-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Trending Topics

Publication

Production of Lithium-Ion Batteries

Publication

Time to Limit the Risk of Cyber War in Property (Re)insurance

Publication

Generative Artificial Intelligence in Insurance – Three Lessons for Transformation from Past Arrivals of General-Purpose Technologies

Publication

Human Activity Generates Carbon and Warms the Atmosphere. Is Human Ingenuity Part of the Solution?

Publication

Inflation – What’s Next for the Insurance Industry and the Policyholders it Serves?

Publication

Pedestrian Fatalities Are on the Rise. How Do We Fix That? -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Training & Education

Publication

Key Takeaways From Our U.S. Claims Fraud Survey

Publication

The Effects of Heatwaves – A Look at Heat-related Mortality in Europe and South Korea

Publication

The Key Elements of Critical Illness Definitions for Mental Health Disorders

Publication

An Overview of Mitral Regurgitation Heart Valve Disorder – and Underwriting Considerations

Publication

Body Mass Index as a Predictor of Cardiovascular Health Moving The Dial On Mental Health

Moving The Dial On Mental Health -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

No Easy Way Out: An Overview of International Trends in Suicide

April 01, 2014

Sara Goldberg

English

Demographers commonly attribute past and projected mortality improvements to advances in medicine, increased health awareness and disease prevention. Since 1950, we have seen over 85% improvement to infant mortality in the developed world and over 70% improvement to age-standardised cardiovascular mortality in the US. In contrast suicide rates remain stubbornly high and even increased in some countries. The current annual global toll from suicide is nearly one million deaths, the third leading cause of death in ages under 45.1 While medical research has driven improvements in challenging clinical fields – HIV and breast cancer treatment serve as examples – similar work has not proved capable of mitigating suicide.

Suicide prevention and risk detection efforts have fallen short due in large part to a lack of awareness of serious depressive illness, especially when coupled with existing social and cultural stigma that blights open discussion of its impact. Unlike most illnesses where patients exhibit a strong will to avoid mortality – to beat cancer, to fight infection – the will in those at risk of suicide takes a fundamentally opposite tack. This article explores the background to the persisting trends in suicide, its drivers and exacerbation by economic uncertainty, and considers what steps insurers may take to protect themselves from the impact of claims.

Introduction to drivers

An analysis of the “causes of causes” of death, though difficult to ascertain, may clarify whether mortality triggers are stable, poised for improvement or deterioration or, more specifically, linked to the economy. A Japanese study found a strong economy was positively correlated with heart disease mortality and transport accidents, but uncorrelated in stroke and negatively correlated with suicide.2 Meta-analysis reveals differing findings on the correlation between economy and cause of death trends, but suicide is the one cause uniformly agreed as inversely correlated with a good economy.3,4,5

Suicide has multiple drivers, including underlying clinical depression and mental disorders whose long-term prevalence (detected or not) should be fairly stable over time. Greenland’s disturbing suicide rate is perhaps partly a function of its geography – higher general rates of depression with seasonal suicide peaks in the permanent daylight of the summer months – which would not be expected to change significantly over time. Cultural perception and acceptance also plays a major role in explaining why certain East Asian countries’ long-term suicide rates remain far higher than, for example, in South America.

Ironically, increased awareness can prompt an increase in suicide levels. Before the Jonestown cult mass-suicide of 1978, Guyana enjoyed a low incidence (in common with other South American countries) but ever since, the suicide rate has continued to climb – predominantly in the youth – and is currently the highest in the Western Hemisphere. This trend may have initially been the mark of copycat suicide, stemming from “awareness” drawn from media coverage. Another rationale could be the increased availability of agricultural pesticides in Guyana – limiting supply of similar chemical agents has been discussed in South Africa and China where they have long been a major contributor to suicide deaths.6 Theoretically, constricting supply is not effective prevention if demand still exists, as means (supply) will eventually be replaced. However, limiting or even removing easy access to poisonous agents has been proven to reduce suicide. Restrictions on Paracetamol sales and the prescription of less toxic antidepressants have had a positive impact. In the United Kingdom, self-poisoning with carbon monoxide accounted for nearly half of all suicide deaths before domestic coal gas was phased out in favor of harmless natural gas in the 1960s, after which the suicide rate fell by nearly one-third permanently.7

Variation and trends

The precise drivers of suicide tend to be age-specific. For example, copycat behaviour and social pressure are commonly identified in younger suicides. Pressure to maintain financial stability disproportionately impacts vulnerable males in middle age. Concerns over losing independence or becoming a financial or care burden prompt suicide at older ages.

In fact, weakening social integration and erosion of the traditional support base for the elderly are trends implicated in suicides by South Korean men over age 80, which have more than doubled in the decade preceding 2011, exceeding rates of two per mille. Accordingly, South Korea has recently surpassed Japan in suicide rates, and the Korean insurance industry has seen corresponding increases in suicide claims, from KRW 56.2 billion in 2006 to KRW 165 billion in 2010.8,9,10,11 Despite the existence of such patterns, suicide risk remains extremely difficult for life underwriters to identify and nearly as impossible to predict, much less prevent, as it was a century ago.12

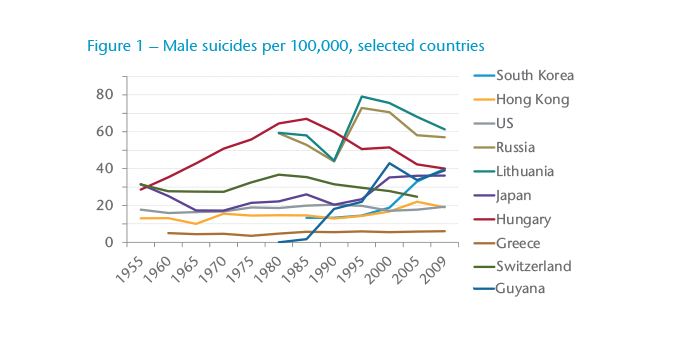

Figure 1 provides an overview of male suicide trends in selected countries. Among the countries featured in the graph, Hungary and Switzerland exhibit promising trends, but they are alone here in showing steady improvements. It depicts male trends only; as a rule, male rates are higher than female rates globally. China (not pictured due to conflicting data), where the female rate is as much as three times higher, is a notable exception to this rule. The rate in China – reported to be among the highest in the world – is partially driven by high numbers of rural suicides, which affect life insurers to a lesser extent.13 One phenomenon that may impact insurers in neighboring markets, however, is the purchase by affluent Mainland Chinese of policies with high benefits available in Hong Kong and elsewhere. There are many reasons to purchase a policy overseas, but one might be moral hazard and, among other things, cross-border claims investigations can be futile.

Suicide rates increased so sharply in the 1990s following the monetary and political upheaval in Russia, and an economic slowdown in Japan, that aggregate mortality among young males in those two countries experienced a rare deterioration in the decade. A major Japanese insurer reported that 10% of all life claims in one year were suicides – this alone would eliminate margins for many insurers. In both countries, but particularly Japan with its high insurance penetration, suicide can exert a major effect on overall insured mortality trends and can be over-represented in claims, depending on the age range and duration of product sold.

Japanese men have suicide rates twice those of women, though it is increasingly a factor of death in young females. Numbers doubled for males in all ages since the 1970s with a spike starting in 1997. Due to the age shape of mortality curves, most deaths take place in high ages where suicide is a low contributing factor; in ages 0-84 alone, over 90% of deaths occur in ages 50+ where the contribution of suicide as cause-of-death appears to be around 3%. In younger age groups, suicides officially account for up to 40% of deaths in Japan, though the actual figure is perhaps higher.14 A recent study found that age-standardised mortality rates substantially declined from 1980 to 2005 for Japanese males who were either unemployed or in all occupations except management and professional workers. Mortality rates for male management and professionals in Japan began to increase in the late 1990s alongside sharp increases in suicide rates.15 These concerning trends are believed to be correlated with the stagnation of Japan’s economy, and this occupational cohort is exactly the group to whom insurers are most financially susceptible.

Russia and other ex-Soviet member states experienced similar peaks in aggregate mortality, in large part driven by suicide spikes in middle-aged men. Much of this is reported to be alcohol- and depression-induced and has tapered off since, but these states still have among the highest suicide rates in the world – Russia alone has lost 600,000 to suicide in the 10-year period after hyperinflation and removal of Soviet price controls. These histories of Russia and Japan may have stabilised, but the correlations between suicide and economic instability there prove as insightful backdrop to recent sharp increases in Greece, Italy and Ireland – all countries with historically low suicide rates.16,17

The global financial crisis coincided with a reversal of downward trends in 2008 and 2009 in both European and North American countries.18,19 The latest available data indicates stabilization in some EU countries in 2010 but continued deterioration in others.20 Though the US suicide rate still trails most of East Asia and Eastern Europe, recession since 2008 has also been linked to the dramatic increase in US suicides. They also have a disturbingly high suicide rate amongst veterans, with approximately 9% of the US population being veterans but over 18% of suicides stemming from veterans. Puzzlingly, many were never deployed and cannot be solely attributable to post traumatic stress disorder.21 These factors are temporal, arguably circumstantial and preventable with a better social care and health resource safety net, all of which depend on an economy able and willing to support it.22,23

While suicide prevention measures are often targeted at younger people and seniors, males aged 35-64 in the US have seen the highest trends, yet there is little targeted prevention for this age range.24,25 A trend in this age range has a material impact on insurers, especially where their baseline mortality in that age group has fallen to well below one per mille in its actuarial nonsmoker table at issue age.26 Suicides have never comprised the leading cause of death in any country or age group in the long run, but they are on the rise in certain areas. Prevention and awareness are public health concerns that go well beyond the scope of insurance; community vigilance and government initiatives can limit a recession’s disturbing consequences.27

Action for insurers?

In the meantime, with economic uncertainty persisting in various markets, what can insurers do to mitigate this high-persisting suicide rate? A close look at loadings on mental health history, continued development of more accurate ways to detect and assess suicide threats, and strong financial underwriting are essential at high insured sums. Yet given the extreme difficulty in underwriting for suicide risk and subtleties encountered at claims stage, which is discussed elsewhere in this issue of Risk Insights, options for insurers are limited.28

A blunt but common method of managing suicide risk is for policy wording to simply exclude suicide from coverage. With death benefits, most markets apply a one-to three-year exclusion period. For suicides that are triggered by personal events or circumstances, do these subside by the end of the exclusion period? If suicide is driven by sudden loss of job, income or a stock market crash, for example, many claims may be avoided with a one-year exclusion and even more so with a three-year exclusion. As for changes in family structure, lack of support structure in older age, poor longer-term financial outlook or inability to provide for the next generation (often cited in Korea and Japan), suicide may be pre-meditated over a longer time with action deferred until any exclusion period has expired. Accordingly, some insurers and regulators are currently considering increasing exclusion periods in the wave of deteriorating claims experience.

It is also noteworthy that the attempted suicide rate is much higher than the completed rate – estimates range from a multiple of 10 to 40 times the completed rate.29 This would have a considerable impact on living benefits – medical reimbursement, disability and critical illness insurance – so self-inflicted injury is typically excluded from the living benefits.

What data do we have on the effect of an exclusion period, and whether suicides are avoided or simply paid out as accidents or other causes instead? Data from the Society of Actuaries in the US concludes there was a quadruple increase in suicides at the end of the exclusion period (typically two years in the US) and that during the exclusion period, a number of “disguised” suicides come through in higher accidental death rate.30 There is differing evidence in other countries, such as Japan and Australia, on what portion of suicides are simply delayed (pent-up “demand”) versus avoided, and whether they too are disguised as accidents.31,32 Most evidence points towards the theory that moral hazard does exist in this area – that those who take out higher insured sums are more likely to commit suicide, and that a longer exclusion period reduces a significant portion of the anti-selection.

Since the start of the suicide epidemic in Japan, life insurers increased the exclusion period gradually from one year to three years by 2005. Germanic countries also have a three-year standard. Some UK insurers have reintroduced one-year clauses but these remain inactive if a policy is assigned to a lender. Other markets tend towards a zero- to two-year exclusion period; for example, China’s standard is two years while Hong Kong’s is typically only one year. Belgian and Greek insurers denied benefits for suicide altogether until implementing a two-year exclusion in the 1990s.

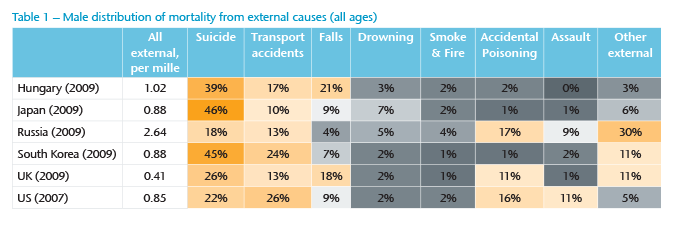

One flaw is that the longer the exclusion period, the more tempted the vulnerable might be to disguise suicide as an accident – perhaps one reason why the US sees an accident spike but Australia, with a 13-month period, does not. Increasing it to three years, or even longer, might pose difficulties in claims management – in deciding when to pay for an unexplainable traffic fatality, for example. In addition, death certificates and coroner’s reports frequently omit “suicide” as the cause; while police reports that could assist, frequently do not exist.Table 1 shows the distribution of mortality from external causes in males for selected countries. Although interesting, the numbers depend on the death certificates being coded correctly.

Aside from claims management complications, lengthening the exclusion period or denying benefits to an estate in the instance of suicide can cause undue trauma to family members and poses a reputational risk for insurers.

A possible alternative to a long exclusion period, and one that takes due consideration of moral hazard – particularly with reference to US data, which boasts some quite high insured sums, up to 60% higher average sums on suicide claims than other claims – is to cap benefit. For instance, suicides or accidents during the exclusion period receive a maximum payment of the lower of $500,000 or 75% of the purchased face amount. It is admittedly important to strike a balance between simplicity and clarity of terms and protection against moral hazard.

The insurance industry can raise awareness and help, but society also needs to play its part. Discounting the impact of any cultural or geographic differences, all suicide is usually at least partly circumstantial and triggered by a life event. This may include redundancy or loss of financial, family or political stability, and is exacerbated by health systems with a weak safety net to accommodate them.

We have come a long way from the times when attempted suicides were treated medically with buckets of cold water thrown at the head; there is now much better awareness and treatment of clinical depression, one of the key underlying factors. Yet far too many suicides are attempted and completed each year, and no one can afford to ignore the persisting trends seen in suicide rates.