-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

Biometric Information Privacy – Statutes, Claims and Litigation [Update]

Publication

Inflation – What’s Next for the Insurance Industry and the Policyholders it Serves?

Publication

Human Activity Generates Carbon and Warms the Atmosphere. Is Human Ingenuity Part of the Solution?

Publication

Illinois Changes Stance on Construction Defect Claims – The Trend Continues

Publication

Generative Artificial Intelligence in Insurance – Four Aspects of the Current Debate

Publication

Battered Umbrella – A Market in Urgent Need of Fixing -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Publication

Underwriting High Net Worth Foreign Nationals – Considerations for U.S. Life Insurance Companies

Publication

Group Term Life Rate & Risk Management – Results of 2023 U.S. Survey

Publication

Trend Spotting on the Accelerated Underwriting Journey

Publication

All in a Day’s Work – The Impact of Non-Medical Factors in Disability Claims U.S. Industry Events

U.S. Industry Events

Publication

Marginal Gains in the Medicare Supplement Market -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

After the Pandemic – Will Personal Lines Insurance Look the Same As Before?

May 27, 2020

Bruce Hackworth

Region: North America

English

Financial strains on society, and on the Property/Casualty insurance industry, from the coronavirus pandemic are likely to persist for some time. The impact of what is occurring now - coverage issues, premium rebates, extensions of coverage for activities that businesses are doing to keep afloat, losses that occur in normal times and that have either increased (burglaries in New York City) or decreased (auto accidents) - will be felt for a long time after the pandemic subsides. It is not clear when, or if, premiums will return to previous levels.

For Personal Lines insurance, the after-effects will come from reduced economic activity and the ensuing adjustments in lifestyle and work practices. Thought leaders didn’t wait long to begin speculating on what comes after the pandemic. In a recent Wall Street Journal article, for example, a University of Illinois engineering professor made this observation:

“I think we will have a permanent and long-term reduction in travel patterns. We are learning right now how we can do our daily activities - running our work meetings, attending our classes - online instead of spending our time traveling.”1

Personal Auto

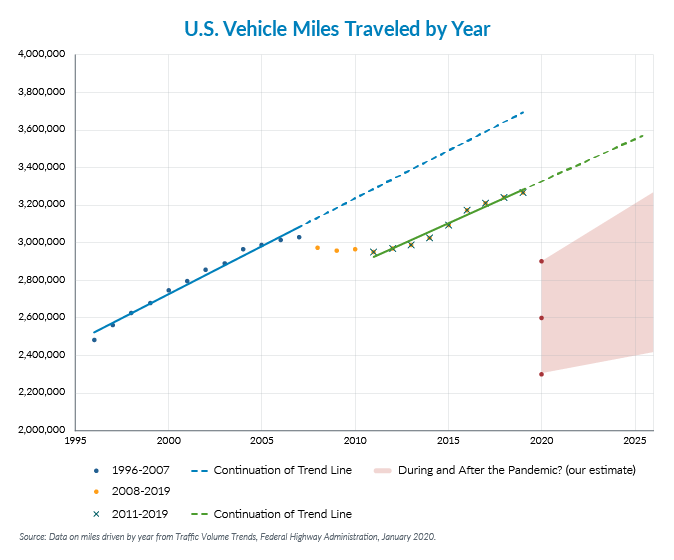

Supporting this idea of reduction, we see from the U.S. Federal Highway Administration data that miles driven fell in the immediate aftermath of the 2007-2009 financial crisis and did not rebound to the previous trend line during the recovery. We can speculate on the reasons - more purchases online, use of Uber and Lyft, greater conservatism in spending after a period of unemployment, and Millennials forgoing their drivers’ licenses.

Homes and Lifestyles

As we witnessed after the financial crisis, Millennials and Gen-Zers may need to move back in with their parents or live with roommates longer. This would slow home-buying and related insurance purchases. It could also slow family formation, reducing purchases of Life insurance for this age group. We may see more multi-generational households from the other direction, as older people are less inclined to move into senior living arrangements from fear of contagion risk. Finally, speculation is emerging that fewer people will choose to live in urban centers due to concerns about future pandemics. Will we see some migration away from cities as people recalibrate to a new normal? For example, a recent New York Times article asked,

“Beyond the basics, what is a city without its public spaces - movie theaters, restaurants, concert halls? And why pay exorbitant prices to live somewhere [in the city] if those disappear?”2

Vacation travel may not return to previous levels, having a domino effect on spending throughout the hospitality sector. Ultimately, the financial factors and contagion fear could further depress miles driven in personal vehicles.

Socializing

Online socializing, a way of life for many people before and many more during the crisis, will likely continue at high levels. This increases personal cyber risk, as seen by the instances of Zoombombing.3

Intrusion and invasion of privacy have become daily risks in our interconnected homes, with the exposure increasing with more devices and increased usage. These risks and other inappropriate online behaviors could lead to personal liability claims, along with the need for Personal Cyber insurance.

Working From Home

Many insurance and other employees already work from home, but the pandemic has made that practice more widespread. If work-from-home arrangements during difficult times prove effective, increased interest by workers and management alike could make them permanent. Once reluctant managers overcome long-held objections, some functions traditionally viewed as “on-site” might be doable at home.

One immediate impact of working from home is fewer miles driven, but Personal as well as Commercial lines are affected in other ways. By more blurring of the lines between work life and home life, there are more risks from increased use of personal devices for work and/or increased personal use of work devices. Workers will be concerned for their privacy, a reaction to employers deciding how to monitor remote work. Corporate data will be at increased risk as it is utilized over personal networks and stored on remotely located machines. The blurring of home and work is likely to affect Commercial Cyber coverage, EPLI, and Workers’ Compensation, and there could be spillover into Personal Liability and Personal Umbrella. The risk may not be new, but the level of risk is.

Emerging Data

Beyond speculation, actuaries and data scientists from companies and industry organizations - such as ISO and AAII - could test some auto, home, lifestyle, and work hypotheses on data ranging from 2008 to now, as an aid to understanding what comes next after the pandemic. However, insurance loss experience history may prove different from what our future may hold, so rate making processes may need fine tuning - not an easy process even before consideration of the roles and influence of insurance regulators. Meanwhile, actuaries and data scientists may learn about data sources, which they hadn’t previously considered, from new studies that predict the effects of the pandemic; we actuaries may learn something from reading about the methods used by epidemiologists and bio-statisticians.

Insurance companies and industry organizations have responded quickly to new challenges presented by the pandemic. The Property/Casualty industry employs over 500,000 people and the majority of companies have transitioned with little warning to operating remotely. In addition, we have found ways to continue to service claims, process premium credits for changing use, extend premium payment deadlines, and provide tailored coverages for the use of personal vehicles in commercial restaurant food delivery.

The insurance industry has stepped up in the last few years to provide solutions for ride-sharing, home-sharing, and drones. With this kind of problem solving and flexibility, we expect that insurance professionals will be able to meet the challenges we’ll face after the pandemic.

Endnotes

- Ramin Shabanpour, “Gasoline Is Cheap, but Few Are Buying,” The Wall Street Journal, March 31, 2020.

- S. Tavernise and S. Mervosh, “America’s Biggest Cities Were Already Losing Their Allure. What Happens Next?” The New York Times, April 19, 2020, Updated April 23, 2020, https://www.nytimes.com/2020/04/19/us/coronavirus-moving-city-future.html?searchResultPosition=1.

- For those not aware of the term, Zoombombing is defined in Wikipedia as “unwanted intrusion into a video conference call by an individual, which causes disruption.”