-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

Production of Lithium-Ion Batteries

Publication

Time to Limit the Risk of Cyber War in Property (Re)insurance

Publication

Generative Artificial Intelligence in Insurance – Three Lessons for Transformation from Past Arrivals of General-Purpose Technologies

Publication

Human Activity Generates Carbon and Warms the Atmosphere. Is Human Ingenuity Part of the Solution?

Publication

Inflation – What’s Next for the Insurance Industry and the Policyholders it Serves? -

Life & Health

Life & Health Overview

Life & Health

Gen Re’s valuable insights and risk transfer solutions help clients improve their business results. With tailor-made reinsurance programs, clients can achieve their life & health risk management objectives.

UnderwritingTraining & Education

Publication

The Key Elements of Critical Illness Definitions for Mental Health Disorders

Publication

What Are We to Make of Cannabis Use in The Insured Population? Business School

Business School

Publication

Knife or Needle: Will the New Weight Loss Medication Replace Bariatric Surgery?

Publication

Weight Loss Medication of the Future – Will We Soon Live in a Society Without Obesity? Moving The Dial On Mental Health

Moving The Dial On Mental Health -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

The Home-Sharing Economy and Upcoming Coverage Options in the U.S.

December 13, 2016

Christine Unger

Region: North America

English

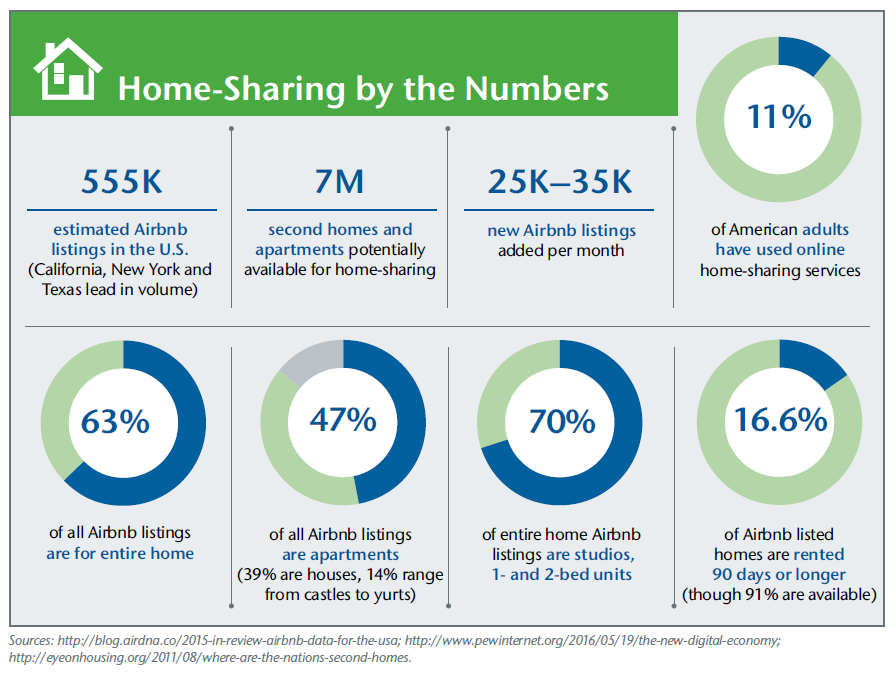

As the sharing economy becomes more common and accessible, the volume of people who use and provide services within it will continue to grow. According to Pew Research, 11% of all U.S. adults have used home-sharing services, and homesharing use is expected to quadruple in the next few years.

The rise of the sharing economy has also influenced the way that insurers look at their personal lines products. One aspect of the sharing economy insurers are addressing is home-sharing. Homesharing activities include renting out a single room in your home or renting out your entire home, typically for a short period of time. Some potential exposures include damage to the premises or personal property in the premises, theft of the homeowner’s personal property and bodily injury to guests while staying in the home. Several companies are offering endorsements to add coverage for home-sharing activities and ISO has developed endorsements to address the new exposures.

Proprietary Forms

Two national writers have developed endorsements for their insureds to add coverages for home-sharing onto their homeowners policies. The first’s endorsement, initially offered in a handful of states, offers limited coverage for personal property up to $10,000 per rental period. The second’s endorsement includes: protection for rental of other structures, increased coverage for damage to a landlord’s furnishings, increased protection for personal property, coverage for theft of personal property from the part of a residence rented to others, $100,000 for watercraft liability, and coverage for damage to trees, scrubs, plants or lawns caused by tenants.

These are only samples of proprietary forms. As home-sharing grows, so will the variety of underwriting approaches and company-specific coverage endorsements.

ISO Home-Sharing Endorsements

ISO has recently introduced several endorsements to be attached to their homeowners policies. These endorsements are expected to become effective March 1, 2017. Already, most states have approved the endorsements.

The endorsements can be divided into four different types:

- Endorsements that exclude home-sharing but preserve the traditional homeowners coverage

- Endorsements that include coverage for home-sharing host (homeowner’s) activities

- An Endorsement that increases the limits for Damage to Property of Others

- Other Endorsements that need to be revised as a result of the introduction of the endorsements discussed in numbers 1) and 2) above

Amendatory Endorsements

ISO has drafted Home-Sharing Host Activities Amendatory Endorsement for each of ISO’s homeowners policies for use with HO 00 02 through HO 00 08, respectively (HO 06 52, HO 06 53, HO 06 54, HO 06 55, HO 06 56, HO 06 58). The mandatory endorsements specifically exclude home-sharing activities, while preserving existing traditional coverage for homeowners’ incidental rentals and non-owner exposures. The endorsements accomplish this by introducing new definitions, including home-sharing host activities, home-sharing network platform, and home-sharing occupant. The current definition of business has also been revised to incorporate home-sharing. These endorsements reinforce that coverage is not extended to:

- Personal property of home-sharing occupants

- Personal property of another person occupying the

- Personal property in a space rented or primarily held for rental to a home-sharing occupant

- Personal property in a home used primarily for home-sharing host activities

- Fair rental value arising out of or in connection with home-sharing activities

- Losses because of theft, vandalism or malicious mischief resulting from home-sharing host activities.

Further, exclusions are added that address both renting–or holding for rent–an insured location for homesharing activities, and personal injury coverage arising out of home-sharing host activities.

Broadening Home-Sharing Endorsements

ISO has also drafted home-sharing broadening endorsements for each of its homeowners policies (HO 06 62, HO 06 63, HO 06 64, HO 06 65, HO 06 66, HO 06 68). The purpose of the broadening endorsements is to provide coverage for hosts of home-sharing participants. The broadening endorsements contain the same definitions as the amendatory endorsements (home-sharing host activities/network platform/occupant and amended definition of business). The endorsements provide property coverage for other structures and landlord furnishings, as well as property coverage for losses as a result of theft; however, the coverage does have some exceptions. Also covered is lost rental income due to the cancellation of homesharing occupants under certain conditions.

With respect to liability coverages, the broadening endorsement provides coverage for personal injury arising out of home-sharing host activities and the rental of an insured location for home-sharing host activities. Also included in the liability coverage is a “Damage to Property of Others Provision,” which addresses damages arising out of homesharing activities caused by an insured. If increased limits are not selected, a $1,000 limit per occurrence will apply to the Damage to Property of Others Provision.

The broadening endorsement categorizes both the property and liability coverages as primary. The coverage is primary over other insurance, a protection plan or a guarantee.

Damage to Property of Others – Increased Limits Endorsement

This endorsement (HO 06 51) allows for the selection of increased limits greater than the standard $1,000 limit provided under Section II–Additional Coverage, Damage To Property Of Others.

Revisions to Other Home-Sharing Endorsements

Several endorsements have been revised as a result of the introduction of the new home-sharing endorsements. These endorsements include: Special Computer Coverage (HO 04 14), Theft Coverage Increase (HO 04 30), Other Members Of Your Household (HO 04 58), Coverage B–Other Structures Away From the Residence Premises (HO 04 91), Specific Structures Away From the Residence Premises (HO 04 92), Extended Theft Coverage For Residence Premises Occasionally Rented To Others (HO 05 41), Trust Endorsement (HO 06 15), Unit-Owners Coverage A Special Coverage (HO 17 32), and Unit-Owners Rental To Others (HO 17 33). These endorsements have been revised to fit with the changes made to the Home-Sharing Host Activities Amendatory and the Broadening Home-Sharing Host Activities Coverage Endorsements. ISO is also revising the schedule of HO 24 73, the Farmer’s Personal Liability Endorsement, to address part-time farm employees working 40 days or fewer per year.

The changes discussed in this article are a reflection of the changing economy and give some insight into how both insurers and insureds should look at personal insurance products. Similar endorsements have not been developed for ISO’s Personal Umbrella Policy. If you need assistance developing similar endorsements for any of your personal umbrella products please contact your Gen Re account executive.