-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Trending Topics

Publication

Production of Lithium-Ion Batteries

Publication

Time to Limit the Risk of Cyber War in Property (Re)insurance

Publication

Generative Artificial Intelligence in Insurance – Three Lessons for Transformation from Past Arrivals of General-Purpose Technologies

Publication

Human Activity Generates Carbon and Warms the Atmosphere. Is Human Ingenuity Part of the Solution?

Publication

Inflation – What’s Next for the Insurance Industry and the Policyholders it Serves?

Publication

Pedestrian Fatalities Are on the Rise. How Do We Fix That? -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Training & Education

Publication

Key Takeaways From Our U.S. Claims Fraud Survey

Publication

The Effects of Heatwaves – A Look at Heat-related Mortality in Europe and South Korea

Publication

The Key Elements of Critical Illness Definitions for Mental Health Disorders

Publication

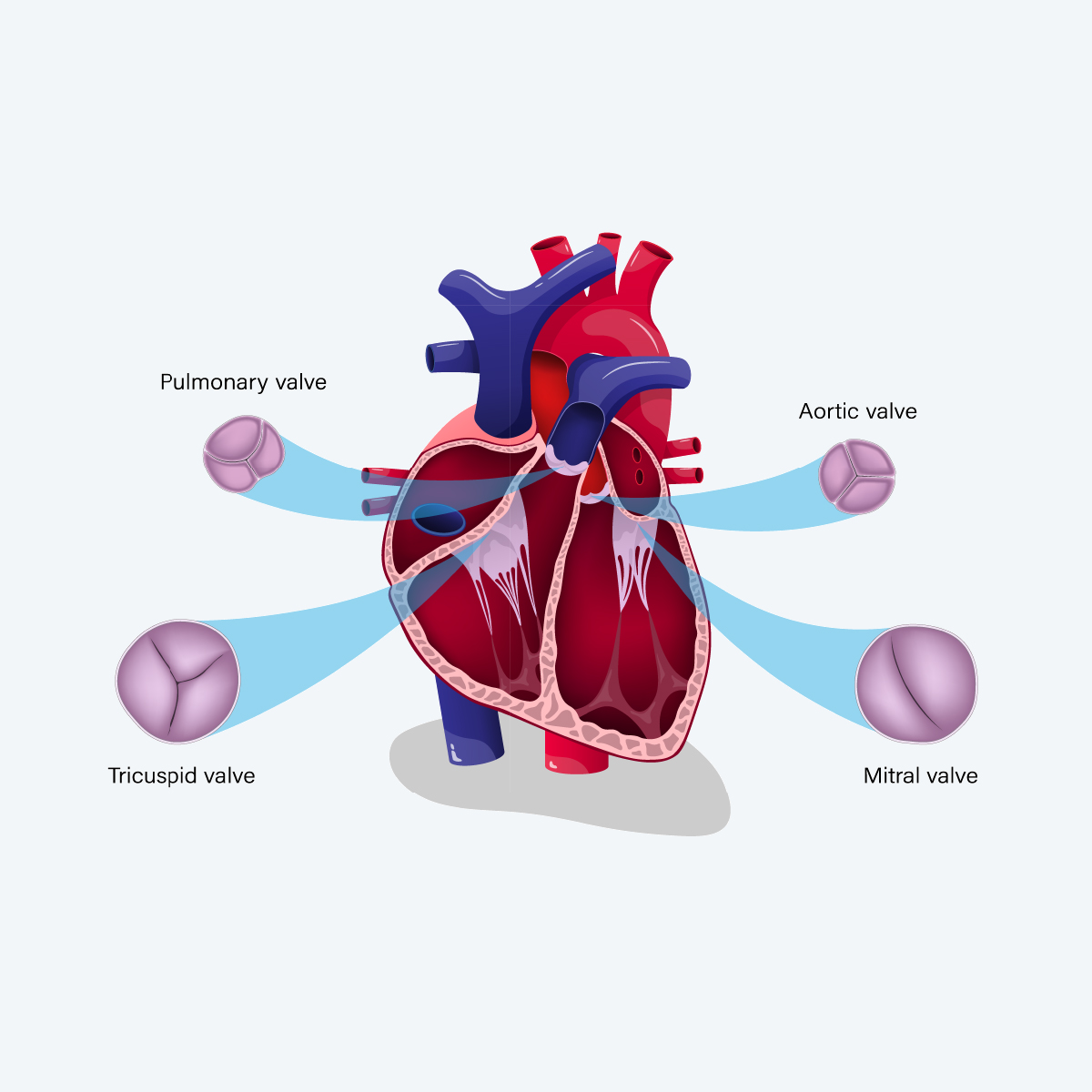

An Overview of Mitral Regurgitation Heart Valve Disorder – and Underwriting Considerations

Publication

Body Mass Index as a Predictor of Cardiovascular Health Moving The Dial On Mental Health

Moving The Dial On Mental Health -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Critical Illness Insurance – Highlights of 2019 U.S. Market Survey

October 20, 2020

Heidi Alpren

Region: North America

English

Gen Re is pleased to share this summary of key highlights from our 2019/2020 U.S. Critical Illness Insurance Market Survey. The full report provides insight into the state of the market, tracking sales and in-force results for Traditional Individual, Group/Worksite Attained Age and Group/Worksite Issue Age products, as well as Accident Insurance, and is made available only to participating companies.

Forty-six companies responded to this survey, with 37 also providing data for their Accident Insurance product.

Throughout the following report, some comparisons have been made to prior years’ results. Caution should be used in interpreting these comparisons, as the companies participating vary from year to year. In addition, as awareness of and interest in this product increases in the U.S., new companies are constantly entering the market. While each report is intended to be a snapshot for that year, we understand the importance of identifying trends and to that end have provided some commentary.

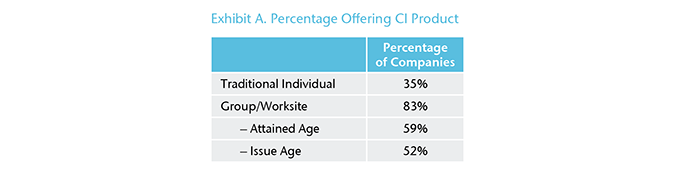

Marketing Critical Illness Products

Of the 46 participating companies, 26 offer one Critical Illness product, 19 offer two products and the remaining company offers three products. The majority (38 or 83%) offer a Group/Worksite (G/W) product, with 13 companies offering both Attained Age and Issue Age CI. (Exhibit A)

In total, the results represent 81 products currently being marketed. While 11 companies plan to make changes to their current G/W offering, none plan to modify their Traditional Individual product. Over half (51%) of the companies currently marketing a CI product expect to increase their focus on CI over the next few years. None reported their focus would decrease.

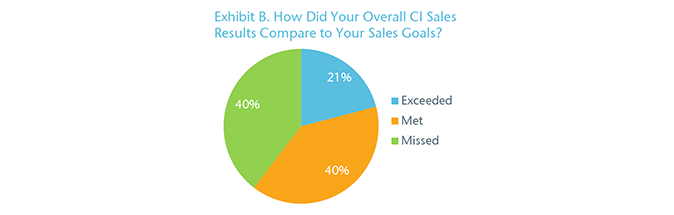

2019 Sales Results Compared to Goals

When asked how overall sales results compared to goals for 2019, more than half (61%) reported exceeding or meeting their sales targets. (Exhibit B)

For those companies that missed their goals, some mentioned competitive pressures; others commented on challenges with agent recruitment and distribution effectiveness.

Average Age at Time of Sale

The issue age for new business averaged 43 years for all three products combined. Traditional Individual averaged the highest issue age at 48 years, compared to 41 years for both G/W Attained Age and Issue Age. (Exhibit C)

Same Company Growth

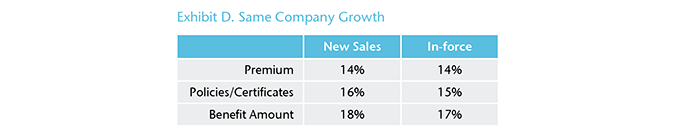

When comparing only those companies that provided product data for both survey years and taking into account any adjustments made to the 2018 data, the CI industry as a whole continued to exhibit positive growth in 2019. (Exhibit D)

New Business Sales

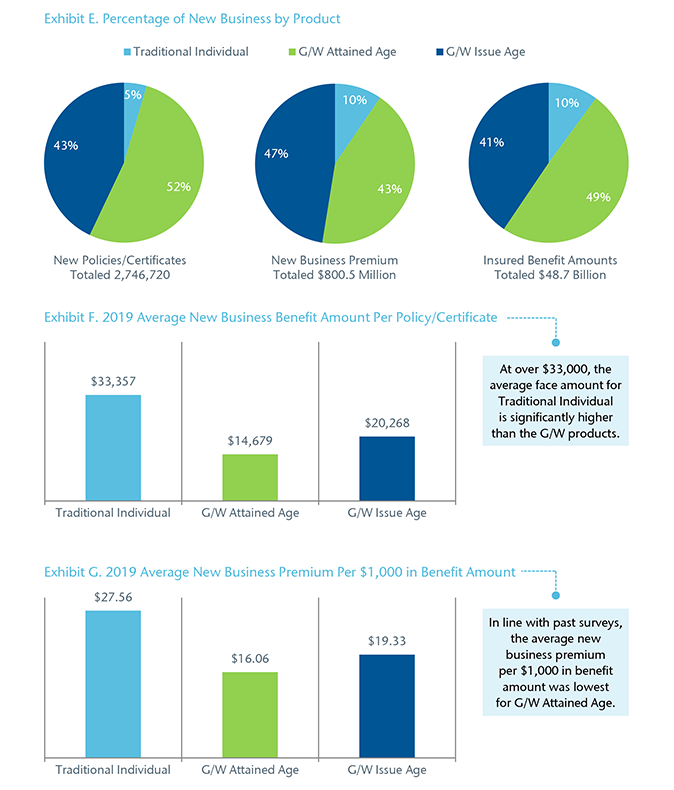

For 2019, participants reported selling 2.7 million new policies/certificates and just over $800.5 million in new sales premium. In terms of new sales premium, G/W Issue Age represents the largest segment, with $379.7 million of new sales premium or 47% of the total. (Exhibit E)

In-force Business

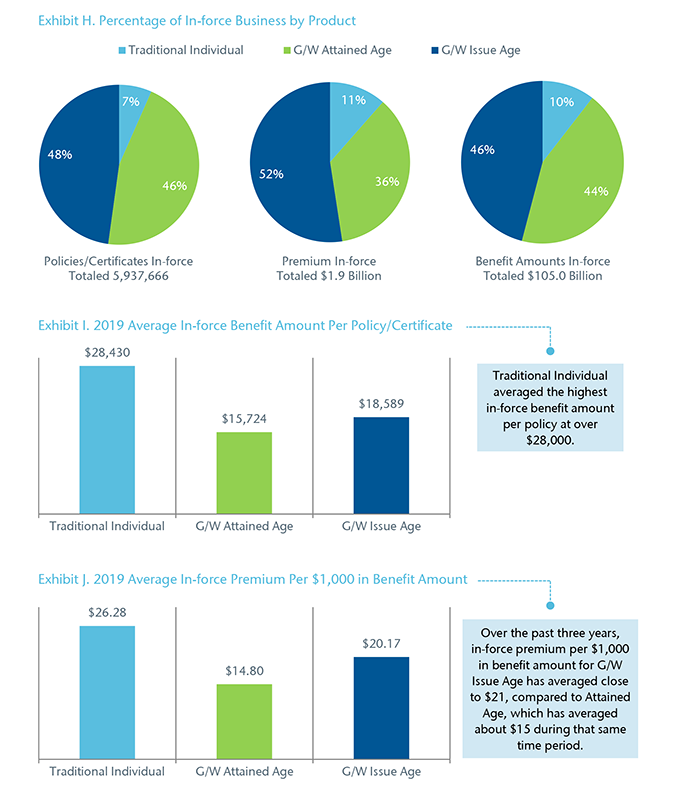

Participating carriers reported a combined total of 5.9 million policies/certificates with just over $1.9 billion of in-force premium in 2019. (Exhibit H) Based on in-force premium, G/W Issue Age business accounted for 52% of the total, with $984.1 million in premium.

Underwriting Administration

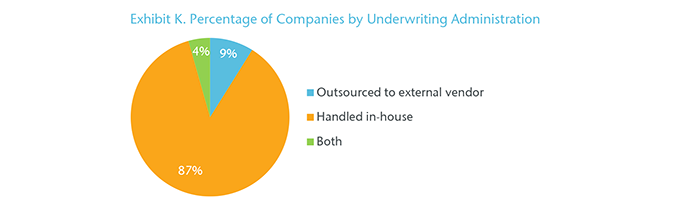

The majority of companies (87%) underwrite their CI products in-house. Four (9%) outsource their underwriting. (Exhibit K)

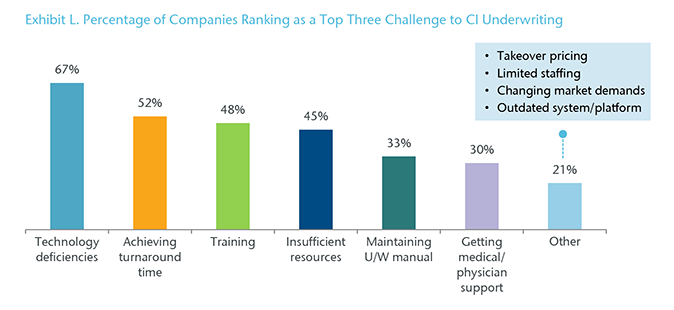

Underwriting Challenges

Two-thirds (67%) of companies cite technology deficiencies as one of the top three challenges to underwriting CI products. Fewer companies mentioned getting necessary medical/physician support (30%). (Exhibit L)

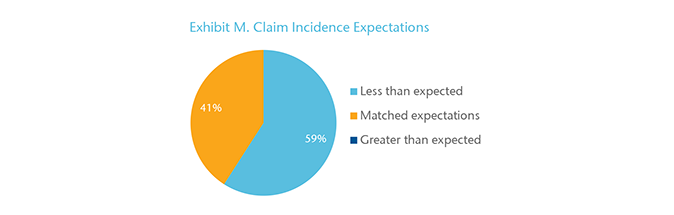

Claim Experience to Date

At the time that data was collected in June and July of 2020, all participants reported their claims incidence was less than or matched their expectations for the year. (Exhibit M)

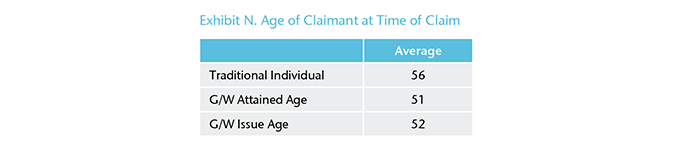

Average Claimant Age

At time of claim, the average age of a Traditional Individual claimant was 56 years, compared to 51 years for G/W Attained Age and 52 years for Issue Age. (Exhibit N) The lowest claimant age reported was 42 years for Traditional Individual and the highest was 72 years for the same product.

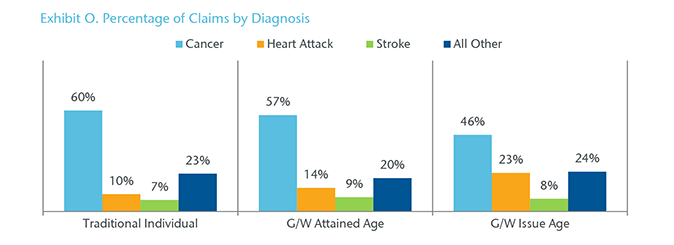

Types of Claims

On a combined basis, the three major diagnosis categories represent over 77% of the claims submitted for Traditional Individual, 80% for G/W Attained Age, and over 76% for Issue Age. (Exhibit O)

New Sales and In-force Business for Accident Insurance

Thirty-seven companies provided results for their Accident insurance product. For 2019, participating companies reported nearly 3.5 million new Accident policies and $773.6 million in new sales premium. For in-force business, roughly 8.4 million policies and $1.9 billion in premium was reported.

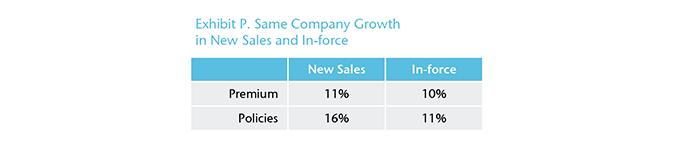

Same Company Growth

When comparing only those companies that provided data for both survey years and taking into account any adjustments made to the 2018 data, the Accident industry as a whole continued to exhibit positive growth in 2019. (Exhibit P)

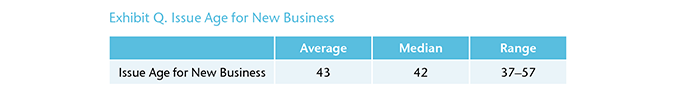

Issue Age for New Business

For companies that track the data, the average issue age for new business averaged 43 years for 2019 and ranged from 37 to 57 years. (Exhibit Q)

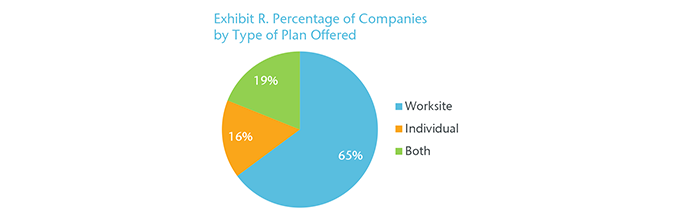

Type of Plan Offered

More than half of the companies (65%) offer worksite Accident only, while 19% offer both worksite and individual plans. (Exhibit R)

Download the PDF version for a list of participating companies.