-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Trending Topics

Publication

Production of Lithium-Ion Batteries

Publication

Time to Limit the Risk of Cyber War in Property (Re)insurance

Publication

Generative Artificial Intelligence in Insurance – Three Lessons for Transformation from Past Arrivals of General-Purpose Technologies

Publication

Human Activity Generates Carbon and Warms the Atmosphere. Is Human Ingenuity Part of the Solution?

Publication

Inflation – What’s Next for the Insurance Industry and the Policyholders it Serves?

Publication

Pedestrian Fatalities Are on the Rise. How Do We Fix That? -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Training & Education

Publication

Key Takeaways From Our U.S. Claims Fraud Survey

Publication

The Effects of Heatwaves – A Look at Heat-related Mortality in Europe and South Korea

Publication

The Key Elements of Critical Illness Definitions for Mental Health Disorders

Publication

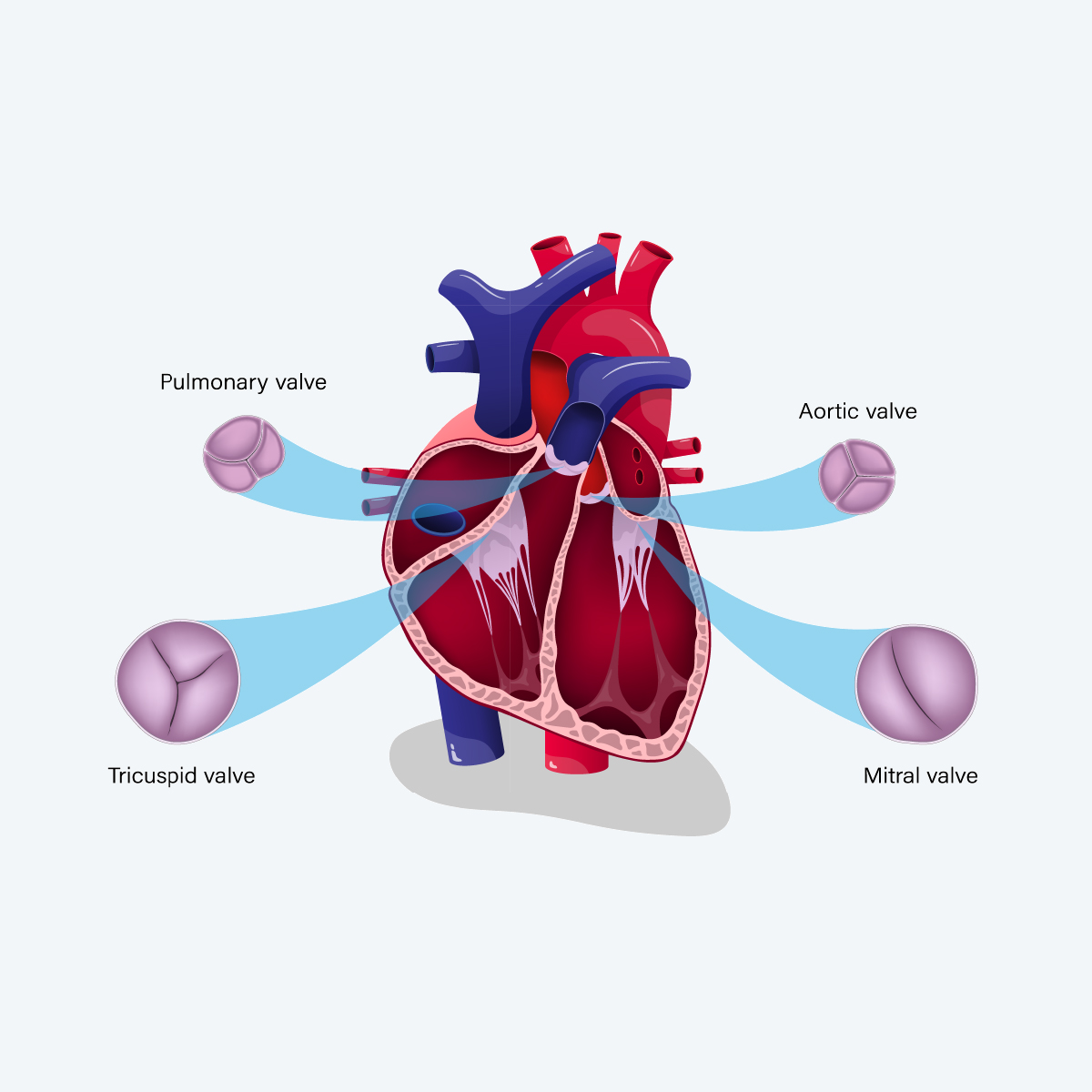

An Overview of Mitral Regurgitation Heart Valve Disorder – and Underwriting Considerations

Publication

Body Mass Index as a Predictor of Cardiovascular Health Moving The Dial On Mental Health

Moving The Dial On Mental Health -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

How to Make the Right Income Protection Claims Decisions

January 13, 2021

Mary Enslin,

Clio Lawrence

English

Français

The customer journey has rightly become crucial in Income Protection (IP), and key to that journey is a fast, accurate and positive claims experience. Insurers have made huge strides in achieving this, frequently supporting their clients’ recovery, but our research has found insurers could achieve more consistency in their claims decisions by putting in place treatment guidelines and better measurement tools.

That’s the message from a deep dive into the results from the UK, South Africa and Australia/New Zealand - all mature IP markets - in our global Claims Consistency Survey. (See our previous blog for other global findings and themes.).

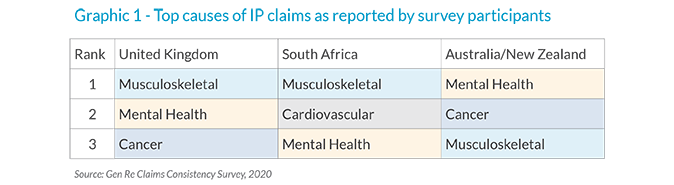

The biggest causes of claims

Mental health and musculoskeletal conditions are the biggest source of claims in the three markets. Both of these create challenging claims, as they can be difficult to manage and often have subjective symptoms. Frequently, they become intertwined and can, if not managed well, mean claims drag on. Claims managers must try to strike a tricky balance between the claimants’ needs with the known benefits of work.

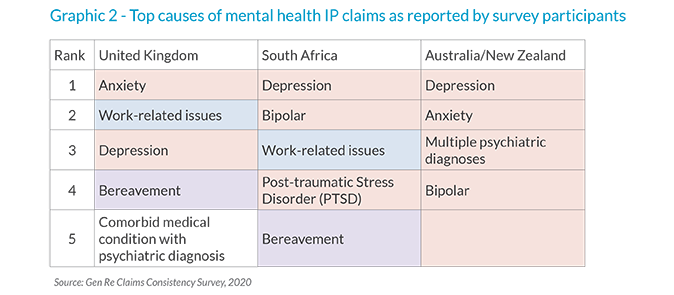

Of the specific top causes of mental health claims, some are commonly recognised conditions, whereas others are environmental stressors without a formal diagnosis. For example, in the UK and South Africa, work-related issues are the trigger of many mental health claims. While work-related issues can cause mental health symptoms, they do not necessarily result in disability in all cases and there is no agreed treatment protocol for these types of stressors. It is therefore surprising that this is a leading cause of claim and insurers should evaluate the medical and occupational evidence with care.

The COVID-19 pandemic has put mental health firmly in the spotlight, as workers struggle to cope with worries, including health fears, job security and lockdown rules. But there are encouraging early signs that people might be learning to cope with the “new normal”. The Total Brain Mental Health Index in August found that while feelings of anxiety and depression remained higher than pre-COVID levels, they had receded since May 2020.1 It is too early to know what effect this might have on IP claims, but insurers would do well to ensure their claims teams are equipped to manage these claims.

Inconsistency in rehabilitation

COVID-19 has created a new obstacle to helping claimants return to work. Many insurers already assist their claimants though this process, but, with anxieties running so high, early provision of the right intervention is more important than ever.

Cognitive Behavioural Therapy (CBT) is a valuable tool for dealing with for mental health claims, but, studies have shown that it often doesn’t result in the claimant returning to work unless it is provided with a clear focus on enabling that outcome.

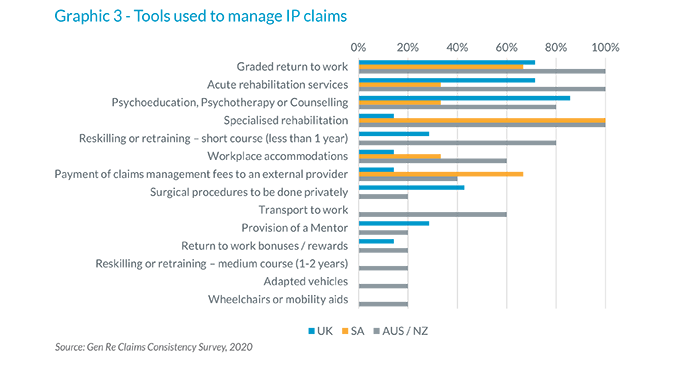

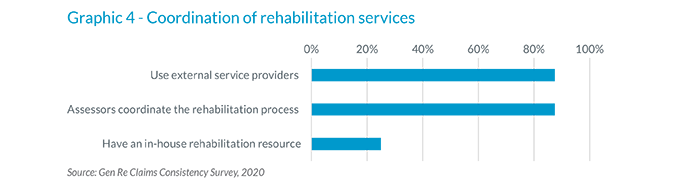

Also, our survey shows that while companies were good at determining a claim’s validity, they were less consistent when deciding on the best strategy for the review, management and rehabilitation of ongoing IP claims. Some said they would refer a claim to an external rehabilitation provider even when they have that resource in-house, raising the question of whether there are clear guidelines in place.

The need to measure claims interventions

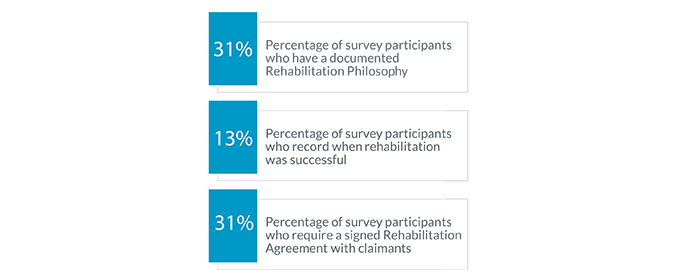

COVID-19 has forced medical staff and IP providers to move more of their diagnosis and treatment online. That’s had very positive outcomes, but most insurers are not measuring the effectiveness of their interventions particularly well - fewer than one-in-three, our survey suggests.

Claims teams have faced many challenges from the pandemic, but most survey respondents are using rehabilitation tools without measuring the outcomes. Claims departments are not capturing the impact of factors, such as product features, social issues, political context, internal processes and team experience. They need to do so in order to properly understand what impact this has on claims assessment and portfolio management.

In the first blog, we discussed the importance of having a documented general claims philosophy to create a framework on which decisions are made. Looking in more detail at claims management protocols, fewer than one in three respondents said they have a documented rehabilitation philosophy, which informs the claims management strategy and ensures the right resources are allocated to the right case at the right time. Also, surprisingly, little more than one-in-ten survey respondents require claimants to sign a formal agreement to participate in rehab, even though we know this results in a higher chance of success.

It’s clear from our survey that achieving consistency, through having robust decision-making frameworks in place as well as accurate data to inform the decision about which is the best rehabilitation strategy to pursue, is essential for a customer’s experience. Consistency also ensures insurers are making the best use of their resources.

If you are interested in learning more about the survey results, improving your claims team’s skills and consistency, or implementing any of the tools and techniques mentioned in this article, please contact your account executive at Gen Re.

Endnote