impossible, but quite unlikely.

In this case, where we would normally tend to apply an exclusion, we might consider offering the applicant the following options:

Conclusion

Out-of-the-box thinking, combined with BE concepts, could provide the insurance industry with new pathways to generate additional business – and not just in IP products. Of course, the concepts we have discussed would need further refinement and do not represent fully realized solutions. Before any of them could potentially be put into practice, various additional factors and the overall market situation would need to be studied. However, it is our hope that this article has served to stimulate further thought and show how a multidisciplinary approach can drive innovation.

This does not necessarily mean that completely new approaches need to be explored. A lot can be achieved with little effort by reviewing and optimizing the traditional approaches; for example, by explaining underwriting decisions, actively offering to review exclusions or providing alternatives (exclusion or loading).

We would be interested to hear about your experience and any advances in this field. We welcome any collaboration that could help develop the use of BE in designing better IP insurance products and drive penetration among younger people.

A big thank you again to all the parties involved!

Endnotes

- https://ourworldindata.org/does-the-news-reflect-what-we-die-from.

https://owenshen24.github.io/charting-death/. - Kahneman, D., & Tversky, A. (1979). Prospect theory: An analysis of decision under risk.

- https://www.nature.com/articles/s41598-019-41242-w.

- Kahneman, Daniel; Knetsch, Jack L.; Thaler, Richard H. (1990). Experimental Tests of the Endowment Effect and the Coase Theorem.

- https://link.springer.com/article/10.1186/s40691-018-0128-2#:~:text=Affective%20effects%20of%20price%20discounts&text=1999).,aroused%20by%20a%20price%20discount.

- https://www.tk.de/resource/blob/2066014/c68f8b033bd9b55466d55a39fc29ccb1/tk-bonusprogramm-englisch-data.pdf.