-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Trending Topics

Publication

Production of Lithium-Ion Batteries

Publication

Time to Limit the Risk of Cyber War in Property (Re)insurance

Publication

Generative Artificial Intelligence in Insurance – Three Lessons for Transformation from Past Arrivals of General-Purpose Technologies

Publication

Human Activity Generates Carbon and Warms the Atmosphere. Is Human Ingenuity Part of the Solution?

Publication

Inflation – What’s Next for the Insurance Industry and the Policyholders it Serves?

Publication

Pedestrian Fatalities Are on the Rise. How Do We Fix That? -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Training & Education

Publication

Key Takeaways From Our U.S. Claims Fraud Survey

Publication

The Effects of Heatwaves – A Look at Heat-related Mortality in Europe and South Korea

Publication

The Key Elements of Critical Illness Definitions for Mental Health Disorders

Publication

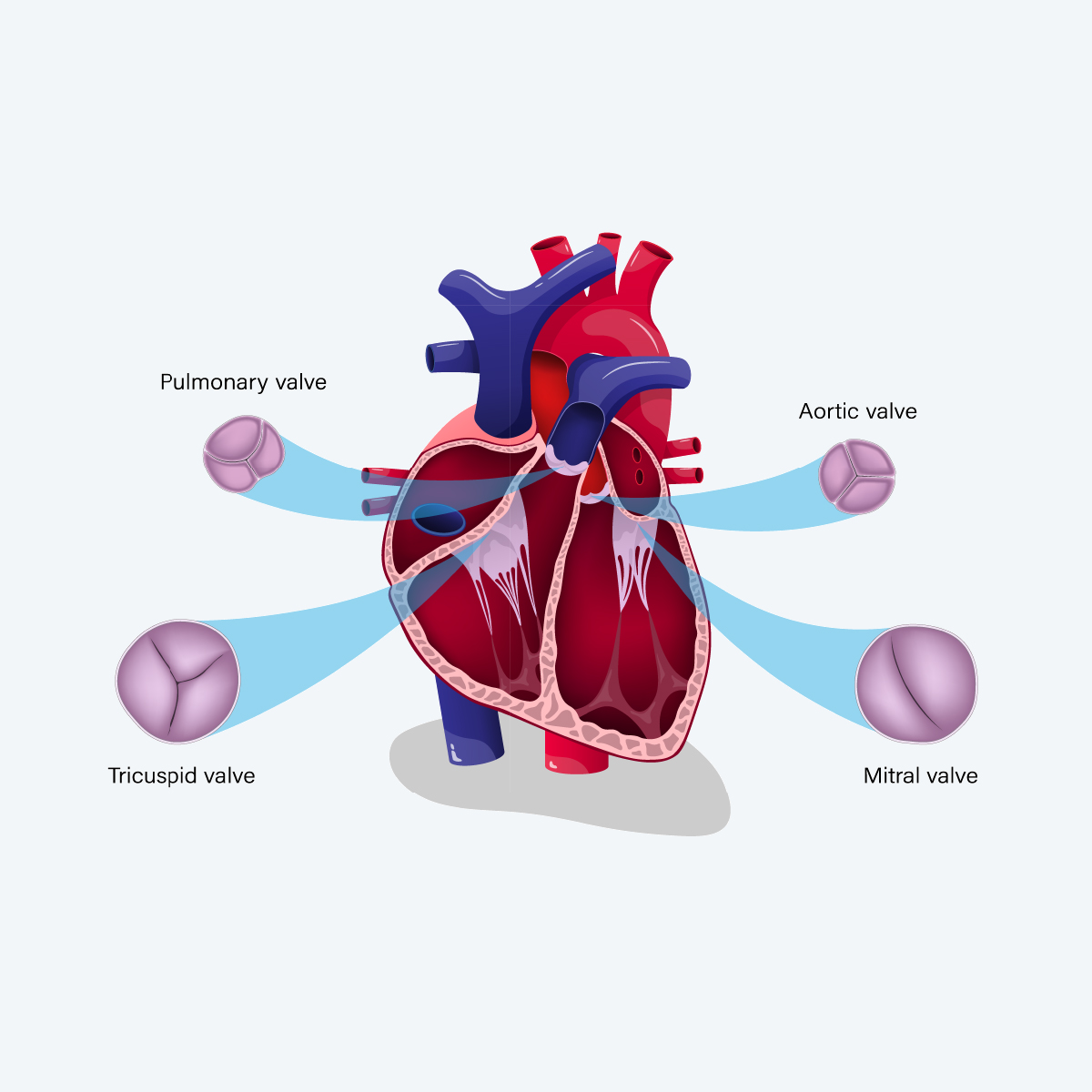

An Overview of Mitral Regurgitation Heart Valve Disorder – and Underwriting Considerations

Publication

Body Mass Index as a Predictor of Cardiovascular Health Moving The Dial On Mental Health

Moving The Dial On Mental Health -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Contractors and Defective Workmanship – Insurer Claim Perspectives

April 13, 2014

Paul Kelejian

Region: North America

English

Insurance claim departments have decades of experience handling construction defect claims. As a result, they have accumulated many valuable insights into contractor exposures. What perspectives might they want to share with underwriters? We conducted interviews with a variety of insurance company claim personnel across the industry to get their thoughts and suggestions. In this article, we share the collective claim wisdom gleaned from their daily work in the construction defect trenches, discussing types of programs, structuring coverage, policy wording, risk selection and loss control. Insurers with different construction specialties and jurisdictions might take exception to a few comments. Indeed, we might not share all their views. However, the general claim discussion should strike a few chords with all carriers writing in the contracting space.

Key Issues and Learnings

1. Type of Program refers to whether the work is residential or commercial, as these two types of construction often run on different tracks within insurance companies. There was a difference of opinion on this, with some carriers asserting the risks were essentially the same. These carriers, however, underwrite insurance for smaller artisans, so the commercial risks they see may be smaller in scale than the companies that underwrite projects of larger subcontractors and general contractors.

Commercial projects tend to attract larger contractors, who have better record-keeping, up-front-diligence and construction practices (except in New York and Illinois where site safety issues are problematic). Residential work needs to be parsed between various categories of structures/projects: single-family homes, tract developments (size of tracts is also a factor), apartments, condominiums/townhouses and remodeling. Commercial projects also are more likely to have steel framing or reinforced rebar rather than the more problematic wood framing. High-rise construction is generally thought to have fewer problems due to the sophistication of the design and specialty of the contractors involved. When the type of project is not aligned with contractor size and experience, construction issues are more likely to arise.

2. Insurance Program Structure is a significant factor in risk mitigation. Is there a Wrap policy covering all entities on the job site, or a traditional policy issued to a named insured? The chronic problem of construction litigation is the number of parties involved looking to shift liability: GCs pointing to subcontractors, and subcontractors pointing at each other and back at the GC. Add to this the likelihood of multiple insurers for each defendant. The inherently inefficient dynamics increase the litigation costs in CD cases, and this translates into higher settlement values as well.

Wraps generally reduce coverage battles, assuming that the limits are adequate. In the CD context, the benefit of a Wrap is that the carrier is controlling the entire claim and can contain costs by avoiding the numerous claims and cross-claims between and among the subcontractors. A drawback to Wraps is that any coverage issues at all, regardless of type of loss, will result in a great deal of cost for all the contractors. And we know that CD losses tend to present coverage issues.

It remains to be seen if Wrap coverage can be fully utilized across all sizes of projects, rather than the very large ones with which it has historically been associated.

3. Insurance Wordings are also critical to coverage outcomes. Depending on the risk type, a self-insured retention (SIR) is viewed as a favorable way to align interests. If a large entity can afford to retain a substantial portion of the risk, the SIR option is viable. Deductibles can be an inadequate mechanism for ensuring the insured has “skin in the game.” Will they be collectible after contractors are beset with lawsuits? They present a credit risk that does not help the carrier (and cannot be ceded to the reinsurer), and it's a credit risk that increases with long-tail claims. However, insurers may still need to respond even with an unsatisfied SIR, depending on the case law in the jurisdiction. Also, a carrier may want to defend to protect its exposure above the SIR.

Most carriers are now including Montrose exclusions, excluding known losses and prior work. Some are deleting the subcontractor exception to the “Your Work” exclusion. Many use multi-family unit exclusions and sub-limits for completed ops cover. A real trend watched by carriers is the increased exposure to Additional Insured (AI) endorsements under developing case law. Companies are now trying to limit their AI exposure, either monitoring the issuance of same, or by making them apply only to ongoing operations. Insurers for both GCs and subs need to be aware of the scope of AI cover that is or is not available.

ISO has wording options available to match underwriter intent with coverage on all of these issues. Knowing exactly which forms were issued and how they apply to the claim is part of the job.

4. Risk Selection remains an important factor, with many carriers being selective about the types of contractors they underwrite. The subcontractors that typically draw the most exposure - foundation, framers, roofers, window installers, etc. - are considered more difficult risks due to their scope of work being inherently more problematic than other subs, and often times the focus of the claims. Some carriers avoid framers; others prefer to stay with smaller artisan-type contractors. General contractors remain the most difficult class to underwrite because they are usually the lead defendant in any multi-party suit.

5. Geography is another component of risk selection. New York and Illinois are considered very difficult from the standpoint of worker bodily injury arising out of job site accidents. Otherwise, insurers tend to encounter more challenges in a variety of Western states, including: Arizona (Phoenix), California (except the Sierras and North of Santa Rosa), Colorado, Montana, Oregon (Portland/wet areas), Nevada (Las Vegas) and Washington (similar to Oregon, coupled with very strict claim-handling standards and high bad faith exposure). The legal environment in these states can change, as can an insurer's view of that environment. For example, one carrier advised that after a moratorium prompted by the Colorado 2010 CD statute, they have re-entered that state.

In some locales, challenges may stem from insurance claim handling regulations rather than CD risks, such as Missouri. Finally, we often hear that Texas urban areas present large CD exposures, but many carriers indicated that the entire state requires strong underwriting practices.

6. Risk or Loss Control is viewed as another key component to underwriting this line profitably. Verifiable risk control practices are the key. Construction contracts and enforceable risk transfer provisions must reflect best practices. Additional Insured endorsements need to be scrutinized (more subcontractor carriers are including AI endorsements that do not respond until the subcontractor's liability has actually been adjudicated). Many carriers also examine a risk's due diligence for verifying its AI status. The more experienced contractors maintain counsel to regularly assist with their contracts (both with their customers and with their subcontractors), and that may be part of an insurer's loss control checklist. For all size risks, good job site safety practices are critical, including the training of employees, oversight of subcontractors and quality control procedures.

For smaller subcontractors, the focus is often on risk transfer: Does it seek to name all potential AI entities or just rely on a blanket? Does it also subcontract work? What is the quality of its contracts? Another loss control practice is video-documentation of the building as it is being constructed. Documentation of all changes is also important, too, and it is best to have contemporaneous notes, taken by someone present, that include the date, parties present, and to whom and how the changes were communicated.

Closing Thoughts

Claim professionals recognize that insuring construction is an inherently difficult undertaking, as do the insurance underwriters with whom they work. Great care and expertise are critical for both disciplines if a company truly intends to achieve and maintain profitability.

The economic downturn resulted in a “thinning of the herd” in the construction industry, with the survivors being the more capable contracting firms. With good risk selection, insurance programs and loss control, insurance carriers have the potential to reap great rewards. Strong claim skills will be an important part of that success.

We express our appreciation to the many insurance claim professionals who took the time to share their insights from handling construction defect claims. We continue those conversations as part of our reinsurance support role, and look forward to providing more of their learnings and expertise in the future.