-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Trending Topics

Publication

Production of Lithium-Ion Batteries

Publication

Time to Limit the Risk of Cyber War in Property (Re)insurance

Publication

Generative Artificial Intelligence in Insurance – Three Lessons for Transformation from Past Arrivals of General-Purpose Technologies

Publication

Human Activity Generates Carbon and Warms the Atmosphere. Is Human Ingenuity Part of the Solution?

Publication

Inflation – What’s Next for the Insurance Industry and the Policyholders it Serves?

Publication

Pedestrian Fatalities Are on the Rise. How Do We Fix That? -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Training & Education

Publication

Key Takeaways From Our U.S. Claims Fraud Survey

Publication

The Effects of Heatwaves – A Look at Heat-related Mortality in Europe and South Korea

Publication

The Key Elements of Critical Illness Definitions for Mental Health Disorders

Publication

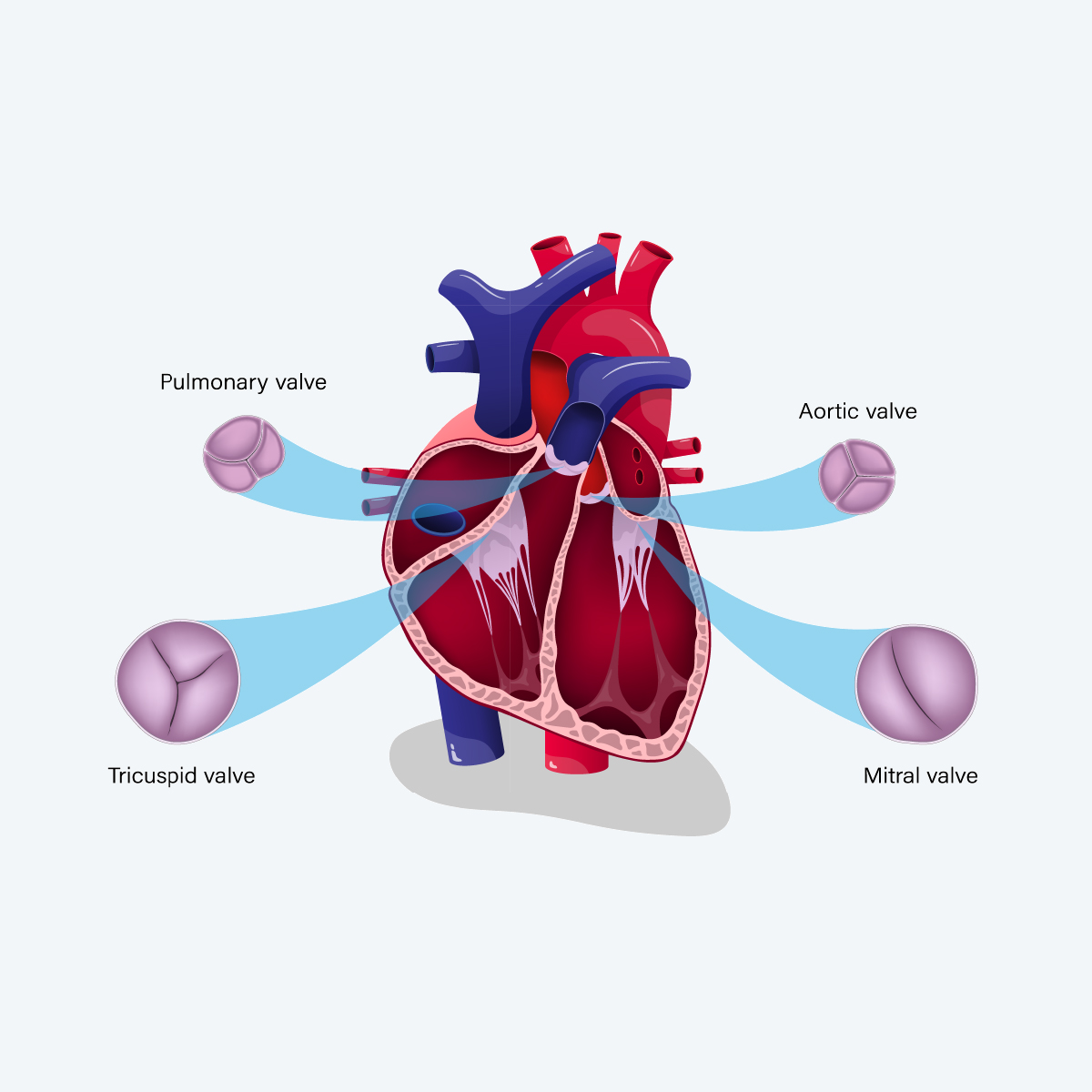

An Overview of Mitral Regurgitation Heart Valve Disorder – and Underwriting Considerations

Publication

Body Mass Index as a Predictor of Cardiovascular Health Moving The Dial On Mental Health

Moving The Dial On Mental Health -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Medicare Supplement - Is It Your Next New Product?

November 29, 2016

Steve Woods

Region: North America

English

It’s never easy adding a new product to your current portfolio. After all, there are many factors to consider and questions to answer. What if the new product doesn’t align with your current strategy? Can your distribution sell this product? What will the capital strain be? Does it adequately meet customers’ needs? These are just a few of the many questions that come to mind.

Sometimes in the midst of a new product initiative, other important questions go unanswered. In fact, one that may not come up is whether your new product offers adequate cross-selling opportunities. I’ll get into why in a moment.

Over the past several months we’ve spoken with Individual Life carriers of all sizes about their unique challenges given the current economic environment. Some of the common themes include declining sales, flat earnings, limited capital and the struggle to attract new customers. They’ve been looking for product solutions to address these challenges but realize that most come with a hefty price tag.

During this time, Gen Re has been working with carriers to bring a new product to market that addresses some of these challenges - one that promises to expand their product portfolios quickly and profitably. The product is Medicare Supplement insurance, or Medigap as it’s also called.

Here are a few facts to consider:

- Medigap is currently a $25 billion market with premium growth of 6.7% in 2015.

- 10,000 people a day are turning age 65 - a trend that will continue for the next 15 years.

- Entering the Medigap market can be accomplished with very limited resources and risk assumption.

Read Our White Paper "Mind the Medigap Opportunity" to Learn More

Back to my point about cross-selling, we feel that Medigap offers an excellent means of not just attracting a new segment of the population to your company but also selling additional coverage to existing customers. After all, meeting the needs of an existing customer is valuable to a company’s sales efforts. (In fact it’s 50% easier to sell to a current customer versus a new one.1)

We get it. You have lots of questions that sometimes go unanswered. Having said that, before you move on from this blog please take a moment to review the information below. It might help address your preliminary questions about Medigap.

We’re not a health company and don’t want to get into the health business. Medicare Supplement is not a traditional health product. It is a supplement to traditional Medicare insurance. It is a standardized product that helps to pay coinsurance or copayments and deductibles that Medicare does not cover. In fact, none of the companies we work with today are in the health insurance business.

We’re not in the senior market. Few carriers today are focused on the senior market (65+). However, not only is this an excellent opportunity to attract new senior customers, it will also help to retain those that you already have. As your current policyholders approach retirement, their financial needs are changing. Having a product in your portfolio that directly addresses a need they will have in retirement will help to solidify the relationship.

Capital strain is an issue for us right now. We can’t afford to bring a new product on that would magnify this issue. Unlike some life products, the capital requirement for Medicare Supplement is less burdensome. Lapse rates are extremely favorable, first-year commissions are usually less than 30%, and rates are predominantly based on attained age and annually renewable.

We don’t have the resources to bring a new product to market. One of the benefits with the way Gen Re approaches our Medicare Supplement carrier relationships is that you can be as involved with the process as your resources allow. We will take up to 95% of the risk; however, the value we bring to the table is much broader than our risk share. By leveraging our existing expertise and third-party relationships, we are able to present multiple options for administration, distribution and actuarial pricing.

We have no expertise in the Medicare Supplement market and don’t want to hire someone to manage this product. Partnering with Gen Re to bring a Medicare Supplement offering to the market will give you access to our consultative services. Reinsurance is our primary business; however, we will work with you on all aspects of this project, from product development and pricing to issuing the first policy through administration of the in-force block of business.

Our distribution is focused on our core products and we don’t want them distracted by a new product. We constantly hear from carriers that they don’t want their current distribution people taking their eye off the products they are selling. We understand their position and agree that in some situations it makes total sense. In this case, however, bringing an alternative distribution to the table that focuses on Medicare Supplement is a better approach. The added benefit is that this alternative distribution channel may be able to cross-sell some of your other products, which would enhance and expand your current distribution.

If you were thinking about making Medicare Supplement your next new product, hopefully this answered your initial questions. If you are looking for a more detailed conversation - including how it can solve some of the challenges you are facing today, or how we can help your company enter a new and growing market - please reach out to me at steve.woods@genre.com or +1 207 347 4621.