-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

Biometric Information Privacy – Statutes, Claims and Litigation [Update]

Publication

Inflation – What’s Next for the Insurance Industry and the Policyholders it Serves?

Publication

Human Activity Generates Carbon and Warms the Atmosphere. Is Human Ingenuity Part of the Solution?

Publication

Illinois Changes Stance on Construction Defect Claims – The Trend Continues

Publication

Generative Artificial Intelligence in Insurance – Four Aspects of the Current Debate

Publication

Battered Umbrella – A Market in Urgent Need of Fixing -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Publication

Underwriting High Net Worth Foreign Nationals – Considerations for U.S. Life Insurance Companies

Publication

Group Term Life Rate & Risk Management – Results of 2023 U.S. Survey

Publication

Trend Spotting on the Accelerated Underwriting Journey

Publication

All in a Day’s Work – The Impact of Non-Medical Factors in Disability Claims U.S. Industry Events

U.S. Industry Events

Publication

Marginal Gains in the Medicare Supplement Market -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Michigan’s No-Fault Insurance Law - A New Direction

October 23, 2019

Brian Monahan

Region: North America

English

Throughout my 23 years in the business, I’ve learned that certain phrases make insurance professionals cringe. Phrases like “unfavorable development,” “derecho,” and “judicial reformation”…the list is quite long! One phrase that has consistently caused consternation among Midwest carriers is “Michigan PIP.” To understand why, we need to understand insurer experience under Michigan PIP - with a look at the major changes made in 2019 to the Michigan Auto law.

What is Michigan PIP?

Michigan PIP or “Personal Injury Protection” was first enacted by the state legislature in 1973. Also referred to as Michigan No-Fault insurance, this unique law requires all licensed Michigan drivers to purchase unlimited lifetime personal injury protection. It is considered “first party” insurance as the coverage benefits the insured under their Auto policy.

Injured drivers look to their own Auto insurer for coverage; injured passengers look to their own insurer as well. Passengers without Auto insurance can find PIP coverage from other sources, including the carrier providing PIP to the vehicle they were in when the accident occurred.

Insured Michigan drivers have several benefits available to them under PIP law if they find themselves injured from an auto accident:

- Medical Expenses incurred by the insured for his/her own injuries are unlimited and available for the insured’s lifetime, as needed.

- Medical Mileage Expenses from transportation to and from medical care and treatment facilities.

- Wages Lost due to injuries that prevent/preclude an insured from working, up to 3 years and 85% of wages from the date of the accident, subject to a statutory monthly maximum that is adjusted each year (currently $5,700).

- Household Replacement Services pays up to $20 per day for services the insured used to perform on his/her own but now must hire someone to do for them.

- Attendant Care for a person unable to perform normal daily activities or care for themselves.

Why Do Insurers Dislike PIP?

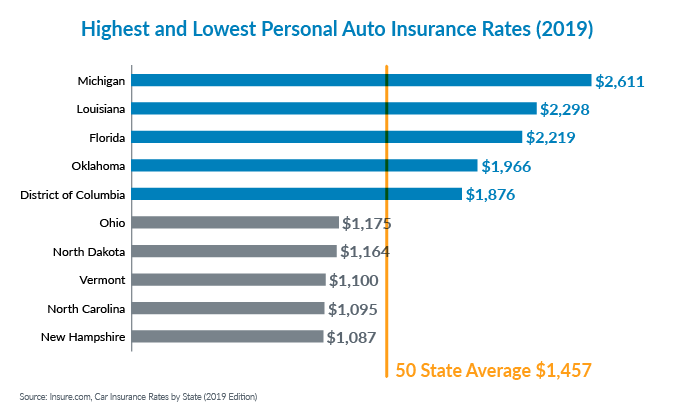

Refer back to Medical Expenses in the list above and you will see two key words: “unlimited” and “lifetime.” Those two words contributed to Michigan becoming a hotbed for treatment of brain and spinal injuries and generated angst among insurers, making the state’s average Auto premium 79% higher than the national average.1

In addition to unlimited and lifetime benefits, there was no fee schedule for medical procedures and treatment. Litigation was also problematic: 37,000 no-fault and auto negligence cases were filed in 2017, which represented a staggering 42% of the statewide civil case load.

8 Key Changes

In May 2019, the Michigan Legislature passed a new Michigan No-Fault Law in the form of Senate Bill 1. Senate Bill 1 provided large scale changes to Michigan’s Auto insurance landscape. The new law went into effect on May 30, 2019. Here’s a quick rundown of the key changes:2

- Limit Options - Effective July 2, 2020, consumers will no longer be required to purchase unlimited PIP. Instead, they will have the option to purchase $50,000 (Medicaid recipients only), $250,000, $500,000, or unlimited PIP coverage. Drivers on Medicare can also opt-out of No-Fault PIP medical benefits. In conjunction, the law mandates minimum premium reductions for those lower limits. Even drivers that maintain unlimited protection will see a 10% reduction in the No-Fault PIP medical portion of their Auto insurance bill - a coverage that often makes up over 30% of total Auto insurance premiums.

- Health Insurance - Insureds that lose health insurance are eligible for up to $2 million of No-Fault PIP Medical Coverage through the assigned claims plan. However, PIP coverage must be purchased within 30 days of losing health insurance in order to maintain this benefit.

- Multiple Policy Benefit Cap - A PIP Benefit Coverage cap was installed for situations where benefits are payable under two or more policies. Under this scenario, benefits are payable up to an aggregate limit equaling the highest available coverage limit.

- Fee Schedule - The law enables use of managed care networks for treating auto accident injuries and establishes a PIP fee schedule. Beginning July 2021, PIP reimbursements for most treatments will be limited to 200% of the amount payable to Medicare. The cap will drop to 195% and 190% over the following two years. Importantly, attendant care services provided by a friend or a family member is limited to 56 hours per week unless an insurer contracts to pay for additional hours.

- Utilization Panel - The law also establishes a utilization review panel to ensure that the level and quality of care is appropriate for a given case.

- Minimum Limits - Minimum Bodily Injury limits are raised from $20,000 each person / $40,000 each accident to $250,000 each person / $500,000 each accident. However, insureds can formally request this limit be reduced to $50,000 each person / $100,000 each accident.

- Rating Factors - While insurance scoring is still allowed, the following rating factors are now prohibited:

- Education

- Occupation

- Gender

- Marital Status

- Home Ownership

- ZIP Code

- Credit Scores

- Attorney Fees - New restrictions are imposed for some attorney fees.

What Does This Mean for Insurers?

Truth be told, most carriers feel the new law is a mixed bag and did not go far enough when it comes to cost reduction. Insurers feel the mandated rate reductions are too aggressive and not actuarially sound. The timing of the PIP Fee Schedule caps also lags the rate reductions by one year, and caps based off Medicare are questionable at best.

Yet, there is no question that this is still a major historic step in the right direction towards controlling PIP costs for Michigan Auto carriers and ultimately their insureds. As experience with the new law grows, we hope the legislature will consider tweaks that are warranted. Perhaps soon, the words “Michigan PIP” will no longer elicit an automatic cringe from Auto insurers. In the meantime, we are here to help our clients navigate the changes.

Special thanks to Nicole Massini, Gen Re Treaty Account Underwriter, for her research assistance.

Endnotes

- See auto insurance rate data at www.michiganautolaw.com/no-fault/no-fault-benefits/pip-benefits and insure.com.

- See law analysis at www.michiganautolaw.com/blog/2019/05/24/new-michigan-no-fault-law.