-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

Biometric Information Privacy – Statutes, Claims and Litigation [Update]

Publication

Inflation – What’s Next for the Insurance Industry and the Policyholders it Serves?

Publication

Human Activity Generates Carbon and Warms the Atmosphere. Is Human Ingenuity Part of the Solution?

Publication

Illinois Changes Stance on Construction Defect Claims – The Trend Continues

Publication

Generative Artificial Intelligence in Insurance – Four Aspects of the Current Debate

Publication

Battered Umbrella – A Market in Urgent Need of Fixing -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Publication

Underwriting High Net Worth Foreign Nationals – Considerations for U.S. Life Insurance Companies

Publication

Group Term Life Rate & Risk Management – Results of 2023 U.S. Survey

Publication

Trend Spotting on the Accelerated Underwriting Journey

Publication

All in a Day’s Work – The Impact of Non-Medical Factors in Disability Claims U.S. Industry Events

U.S. Industry Events

Publication

Marginal Gains in the Medicare Supplement Market -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Overweight and Obesity in Asia

November 30, 2014

Wan Siang Cheong

English

Although Asian countries have some of the lowest prevalence of overweight and obesity worldwide, they are experiencing alarming rates of increase in recent years. The boom in economic development and cultural factors are often cited as drivers. Knowledge about trends in overweight and obesity is important for underwriting this increasingly common risk group.

Trends of overweight and obesity rates

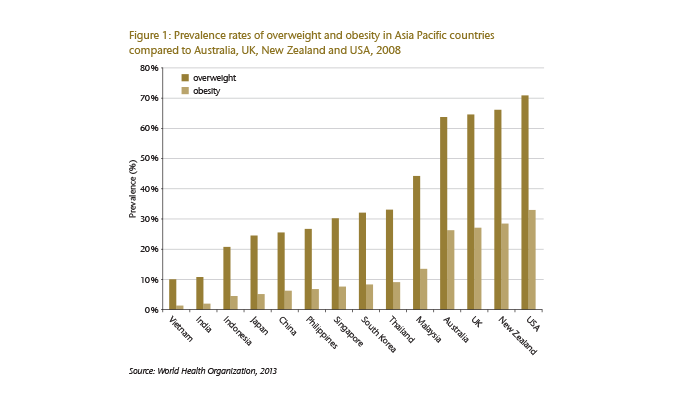

Vietnam and India have the lowest rates of obesity in Asia Pacific (1.7 % and 1.9 % respectively). Malaysia has the highest obesity prevalence at 14 % in the South East Asia region, with Thailand next in line (8.8 %). These figures fall far behind those in the Oceanic countries, with 26.8 % obesity rates in Australia and 28.3 % in New Zealand. The prevalence of obesity in these countries is similar to rates seen in the United Kingdom (26.9 %) and US (33 %) (see Figure 1).

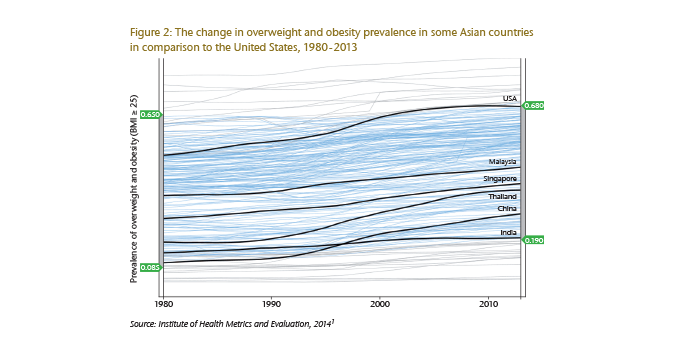

As seen in Figure 2, overweight and obesity rates in the United States have almost stabilized in the last five years, while rates are increasing at a faster pace in the Asian countries. Between 1980 and 2013, China’s overweight and obesity prevalence in adults rose from 11.3 % to 27.9 % and in individuals below age 20 from 5.7 % to 18.8 %.1 Malaysia saw a three-fold increase in obesity prevalence among adults, from 4.4 % in 1996 to 14 % in 2006.2 Likewise, overweight and obesity prevalence among adults in Vietnam more than doubled from 1992 to 2002 (2.0 % to 5.7 %).3

Higher risks associated with overweight and obesity in Asia

According to the World Health Organization, individuals with body mass indexes (BMIs) of 25.0 kg/m2 to 29.9 kg/m2 are considered overweight and BMIs of 30.0 kg/m2 and above are labelled as obese. However, since Asians tend to have higher amounts of abdominal fat at lower BMIs, these cutoffs may be insufficient in identifying Asian individuals with a high risk of obesity-related morbidity and mortality. In 2000 the Western Pacific Regional Office of WHO (WPRO) proposed an alternative definition of overweight (BMI 23.0 – 24.9) and obesity (BMI ≥ 25.0) for Asian populations. Multiple studies have confirmed the validity of the WPRO’s definitions in Asian cohorts. At any given BMI above 25.0 kg/m2, the respective mortality risk was higher among Asians in comparison to their US counterparts.4,5

Reasons for this are speculative, but likely due to the following:

- Asians have a higher percentage of fat at any given BMI, with proportionately higher cardiovascular risk.6

- Asians are more likely to develop central obesity, which is associated with higher risk of developing dyslipidaemia, impaired glucose tolerance, type 2 diabetes mellitus and CVD, as well as more adverse cardiovascular outcomes.7,8 One study demonstrated that children of Southeast Asian origin have a higher risk of increased blood pressure with higher BMIs compared to Caucasian children. Moreover, subsequent increase in Southeast Asian children’s BMI was accompanied by a more marked increase in systolic blood pressure compared to Caucasian children.9

- Asians engage in less physical activity than Caucasians. More than half of the adults in Taiwan admitted to having no leisure-time physical activity in the last two weeks, with 19 % meeting recommended physical activity in Taiwan, in contrast to 45 % in the US.4

Obesity-associated diseases such as hypertension, cardiovascular disease, and diabetes mellitus are on the rise, too. The prevalence of diabetes in China almost quadrupled in the last 15 years, making it home to the largest diabetic population in the world, with over 92.4 million Chinese diabetics and 148.2 million with impaired glucose tolerance.10 Malaysia experienced a twofold increase in diabetes prevalence from 11.6 % in 2006 to 22.6 % in 2013.11 In India, urban populations experienced a substantial increase in coronary heart disease prevalence from 1.05 % in 1960 to 9.67 % in 1995.12

Counteracting overweight and obesity

As of today, effective drugs for weight loss have yet to surface. As such, public health initiatives are considered one of the most important elements of obesity control and prevention. Multiple studies highlight the marked increase in energy-dense foods and the reduction in physical activity as a result of urbanization and affluence. Accordingly, obesity prevention policies focus on altering the food and physical activity environment.13

Although some progress has been made to curb overweight and obesity, much of Asia is still unaware of the consequences of obesity. In contrast to the West, where the consumption of fast food is considered cheap and time- saving, dining at an American fast food joint is proof of economic status in Asia. With economic development and easier access to fast food, households are able to indulge in energy-dense foods, along with luxury entertainments that encourage sedentary lifestyles.

In China parents and grandparents are constantly worried that their child/grandchild is not eating enough. A recent study revealed that 72 % of Chinese mothers thought their overweight children were normal or underweight.15 Thus, altering the cultural perception that “fat is prosperity” is essential for curbing the rise in overweight and obesity.

Case study: Singapore

Singapore’s Health Promotion Board has a strong presence within the local community, actively promoting health awareness through media campaigns. The following are specific campaigns implemented to promote healthy eating and active lifestyle among locals:

- CHERISH (Championing Efforts Resulting in Improved School Health) Award for Schools: This is awarded to schools with comprehensive health promotion programs for staff and students. To date, around 80 % of the schools in Singapore have received the CHERISH Award. Participating schools are also each given a grant to sustain their health promotion efforts.

- HEALTH (Helping Employees Achieve Lifetime Health) Award for Companies: This is given in recognition of companies with commendable Workplace Health Promotion programs, such as health risk assessment for employees and health education activities.

- Healthier Hawker Program: The program encourages hawker centers, local food courts where the majority of locals dine on a daily basis, to prepare their signature dishes with healthier ingredients. Participating stalls display a “Healthier Choice Symbol” on their Food Hygiene Certificates.14

Effects on the Life/Health insurance market

What we currently see in Asia is a divergence in nutritional status across geographical regions and socioeconomic status. This makes it difficult to generalize how increasing overweight and obesity rates will impact the Asian market. If the average BMI of the population increases, the additional mortality and morbidity risks may already be reflected in the baseline pricing. On the other hand, the long- term impact of overweight and obesity on mortality and morbidity may not be reflected in the past experience since the rising prevalence has been more pronounced only in recent years.

Mortality products

The effects of rising overweight and obesity prevalence on mortality products will be minimal in the long run, as the detrimental effects of obesity will be offset by better access to healthcare and improving medical technology.

Critical Illness products

The top three causes for CI claims in Asia are cancer, ischaemic heart disease and stroke,16 and the expectation is that the rise in obesity will directly influence the number of CI claims for obesity-affected risks. These include diabetes, heart disease, gallstones and certain cancers such as colorectal cancer, breast cancer in women, endometrial cancer, and cancers of the kidney, pancreas, liver and gallbladder.17

Health products

A prudent risk classification should ensure that overweight and obesity are appropriately rated for mortality and morbidity risk, or filtered out. The difficulty is in identifying individuals who will develop obesity in the future. Utilization of healthcare services by the overweight and obese is significantly higher – an obese patient spends US$ 2741 more a year for weight-related medical bills compared to a normal weight individual.18

Underwriting obesity in Asia

According to the build rating guidelines of Gen Re’s underwriting manual CLUE, a 35-year-old Asian will be accepted within the standard risk pool until he has a BMI of 29 and above. Underwriting for the Indian market is even more lenient as underwriters use the non-Asian BMI ratings, which only consider a BMI of 32 and above substandard risk.

A large proportion of Life and CI insurance applicants in Asia fall within BMI 25 to 30, a grey zone where the extra risks are small. Many of the people who are overweight or obese show unhealthy changes metabolically (e. g. raised blood pressure, raised cholesterol levels) and these indicators will be rated accordingly. This means that part of the extra morbidity and mortality risk is accounted for.

But what about the metabolically healthy overweight? The concept of being healthy and overweight has been debated over the past decade. In day-to-day underwriting, overweight individuals with no other ailments are rated as standard risks. However, recent studies suggest that overweight healthy individuals have an increased risk of cardiovascular events compared to normal weight healthy individuals.19

Despite the undisputable evidence that overweight and obesity increase the risk of multiple diseases, insurers in Asia continue to push the BMI cutoff for standard Life and CI ratings up. Nowadays, some insurers in Asia consider a BMI of 35 a standard risk, in an attempt to remain competitive. Fortunately, Asia’s obesity rates have yet to reach the extreme prevalence observed elsewhere and morbidly obese applicants are rare. With increasing media coverage of the “obesity pandemic” in conjunction with health initiatives, it is possible for Asia to curb the problem before it expands beyond control.

Download PDF version for Endnotes