-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

Biometric Information Privacy – Statutes, Claims and Litigation [Update]

Publication

Inflation – What’s Next for the Insurance Industry and the Policyholders it Serves?

Publication

Human Activity Generates Carbon and Warms the Atmosphere. Is Human Ingenuity Part of the Solution?

Publication

Illinois Changes Stance on Construction Defect Claims – The Trend Continues

Publication

Generative Artificial Intelligence in Insurance – Four Aspects of the Current Debate

Publication

Battered Umbrella – A Market in Urgent Need of Fixing -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Publication

Underwriting High Net Worth Foreign Nationals – Considerations for U.S. Life Insurance Companies

Publication

Group Term Life Rate & Risk Management – Results of 2023 U.S. Survey

Publication

Trend Spotting on the Accelerated Underwriting Journey

Publication

All in a Day’s Work – The Impact of Non-Medical Factors in Disability Claims U.S. Industry Events

U.S. Industry Events

Publication

Marginal Gains in the Medicare Supplement Market -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Indications Point to Rising Personal Umbrella Losses – What About Your Book?

October 14, 2019

Karen Tuomi

Region: North America

English

Several major companies have increased Personal Umbrella rates in 2019. While this is not unprecedented, the amount of the increases and indications within the filings are worth noting. All the data we reference was found in recent public insurance department filings.

Recent Filings Tell a Story

As an example, National Writer A was approved for a 34% rate change to its Personal Umbrella in the State of California, and 20% in Indiana.1 In particular:

- The $10 million Umbrella limit has been cut in half to $5 million.

- The available Personal Umbrella limit has shrunk to $1 million for drivers over age 75 and under age 23.

- In California, insureds are now limited to $1 million of UM/UIM coverage, down from $5 million.

- In Indiana, the required underlying Auto limit has been raised from $250,000 to $500,000 CSL or $500,000/$500,000. ($250,000/$500,000 or $300,000 will no longer suffice.) As stated in the Indiana filing, the higher underlying limits are “an effort to improve the deteriorating results we have seen with this product by reducing our exposure.”2

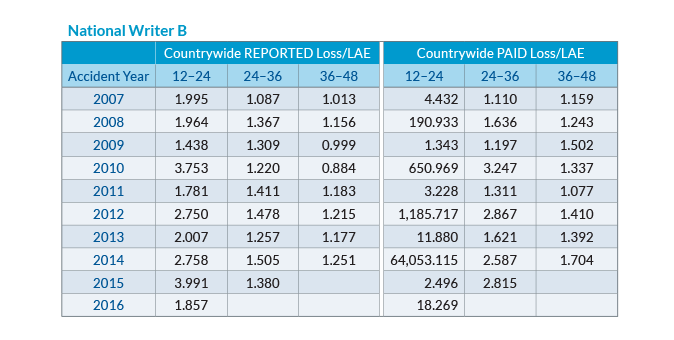

National Writer B was approved for an increase of roughly 5% in Ohio in 2019.3 That increase is not earthshattering, but this filing includes its countrywide Personal Umbrella loss development factors. They highlight recent years experiencing a greater number of claims as well as increases in paid claim amounts.

Other filings of note:

- National Writer C’s Personal Umbrella holders in Mississippi will experience a premium increase of over 25%.4

- In New York in 2015, National Writer D decreased rates almost 4%. But in 2016 they began taking annual increases of 8% or more and have continued doing so right through 2019.5

- National Writer E’s 2019 New York filing laments that the product has not been profitable, and that “countrywide this business has seen a deterioration in the loss ratio and is not projected to be profitable in the prospective period.”6

3 Major Drivers of Loss Activity

What is causing this shift in Personal Umbrella activity and claims? Our experience tells us the following are likely contributing to the disruption:

Automobile Accidents

We know from our own loss experience that motor vehicle accidents are the leading cause of Personal Umbrella claims. The improving economy has led to more miles driven and thus more auto claims occurring. And a growing number of auto accidents involve vehicles colliding with pedestrians and cyclists. In Gen Re’s loss experience such claims increased from 11.4% of total claims (2011-2015) to 19.5% (2016 to today) when comparing accident-year development. Our work suggests that urban congestion and distracted driving are two big contributors to this growing accident frequency.

Traumatic Brain Injury

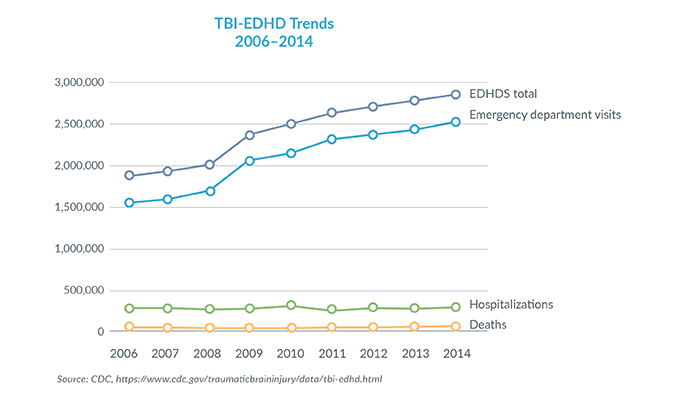

Not only are there more auto accidents but there are more catastrophic accidents involving autos. Those involving pedestrians and bicyclists are more likely to have disastrous effects. The increasing severity of bodily injury claims from personal automobile accidents includes a growing number of traumatic brain injuries (TBIs). In 2000, there were 10,958 TBI diagnoses. In 2015, this number jumped to 344,030.7 According to the CDC, the number of TBI-related emergency department visits, hospitalizations, and deaths grew by 53% between 2006 and 2014.

Loss Inflation

Increased litigation frequency and severity is another contributing factor to the deterioration of Personal Umbrella experience. According to IBNR Weekly, signs of social inflation are spreading from Commercial Auto into other liability lines.8 Such social inflation pressures are increasing plaintiff’s bar activity and resulting in higher jury awards. USI’s 2019 mid-year update reported that, “Multiple years of a protracted soft market, adverse large loss trends magnified by liberal jury verdicts and litigation financing trends have contributed to creating an environment where premium rates are not adequate to absorb long tailed liability costs.”9

Keeping Up

We are concerned that many of the trends described above can be expected to continue, or even accelerate. Increasing accidents, more losses involving TBI, and greater attorney involvement, among other trends, seem likely to drive losses higher, absent a significant change in these loss drivers or the legal environment. If not already in their best practices, Umbrella carriers should regularly review their Umbrella rates and guidelines - and make necessary adjustments - in order to persevere through these trends.

Gen Re will continue to watch rate filings and study our extensive Umbrella experience. If you would like to share your own observations, or discuss this complex topic, please contact me or your Gen Re representative. We’d love to hear from you.

Special thanks to Jill Tumney, Gen Re Treaty Personal Umbrella Line of Business Underwriter, for her research assistance.

Endnotes

- We did not include company names but can provide that information upon request.

- Indiana filing RFC INP64012; SERFF USLI-131999001; California filing RFC CAP78479; SERFF USLI-131982530.

- Ohio filing RFC OHP59896; SERFF RLSC-131638713. All data taken from this public filing.

- RFC MSP55943; SERFF LBPM-131946665.

- RFC NYP59936; SERFF GECC-131958341.

- RFC NYP59886; SERFF HINC-131809546.

- National Center for Biotechnology Information, U.S. National Library of Medicine, January 30, 2019, https://www.ncbi.nlm.nih.gov/books/NBK459300.

- IBNR Weekly, July 11, 2019.

- USI 2019 Commercial Property & Casualty Market Outlook - Mid-Year Update.