-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Trending Topics

Publication

Production of Lithium-Ion Batteries

Publication

Time to Limit the Risk of Cyber War in Property (Re)insurance

Publication

Generative Artificial Intelligence in Insurance – Three Lessons for Transformation from Past Arrivals of General-Purpose Technologies

Publication

Human Activity Generates Carbon and Warms the Atmosphere. Is Human Ingenuity Part of the Solution?

Publication

Inflation – What’s Next for the Insurance Industry and the Policyholders it Serves?

Publication

Pedestrian Fatalities Are on the Rise. How Do We Fix That? -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Training & Education

Publication

Key Takeaways From Our U.S. Claims Fraud Survey

Publication

The Effects of Heatwaves – A Look at Heat-related Mortality in Europe and South Korea

Publication

The Key Elements of Critical Illness Definitions for Mental Health Disorders

Publication

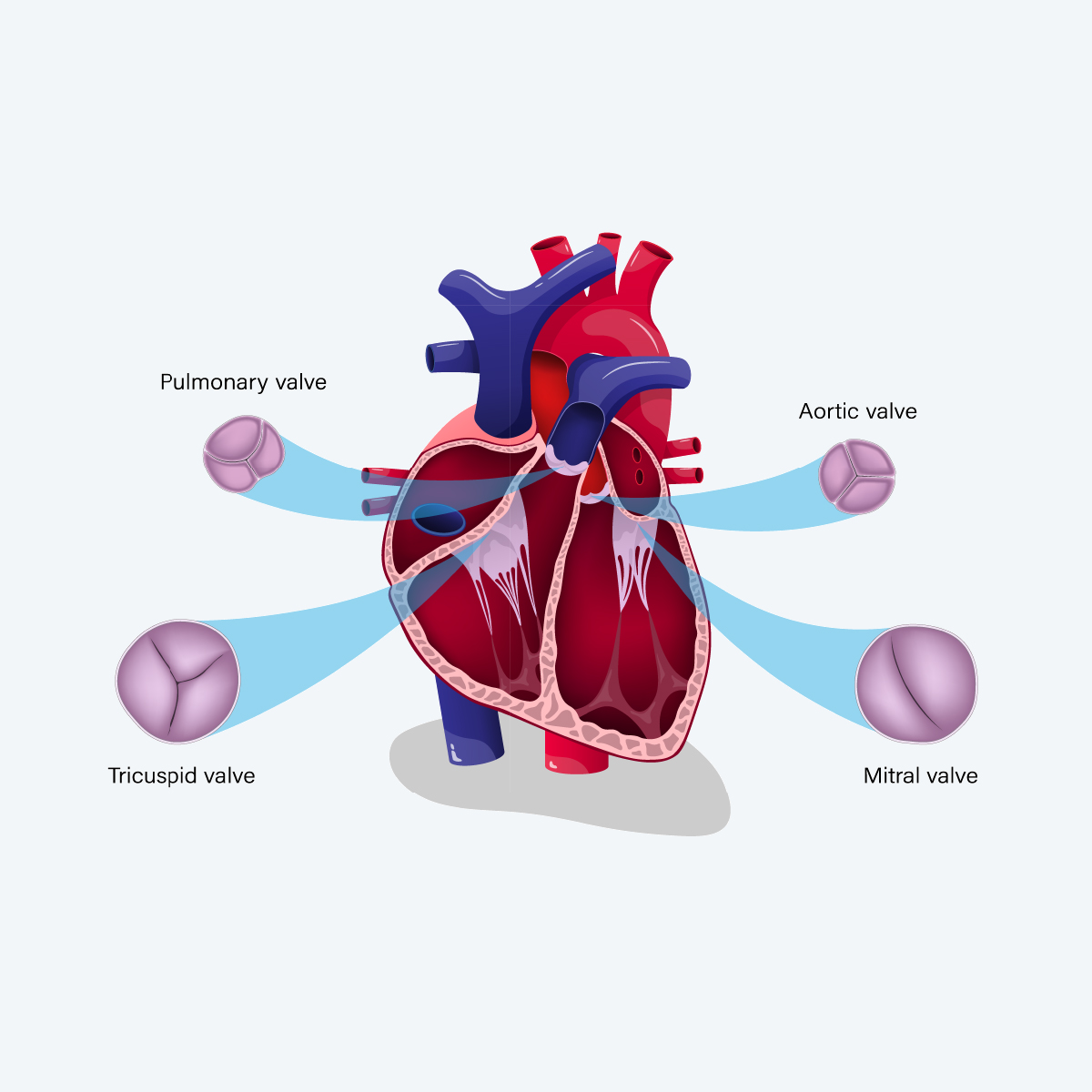

An Overview of Mitral Regurgitation Heart Valve Disorder – and Underwriting Considerations

Publication

Body Mass Index as a Predictor of Cardiovascular Health Moving The Dial On Mental Health

Moving The Dial On Mental Health -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Ecosystems – The Third Leg for Insurance Distribution in Asia

March 17, 2020

Tuan Miang Chua,

Hugh Terry, The Digital Insurer (guest contributor)

Region: Asia

English

When bancassurance came to Asia 20 years ago there were many in the industry who believed it wouldn’t work. History was clearly on the side of the innovators.

Over the last few years, we have seen the innovation of ecosystem models and the parallels with the introduction of bancassurance are similar - with the exception being that this time the insurance industry knows there are new opportunities to pursue. When we wind the clock forward to 2030 we might see three distribution channels in Asia - re-modelled agency, digitally invigorated bancassurance, and a raft of ‘ecosystem’ models.

Why do ecosystems rock?

Ecosystems work for insurers in the following four key areas:

- Affinity: They have a collection of people who are likely to be interested in insurance (think second-hand car websites or health record portals).

- Connectivity: They are connected to those clients digitally via apps, email, and social media.

- Data insights: They collect data on their customers so they can understand and anticipate customer needs.

- Compelling new products: The best ecosystems can create new products incorporating insurance into a broader solution (such as refund shipping insurance from Zhong An, or insurance offerings via the Ping An Good Doctor app).

In essence, ecosystems offer access to customers at a lower cost and the development of broader product propositions that will keep customers loyal.

What is the role of the insurer in ecosystems?

Insurers can, in broad order of ‘ecosystem influence’, take one or more of the following roles:

- Ecosystem orchestrators: Owning and developing the ecosystem. This is tough and many opportunities are already gone. But ecosystems in the health arena are still up for grabs.

- Ecosystem partners: Using partner agreement and strategic investments to secure a preferential and sustainable position in an ecosystem - this is much like bancassurance.

- Ecosystem supporters/participants: A specialist wholesaler able to offer ‘manufacturing’ capacity.

Any of these roles can be both valuable and profitable, but to be successful insurers need to be aware of their strategy and approach. Ecosystems do not have to be global or large - a niche approach to ecosystems in a single country could be very effective.

The evolution of super ecosystems

In China, we are now seeing the combination of payment and social media into WeChat, a made for measure tool that allows targeted marketing of insurance as well as education and customer service. Tencent (who owns WeChat) manages to provide insurers with payment and marketing services, at the same time as investing in new insurance startups such as WeSure and Zhong An, which allows access to additional opportunities.

Generally speaking, companies that can successfully combine payment platforms and social media are well placed to build an insurance business. The super apps from ride-hailing companies such as Gojek and Grab may also emerge - but they need to secure their payment capabilities first.

These tech giants can potentially bring a different profit margin perspective to insurance. Would we be ready for an aggressive entrant that treats insurance as a marginal cost business and doesn’t feel the need to cross-charge any of the fixed costs of its existing digital ecosystem?

Who will the winners be out of the existing incumbents?

It is too early to say, but partnership skills and agile/configurable tech will clearly be two of the key ingredients needed for success, as well as upfront capital investment in the form of equity and one-off distribution fees.

What will be the impact of ecosystem-based distribution in Asia by 2030?

The Asian insurance pie in 2030 will be a lot larger, and those that have re-modelled their existing agency and digitally re-invigorated the bancassurance channels will continue to thrive. Ecosystem models will also command a significant percentage of distribution. However, distribution channels might be increasingly blurred as some banks create their own ecosystem models and some agency channels plug into ecosystems.

For an in-depth look at how ecosystems are evolving in Asia, visit issue two of our Life and Health in Asia newsletter on The Digital Insurer website (sign-up is free).

About the authors

Tuan Miang Chua is head of Gen Re’s Life/Health business in a region consisting of ASEAN, China, Hong Kong and India. He has over 20 years of experience working in various Asian countries, Australia and Europe. Tuan is a Fellow of the Institute of Actuaries of Australia.

Hugh Terry is the Founder of The Digital Insurer. He has more than 20 years’ experience in the insurance industry including operational, consulting and entrepreneurial roles. He is an actuary by profession and lives in Singapore. He is passionate about the application of technology to insurance business models and as well as writing articles he actively shares his experience via consulting assignments, speaking opportunities and participation in entrepreneurial initiatives in the field of digital insurance.

Also included in issue two of Life and Health in Asia:

The New Wave: Evolving Pricing and Underwriting Models

This article looks at some emerging use cases for life and health underwriting in the region.

Mobile Payments as a Springboard for Life and Health Insurance - PayTM Case Study

An in-depth analysis of PayTM, one of the leading payment providers in India.

In Conversation with Gen Re Regional Director, Dirk Nieder

Dr. Dirk Nieder, Regional Director of Gen Re’s Life/Health reinsurance activities in North East Asia, discusses the rise of insurtech in Japan and Korea.

Chief Executive, Asia Life/Health & General Manager, Shanghai Branch

See All Articles